The Transferring Common Convergence/Divergence (MACD) is a well-liked technical evaluation instrument utilized by merchants to determine tendencies and potential development reversals in monetary markets. Developed by Gerald Appel within the late Nineteen Seventies, the MACD has grow to be one of the vital broadly used indicators amongst technical analysts.

Nevertheless, many merchants right this moment are transferring past conventional lagging instruments like MACD looking for extra responsive, non-repainting options that align with real-time worth motion. For those who’re exploring the right way to complement—and even improve—from traditional oscillators, think about skilled alternate options like Magic Histogram — a next-generation MetaTrader 5 indicator designed for correct, well timed indicators with out the drawbacks of transferring averages or delayed responses.

On this article, we are going to delve deeper into the MACD indicator, exploring its elements, calculation, and interpretation. We will even focus on completely different buying and selling methods that merchants can use with the MACD indicator to make higher buying and selling selections.

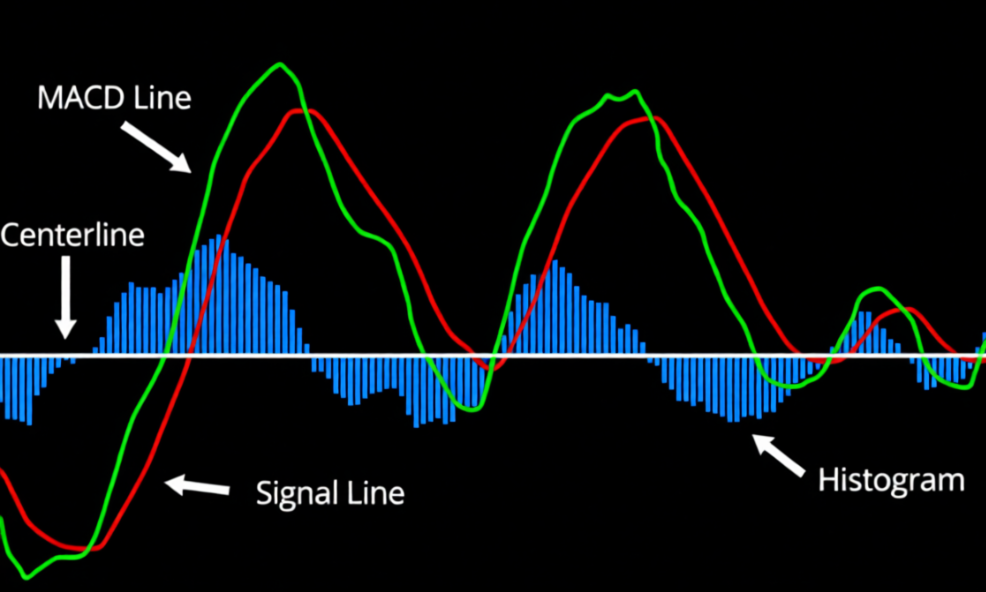

The MACD indicator consists of three elements:

My options on MQL5 Market: Evgeny Belyaev’s merchandise for merchants

-

MACD Line: The MACD line is the distinction between two exponential transferring averages (EMAs). Probably the most generally used EMAs are the 12-period EMA and the 26-period EMA. The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA.

-

Sign Line: The sign line is a transferring common of the MACD line. Probably the most generally used sign line is the 9-period EMA. The sign line is plotted on prime of the MACD line, and it’s used to generate purchase and promote indicators.

-

Histogram: The histogram is a visible illustration of the distinction between the MACD line and the sign line. When the MACD line crosses above the sign line, the histogram is optimistic, indicating a bullish development. Conversely, when the MACD line crosses under the sign line, the histogram is unfavourable, indicating a bearish development.

Calculating the MACD Indicator

The MACD indicator is calculated utilizing the next system:

MACD Line = 12-Interval EMA – 26-Interval EMA

Sign Line = 9-Interval EMA of the MACD Line

Histogram = MACD Line – Sign Line

Decoding the MACD Indicator

Merchants use the MACD indicator to determine development route, development power, and potential development reversals. Listed here are some key interpretations of the MACD indicator:

-

Crossovers: When the MACD line crosses above the sign line, it’s thought-about a bullish sign, indicating a possible development reversal from bearish to bullish. Conversely, when the MACD line crosses under the sign line, it’s thought-about a bearish sign, indicating a possible development reversal from bullish to bearish.

-

Divergences: When the MACD line diverges from the value, it will probably sign a possible development reversal. A bullish divergence happens when the value makes a decrease low, however the MACD line makes the next low. A bearish divergence happens when the value makes the next excessive, however the MACD line makes a decrease excessive.

-

Histogram: The histogram can be utilized to determine the power of the development. When the histogram is optimistic and growing, it signifies a robust bullish development. When the histogram is unfavourable and reducing, it signifies a robust bearish development.

-

Zero Line: The zero line is a vital degree for the MACD indicator. When the MACD line crosses above the zero line, it signifies a shift from bearish to bullish. When the MACD line crosses under the zero line, it signifies a shift from bullish to bearish.

Buying and selling Methods with the MACD Indicator

Listed here are three buying and selling methods that merchants can use with the MACD indicator:

-

Crossover Technique: This technique relies on the MACD line crossing above or under the sign line. When the MACD line crosses above the sign line, it’s a purchase sign, and when the MACD line crosses under the sign line, it’s a promote sign. Merchants can use the crossover technique to enter and exit trades.Divergence Technique: This technique relies on the concept that divergences between the MACD indicator and the value can sign potential development reversals. Merchants can use bullish divergences to determine potential purchase alternatives and bearish divergences to determine potential promote alternatives.

-

To determine bullish divergences, merchants search for conditions the place the value is making a decrease low, however the MACD line is making the next low. This means that the underlying development could also be shifting from bearish to bullish. Conversely, to determine bearish divergences, merchants search for conditions the place the value is making the next excessive, however the MACD line is making a decrease excessive. This means that the underlying development could also be shifting from bullish to bearish.

Merchants can use divergences to verify potential development reversals recognized by different technical indicators or worth motion patterns. For instance, if a dealer identifies a possible double backside sample on a worth chart, they will search for a bullish divergence on the MACD indicator to verify the potential reversal.

To make use of this technique, merchants can enter lengthy positions when the histogram is optimistic and growing and exit these positions when the histogram begins to lower. Conversely, merchants can enter quick positions when the histogram is unfavourable and reducing and exit these positions when the histogram begins to extend.

It is very important observe that the MACD indicator is just not infallible and ought to be used together with different technical indicators and elementary evaluation. Merchants also needs to pay attention to the restrictions of the indicator, resembling its tendency to generate false indicators in uneven or sideways markets.

-

Development Energy Technique: This technique relies on the concept that the histogram can be utilized to determine the power of the development. When the histogram is optimistic and growing, it signifies a robust bullish development, and when the histogram is unfavourable and reducing, it signifies a robust bearish development. Merchants can use the development power technique to enter and exit trades based mostly on the power of the development.