What’s it about some merchants that permit them spot the most effective trades within the inventory market?

Is it some type of insider information we’re not allowed to have?

The truth is, the reality is quite a bit less complicated!

They’re utilizing instruments which assist make worth motion a lot simpler to grasp.

And some of the helpful?

The Quantity Weighted Transferring Common (VWMA).

OK, you’re pondering you already know every little thing about shifting averages, proper?

However VWMA isn’t simply any outdated customary shifting common.

Quantity Weighted Transferring Common is far more responsive, reacting to buying and selling quantity and supplying you with deeper perception into the place worth motion is basically taking place.

It might aid you perceive market dynamics extra clearly, highlighting key turning factors and developments.

When you grasp the way it works, Quantity Weighted Transferring Common can utterly remodel the way you analyze markets.

On this article, I’ll cowl every little thing it’s essential to learn about the way it can take your buying and selling methods to the following degree.

By the top, you’ll have realized:

- What makes VWMA stand out from different shifting averages

- Tips on how to apply VWMA throughout numerous market situations and volatilities

- Tips on how to use VWMA to establish key worth ranges and developments, with actual chart examples to information you

- Frequent errors merchants make when utilizing VWMA, like misreading deviations throughout low-volume situations

Prepared to start?

Let’s dive in!

Understanding VWMA

How is Quantity Weighted Transferring Common Calculated?

VWMA is calculated by weighting every worth level with its buying and selling quantity throughout a time frame.

You get it by:

…including the product of worth and quantity for every interval…

… after which dividing by the overall quantity over that interval.

That’s it!

This offers you a shifting common that displays the common worth of the asset over time but in addition reveals you worth factors the place buying and selling exercise was most concentrated.

It additionally implies that higher-volume durations have a better affect on the Quantity Weighted Transferring Common than lower-volume durations.

Alright, I do know the apparent query is, why not simply use a easy shifting common?

Whereas each instruments are beneficial, VWMA offers you a novel benefit as a result of it contains quantity within the calculation.

It’s this additional info which might give you deeper perception into the place everybody’s getting concerned!

Let’s discover a bit of extra about why Quantity Weighted Transferring Common is price it.

How Does VWMA Differ from Regular Transferring Averages?

Whereas each the Quantity Weighted Transferring Common and conventional shifting averages are used to research worth developments, the way in which they work and the insights they provide you differ quite a bit.

As talked about, the principle distinction comes from VWMA together with quantity.

It offers extra weight to cost factors with increased buying and selling exercise.

Conventional shifting averages, such because the Easy Transferring Common (SMA), calculate the common worth over a set interval with out touching quantity.

Are you able to see how extra quantity strikes might give additional perception in comparison with a easy shifting common?

Check out what VWMA is attempting to indicate you…

What Does VWMA Signify?

In contrast to a Easy Transferring Common (SMA), which treats all worth factors equally, the VWMA ensures that worth actions with heavier volumes present up extra clearly in your radar.

In different phrases, Quantity Weighted Transferring Common helps you to in on the value strikes that really matter.

A useful method to consider it’s as a measure of honest worth for the time interval you’re taking a look at.

The VWMA reveals the place a lot of the buying and selling occurred, highlighting key worth zones and offering a extra exact understanding of market conduct.

Crucially, this implies the VWMA can usually reveal market sentiment, too.

Costs above the Quantity Weighted Transferring Common could replicate bullish momentum, suggesting a safety is buying and selling at a premium, whereas costs under the VWMA could point out bearish sentiment and a possible low cost.

This volume-adjusted viewpoint is efficacious in pattern evaluation, too, serving to you’re employed out pivotal ranges for decision-making.

I’ll present you the way these work virtually a bit later on this article.

For now, let’s have a look at how timeframes form the Quantity Weighted Transferring Common.

Capability to Be Related on Totally different Timeframes

Whereas Quantity Weighted Transferring Common is historically used for versatile pattern evaluation, it may be tailored for numerous timeframes.

For shorter timeframes, the VWMA captures the connection between worth and quantity over minutes or hours, serving to merchants discover extra speedy developments and key ranges of curiosity.

For longer timeframes, resembling each day, weekly, or month-to-month durations, the VWMA can reveal broader developments by balancing the volume-weighted exercise over prolonged durations.

What do I imply by that?

Nicely, the additional you zoom out with VWMA, the extra exterior elements may cause it to replicate vital however remoted actions.

And since they’re remoted, they may not all the time present essentially the most helpful perception.

Let me provide you with an instance.

