08 Dec Bitfinex Alpha | BTC Demand Weakens

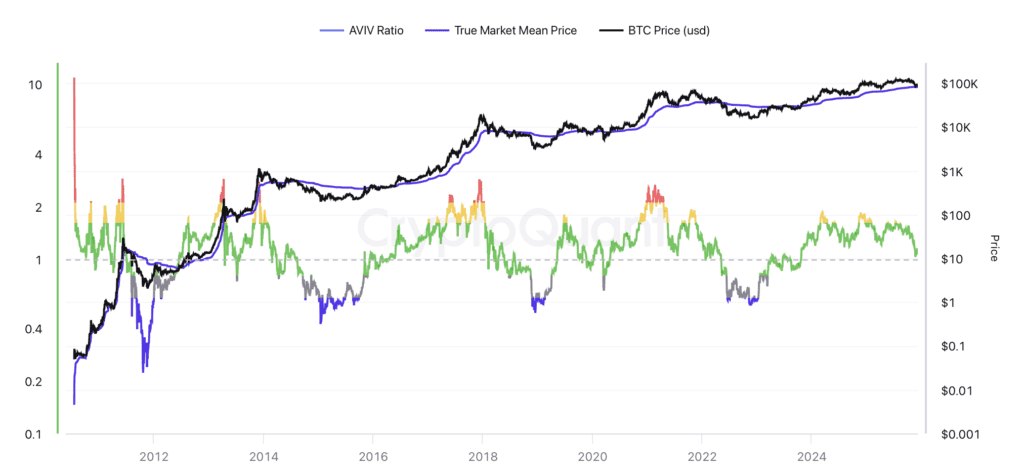

Bitcoin is coming into a section the place weakening spot demand and chronic structural softness are colliding, revealing a market that’s stabilising however removed from wholesome. Regardless of drifting greater from its latest lows, BTC stays trapped in a good $84,000–$91,000 vary whereas the S&P 500 sits close to report highs, underscoring deepening relative weak point and a widening decoupling from conventional danger belongings. On-chain knowledge reveals greater than seven million BTC sitting at an unrealised loss, mirroring situations final seen through the uneven consolidation of early 2022 and emphasizing the market’s battle to reclaim its True Market Imply, the dividing line between mid-cycle fatigue and full bear-market deterioration. But capital inflows stay modestly optimistic, providing at the very least a skinny buffer towards any additional draw back.

On the similar time, spot-side demand has meaningfully eroded: US Bitcoin ETFs have logged persistent outflows, taker shopping for has deteriorated considerably, and Cumulative Quantity Delta throughout main exchanges has turned decisively unfavourable, signalling merchants are promoting into power fairly than accumulating.

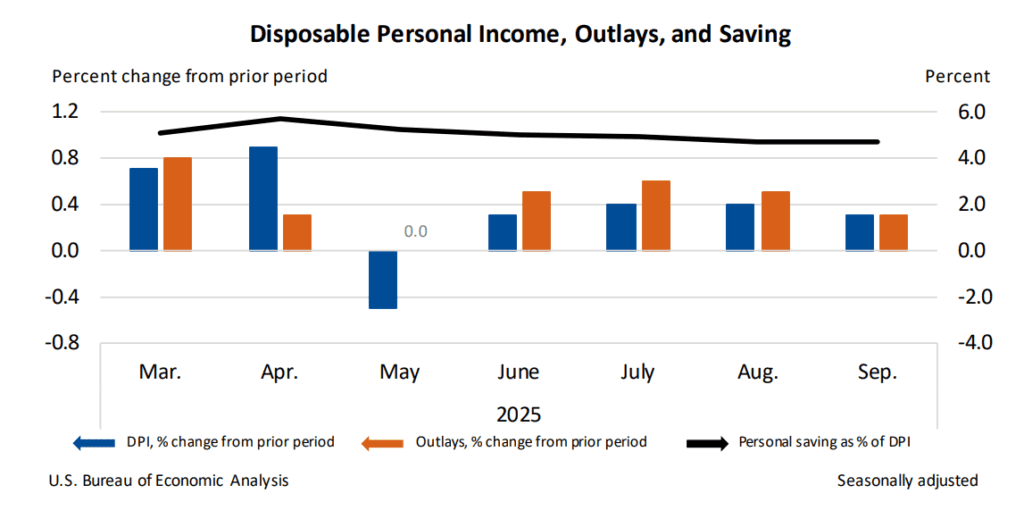

The newest financial knowledge indicators a US economic system nonetheless advancing however far more slowly, with slowing client spending, persistent inflation, and indicators of pressure rising. Actual client spending was flat in September, with incomes barely maintaining with costs, highlighting monetary pressure for lower- and middle-income households and signalling a softer fourth quarter. Inflation remained cussed at 2.8 p.c year-over-year, complicating expectations for a extensively anticipated December charge reduce, particularly as Fed officers stay divided over whether or not the economic system has cooled sufficient to justify easing.

In the meantime, labour and enterprise indicators reveal a equally uneven panorama. Personal-sector hiring unexpectedly fell in November, led by small-business job losses, at the same time as jobless claims dropped to their lowest stage since 2022, exhibiting employers are hesitant to chop workers. The companies sector continued to develop, with stronger demand and rising backlogs, although hiring throughout the sector contracted and costs remained elevated. Collectively, the information counsel an economic system that’s cooling erratically—supported by resilient companies and steady employment—however more and more weak as persistent inflation erodes family power and weighs on progress heading into the Fed’s subsequent coverage resolution.

Within the information, Vanguard, lengthy identified for rejecting cryptocurrencies as too speculative, has reversed its stance by permitting purchasers to commerce third-party crypto ETFs and mutual funds, together with these tied to Bitcoin and Ethereum. Whereas it nonetheless doesn’t plan to supply its personal crypto merchandise, and says explicitly that it’s going to not endorse any funding allocation to meme cash, the choice displays rising confidence within the maturity of crypto markets in addition to sturdy investor demand.

Governments too are updating their view of the crypto business, with the UK passing the Property (Digital Belongings and so forth.) Act 2025, which recognises cryptocurrencies as a definite type of private property. This reform provides clearer rights in circumstances of theft, insolvency, and inheritance, and is considered as a vital step towards making the UK a extra engaging surroundings for digital-asset companies. In america, regulators are additionally shifting ahead: the Commodity Futures Buying and selling Fee has authorised the first-ever itemizing of spot cryptocurrency merchandise on federally regulated exchanges, aiming to offer a safer, regulated different to offshore markets. Collectively, these developments replicate a world pattern towards integrating digital belongings into established monetary and authorized programs, increasing entry, safety, and legitimacy for crypto markets.