What’s ‘Finish-of-Day’ Buying and selling, what’s going to it do for you and the way precisely do you commerce ‘Finish-of-Day’ methods? Proceed studying to search out out…

What’s ‘Finish-of-Day’ Buying and selling, what’s going to it do for you and the way precisely do you commerce ‘Finish-of-Day’ methods? Proceed studying to search out out…

After I speak about ‘Finish-of-Day’ buying and selling methods, what I’m mainly speaking about is buying and selling based mostly on the each day chart timeframe. We’re specializing in each day chart candles which might be closed out, not candles which might be nonetheless open. The precise each day shut of Forex happens at 5pm New York time, nevertheless, not all brokers present charts that present the 5pm New York shut. To ensure you are seeing the true each day shut of the market, you want a dealer that gives 5 each day bars per week that shut at 5pm New York time. Right here’s a hyperlink to get the fitting charting platform – New York shut charts.

What’s going to buying and selling end-of-day do for you? Nicely, when you truly do it, it’ll enhance your buying and selling outcomes and significantly simplify the complete buying and selling course of. It does this by a number of channels; it reduces the period of time and variety of variables wanted for buying and selling which helps to naturally type the right buying and selling mindset since you aren’t watching charts all day (most merchants’ downfall). Watching charts too lengthy is what causes you to over-think and over-analyze and finally over-trade (and lose cash). Finish-of-day buying and selling additionally naturally helps you with cash administration and commerce administration by the set and neglect buying and selling strategy that goes together with it. It helps to get rid of a lot of the second-guessing, confusion and emotion that plague most merchants.

Primarily, end-of-day buying and selling offers merchants a framework, that if correctly utilized, permits them to keep away from many of the buying and selling errors that folks make merely attributable to how we’re wired. We’re pre-wired, if you’ll, to hunt pleasure and keep away from ache, it’s in our DNA. This has served people properly for a lot of, many centuries. Nonetheless, within the trendy world this sort of wiring may cause many issues, particularly with buying and selling. For instance: we naturally need to commerce actually because it makes us FEEL protected and ‘in management’ and it offers us an injection of endorphins once we hit the purchase or promote button as a result of we’re stuffed with the hope that we’ll hit a winner. Then, when that commerce turns in opposition to us because it generally does, what can we naturally need to do? Keep away from ache. So, we shut the commerce out for a small loss, solely to then see it transfer again in our favor and go on to be a would-have-been winner, how irritating! This is only one instance of how we’re wired to self-destruct available in the market, there are various extra.

So, what does end-of-day buying and selling do for you? A number of issues, however maybe essentially the most useful is that it offers you a framework that will help you circumnavigate your personal tendencies and ‘defective’ buying and selling wiring. Learn on to be taught extra…

Who’s actually in management? (you or the market)

The one factor you may management in buying and selling is your self. In the event you over-trade and commerce like a machine-gunner quite than commerce like a sniper, you aren’t controlling your self and you’ll find yourself being managed by the market. The market can have an effect on your feelings in very destructive ways in which trigger you to provide your cash to it in a short time. The one solution to counteract that is by controlling your self.

The rationale many individuals are interested in day buying and selling is as a result of they really feel extra answerable for the market by smaller time frames and leaping out and in of positions often. Sadly for them, they haven’t found out that they’ve the identical quantity of management because the swing dealer who could maintain positions for every week or extra and solely seems at the marketplace for twenty minutes a day and even much less. Neither dealer has any management over the market, however day-trading and scalping offers merchants the phantasm of extra management. The one factor we actually have management over in buying and selling, is ourselves.

What is an efficient strategy to ensure you are controlling your self and never being managed by the market? Finish-of-Day buying and selling!

Right here’s the way it’s accomplished…

Methods to commerce Finish-of-Day…

One of the best ways for me to ‘clarify’ find out how to commerce end-of-day methods is to easily present you. The proof is within the pudding, so to talk, so let’s check out a few of my favourite worth motion alerts and how one can commerce them in an end-of-day method.

OK, first off, we’re going to take a look at how one can commerce end-of-day with my inside bar worth motion sample. Within the chart picture beneath, discover we had an present up development earlier than the within bar(s) sample shaped, and we usually wish to commerce inside bars with the each day chart development, so we have been trying good. Additionally, in fact, discover we’re on the DAILY CHART timeframe and the within bar sample was closed out earlier than our entry, so we have been buying and selling finish of day.

Now, right here is the place the REAL POWER OF END-OF-DAY TRADING is available in…

Within the above inside bar instance, you’ll discover that the commerce labored out properly. This doesn’t at all times occur in fact, as a result of winners and losers are randomly distributed for any buying and selling technique, however on this case, it was a winner. An important factor to note is that you simply actually needed to do nothing however place your entry order, cease loss and revenue goal and the market took care of the remainder. You could possibly have actually gone on a 7-day, 6-night Caribbean cruise, not checked out your commerce and are available again to a 5R winner by using set and neglect and buying and selling this chart end-of-day.

You could have eradicated essentially the most troublesome component of buying and selling; commerce administration. You’ve taken your human emotion out of the equation by buying and selling end-of-day and setting every thing up upfront and simply letting the commerce run. The outcomes communicate for themselves!