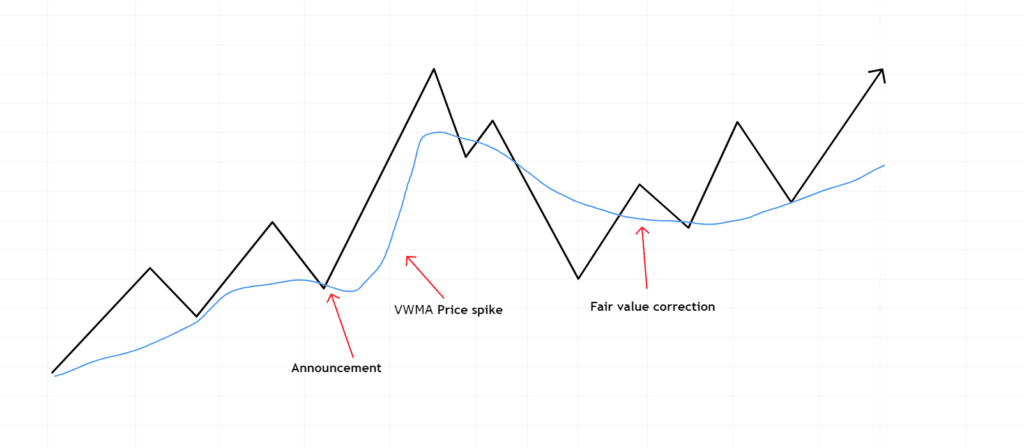

Say an organization pronounces a groundbreaking new product in the beginning of the yr.

This announcement might result in a pointy improve in each buying and selling quantity and inventory worth over the next week, proper?

So, should you calculate the VWMA over a month-to-month or yearly timeframe that features this occasion, it’s going to be closely influenced by the excessive quantity and elevated costs throughout that information interval…

And I imply, whereas this displays substantial exercise, it may not precisely be honest worth for your entire timeframe (e.g. a yr)

It’s one thing to bear in mind when utilizing Quantity Weighted Transferring Common for longer-term evaluation…

Instance of bulletins on Quantity Weighted Transferring Common:

On this state of affairs, Quantity Weighted Transferring Common represents the common worth throughout a interval of volatility, however not essentially throughout regular buying and selling exercise.

And now the main query…

With all of the above thought of, can you employ VWMA in foreign exchange?

Relevance to Inventory Buying and selling vs. Foreign exchange

In inventory buying and selling, the Quantity Weighted Transferring Common is extremely efficient as a result of it leverages exact quantity information supplied by centralized exchanges.

This reliability permits correct VWMA calculations, providing you a transparent image of honest worth and vital buying and selling exercise inside the inventory market.

I imply, the VWMA displays actual market dynamics – actuality, proper?

Nevertheless, foreign currency trading?

Nicely, it presents a distinct problem!

As a result of the foreign exchange market is decentralized, it means there is no such thing as a single trade offering complete quantity information.

As an alternative, brokers usually provide tick quantity, which measures the variety of worth modifications slightly than the precise traded quantity.

In consequence, Quantity Weighted Transferring Common calculations in foreign exchange are quite a bit much less dependable and will not precisely replicate what’s really occurring.

So, it’s honest to say underneath these situations, the VWMA can lose its effectiveness and dangers turning into extra of a supply of noise than a great tool!

For that reason, foreign exchange merchants could have to depend on different indicators or interpret VWMA information with an additional pinch of salt.

At any price, let’s discover some actual examples of how it may be utilized in apply!

VWMA Methods

OK – the enjoyable half!

Let’s have a look at easy methods to really use Quantity Weighted Transferring Common in your buying and selling.

Start by taking a look at trend-following programs…

Pattern Following

VWMA can function a useful information for trend-following methods, serving to you verify the power and path of a pattern.

In an uptrend, costs persistently buying and selling above the VWMA counsel bullish sentiment, indicating that patrons are dominating the market.

Is smart, proper?

Costs under the VWMA in a downtrend sign bearish situations, reflecting robust promoting strain.

Put them collectively, and VWMA turns into a dynamic instrument for figuring out pullback alternatives.

In an uptrend, as an example, a short lived retracement to the VWMA can act as a possible entry level for an extended commerce, that means you possibly can align your positions with the broader pattern.

Nevertheless, it’s necessary to do not forget that VWMA is best when used along side different indicators.

Instruments like momentum oscillators, trendlines, horizontal ranges, or candlestick patterns may give additional affirmation of the pattern and aid you refine your entry factors.

