Like myself, maybe the Bollinger Band was one of many first indicators you found in the beginning of your buying and selling journey.

In spite of everything, it’s imagined to make all the pieces tremendous straightforward…

…simply purchase low and promote excessive, proper!?…

Properly, certain, there could also be some fortunate wins firstly.

However as time goes on… you begin experiencing losses…

Worse but, they will come alongside way more ceaselessly with the Bollinger Band!

So, you cease utilizing the indicator and doubtless begin studying about RSI… transferring averages…

…you begin system hopping.

I’m guessing it might be a well-recognized state of affairs.

It was for me, anyway!

However, what if I advised you there’s a provable approach the Bollinger Band works persistently in actual markets?

Not simply in earnings, however statistically, too?

Properly, that’s what I’m about to indicate you on this information.

Particularly, you’ll study:

- A fast refresher on how the Bollinger Band works and the way a variety of merchants use it

- Timeless buying and selling rules on how one can construct a working Bollinger Band buying and selling system

- The foundations of the Bollinger Band buying and selling system and why they exist

- A whole metric of the outcomes of the Bollinger Band buying and selling system

You prepared?

Then let’s get began…

How the Bollinger Band works and how one can use it

The indicator just about consists of three issues:

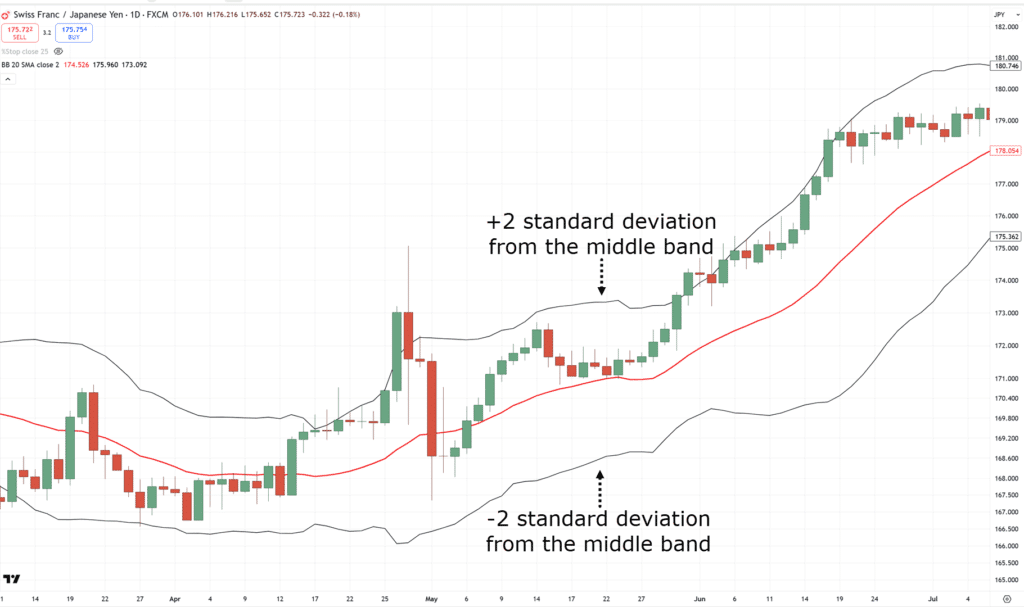

- Higher Band

- Center Band

- Decrease Band

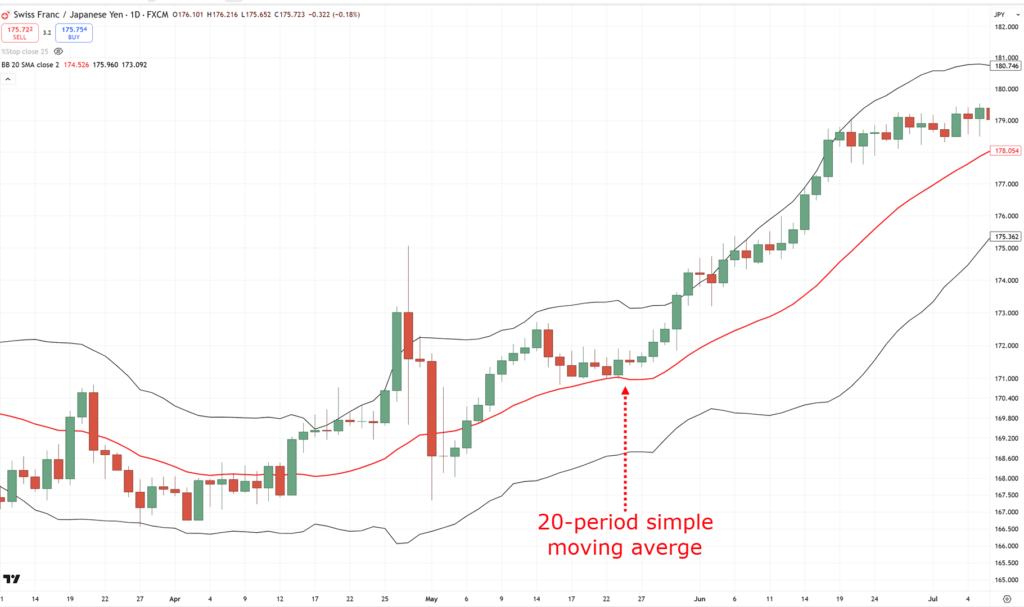

Beginning on the coronary heart of this indicator is a 20-period transferring common…

The indicator works by including a typical deviation of two to the higher band and subtracting a typical deviation of two from the decrease band…

Mainly, it provides “distance” to the transferring common on the center band.

Now, how do merchants interpret it?

