What to Know:

- Stripe’s stablecoin arm, Bridge, has utilized for a US nationwide belief financial institution constitution underneath the GENIUS Act, becoming a member of Circle, Ripple, Paxos, and Coinbase.

- The GENIUS Act introduces federal oversight for stablecoin issuers, requiring 100% money or Treasury reserves and month-to-month public disclosures.

- This might mark the beginning of ‘Stablecoin Season,’ as regulated issuers bridge the hole between banks and blockchain funds.

- Finest Pockets ($BEST) stands to learn, providing customers safe custody, presale entry, and as much as 80% APY staking rewards.

Stablecoins are going legit, and fairly quick.

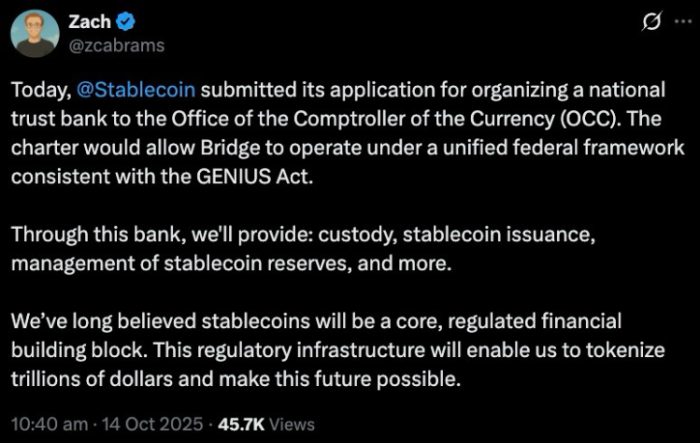

Stripe’s stablecoin arm, Bridge, simply filed an software with the US Workplace of the Comptroller of the Foreign money (OCC) to kind a nationwide belief financial institution underneath the newly enacted GENIUS Act.

It’s the newest transfer in what’s shaping as much as be ‘Stablecoin Season’: a full-blown regulatory dash to carry digital {dollars} underneath federal oversight.

If permitted, Bridge’s constitution would let Stripe challenge, redeem, and custody stablecoins instantly underneath the OCC, as an alternative of juggling dozens of state-level money-transmitter licenses.

Meaning its whole stablecoin enterprise would sit underneath on federal framework, full with 100% money or Treasury-backed reserves and month-to-month public disclosures, as required by the GENIUS Act.

Bridge now joins Circle ($USDC), Ripple ($RLUSD), Paxos ($USDP), and Coinbase ($COIN) in chasing nationwide belief licenses – a race that marks a historic pivot for the US digital asset market.

Collectively, these companies are positioning stablecoins because the regulated spine of worldwide funds, quite than gray-zone fintech experiments.

The timing is sensible. Stablecoins already account for over $315B in circulating worth, and Customary Chartered analysts estimate they may pull $1T in deposits away from conventional banks over the subsequent three years.

For customers and retailers, that shift would make stablecoins the default settlement rail of the web. They’re quicker, cheaper, and now, lastly, compliant.

For Striple, Bridge isn’t nearly compliance; it’s additionally an infrastructure play.

The corporate just lately unveiled Open Issuance, a service that helps apps launch their very own stablecoins utilizing Bridge’s back-end.

Wallets like Phantom ($CASH), MetaMask ($mUSD), and Hyperliquid ($USDH) already depend on Bridge as their issuance accomplice.

All indicators level to a regulated on-chain financial system, the place digital {dollars} transfer underneath federal supervision and mainstream adoption lastly takes maintain.

So the true query for traders turns into: if stablecoins are about to change into the rails of this new system, which tokens will seize person circulation on the edge?

That’s the place Finest Pockets Token ($BEST) enters the image, powering one of many fastest-growing Web3 wallets constructed to bridge the hole between regulated stablecoins and on a regular basis customers.

From Stablecoins to Pockets Wars – the New On-Ramp Race

The race for federal belief charters isn’t nearly who prints the subsequent digital greenback; it’s about who controls the gateway to it. Stripe, Circle, Ripple, and Coinbase are preventing for issuance and compliance. However on the person degree, a distinct battle is breaking out… the battle for wallets.

Underneath the brand new GENIUS framework, stablecoins can lastly plug into conventional finance with clear oversight from the OCC. That unlocks direct settlement with banks, cross-chain interoperability, and compliant collateral for lending protocols. That is the pipeline for a regulated DeFi financial system.

And that is the place crypto wallets are available. They’re not simply storage apps. They’ve change into tremendous apps.

MetaMask now presents staking, Phantom integrates stablecoin rails, and new gamers like Finest Pockets are going additional by mixing funds, presales, and rewards inside one safe, Fireblocks-powered interface.

Finest Pockets Token ($BEST) – The Token Fueling a Web3 Tremendous App Constructed for the Stablecoin Period

As stablecoins edge nearer to federal recognition, pockets ecosystems have gotten the frontlines of adoption. Finest Pockets is positioning itself at that intersection as a non-custodial pockets app that merges safety, yield, and discovery into one seamless platform.

Constructed on Fireblocks’ MPC-CMP framework, the identical institutional-grade tech utilized by main custodians, Finest Pockets presents customers safe on-chain management with out sacrificing usability.

It’s a spot to retailer tokens, purchase into new crypto presales, stake property, and shortly, spend crypto money via the Finest Card. That card will ship cashback and charge reductions to anybody staking the native $BEST token.

And that token is what powers the complete ecosystem. Holding $BEST unlocks lowered transaction charges, greater staking rewards, and early entry to new token launches via the in-app ‘Upcoming Tokens’ function.

Uncover easy methods to purchase Finest Pockets Token in our step-by-step walkthrough.

As stablecoins come underneath the OCC’s watch, wallets integrating compliant rails and institutional safety will stand out. Finest Pockets is constructed exactly for that world, connecting regulated stablecoin infrastructure with DeFi native alternatives.

In that sense, the GENIUS Act units the stage for wallets like Finest Pockets to change into the banks of the long run,

Be part of the $BEST presale and stake now for as much as 80% APY.

This text doesn’t represent monetary recommendation. Crypto carries inherent dangers, so please do your individual analysis (DYOR) and by no means make investments greater than you’re prepared to lose.

Authored by X, NewsBTC — www.newsbtc.com/information/stablecoin-season-stripe-bridge-impact-best-wallet-token