Let’s break this down with an instance…

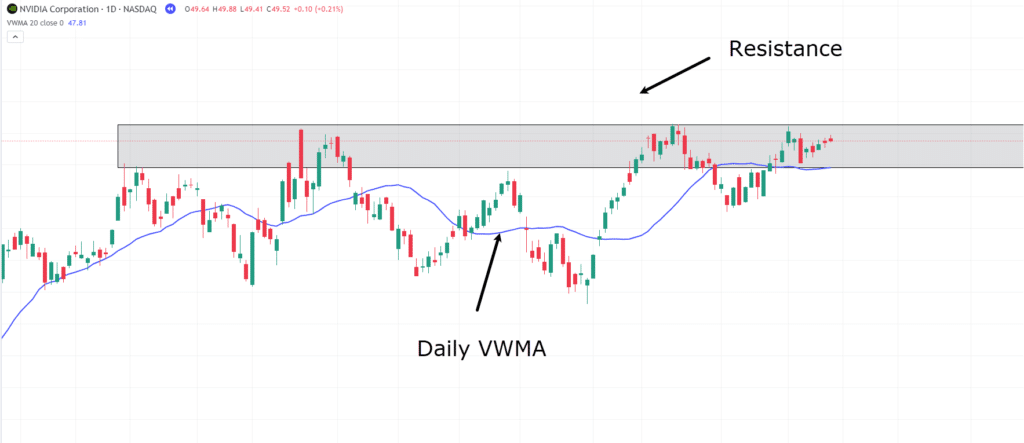

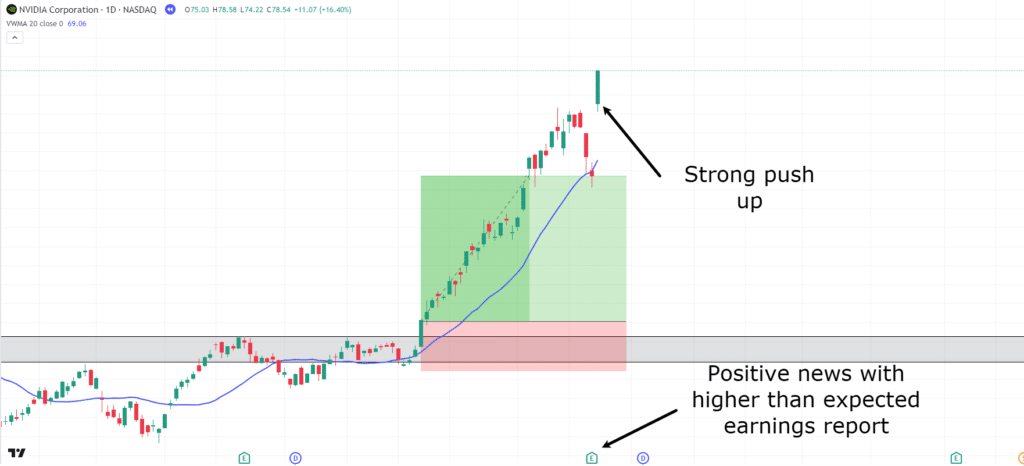

NVIDIA Every day Chart:

On this each day chart of NVIDIA, the value approaches a resistance zone the place you anticipate the following breakout pattern.

Whereas the value usually strikes above the VWMA, getting into too early with out affirmation can get you caught up in market fluctuations as the value oscillates across the VWMA.

To keep away from this, guarantee Quantity Weighted Transferring Common is paired with different types of technical evaluation, resembling a transparent breakout sample or a momentum indicator that confirms the breakout’s power.

Through the use of VWMA collectively like this, you possibly can improve your decision-making and cut back the chance of false indicators.

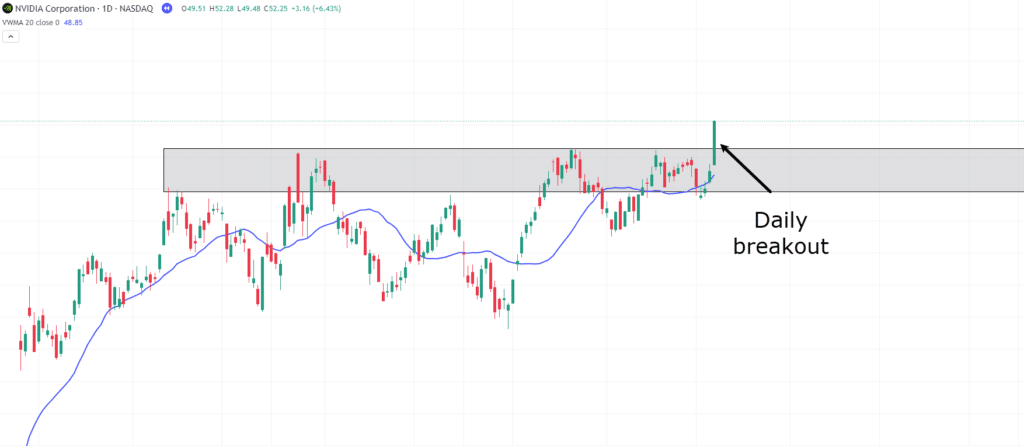

NVIDIA Every day Breakout:

Let’s have a look at this chart and take into consideration whether or not or to not take motion.

Worth has come as much as a resistance zone for the fifth time…

…however each time it’s rejected the zone, it’s fallen barely decrease – however hasn’t gone right into a reversal and began down trending.

This tells you that Worth needs to remain right here for some cause!

Now, on this fifth try to interrupt the resistance, the value has damaged by means of and closed above the resistance degree with a powerful bullish engulfing candle…

Worth is performing above the each day VWMA!

So, evidently quite a bit aligns with bullish sentiment.