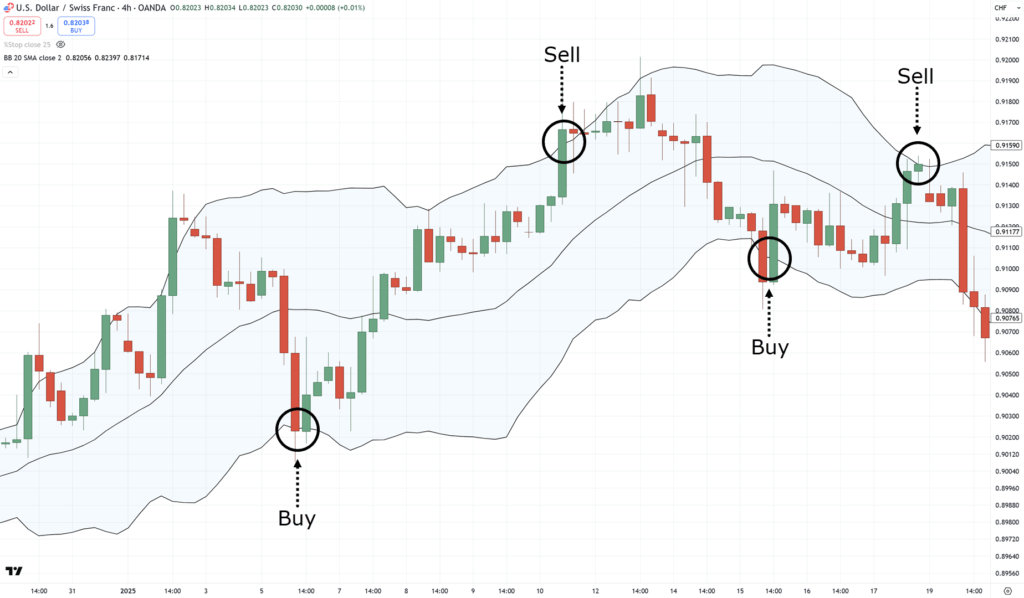

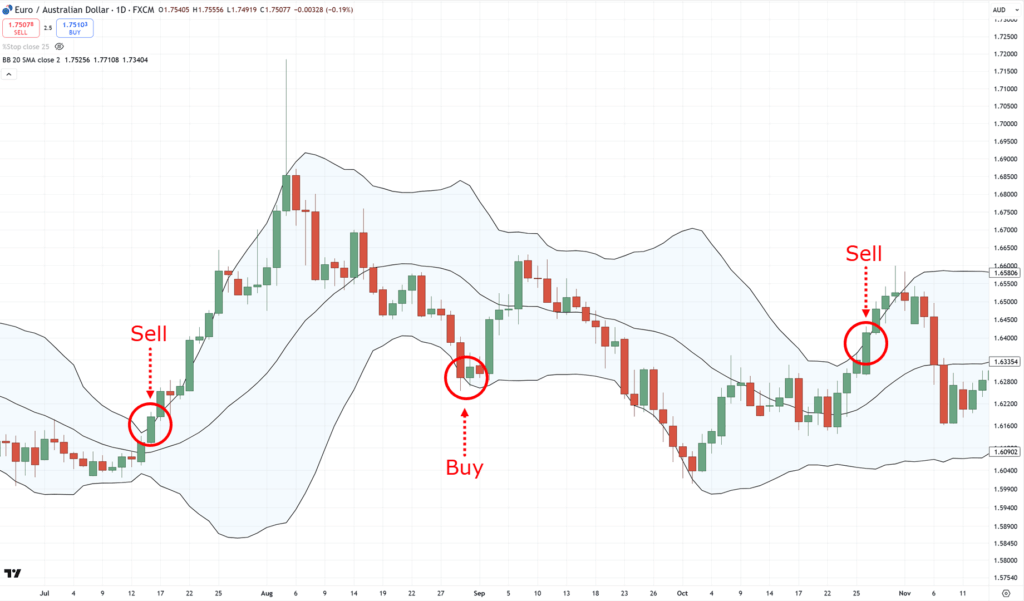

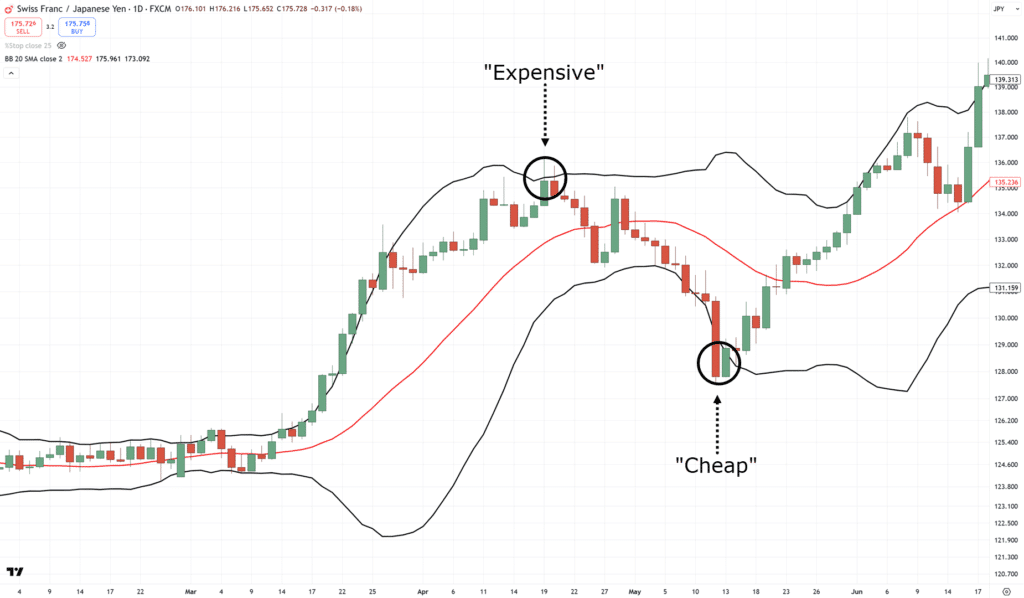

Properly, if the worth is on the higher band, it’s thought of costly, and regarded low cost when it’s on the decrease band…

These examples can then be used to introduce a few methods, equivalent to “shopping for low and promoting excessive”…

It’s basically the textbook strategy to utilizing this indicator.

However, whereas it sounds nice in principle…

…how does it carry out in actuality?

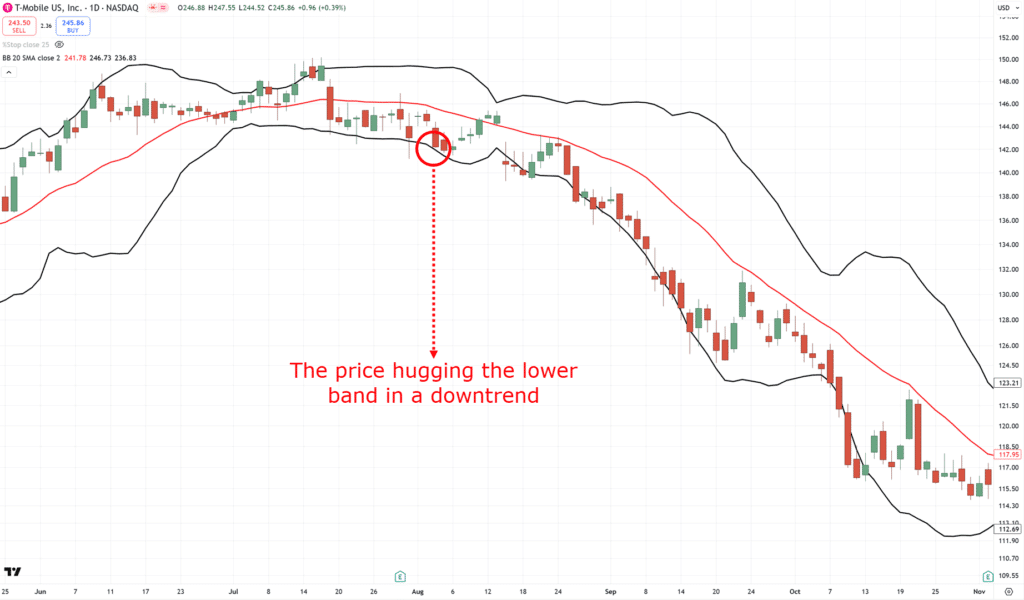

Hmm, not at all times in the best way you’d count on!…

As you may see, in down developments, the worth retains getting cheaper and cheaper.

Think about should you purchase on the decrease band and also you’re nonetheless holding your commerce, hoping that the worth will bounce again greater… not a good time!

Which leaves you questioning once more…

“What, if the Bollinger Band doesn’t work on trending markets…”

“What’s the purpose of this information?”

“Does the indicator work in any respect?”

Properly, indicators are solely ever a small a part of a working buying and selling technique.

When you focus solely on the Bollinger Band, you’ll miss out on how one can combine it right into a worthwhile buying and selling system!

Which is why within the subsequent part…

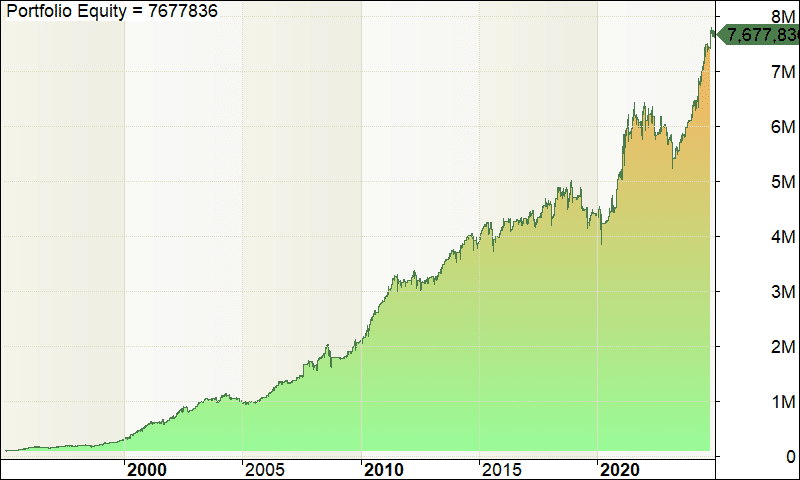

…I’ll clarify the muse behind how the system I’m going to share with you made +7,605% over the past 30 years.

So, let’s take step one on studying how this method works.

Fundamental guidelines and ideas behind the Bollinger Band buying and selling system

Let’s get straight to the purpose, we could?

The Bollinger Band buying and selling system that I’ll share with you primarily trades shares.

Why the inventory markets?

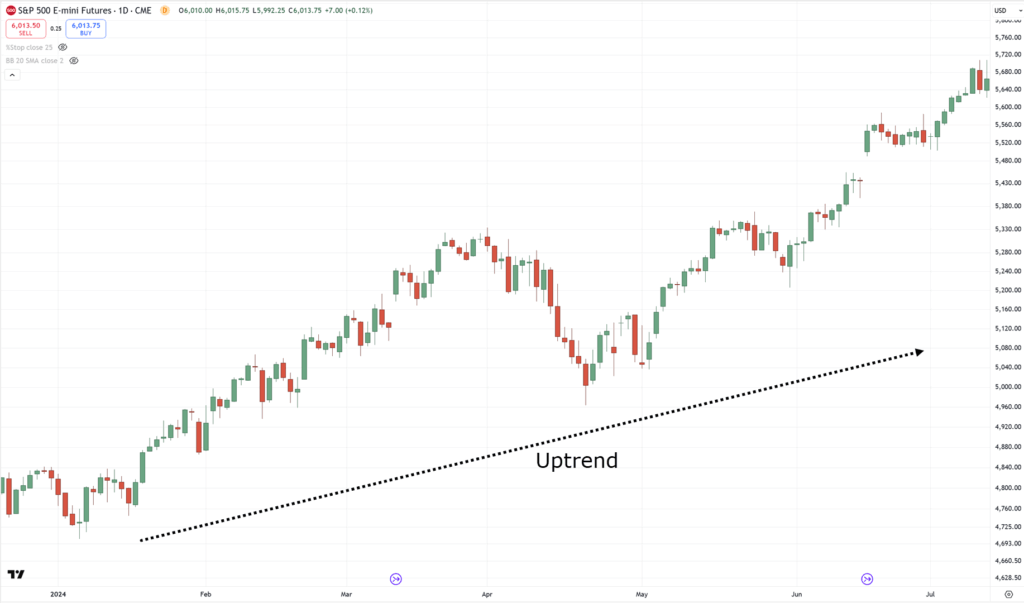

The principle purpose is that the inventory market can transfer like a tide.

Which means that at any time when the markets are in a bull run…

…tons of of alternatives come up within the inventory markets!

