XRP is going through certainly one of its most difficult moments in latest months as promoting stress accelerates and the broader crypto market slips right into a risk-off atmosphere. Bitcoin’s collapse under key psychological ranges has dragged altcoins with it, and XRP has not been spared. Analysts are more and more warning that the market could also be coming into a bear section, pointing to tightening liquidity circumstances, rising international financial uncertainty, and a pointy decline in investor urge for food for danger property.

Associated Studying

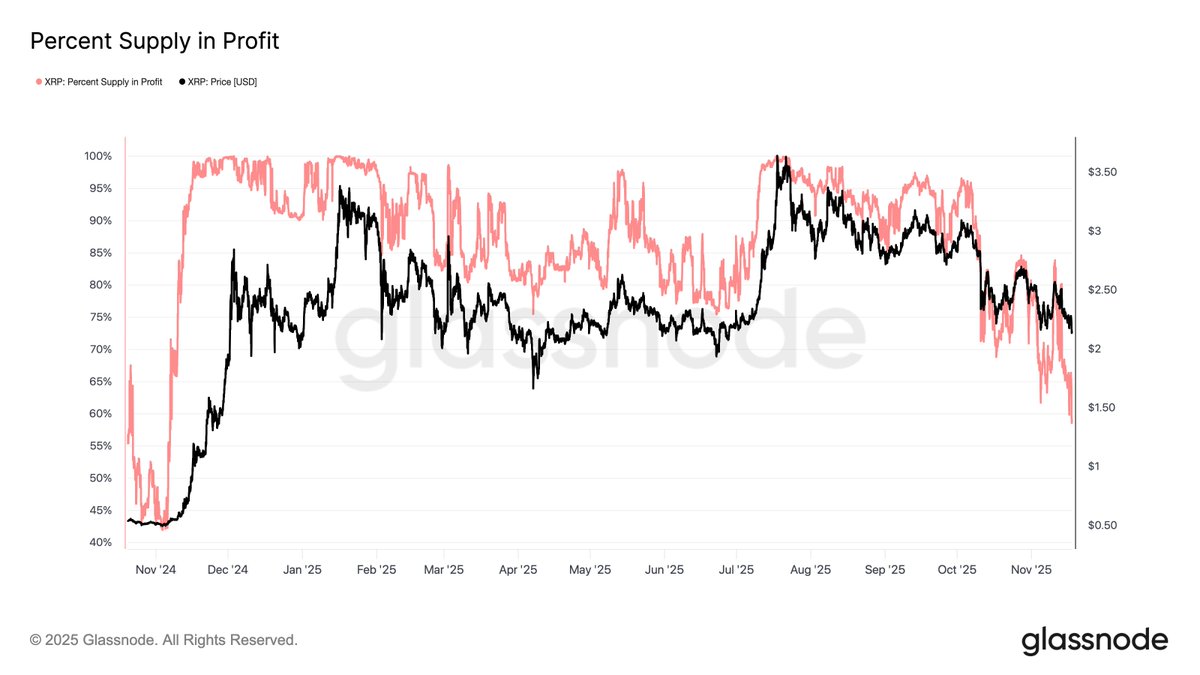

What makes XRP’s scenario extra fragile is the rising variety of holders sitting on unrealized losses. On-chain information reveals that many late patrons — notably those that entered after the ETF announcement and throughout the earlier rally — are actually underwater as the value continues to slip. This top-heavy market construction is creating stress on holders, amplifying sell-side momentum as concern spreads.

The macro backdrop is including gasoline to the fireplace. With international markets adjusting to charge volatility, geopolitical tensions, and tightening greenback liquidity, capital is flowing out of speculative property. XRP’s value is now caught at a crossroads: both it stabilizes at key help zones and absorbs the panic promoting, or a deeper correction unfolds.

XRP Provide in Revenue Indicators Structural Fragility

In response to new information from Glassnode, XRP’s market construction is weakening considerably as the newest sell-off unfolds. The share of XRP provide at the moment in revenue has fallen to 58.5%, marking its lowest studying since November 2024, when XRP traded at simply $0.53. Regardless of right now’s far increased value — round $2.15, almost 4 occasions final 12 months’s stage — an alarming 41.5% of the circulating provide stays at a loss. That represents roughly 26.5 billion XRP sitting underwater.

This divergence highlights a important problem: the market has turn into top-heavy, dominated by traders who entered late into the rally and purchased at elevated value ranges. These holders are actually feeling acute stress as costs retrace. Making the XRP provide distribution extra fragile and growing the chance of panic-driven promoting. Traditionally, such setups typically result in accelerated draw back motion except robust demand steps in.

The truth that a lot provide is within the pink even at present elevated costs means that speculative flows, slightly than long-term conviction, fueled the earlier surge. As these late patrons face losses, promote stress can intensify, feeding right into a vicious cycle of liquidation.

Associated Studying

XRP Value Evaluation: Testing Essential Assist Ranges

XRP continues to wrestle as promoting stress intensifies, with the chart displaying a transparent downtrend forming since early October. The value is now buying and selling round $2.18, hovering simply above a key horizontal help zone that has been examined a number of occasions all year long. Every bounce from this area has grown weaker, suggesting diminishing purchaser power and rising vulnerability to a deeper breakdown.

The shifting averages reinforce this weakening construction. XRP is buying and selling under the 50-day, 100-day, and 200-day MAs, with all three starting to twist downward. A traditional signal of pattern deterioration. The failed try and reclaim the 50-day MA in early November marked a major shift, as sellers shortly regained management and pushed the value decrease. Quantity spikes throughout downswings additional affirm that distribution is ongoing.

Associated Studying

Moreover, the decrease highs forming because the September peak sign that bulls are dropping momentum. Every rally try is being offered into quicker, and the wick rejections close to the $2.50–$2.60 area spotlight robust overhead resistance. If XRP loses the present help band, the following liquidity pocket sits close to $1.70–$1.80, the place patrons beforehand defended aggressively.

Featured picture from ChatGPT, chart from TradingView.com