Let’s take an extended place…

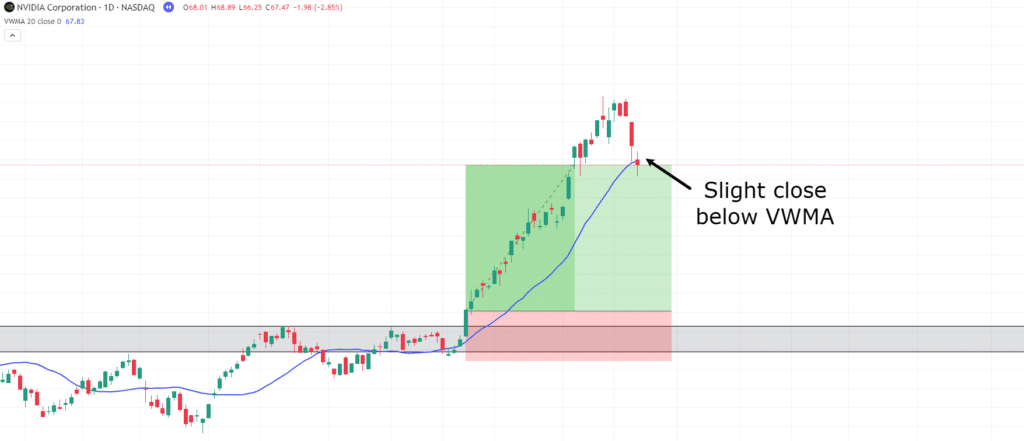

NVIDIA Pattern Following:

OK, now that the value has taken off from the breakout, one thing else has occurred:

Worth has simply barely closed under the Quantity Weighted Transferring Common on the each day.

This presents a buying and selling resolution.

You may both:

– shut early right here anticipating that the value may proceed down or

– you possibly can await the following candle to verify the VWMA pattern has actually completed.

My opinion?

Nicely, because of the hammer nature of this candle, and the indecision behind it, I’d want to carry this commerce for an additional day and see what occurs.

Let’s have a look…

NVIDIA Earnings Report:

I imply, it’s no coincidence that the market acquired a bit of anxious near the earnings report, bringing the value down towards the VWMA in anticipation of probably poor earnings.

Nevertheless, by ready to see the precise earnings, you’d have been rewarded!

Let’s see when this pattern setup offers one other exit set off…

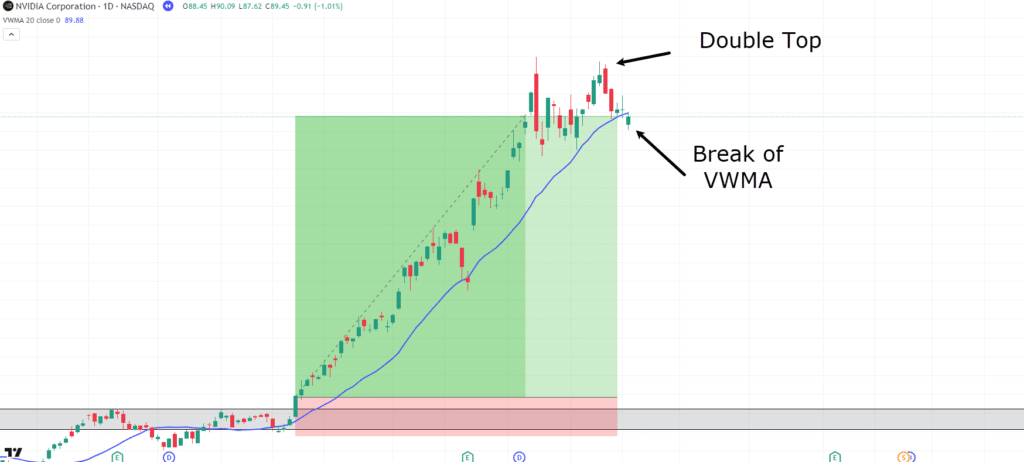

NVIDIA Double High:

There are two issues that stand out from this chart.

A double prime has shaped the place its clear worth is now beginning to kind a brand new resistance degree and there’s a new break of the each day Quantity Weighted Transferring Common.

Though the break isn’t vital, there are beginning to be indicators that the bulls are working out of steam…

This implies this might both be an exit alternative…

Or, it is perhaps a time to attend for a clearer path…

For argument’s sake, let’s wait to see some extra affirmation…

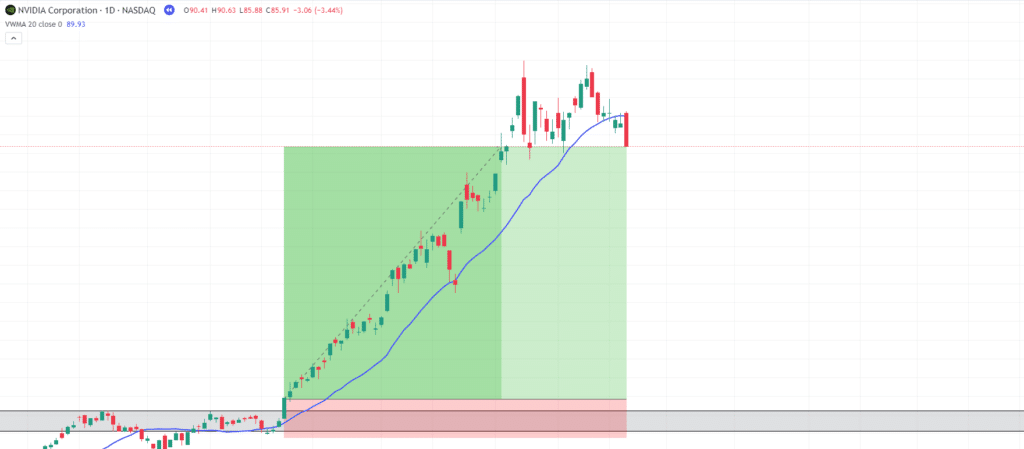

NVIDIA Commerce Exit:

Our instinct was right!