And that is what the created system works on: using and making the most of these “tides” out there.

Now with that stated…

What sort of shares are best suited?

Many of the textbook examples of the Bollinger Band indicator look one thing like this…

In order that they’re implying it’s an indicator finest traded in a spread.

However what if the Bollinger Band may benefit from an uptrend?

Properly, let’s maintain constructing as much as that!

However for now…

Begin trying to find shares that development.

That’s proper, not ranging shares, however trending ones!

Why?

As a result of shares which can be in an uptrend are already prone to proceed greater.

You wish to hop in and wager on a number one horse!

And the perfect half is that everytime you spot a trending inventory, it already implies that the general sentiment of the market in that inventory is nice.

As for a way the corporate has been managed, or how constant it’s in its earnings progress…

…all (in all probability) priced into the chart already!

So now, with the inventory chosen, what’s subsequent?

How do you utilize the Bollinger Band, and why?

All indicators are instruments – they’re only one facet of getting issues executed.

Don’t you agree?

The primary query you could at all times ask is:

“What sort of setups are you trying to enter trades?”

Which, on this case…

…it’s shares which can be trending:..

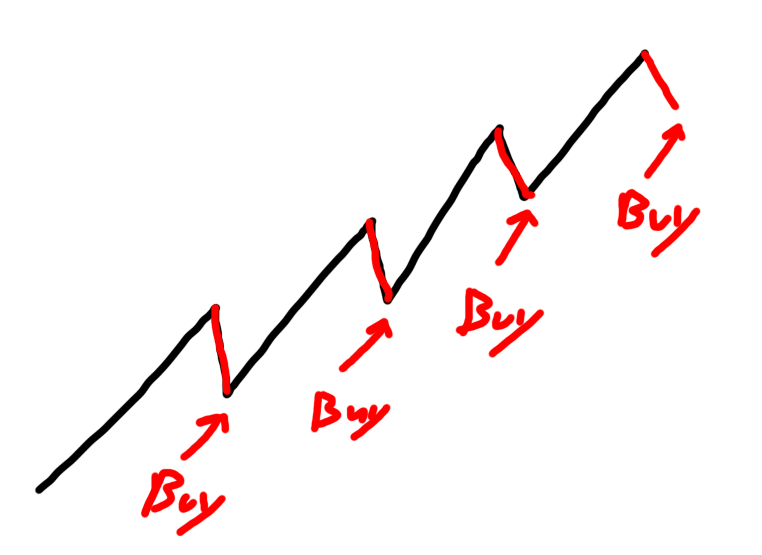

Importantly, you additionally wish to search for pullback setups, to be able to “purchase low and promote excessive” in favour of the general development…

With that well-defined, the following query you could ask is…

“Which indicator will help me discover these setups and entries systematically?”

Now that could be a nice query.

Fortunately, it’s going to be the Bollinger Band!

In what approach?

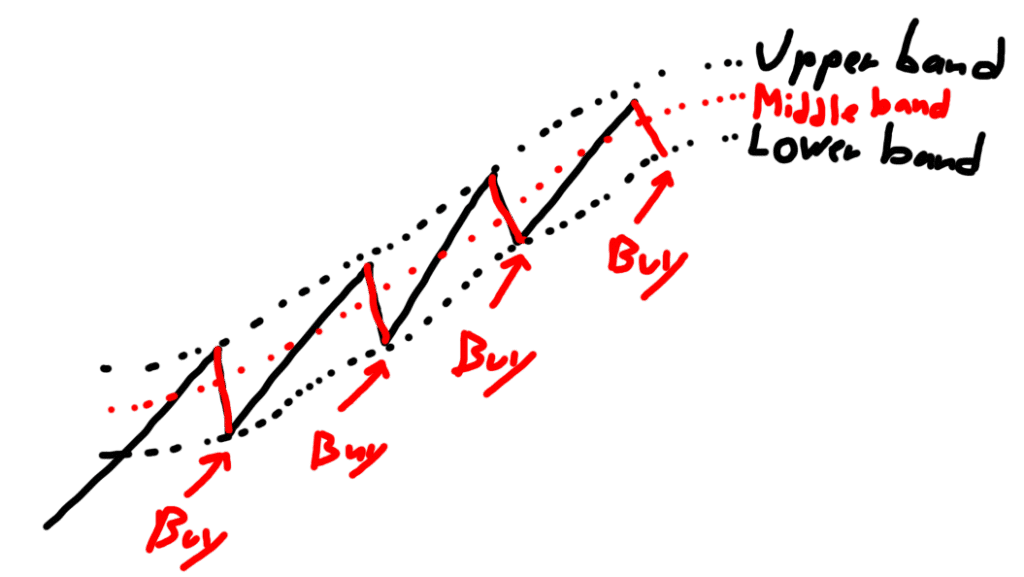

Merely put, by getting into pullbacks on the decrease band on prime of a trending inventory…

Now, whether or not or not you utilize the Bollinger Band, it’s essential to deal with all indicators as a device.

In creating any system, it is best to at all times maintain your thoughts as structured as doable.

First, work out what setup you wish to commerce, then discover the suitable indicator that will help you search for and enter these setups.

Make sense?

Good, as a result of now comes the enjoyable half…

The Bollinger Band buying and selling system itself.

Within the subsequent sections, discover the whole guidelines of this method, in addition to the outcomes, so you may resolve for your self.

You prepared?

Then let’s get on with it!

The entire guidelines of the Bollinger Band buying and selling system

One factor to notice is that the buying and selling system you’re about to study is predicated on imply reversion buying and selling.

This implies you purchase shares on a pullback after which promote them on the rally.

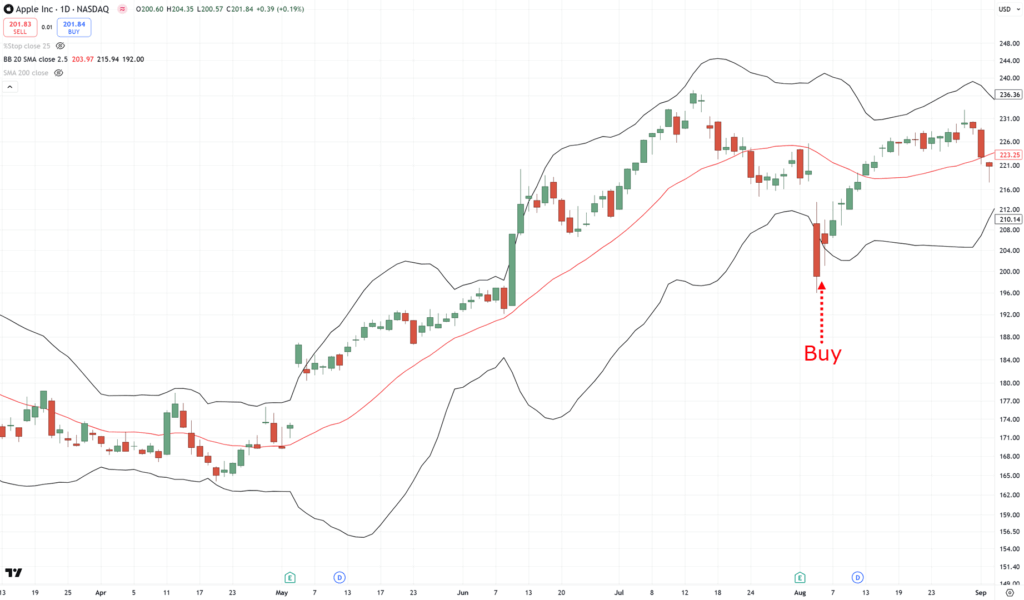

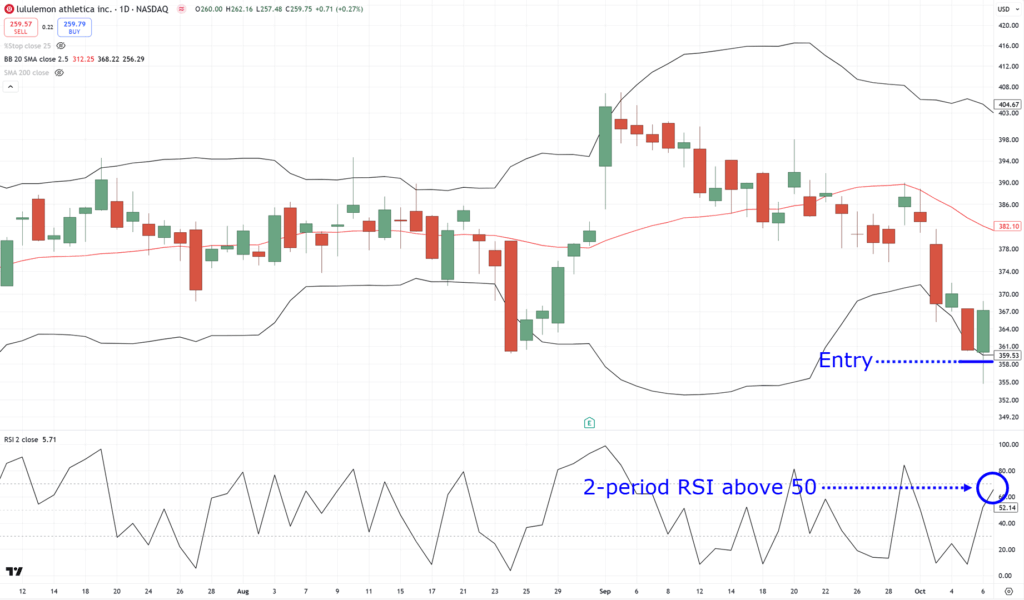

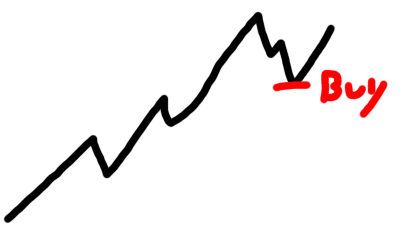

It seems one thing like this…

With that in thoughts, listed here are the foundations of this Bollinger Band buying and selling system…

