Fundstrat’s Tom Lee reiterated his $250,000 Bitcoin goal whereas cautioning that 2026 may very well be a “jagged” yr for crypto adoption and a turbulent one for broader threat belongings, framing any main pullback as a shopping for window relatively than a sign to de-risk.

Talking on The Grasp Investor Podcast with Wilfred Frost in an interview launched Jan. 20, Lee mentioned he expects 2026 to in the end “seem like a continuation of the bull market that began in 2022,” however argued markets should first digest a number of transitions that might ship a drawdown giant sufficient to “really feel like a bear market.”

$250,000 Bitcoin Name Comes With A 2026 Warning

Lee pointed to what he described as a “new Fed” dynamic, arguing markets are inclined to “check” a brand new chair and that the sequencing of identification, affirmation, and response can catalyze a correction. He additionally warned that the White Home may turn into “extra deliberate in selecting winners and losers,” increasing the set of sectors, industries, and even nations “within the bullseye,” which he mentioned is already seen in gold’s power.

Associated Studying

A 3rd friction level, in his telling, is AI positioning: the market remains to be calibrating “how a lot is priced into AI,” from power must data-center capability, and that uncertainty may linger till different narratives take the baton.

Pressed on magnitude, Lee mentioned close to the S&P 500, the drawdown “may very well be 10%,” but additionally “may very well be 15% or 20%,” probably producing a “spherical journey from the beginning of the yr,” earlier than ending 2026 robust. He added that his institutional purchasers didn’t seem aggressively positioned but, and flagged leverage as a inform: margin debt is at an all-time excessive, he mentioned, however up 39% year-over-year—under the 60% tempo he associates with native market peaks.

For crypto, Lee leaned on a market-structure rationalization for why gold outperformed: he mentioned crypto tracked gold till Oct. 10, when the market suffered what he known as “the single largest deleveraging occasion within the historical past of crypto,” “greater than what occurred in November 2022 round FTX.”

After that, he mentioned, Bitcoin fell greater than 35% and Ethereum nearly 50%, breaking the linkage. “Crypto has periodic deleveraging occasions,” Lee mentioned. “It actually impairs the market makers and the market makers are basically the central financial institution of crypto. So most of the market makers I might say possibly half obtained worn out on October tenth.”

That fragility, he argued, doesn’t negate the “digital gold” framing a lot because it limits who treats it that method in the present day. “Bitcoin is digital gold,” Lee mentioned, however added that the set of buyers who purchase that thesis “isn’t the identical universe that owns gold.”

Associated Studying

Over time, Lee expects the possession base to broaden, although not easily. “Crypto nonetheless has a, I feel, future adoption curve that’s larger than gold as a result of extra individuals personal gold than personal crypto,” he mentioned. “However the path to getting that adoption fee larger goes to be very jagged. And I feel 2026 can be a extremely essential check as a result of if Bitcoin makes a brand new all-time excessive, we all know that that deleveraging occasion is behind us.”

Inside that framework, Lee reiterated his high-conviction upside name: “We predict Bitcoin will make a brand new excessive this yr,” he mentioned, confirming a $250,000 goal. He tied the thesis to rising “usefulness” of crypto, banks recognizing blockchain settlement and finality, and the emergence of natively crypto-scaled monetary fashions.

Lee cited Tether as a proof level, claiming it’s anticipated to generate practically $20 billion in 2026 earnings with roughly 300 workers, and argued that the revenue profile illustrates why blockchain-based finance can look structurally totally different from legacy banking.

Lee closed with recommendation that deliberately cuts in opposition to short-horizon reflexes. “Attempting to time the market makes you an enemy of your future efficiency,” he mentioned. “As a lot as I’m warning about 2026 and the potential for a variety of turbulence, they need to view the pullback as an opportunity to purchase, not the pullback as an opportunity to promote.”

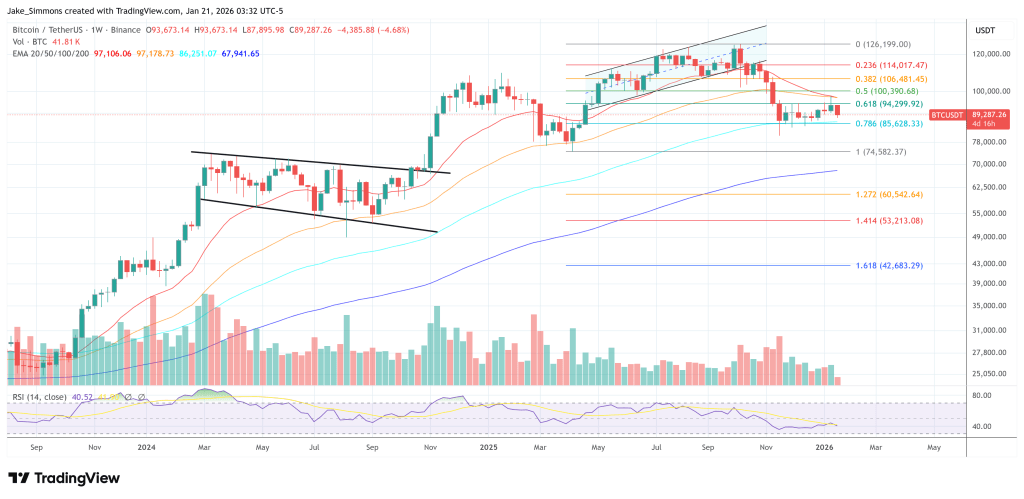

At press time, Bitcoin traded at $89,287.

Featured picture created with DALL.E, chart from TradingView.com