The earlier weekly notice categorically talked about that whereas the markets might proceed to say no, the Indian equities are set to outperform its world friends comparatively. In step with this evaluation, the market noticed large swings owing to prevailing world uncertainties however continued displaying outstanding resilience towards different world indices. The volatility spiked; the India VIX surged sharply by 46.18% to twenty.11 on a weekly foundation. The markets witnessed vital volatility, and in consequence, the Nifty oscillated in a large 1180.25 vary through the previous week. Regardless of this, the headline index Nifty 50 closed with a negligible lack of simply 75.90 factors (-0.33%).

The approaching week can be quick; Monday is a buying and selling vacation for Dr. Babasaheb Ambedkar Jayanti. From a technical perspective, a number of of the numerous issues have occurred. Though the Nifty shaped a recent swing low of 21743 whereas slipping beneath its earlier low of 21964, the Index has efficiently defended the necessary assist stage of 100-week MA that stands at 22152. This stage stays an important assist stage for the market within the close to time period. As long as the Nifty retains its head above this level, it should keep in a bigger vary however would avert any main drawdown. A violation of this stage will invite structural weak point within the markets. On the higher facet, it faces stiff resistance between the 23300-23400 zone, which homes the 20-week MA.

With Monday being a vacation, Tuesday will see the markets opening after a spot of someday and adjusting to the worldwide commerce. The degrees of 23000 and 23250 might act as potential resistance factors; the helps are available in a lot decrease at 22400 and 22150.

The weekly RSI is at 44.28; it stays impartial and doesn’t present any divergence towards the worth. The weekly MACD is bearish and stays beneath its sign line; nevertheless, the narrowing Histogram hints at a possible optimistic crossover within the coming days.

The sample evaluation of the weekly Nifty chart displays a powerful rebound following a profitable check of the 100-week shifting common in early March, triggering a pointy 1,700-point rally. Nonetheless, latest corrective strikes pushed by tariff-related considerations have led to the formation of a brand new swing low. Regardless of this, the Index has managed to carry above the essential 100-week shifting common stage of twenty-two,152 on a closing foundation, which stays a key assist zone. So long as the Nifty sustains above this stage, the Index is prone to consolidate quite than witness any vital decline. Nonetheless, a decisive breach beneath this common might open the door to a deeper corrective section, which seems to be unlikely within the close to future.

General, the Nifty is anticipated to come across resistance across the 23,100 stage and above, with volatility prone to stay a dominant characteristic within the close to time period. The Index might proceed to commerce inside a broad vary, making it prudent to undertake a cautious stance. Buyers are suggested to restrict leveraged positions and prioritize defending good points at larger ranges. For recent entries, the main focus ought to stay on shares exhibiting relative power. Given the prevailing uncertainty, sustaining a conservative strategy with modest publicity is really useful for the upcoming week. Danger administration and selective participation can be important to successfully navigate the anticipated market swings.

Sector Evaluation for the approaching week

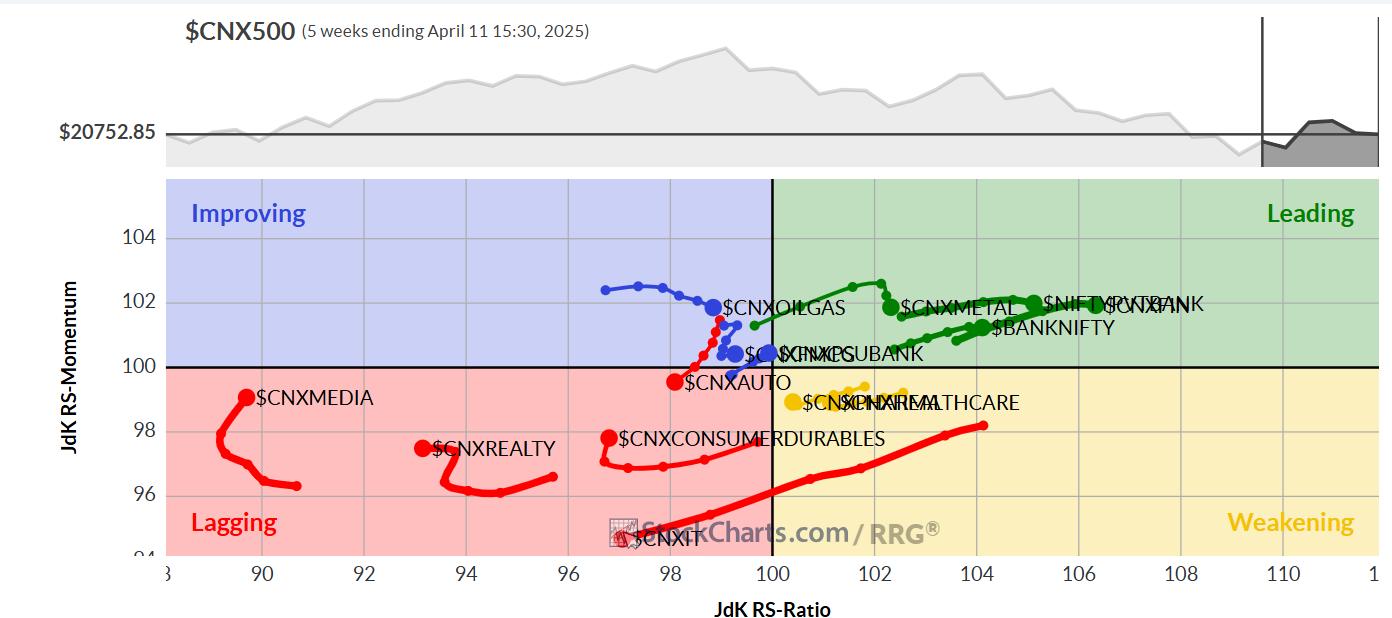

In our have a look at Relative Rotation Graphs®, we in contrast numerous sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present the Nifty Infrastructure, Steel, Banknifty, Providers Sector, Consumption, Commodities, and Monetary Providers sector Indices contained in the main quadrant. Whatever the path the markets undertake, these teams are prone to publish relative outperformance towards the broader markets.

The Nifty Pharma Index is the one sector index current within the weakening quadrant.

The Nifty Auto Index has rolled contained in the lagging quadrant, whereas the IT Index continues to languish contained in the lagging quadrant. In addition to this, the Midcap 100, Media, and Realty indices are additionally inside this quadrant, however they’re enhancing on their relative momentum.

The Nifty FMCG, Power, and PSE Indices are contained in the enhancing quadrant; they’re anticipated to enhance their relative efficiency towards the broader Nifty 500 Index.

Vital Be aware: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used immediately as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, presently in its 18th yr of publication.