Markets traded:

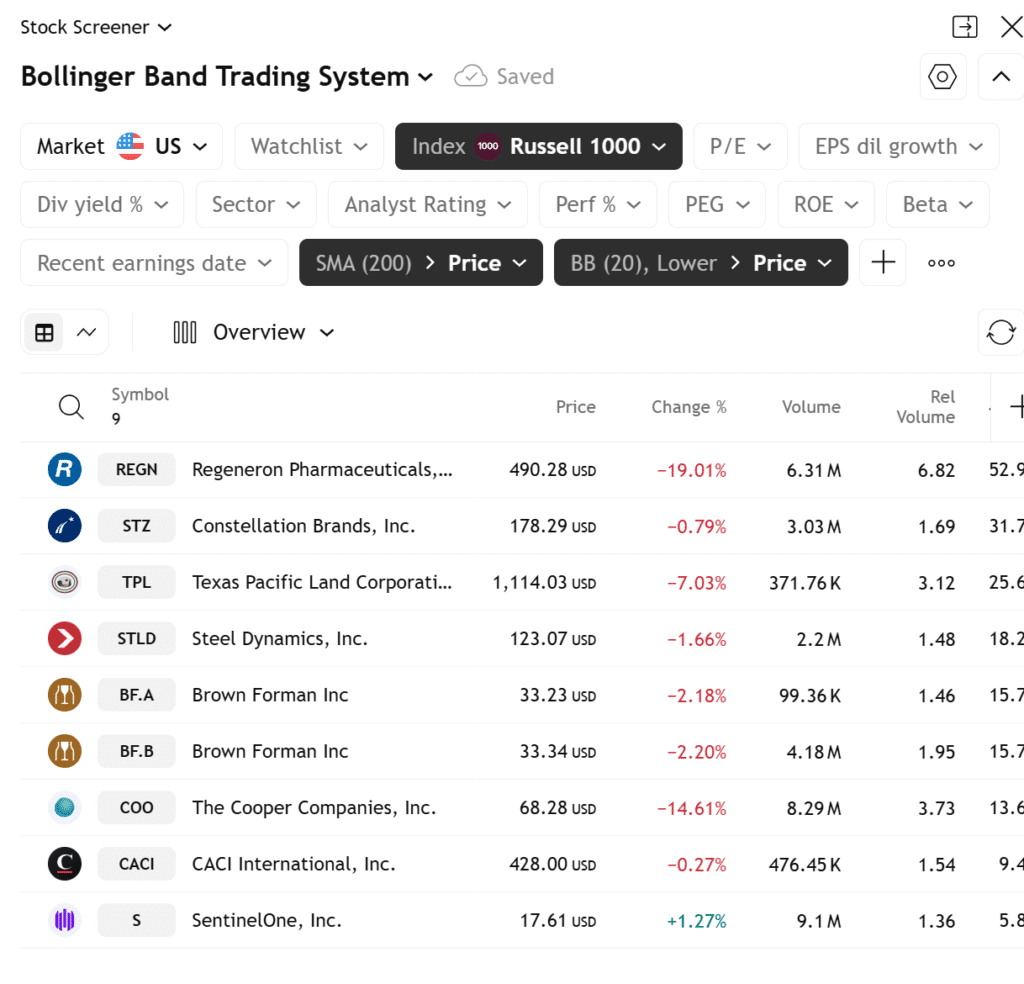

Shares within the Russell 1000 index

Timeframe:

Every day

Threat administration:

20% capital for every inventory and a most of 5 positions

Buying and selling guidelines:

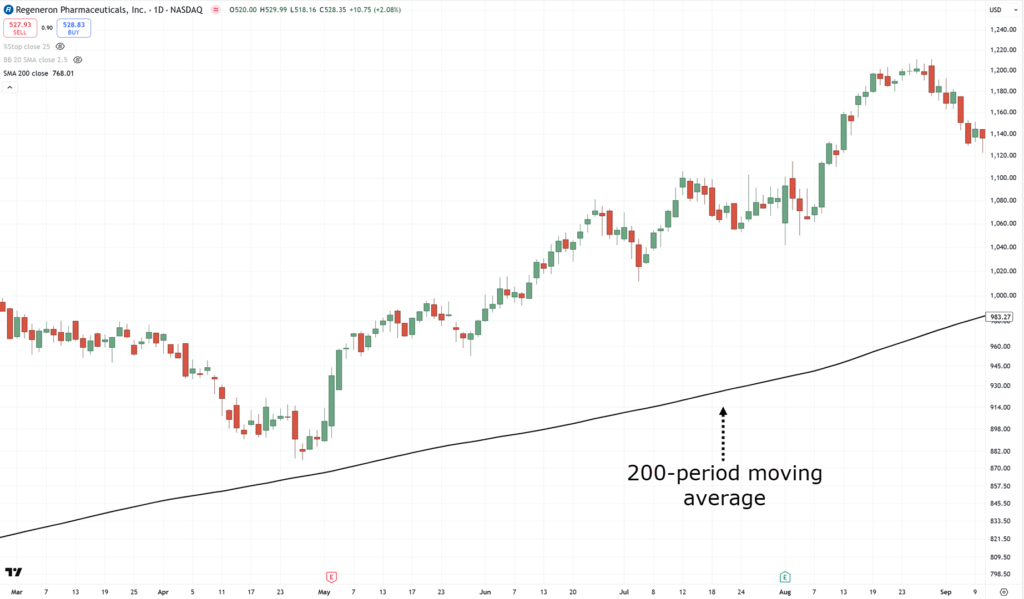

- The inventory is above the 200-day transferring common

- The inventory closes under the decrease Bollinger Band

- Place a 3% purchase restrict order under the final closing value

- If there are too many shares to select from, choose those which have elevated essentially the most in value over the past 100 days (standards to rank shares from strongest to weakest)

- In case your order is stuffed, promote when the 2-day RSI crosses above 50 or after 10 buying and selling days (standards to outline the promote sign)

And simply so as to add, the Bollinger Band settings are: 20-day transferring common and a pair of.5 normal deviation.

I do know it’s lots to soak up hastily.

So, let me stroll you thru every of these guidelines.

The inventory is above the 200-day transferring common

Recall that you just’re attempting to commerce pullbacks on shares which can be in an uptrend.

And as you understand, there are 100 methods to outline what an “uptrend” is!

So to make this definition systematic, merely use a 200-day transferring common…

Meaning if a inventory’s value is above the 200-period transferring common, it meets the primary criterion!

Add it to the record!

And if it’s under the 200-period MA?

Skip the inventory.

However, is there a simple technique to filter for these?

