Buying and selling just isn’t the best career on this planet to succeed at, as you might nicely know by now. We have to do the whole lot we are able to to place the chances of success as far in our favor as doable. Nonetheless, most merchants do the precise reverse; they flip the chances of success in opposition to them, more often than not unknowingly.

Buying and selling just isn’t the best career on this planet to succeed at, as you might nicely know by now. We have to do the whole lot we are able to to place the chances of success as far in our favor as doable. Nonetheless, most merchants do the precise reverse; they flip the chances of success in opposition to them, more often than not unknowingly.

The one most important and EASIEST technique to tilt the scales of success in your favor, is by merely not watching intraday charts. Time and time once more, I’ve seen merchants fail as a result of they’re so hyper-focused on brief time frames. There are various misconceptions about intraday charts that lead merchants to consider watching them gives some sort of benefit. In actuality, particularly to a starting or novice dealer, watching intraday charts does nothing however impede their progress and reduce their probabilities of even surviving, not to mention thriving available in the market.

My Set and Overlook Philosophy

When you learn my weblog frequently, you recognize I’m an advocate of end-of-day buying and selling, which mainly simply means I analyze the market on the finish of the buying and selling day and place trades based mostly on that end-of-day information. I then undertake a set and overlook mentality, not touching trades for probably the most half, letting the market do its factor, as a result of I do know I can’t management what worth does. This helps me to keep away from a lot of the feelings that come up from watching intraday worth actions. It’s essential to notice that I do monitor my trades and positions, however I definitely don’t sit round watching them ‘reside on TV’ or for leisure.

The psychological benefits that you just get once you undertake this set and overlook buying and selling philosophy are many and vital. I gained’t get into all of them right here, however to be taught extra about them take a look at my article on set and overlook buying and selling.

Don’t Torture Your self Watching Your Trades

Ever entered a commerce and watched it tick-by-tick for the subsequent few days, agonizing over each 20-point swing for or in opposition to your place? When you return to the chart and take a look at the scenario retrospectively, you will note that the market moved from level X to Y, regardless of the intraday motion and chop. There isn’t any purpose to sit down there watching all of the intraday chop any time you will have a commerce on. All it should lead to is a whole lot of psychological anguish for you, which might lead you to make some fairly vital buying and selling errors as we’ll discuss subsequent…

Don’t be tempted to fiddle along with your trades

Watching the intraday screens an excessive amount of can definitely do a quantity in your buying and selling mindset. We have to do the whole lot we are able to to not induce the unsuitable mindset as we analyze and commerce the market, as a result of as soon as we get into the unsuitable mindset it may be practically unattainable to interrupt out of it.

As we sit at our charts, looking at them and watching worth tick over, all types of issues can occur in our minds. We make up causes to maneuver our entry orders from the place we initially needed to put them, we transfer cease losses or targets. We could enter a commerce purely on emotion or exit a commerce purely on emotion, all by watching the charts an excessive amount of. Nonetheless, it doesn’t finish there, when you get into this mindset, it makes every subsequent commerce harder since you live within the hindsight loop. That is the place you over-analyze and thus over-think in regards to the market and your trades, inflicting you to lose sight of correct buying and selling habits and second-guess each commerce you are taking based mostly on previous trades that you just missed out on, primarily from being within the unsuitable mindset and over-thinking.

Finish-of-Day vs Intraday

Finish-of-day buying and selling is superior to intraday buying and selling for a lot of, many causes. Maybe an important purpose is {that a} day by day chart timeframe (end-of-day information) reveals you a extra essential view of the market than any intraday chart does. Because of this, any stage, or worth motion sign you see on a day by day chart goes to be rather more correct than any stage or sign on a decrease timeframe, usually talking.

As I focus on in my article on the very best chart time frames to commerce, the upper in timeframe you go, the much less market noise and random worth motion there may be. This in fact makes it simpler to finish your evaluation every day, establish key chart ranges, establish cease loss ranges and plan out your threat administration on any given commerce.

Whenever you take a look at LESS information every day, you will have a a lot better likelihood of not falling sufferer to over-trading and buying and selling dependancy, one thing that may trigger you to blow out your complete buying and selling account a lot quicker than you think about.

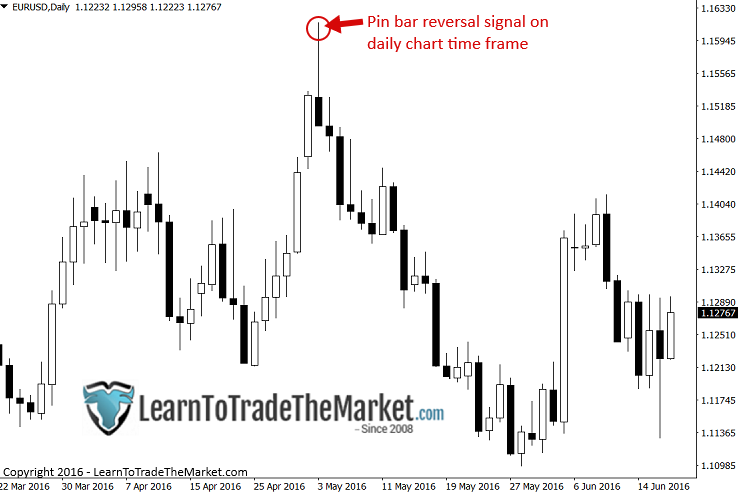

The beneath chart examples present the distinction between analyzing day by day charts and intraday charts. Every day by day chart bar is a single bar that displays 24-hours of information, the intraday chart is a whole lot of smaller bars, ask your self what’s a cleaner and fewer disturbing chart to take a look at to kind a view of the market?

First, check out this day by day EURUSD chart and the clear and apparent pin bar reversal sign that shaped…

Subsequent, take a look at the 5-minute chart of the very same time period because the pin bar on the day by day chart above. First off, you possibly can’t even see the pin bar sign that result in an enormous decline in worth within the subsequent days. Additionally, there are actually a whole lot of bars on this chart, tons of chop, which might fairly actually ‘chop’ up your considering and confuse you, inflicting you to presumably miss-out on the day by day chart commerce on account of over-thinking and over-analyzing…

Within the day by day chart of the AUDUSD beneath, you possibly can see a transparent set of bullish pin bar purchase indicators that shaped in-line with the earlier bullish momentum. A transparent shopping for alternative for any end-of-day dealer; no stress, no worries…

Subsequent, take a look at the 4-hour chart timeframe of the identical time period because the day by day above. Now, the 4-hour chart could be traded efficiently if you understand how to commerce the day by day correctly. However, the purpose right here is to point out that even a great timeframe just like the 4 hour, just isn’t practically as clear and simple to commerce because the day by day chart end-of-day information. I don’t find out about you, however all I see is uneven sideways worth motion on this chart…

Conclusion

This text has defined why watching intraday charts will hurt your buying and selling outcomes, and hurt your means to make correct selections on a constant foundation. If you wish to transition from screen-watching to end-of-day buying and selling and a much less disturbing buying and selling profession and life, it’s good to begin studying to commerce finish of day, and prepare your self to undertake a set and overlook mentality. My skilled buying and selling course, expands on these ideas in nice element and is the core basis of my buying and selling method and beliefs. My private intention in buying and selling is to spend the least period of time doable analyzing the market and watching the market so I can keep away from the stress and feelings of buying and selling and finally get pleasure from my life and the fruits that my career presents.