Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

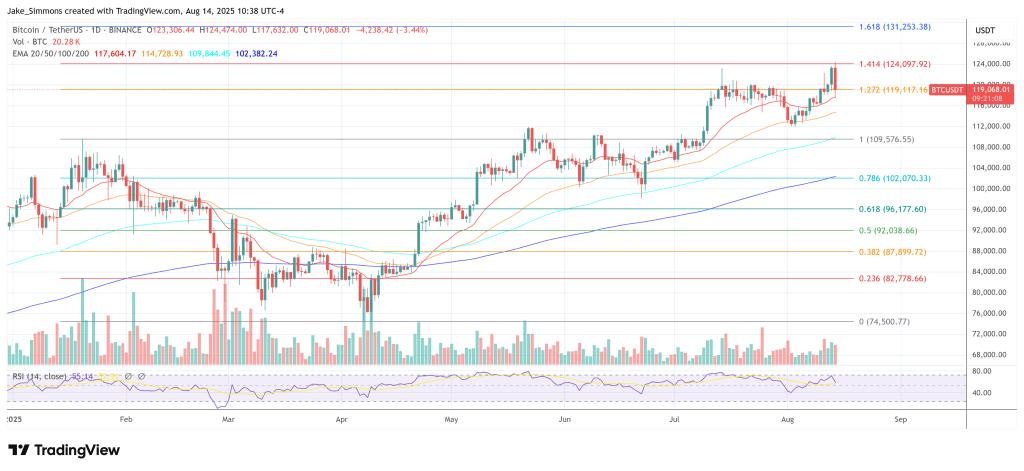

Bitcoin’s contemporary report above $124,000 on Thursday set the stage for a stark take a look at of one in all oldest heuristics, in accordance with Joe Consorti, Head of Progress at Theya. In a video revealed as we speak, August 14, Consorti argued that the fourth quarter will reveal whether or not the market’s long-observed four-year halving cycle nonetheless governs worth habits—or whether or not the asset has entered a brand new regime formed by deep, affected person swimming pools of conventional finance capital.

“Bitcoin simply hit a model new all-time excessive of greater than $123,700,” he stated on the high of the section. “It’s since corrected barely…however we’re nonetheless pushing larger.” That print aligns with Wednesday’s tape throughout main dashboards: Bitcoin worth topped above $124,4000 as we speak as macro merchants leaned right into a potential Fed easing path and threat sentiment firmed.

This autumn Might Bury The 4-12 months Bitcoin Cycle For Good

Consorti framed the breakout towards a month-long tug-of-war round $118,000–$120,000, describing how “longs and shorts have been preventing backwards and forwards for market management,” with bulls “slowly however absolutely” grinding out the higher hand. He tied the setup to the seasonal transition out of the “summer time doldrums,” and to a coverage backdrop he expects to show supportive: “As Wall Road returns from trip… the Fed is positioned for its first upkeep fee lower in a 12 months because the US economic system rebounds.” Futures markets have more and more priced a September lower, a shift that has underpinned threat belongings broadly alongside greenback softness.

The center of Consorti’s thesis is that this enlargement is structurally totally different. “That is additionally Bitcoin’s longest bull market ever… at 21 months in comparison with 13 months,” he stated, utilizing that period to pose the important thing dilemma: “That begs the query, is the 4-year cycle useless? Nicely, on the very least, the 4-year cycle will probably be examined in This autumn of this 12 months.”

Associated Studying

He pointed viewers to evaluation from on-chain researcher James Examine (Checkmate) at CheckOnChain. “If we see an enormous run-up and blow-off high at 4-year finish, the speculation stays intact… but when not, Bitcoin’s habits by means of market cycles has most likely modified perpetually.” Examine, for his half, has just lately written that “if there was ever a time for the 4yr Bitcoin halving cycle to interrupt, this market atmosphere is probably going it,” underscoring how veteran on-chain analysts are additionally bracing for a sample shift.

What’s modified, in Consorti’s view, is the client base. “Conventional finance capital swimming pools have entered the image, they usually play by totally different guidelines.” He highlighted spot Bitcoin ETFs because the prime conduit: “These are bought by retirees, pension funds, and endowments… These are allocators with no near-term intention of promoting. They plan to carry it for years, even a long time, and solely regularly shave down positions over time.”

For example, he cited Harvard College’s endowment: “Their endowment bought 1.9 million shares of iShares Bitcoin Belief, valued at $116.7 million in Q2.” That place—disclosed in a current 13F—impressively demonstrates the institutional adoption of BlackRock’s IBIT.

Associated Studying

Consorti prolonged the long-horizon argument to treasury adopters: “These are companies holding Bitcoin on their stability sheets with no plan to promote. Ever… the intense gamers… are everlasting fixtures out there.” The implication, he stated, is a visual evolution in market construction and tempo: “As a substitute of the violent booms and busts of earlier cycles, we’re seeing one thing new, which is a constant uptrend punctuated by intervals of consolidation, then speedy enlargement, then consolidation once more.”

As provide turns into more and more lodged with long-duration holders and the asset’s capital base thickens, “volatility naturally compresses, however upside doesn’t vanish. It simply performs out in longer arcs, with larger greenback strikes and a slower tempo.” He added that this maturation is already noticeable as Bitcoin grows “past its present $2.4 trillion market cap,” whilst he acknowledged that the fourth quarter would be the crucible for the cycle debate.

“In This autumn, that dynamic could possibly be on full show,” Consorti concluded. A “mixture of easing monetary circumstances, renewed institutional inflows post-summer, and chronic structural demand from ETFs, corporates, and excessive internet price allocators may set the stage for an additional leg larger and a banner This autumn.” However his sign-off was intentionally non-deterministic: “Solely after the fourth quarter of this 12 months will we actually know whether or not or not the four-year cycle is actually useless and buried… We’ll simply have to attend and see.”

At press time, BTC traded at $119,068.

Featured picture created with DALL.E, chart from TradingView.com