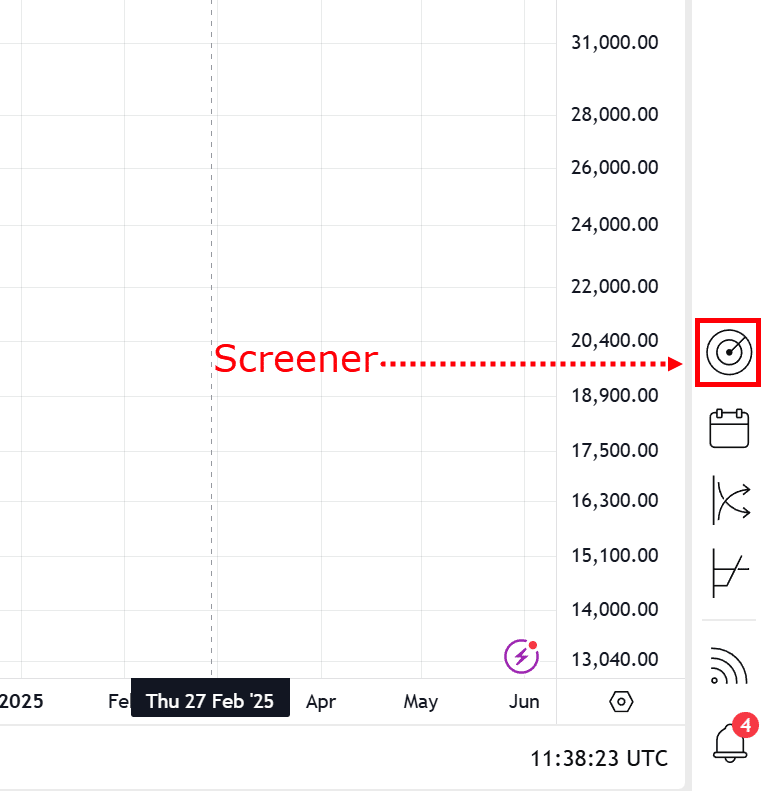

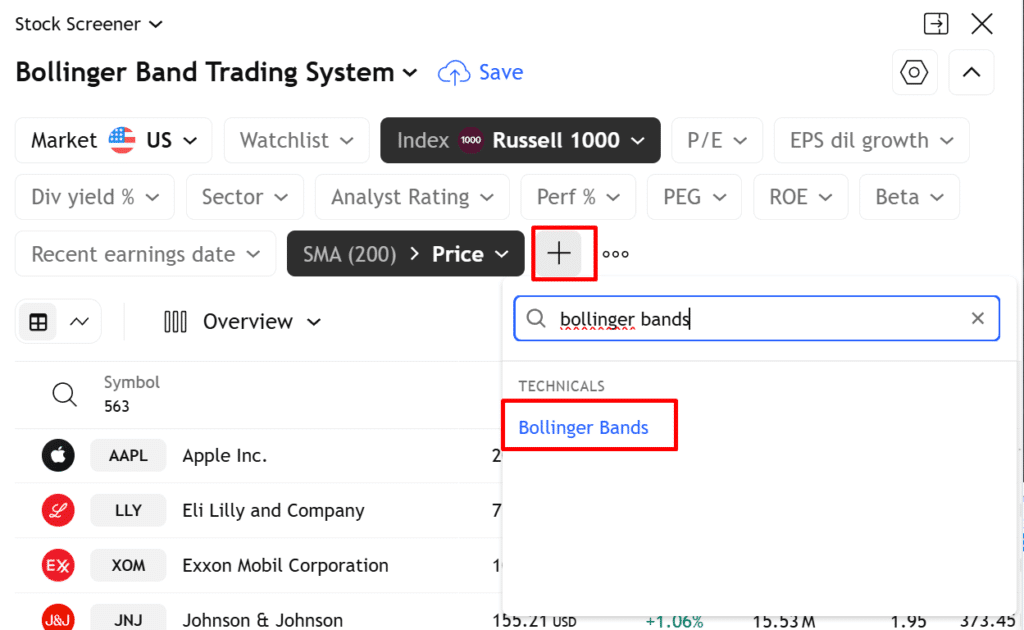

Properly, you need to use TradingView’s free scanning device!…

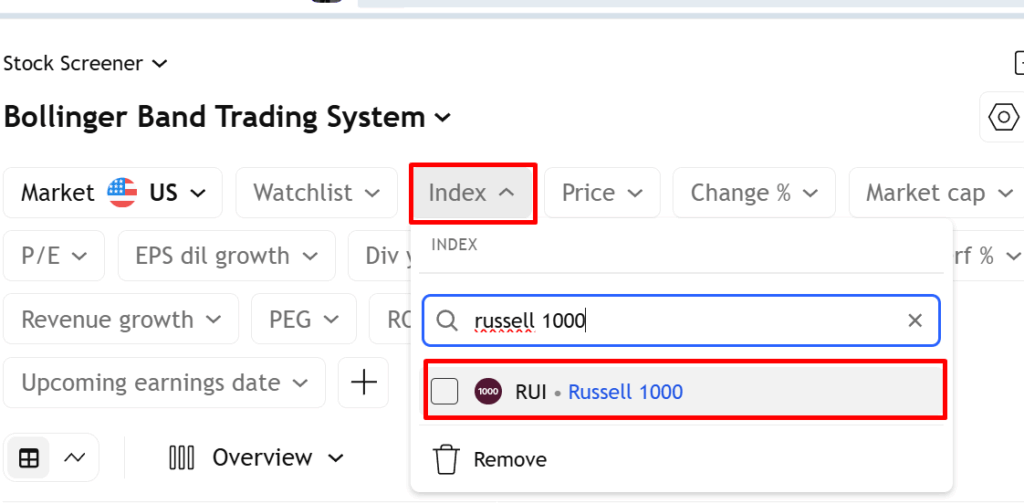

First, set your market to the Russell 1000…

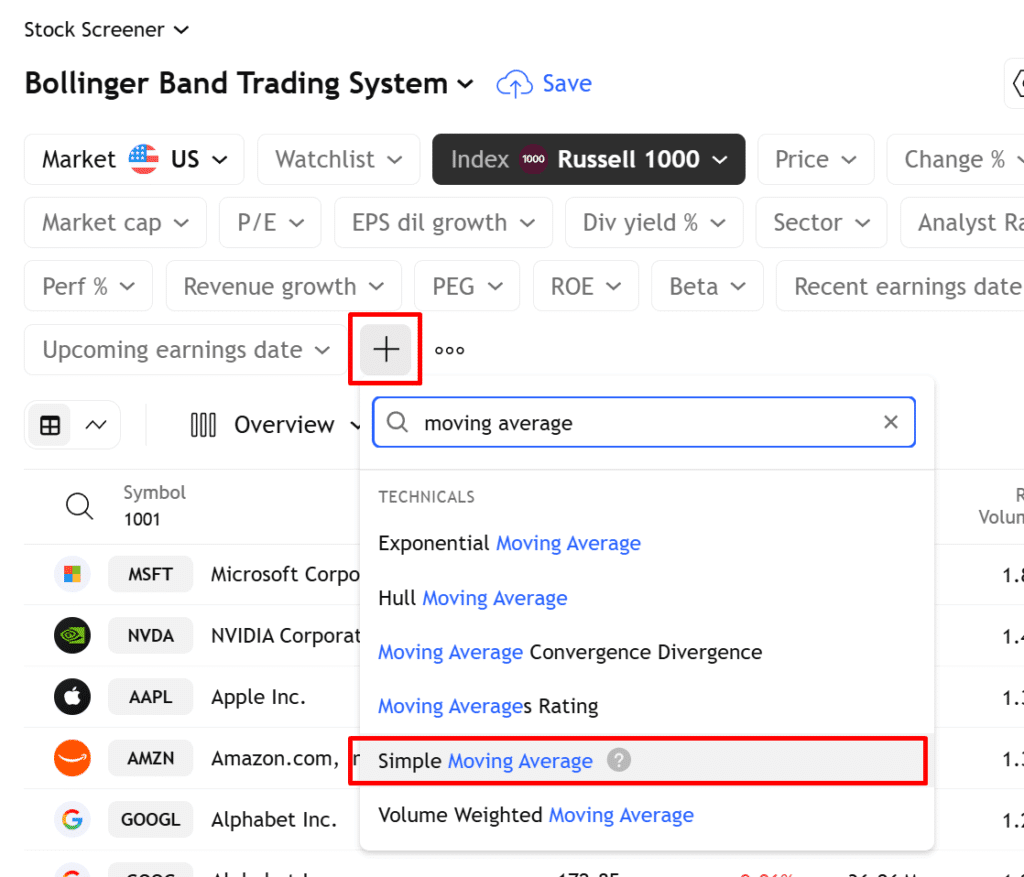

And apply the transferring common filter…

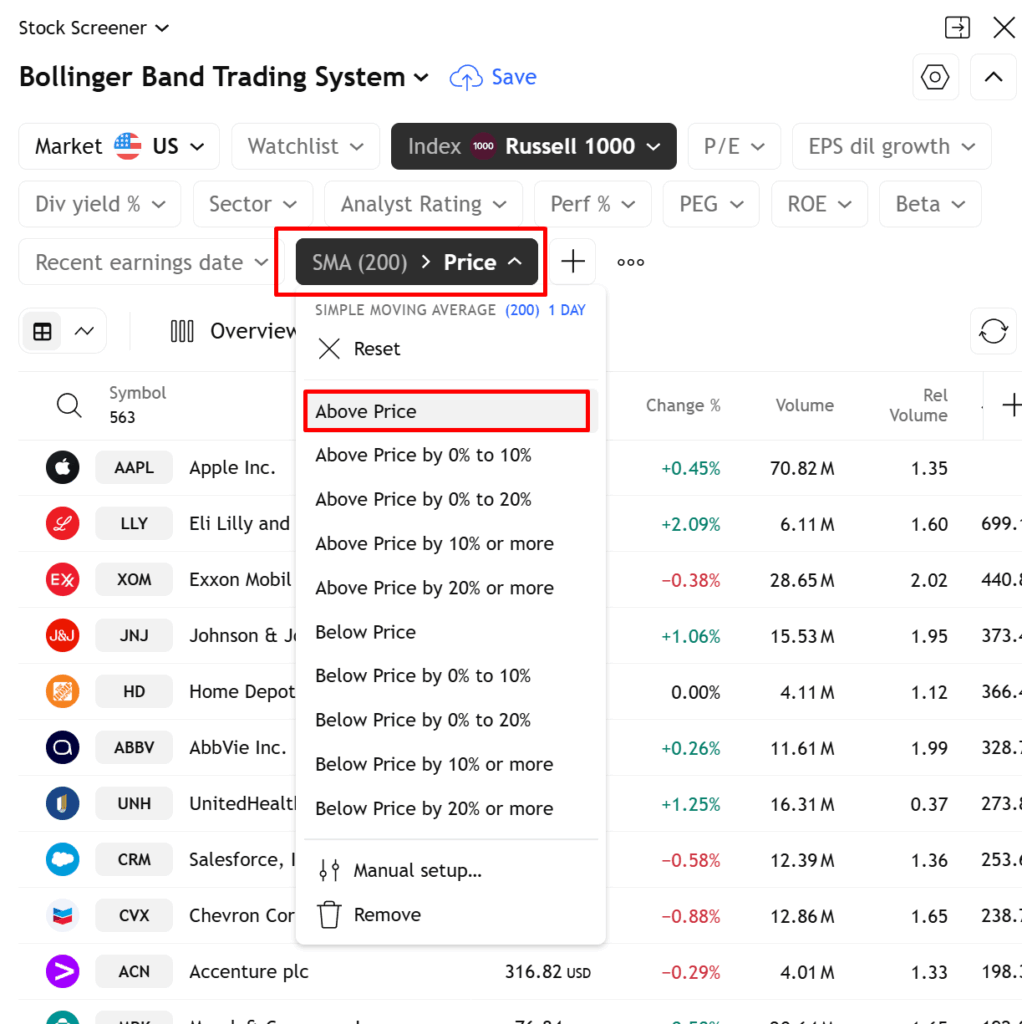

Set it to 200-period, so it solely filters the right shares…

And with that, you’ve already obtained a strong filter for this method!