It’s time to exit this commerce with the bearish engulfing candle.

OK so, are you able to see how at no level the buying and selling selections had been black and white?

You used totally different evaluation instruments and your expertise to inform you the proper and unsuitable time to exit the commerce.

Keep in mind, simply because there’s a minor break of the VWMA – it doesn’t imply you HAVE to exit the commerce.

Ensure to make use of the general context of the market to make the most effective resolution you possibly can on the time.

There’s completely nothing unsuitable with ready for what tomorrow may carry!

Subsequent, let’s have a look at a reversion to the imply technique for you.

Reversion to the Imply

The Quantity Weighted Transferring Common may be a wonderful instrument for mean-reversion methods, permitting you to seek out and earn on worth deviations from the “honest worth” line.

Importantly, when the value strikes considerably above or under the VWMA, it usually indicators overbought or oversold situations.

This implies potential buying and selling possibilities!

Worth tends to gravitate again towards the Quantity Weighted Transferring Common, as a result of it displays the asset’s weighted common worth based mostly on quantity.

As an example, think about a state of affairs the place a inventory’s worth surges nicely above its VWMA throughout a low-volume rally.

This divergence might sign that the rally lacks power and participation, bringing an opportunity to brief the inventory, anticipating the value to revert again to the VWMA.

However all the time bear in mind – context is vital!

In trending markets, the place momentum drives costs additional away from the common, reversion to the imply methods usually fails.

Trying to counter a powerful uptrend or downtrend by betting on imply reversion might end in vital losses.

Because of this reversion to the imply methods works greatest in range-bound or consolidating markets, the place worth motion is extra contained.

Let’s dive right into a real-life instance to see it…

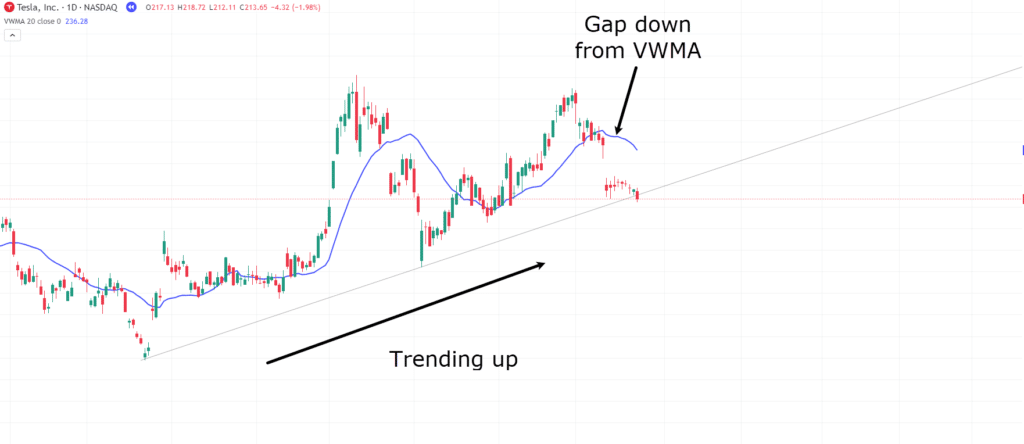

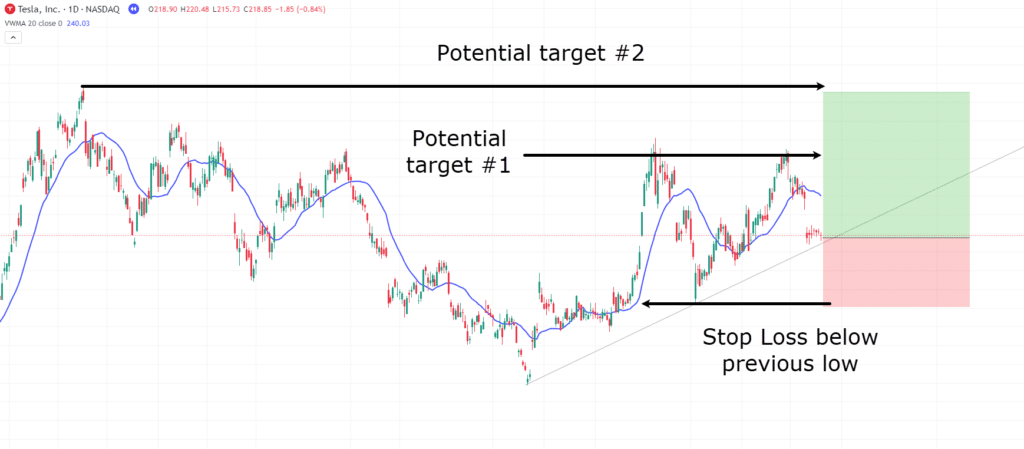

Tesla Every day Chart:

Right here, you possibly can see a novel state of affairs on the Tesla each day chart.

