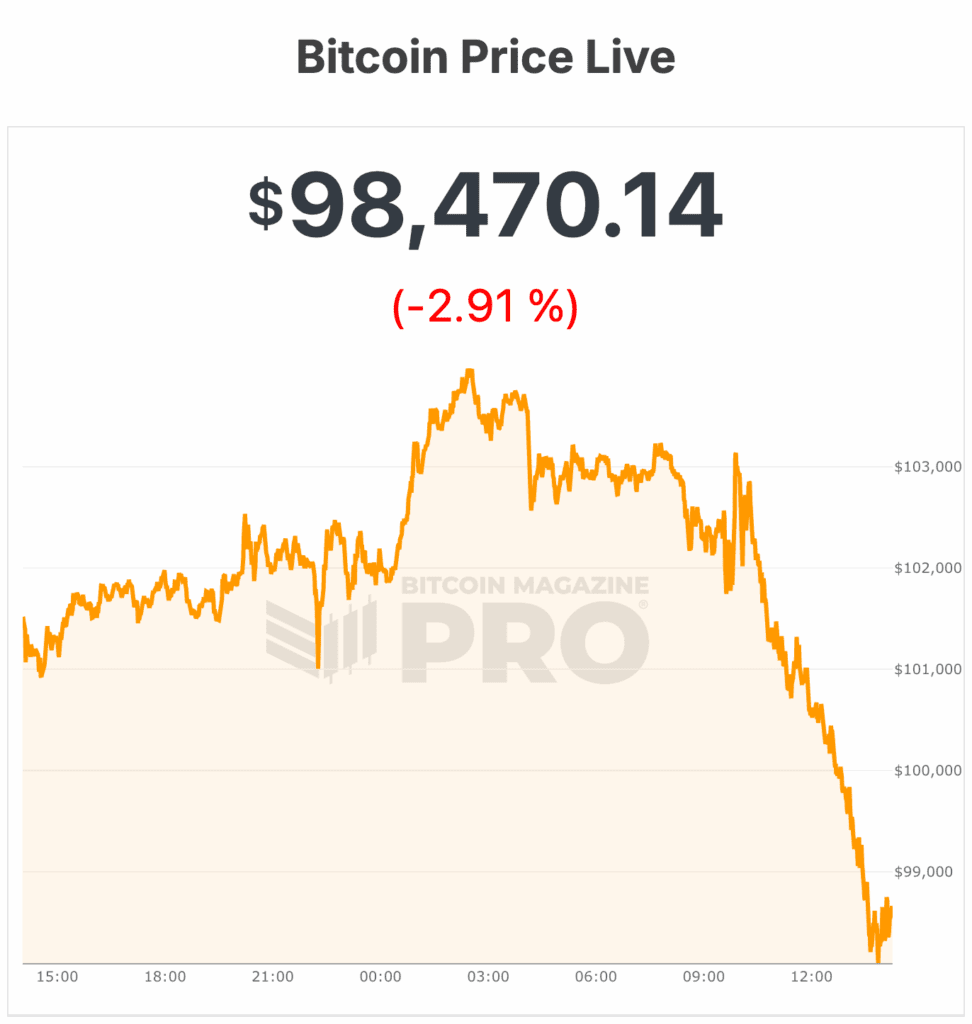

Bitcoin value fell sharply right this moment, sliding from an intraday excessive of $104,000 to $98,113, wiping out earlier positive aspects and marking a decisive breakdown in value motion.

Beginning in morning buying and selling, the Bitcoin value constantly bled down from the higher $102,000s to lows of $97,870.

In line with Bitcoin Journal Professional information, the final time Bitcoin value was close to these ranges (sub $98,000) was in early Could — roughly Could 8 relying on time zone. Bitcoin value vaulted above $100,000 for over 40 days after that earlier than dipping again to $98,000 in late June.