Now don’t fear, as I am going by means of the foundations, I’ll proceed to construct upon this screener so you may observe.

With that stated, what’s the following factor to search for?

The inventory has closed under the decrease Bollinger Band

That is the place the Bollinger Band indicator is available in.

It’s used to systematically outline a pullback – ready for the worth to “shut” under the decrease band…

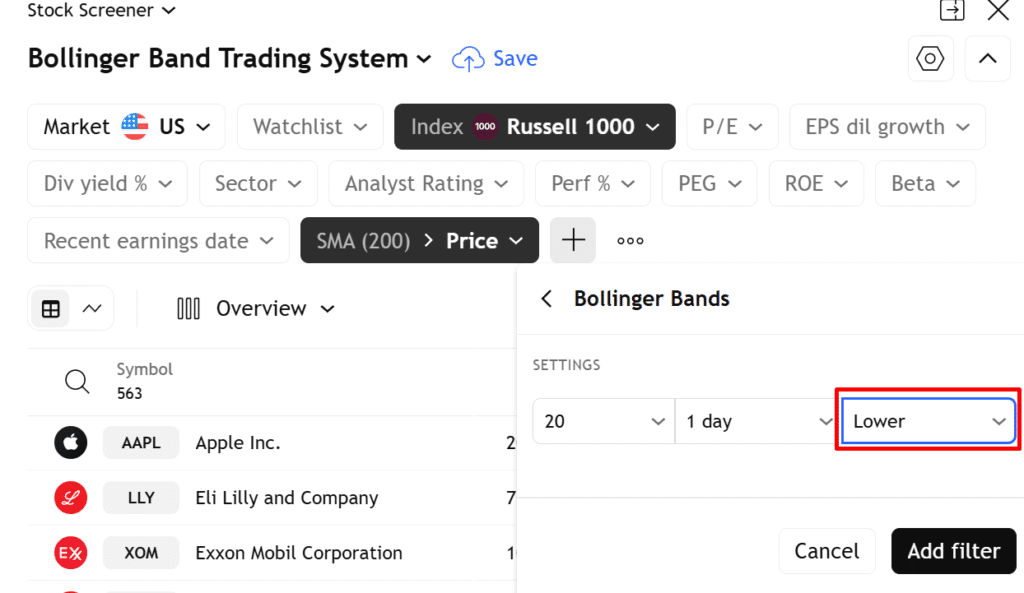

Within the TradingView screener, go forward and apply the Bollinger Band indicator filter…

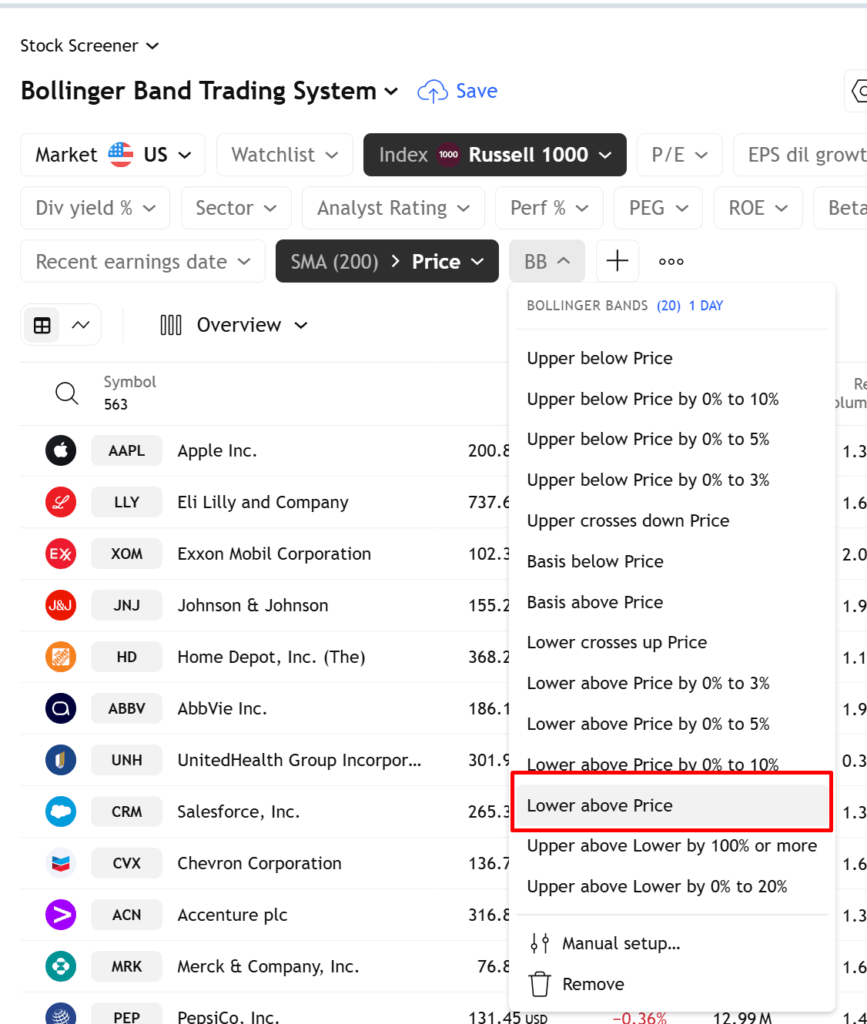

And eventually, set it to solely search for shares the place the worth is under the decrease band…

Which means that on-top of the 200-period transferring common filter, this screener will solely search for shares if the decrease band is above the worth, slightly, if the worth is under the decrease band.

With that in place, if the inventory makes an in depth under the decrease band, what’s subsequent?

If there are too many shares to select from, choose those which have elevated essentially the most in value over the past 100 days

One advantage of the inventory markets is that when issues are going nice, numerous alternatives come up.

Which means that in a bull market, shares are trending more often than not.

Nevertheless, a buying and selling portfolio can solely deal with a lot.

This results in the query… which one to purchase?

Properly, this rule particularly solutions that!

Based mostly on the screener outcomes, you may see the next…

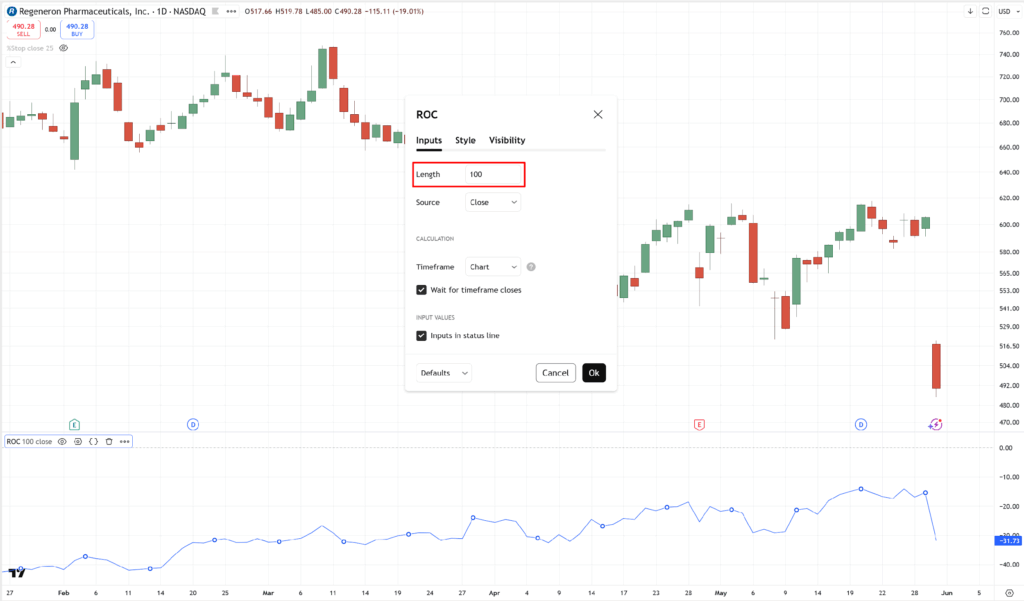

So what you must do now could be get every inventory’s “charge of change” worth.