Worth has gapped down from the Quantity Weighted Transferring Common in the direction of the trendline.

On this case, Tesla is in a shorter-term uptrend whereas in a longer-term vary, which suggests…

…a possibility to seize a transfer utilizing reversion to the imply!

For no matter cause, worth has gapped down, however, as seen beforehand, worth tends to hover across the VWMA…

Let’s check out how you can doubtlessly arrange this commerce…

Tesla Commerce Setup:

Your entry might be positioned on the trendline with a cease loss under the earlier low.

It makes an ideal invalidation level because the commerce doesn’t work if the value varieties a brand new low (the value is not trending up)

As for taking income, there are a couple of choices, with the primary affordable goal being the very best excessive.

The latest highs additionally present a beneficial revenue degree, relying on how the value responds to the trendline and resistance ranges…

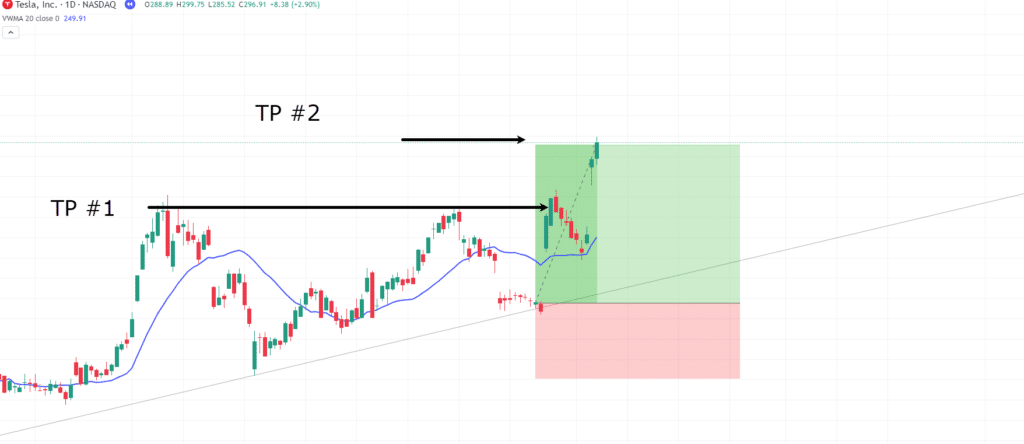

Take Revenue Choices:

As you possibly can see worth was nicely and actually responded to the trendline and bumped as much as the take revenue 1.

Worth then retraced again to the VWMA.

In the event you selected to take income at TP1, the commerce can be over, and also you’d have taken income earlier than the retracement.

Nevertheless, should you had been concentrating on the TP2…

…the Quantity Weighted Transferring Common holding worth as help was essential!

Alright, I wish to provide you with one last use for the VWMA that applies to this precise commerce.

It includes VWMA as a help and resistance, that means you get dynamic take income!

VWMA as Dynamic Assist and Resistance

Quantity Weighted Transferring Common can act as a dynamic degree of help or resistance, supplying you with worth ranges to work with.

In an uptrend, VWMA usually serves as a help degree, the place patrons step in to defend the pattern.

In a downtrend, VWMA can act as resistance, the place sellers are prone to preserve management.

Understanding this offers you an opportunity to set stop-losses or take-profit ranges.

As an example, if a inventory is buying and selling above VWMA and approaches it throughout a pullback, a bounce of VWMA might sign a continuation of the pattern…

…this implies you’d get an opportunity to both add to your place or maintain it!

Nevertheless, if the value breaks under VWMA with robust quantity, it might point out a reversal, prompting you to exit or swap your bias.

Let’s check out the instance…

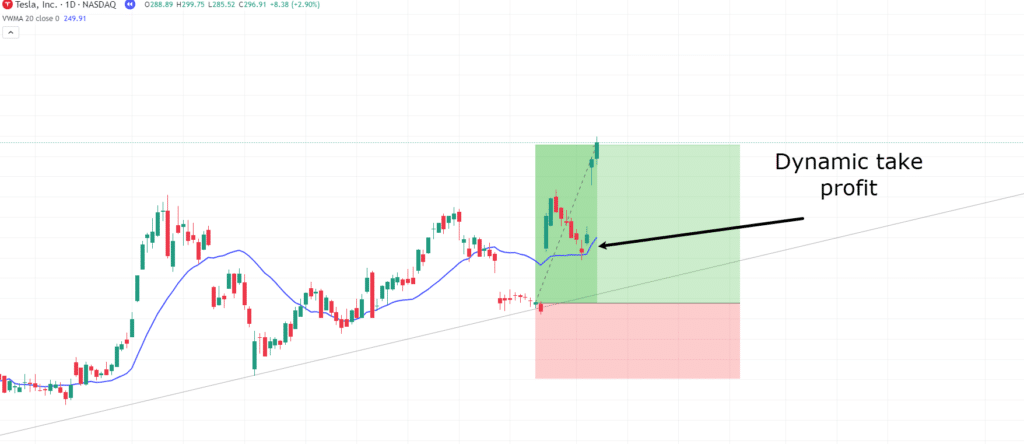

Dynamic Take Revenue:

Utilizing the identical instance because the final commerce, as a substitute of utilizing a static take-profit, what should you seen the VWMA extra as a dynamic help degree?