Let’s take a look at one other instance…

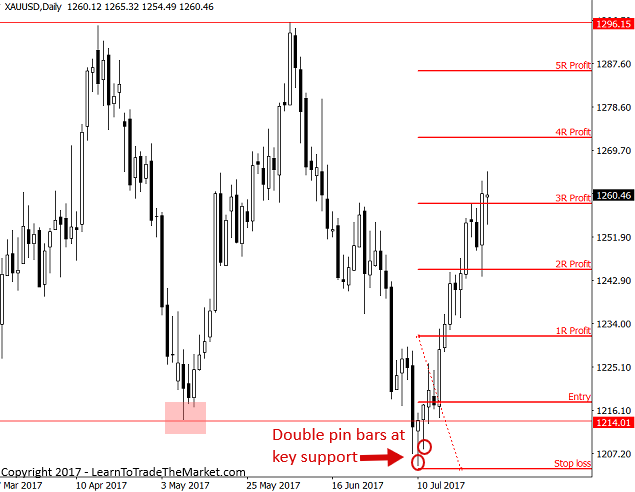

Now we’re going to take a look at an instance of buying and selling the pin bar buying and selling technique in an end-of-day method…

Within the chart instance beneath, we had a stable and outlined buying and selling vary within the Gold market once we received a each day chart pin bar purchase sign on the backside of the vary (key help stage). Truly, we received back-to-back pin bar purchase alerts at this key help stage, so we had loads of affirmation and confluence for a pleasant end-of-day commerce entry. Coincidentally, we did focus on this actual pin bar setup in our each day members market commentary the day it shaped as a possible shopping for alternative.

As of this writing, a stable 3R revenue was attainable from this commerce setup, with none involvement wanted in your half. You could possibly have entered this commerce and let it sit, come again 11 days later and also you had a 3R revenue within the financial institution. Now, how simple is it to disregard the marketplace for every week or two whereas your trades play out? Maybe not as simple it sounds, however if you wish to commerce end-of-day, it’s essential to imagine within the energy of endurance, in different phrases, it’s important to battle your personal want to over-analyze, over-think and over-trade, and you’ll come out WELL forward of 90% of most merchants.

Earlier than we transfer on to our subsequent instance, here’s a little-added advantage of each day chart or end-of-day buying and selling that while apparent, wants declaring…

Many merchants choose to commerce off these each day chart alerts as a result of it’s a much less worrying solution to commerce because you don’t must ‘wade by’ hours of less-significant worth motion. Give it some thought, would you quite sit at your charts looking for a ‘needle in a haystack’ on the 5-minute charts or sit again and analyze the each day chart timeframe and solely concentrate on apparent end-of-day setups?

Don’t be fooled into pondering there are extra ‘alternatives’ by trying on the brief time frames, it’s simply not true. There ARE extra worth bars, certain, however are they actually alternatives? Or are they simply noise? Bear in mind, the upper in timeframe you go the extra important every bar or candlestick turns into, and the each day chart timeframe is really the sweet-spot for a dealer.

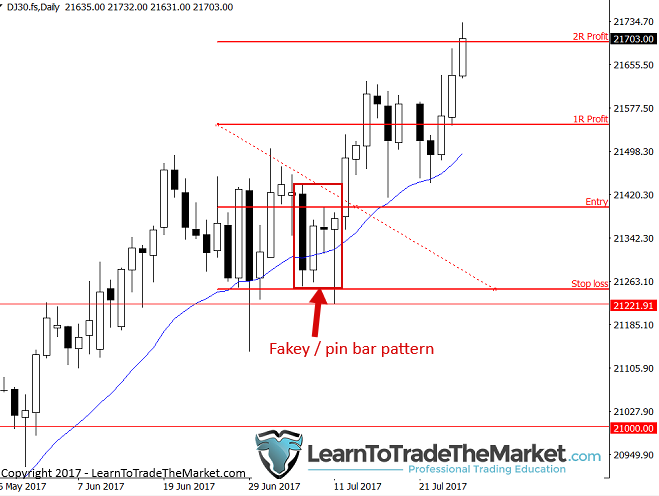

Let’s take a look at an instance of buying and selling end-of-day with the fakey sample…

Within the chart picture beneath, we see a nice instance of a fakey pin bar combo sample which shaped in-line with the underlying each day chart uptrend within the Dow Jones Index.

Had you entered this fakey close to the breakout of the within bar or pin bar excessive and cease loss beneath the mom bar low, you’ll at the moment be up a pleasant 2R reward. The ‘catch’, if you wish to name it that, is that you simply needed to sit in your fingers for about 10 buying and selling days earlier than you realized that reward.

Most merchants have been over-trading and blowing out their accounts throughout these 10 days. Do you need to be the dealer who’s patiently ready for high-probability trades to play out, like those above, or do you need to be the dealer who’s buying and selling intra-day throughout these 10 days? I can assure you the dealer who entered one commerce and waited patiently for it to play out was FAR higher off than the man who day-traded that entire time.

Conclusion

You now perceive why end-of-day buying and selling methods can considerably enhance your outcomes available in the market, and also you even have a fundamental understanding of find out how to commerce end-of-day. I don’t need to sound like that is simple, however it’s far simpler to commerce end-of-day than the way in which most merchants commerce. Most merchants commerce means an excessive amount of, they meddle an excessive amount of with their trades they usually expend an excessive amount of psychological power on their buying and selling. This results in losses, losses and extra losses.

The troublesome a part of buying and selling lies in conquering your inside demons, not to find entries or in comprehending find out how to learn a worth chart. What I’ve laid out for you in at the moment’s lesson and what I clarify in a lot larger element in my buying and selling course, is strictly how I take advantage of end-of-day buying and selling methods to circumnavigate my very own defective human wiring (all of us have it) because it applies to buying and selling. By controlling myself and solely specializing in that, I can actually reap the benefits of the unimaginable alternatives the market presents me, nevertheless often or sometimes that could be.

I WOULD LOVE TO HEAR YOUR COMMENTS & STORIES BELOW 🙂

QUESTIONS ? – CONTACT ME HERE