Particularly, you’d have to tug up the speed of change indicator and set it at a 100-period…

Based mostly on what might be seen within the above instance, REGN has a ROC worth of -31.73

Now, though you might want to get hold of the 100-day ROC worth for all of the shares listed in your screener outcomes your self, for the sake of this information, I’ve supplied some instance values for you right here!

- REGN: -31.73

- STZ: -19.66

- TPL: -8.01

- STLD: +8.77

- A: -8.03

- COO: -7.54

- CACI: +1.87

- S: -22.8

What you might want to do subsequent is rank them based mostly on their values:

- STLD: +8.77

- CACI: +1.87

- COO: -7.54

- TPL: -8.01

- BF.A: -8.03

- STZ: -19.66

- S: -22.8

- REGN: -31.73

Recall, this Bollinger Band buying and selling system has a most of 5 trades.

This implies it is best to allocate not more than 20% of your capital to every inventory.

So, it is a approach of discovering out which shares are most deserving of your cash!

And based mostly on the rankings on this instance…

You’d need to prioritize getting into STLD, CACI, COO, TPL, and BF.A! (and ignore the remainder.)

Now, if, for instance, you have already got 3 open trades, then all you might want to do is to solely enter the highest 2 on the record.

So to reiterate – rank shares from strongest to weakest based mostly on their 100-day charge of change.

Then, prioritize buying and selling them based mostly on the rating till you attain 5 complete open trades!

With that out of the best way, let’s now transfer on to entries and exits.

One of the best piece of recommendation I’ve is…

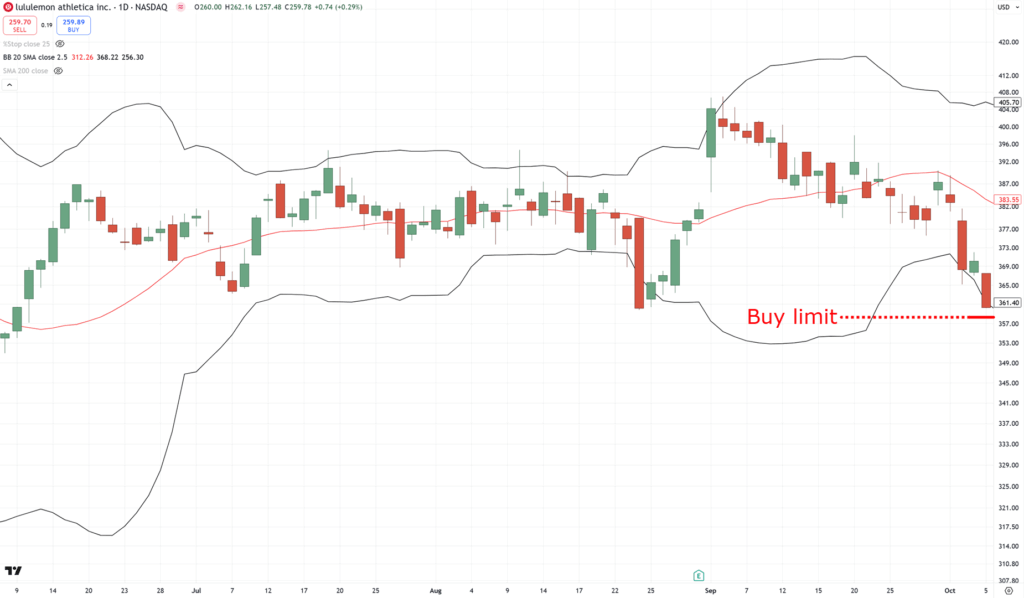

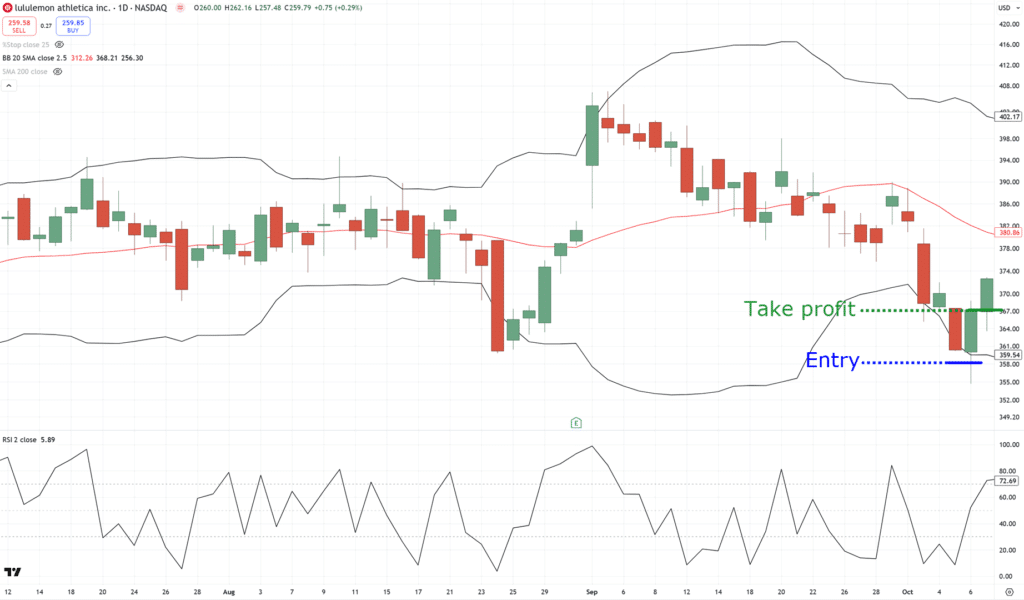

Place a 3% purchase restrict order under the final closing value

Regardless of the final closing value is, because the inventory closes under the decrease band…

Simply subtract 3% from the worth, and then you definately get your restrict order value!…

The rationale you do that is that you really want the inventory to come back to you even additional.

There must be sellers nonetheless looking for the underside, just for the consumers to swoop the worth again in like an prolonged rubber band…

Basically, in case your restrict order didn’t get triggered…

…take the order out and do your scans once more the following day.

Be sure no restrict order lasts greater than a day!

Bought it?

General, this rule is a reasonably nice criterion to establish oversold shares.

So, now that you just’ve entered the commerce, how do you handle it?

In spite of everything, there’s no level in getting into a inventory should you don’t know how one can exit it, proper?

Importantly, no “intestine emotions” vital right here, both…

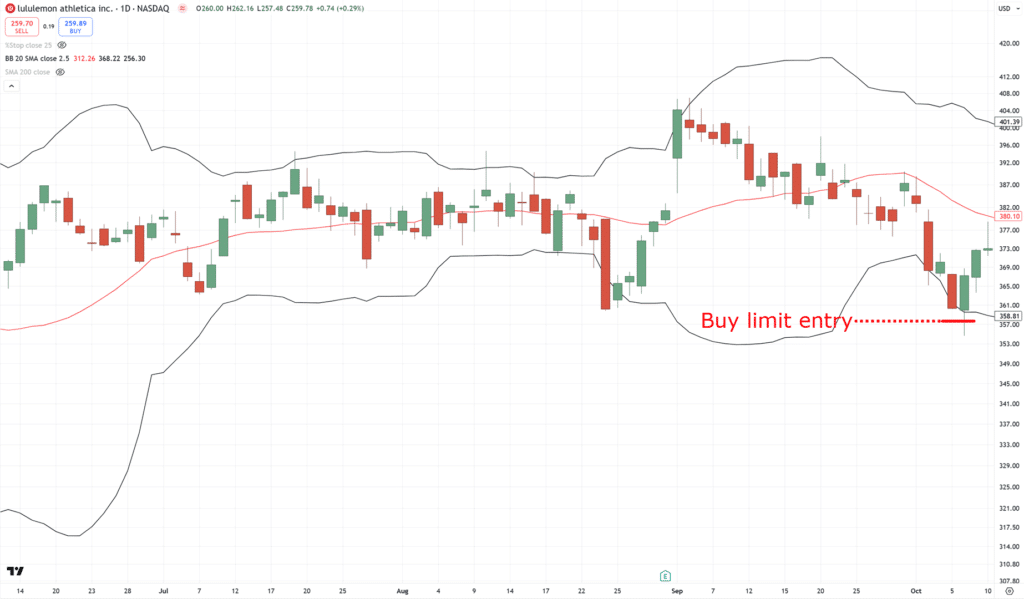

In case your order is stuffed, promote when the 2-day RSI crosses above 50 or after 10 buying and selling days

I do know, this text is concerning the Bollinger Bands.

So, why the heck is the RSI sliding into this text?

Properly, the 200-period transferring common makes certain the shares being traded are in an uptrend.

With that in place, the Bollinger Band helps you enter and search for pullback setups.

The RSI indicator helps work out exits.

Recall, the thought of this technique is to seize pullbacks…

On the similar time, you don’t wish to overstay into the commerce, and at finest, solely seize the power of that pullback setup.”…

And this, my buddy, is what the RSI indicator is for

When you’re within the commerce, await the worth to shut above RSI 50…

Then, exit the following day on the market’s “opening”…

Oh, and don’t neglect plan B.

Simply in case the inventory doesn’t do something, there must also be a time-stop.