The rule can be, if the value fell under the VWMA – you are taking your revenue. Acquired it?

Now, regardless of its risky motion, it’s essential to work out if it’s begun a brand new uptrend.

It’s at instances like these you need to use the VWMA as a trailing cease loss / take revenue.

Let’s see what would happen should you used the Quantity Weighted Transferring Common as a trailing take revenue….

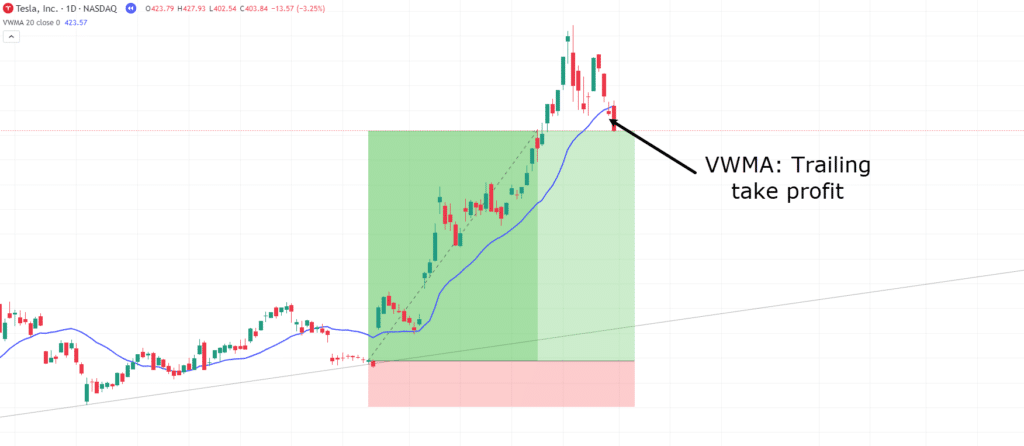

Trailing Take Revenue:

Wow – Fairly the Transfer!

Are you able to see how helpful the Quantity Weighted Transferring Common may be as a dynamic degree?

Construction your trades off it? Test.

Make it easier to work out the proper time to exit or maintain your place? Test once more!

Keep in mind, although, that typically, ready for VWMA to be damaged – pending volatility – you may find yourself delaying an exit that truly finally ends up much less worthwhile, in contrast with a static take revenue over an extended time frame.

So, once more – all the time have a look at as a lot of the image as doable.

Talking of which, let’s present an instance of when VWMA may really hinder your profit-taking…

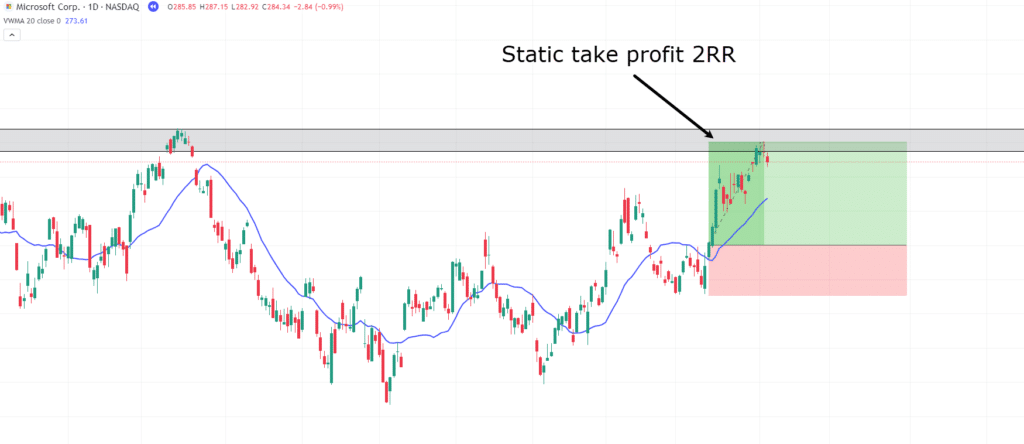

Microsoft Every day Chart:

Say you’re on this commerce, and the value has come again to an inexpensive resistance degree.

You’ve gotten the choice to take income and declare a 2RR commerce in a brief time frame.