One attainable cause why the bitcoin value is long-term holders which can be unloading at report ranges. Information from CryptoQuant reveals they’ve bought about 815,000 BTC in 30 days — probably the most since early 2024 — whereas spot and ETF demand weaken. Revenue-taking dominates, with $3 billion in realized positive aspects on Nov. 7 alone.

Institutional shopping for has additionally dropped under each day mining provide, intensifying promote strain. Costs hover close to the essential 365-day transferring common round $102,000, and failure to carry it may set off deeper losses, in line with Bitcoin Journal Professional evaluation.

Analysts at Bitfinex say the present bitcoin pullback mirrors previous mid-cycle retracements, with the drop from October’s excessive matching the everyday 22% drawdown seen all through the 2023–2025 bull market.

“You will need to observe too, that even on the $100,000 degree, roughly 72 p.c of the full BTC provide stays in revenue,” Bitfinex analysts wrote to Bitcoin Journal. They imagine a brief reduction rally is probably going however {that a} sustained restoration would require recent demand.

In line with The Block, JPMorgan analysts say bitcoin value’s present estimated manufacturing price of $94,000 acts as a historic value ground, suggesting restricted draw back.

The analysts imagine that rising community problem has pushed manufacturing prices increased, protecting bitcoin’s price-to-cost ratio close to historic lows. The analysts preserve a daring 6–12 month upside projection of about $170,000.

All this comes because the U.S. authorities has reopened after a report 43-day shutdown, the longest in historical past, following President Trump’s signing of a funding invoice late Wednesday.

Whereas federal operations are resuming, restoration can be gradual. Federal employees nonetheless await backpay, and air journey delays might persist.

Timot Lamarre, director of market analysis at Unchained, described bitcoin to Bitcoin Journal as a “canary-in-the-coal-mine for liquidity drying up available in the market.” He notes that the current authorities shutdown prompted the Treasury Basic Account to swell, absorbing liquidity, and provides that with the federal government reopening, “extra liquidity injected into the system will profit bitcoin’s greenback value within the close to time period.”

Companies just like the IRS face main backlogs, and nationwide parks battle to get better misplaced income. The short-term funding measure solely extends by way of January 30, leaving the specter of one other shutdown looming.

The return to normalcy will take time as the consequences of the extended closure proceed to ripple by way of the economic system and public companies.

Bitcoin value roared into October as the federal government shutdown started, surging to new all-time highs above $126,000. However the pleasure rapidly gave approach to turbulence — the bitcoin value swung wildly by way of the remainder of October and into November.

On the time of writing, Bitcoin’s value is at $98,470.

Regardless of an total bullish temper available in the market, the bitcoin value has continued to slip deeper into the month.

Bitcoin value and Nasdaq is the correlation that solely hurts: Wintermute

Bitcoin remains to be carefully tied to the Nasdaq, but it surely’s exhibiting an uncommon sample: it reacts extra strongly to inventory market drops than it does to positive aspects, in line with a current report from Wintermute.

This “detrimental skew”—falling tougher on dangerous fairness days than rising on good ones—is often seen in bear markets, not when BTC is close to all-time highs. It means that traders are considerably fatigued, not euphoric.

Two essential components are driving this. First, consideration and capital have shifted towards equities in 2025. Large tech and Nasdaq development shares are absorbing a lot of the chance urge for food which may have flowed into crypto. Bitcoin strikes with the market when issues go flawed however doesn’t get the identical elevate when optimism returns, appearing like a high-beta tail of macro danger.

Second, liquidity in crypto is thinner than earlier than. Stablecoin issuance has stalled, ETF inflows have slowed, and change depth hasn’t totally recovered. This makes draw back strikes extra pronounced and widens the efficiency hole.

That stated, BTC is holding up remarkably properly, in line with Wintermute. Even with this persistent draw back bias, it’s lower than 20% under its all-time excessive. The sample is uncommon close to tops — it normally reveals up close to bottoms — but it surely additionally displays Bitcoin’s rising maturity as a macro asset.