If the worth doesn’t shut above the RSI 50 after 10 day?

Exit on the 11th day.

And sure, in case your restrict order will get triggered, it already counts as the primary day!

Make sense?

So now to deal with the questions lurking behind your thoughts…

Does this technique work?

If it really works, what sort of returns are you able to count on?

Bollinger Band Buying and selling System Outcomes

Discover how I at all times say “system” all through this information?

It’s intentional, as a result of clearly there’s a couple of facet concerned right here.

Nevertheless, the foundations are goal and clearly outlined, which means it may be simply examined.

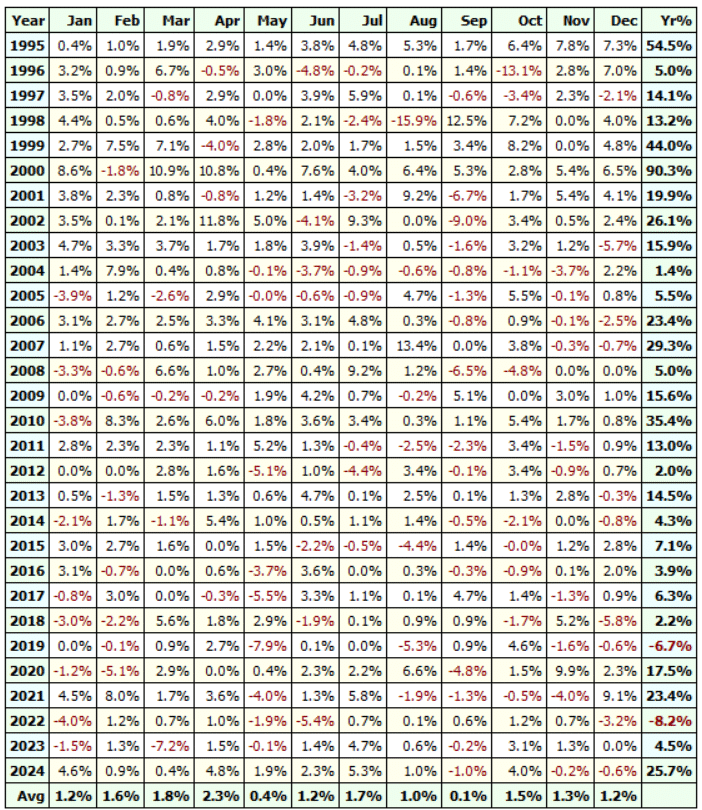

On this case, let’s backtest it from 1995 to 2024.

This set of information implies that the technique will present its efficiency, even by means of a number of monetary crises!

And naturally, this method operates within the Russell 1000 universe.

P.S. the info additionally contains shares which can be already delisted in addition to shares that got here out and in of the Russell 1000 index.

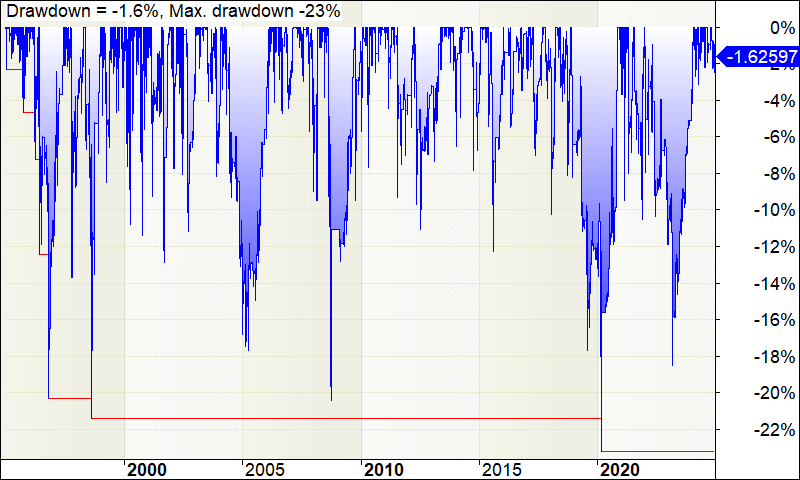

So, listed here are the outcomes…

- Internet revenue: +7,577.84%

- Variety of trades: 1365

- Common Annual return: +15.56%

- Most drawdown: -23.20%

- Successful charge:94%

- Payoff ratio:74

As you may see, this method solely had 2 dropping years out of all 30, and should you take a look at the statistics, this method has a win charge of 66%.

That’s one heck of a system!

I imply, certain, there are some mediocre years…

However total, it’s clear the system has an edge within the markets.

Nevertheless, as with all methods, there are weaknesses.

Any methods could have their dropping streaks.

So, for transparency, right here’s an underwater fairness curve of this method…

Mainly, it exhibits how usually the Bollinger Band buying and selling system goes right into a dropping streak and for a way lengthy it stays there earlier than it breaks even once more.

And there you go!

A whole Bollinger Band buying and selling system that works within the markets!

Now at this level, all that’s left is so that you can apply the system, which admittedly is the toughest half.

As a result of as time goes on, you might want to develop a full understanding of this technique.

Which, at this level, you may begin questioning…

“Why this indicator?”

“Would the system nonetheless work if I modified the settings?”

“How about buying and selling this method within the S&P 500? Will the system nonetheless work?”

Relaxation assured, I’ve created an FAQ part, which possible accommodates the solutions!…

Continuously Requested Questions

Some generally requested questions concerning the Bollinger Bands buying and selling system…

What sort of order do I take advantage of to enter the commerce?

As per the foundations of the technique, at all times use a restrict order.

In case your restrict order doesn’t get triggered for in the present day’s session, for instance, then the restrict order should expire.

Mainly, no purchase restrict order lasts greater than someday.

Why do you utilize the Russell 1000 as a substitute of the S&P 500?

There’s no explicit purpose.

You should utilize the S&P 500, and the buying and selling system will nonetheless work!

In terms of the 200-period transferring common, do I take advantage of a easy or exponential transferring common?

I take advantage of a easy transferring common however to be trustworthy, it doesn’t matter.

You should utilize an exponential or weighted common, and the buying and selling system will nonetheless work!

The idea behind it’s what issues, not the parameters.

I’d be nervous if a buying and selling system broke down merely due to a parameter change!

Does the Bollinger Band buying and selling system work for brief promoting utilizing an reverse set of buying and selling guidelines, which means you quick shares on the higher band?

I’ve backtested this extensively, and sadly…

It doesn’t work.

Would this buying and selling system work for Foreign exchange markets?

Completely different markets have completely different behaviours.

So, if you wish to commerce this method on different markets, these markets should have a mean-reverting behaviour or it gained’t work.

What does place dimension 20% imply?

It means 20% of your capital will probably be used to purchase a inventory.

For instance, let’s say you’ve got $100,000 capital and you might want to purchase shares A, B, C, ,D and E.

This implies you’ll allocate $20,000 to shares A, B, C, D, and E.

After which, all of your buying and selling capital will probably be used up, and also you’ll not take any new positions (even when there’s a legitimate setup).

Isn’t it harmful to commerce and not using a cease loss?

Though you’re buying and selling and not using a cease loss, you’ve got a time cease of 10 buying and selling days.

So, if the exit sign is just not met inside 10 buying and selling days, you’ll exit the commerce on the open of the eleventh buying and selling day.

Additionally, so that you can lose all of your buying and selling capital, each inventory you purchase should drop to $0.

It’s doable however unlikely as you’re buying and selling shares within the Russell 1000 (that are the 1000 largest shares within the USA).

You rank shares based on their Charge of Change (ROC). Is there a minimal ROC worth you’re taking a look at?

No, there’s no minimal worth for it.

If the screener outcomes present a inventory with a detrimental charge of change, do I nonetheless take the commerce?

Sure, you continue to take the commerce although the inventory has a detrimental charge of change

How a lot beginning capital do you might want to begin buying and selling with this method?

It is best to have at the very least $3,000 to commerce the Bollinger Band buying and selling system.

But when your dealer permits you to commerce fractional shares, then you may open an account smaller than $3,000

What if the inventory value hole is greater than 3% decrease? Do I nonetheless purchase the inventory?

Sure, you’ll nonetheless purchase the inventory, albeit at a lower cost (under your restrict order).

Additionally, flip OFF pre-market buying and selling. Most platforms have it turned off by default, but when yours is on, please change it to OFF. If not, you’ll find yourself shopping for the inventory at the next value.

Now, right here’s one secret that I wish to inform you:

That is simply one of many working methods.

What was mentioned right here is mean-reversion buying and selling; nonetheless, there are additionally trend-following methods and breakout buying and selling methods.

All with an edge within the markets!

Now, think about should you may commerce a number of (uncorrelated) buying and selling methods that work.

It’s like having a number of streams of long-term earnings, proper?

So, if you wish to study extra about it, then there’s a brand new e book being launched known as Buying and selling Methods That Work.

On this e book, you’ll get the complete bundle.

It accommodates the system I shared with you in the present day however a lot improved, and in addition three different methods.

When you’re , then you may test it out right here.

With that stated…

I wish to know what you suppose.

Do you suppose that methods buying and selling is the “best” technique to discover an edge out there?

In that case, do you propose to develop your system sometime?

Or attempt to commerce one which already works after which work from there?

Let me know your ideas within the feedback under!