Nevertheless, should you had been to make use of the Quantity Weighted Transferring Common dynamic trialing cease loss to take revenue on this state of affairs, right here’s what may occur…

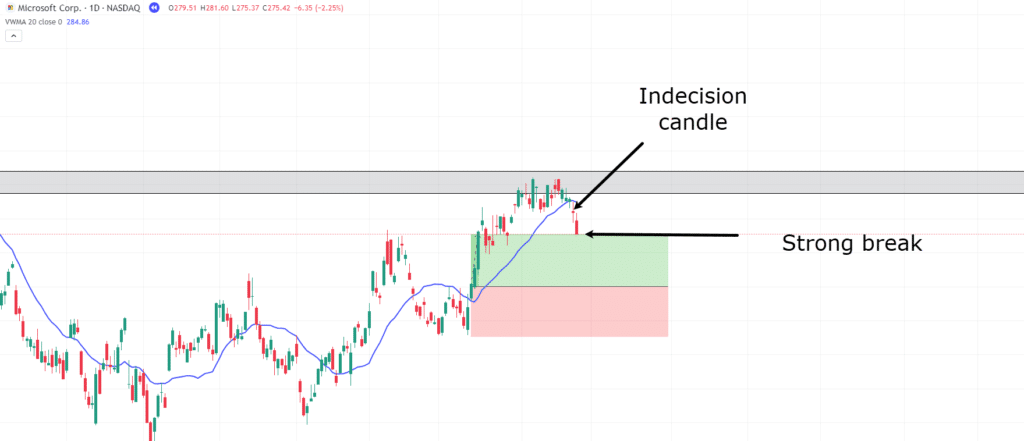

Microsoft Dynamic Take Revenue:

As the value closes under the Quantity Weighted Transferring Common with an indecision candle, you’ve got the choice to carry – within the hope that it’s a short break and that worth stays in an uptrend.

However then the following candle closes strongly under the VWMA, making it appear like this resistance is just too robust for the pattern to proceed.

In the long run, you’ve waited an additional two to 4 days and halved your revenue with a 1RR commerce.

Irritating!

However, this may occur and it’s why VWMA should all the time be thought of within the context of the general market and your buying and selling targets.

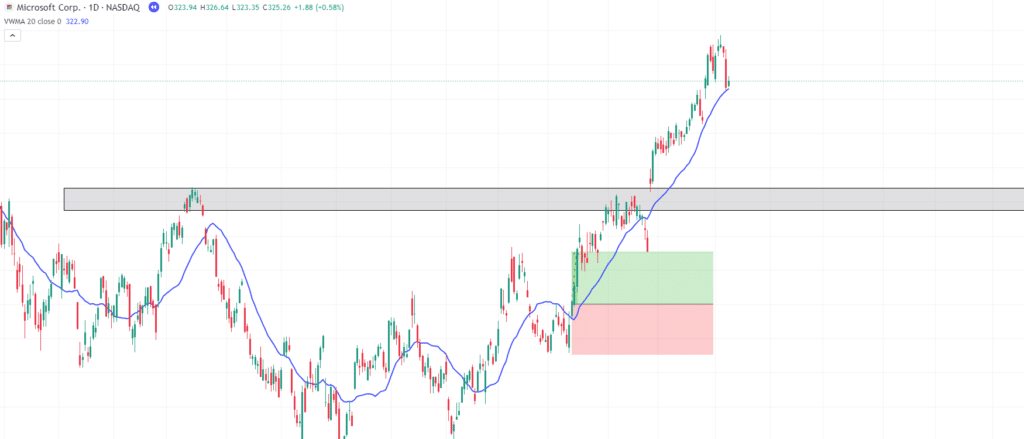

Check out what occurs subsequent, although…

Microsoft Pattern Continuation:

Worth really does proceed its the path of the pattern, and the break under the VWMA was solely temporary.

What’s my level?

Nicely – hopefully, you possibly can see Quantity Weighted Transferring Common just isn’t the proper resolution to all of your buying and selling issues!

Typically, the market will reply in another way to totally different market information, stories, and technical ranges.

Taking income early could appear to be a failure but when there are income to be taken, it’s usually greatest to take them when they’re obtainable or should you don’t have a transparent learn on what the market is attempting to do.

I imply, this commerce might simply have ended up proper again on the entry-level!

Keep in mind – don’t get grasping.

Limitations and Errors to Keep away from

Limitations and Errors to Keep away from

As proven within the final instance, whereas the Quantity Weighted Transferring Common (VWMA) is a flexible and insightful instrument, it does have its limitations.

Failing to grasp these challenges and avoiding frequent pitfalls can stop you from getting helpful outcomes out of the VWMA.

Misinterpreting VWMA in Low-Quantity Markets

Quantity Weighted Transferring Common’s reliability can falter in low-volume markets.

When buying and selling exercise is minimal, a couple of giant trades or abrupt worth actions can actually mess up the VWMA’s significance.

In flip, this distortion usually leads to deceptive indicators, because the indicator turns into too closely influenced by quantity spikes.

You’ll usually discover it taking place in thinly traded shares or illiquid belongings, for instance.

In such instances, the VWMA may seem to sign vital worth ranges or pattern shifts when, in actuality, there isn’t that a lot market curiosity or exercise to again it up.

To keep away from falling into this lure, it’s essential to enter low-volume conditions with skepticism.

I wish to ask myself whether or not the amount behind the transfer justifies the motion, or whether or not it’s an outlier that’s throwing off the info.

As talked about, let VWMA add to what you’re doing slightly than attempt to dwell off it.

At all times begin with a transparent plan of what you’re in search of out there…

…then use Quantity Weighted Transferring Common to assist verify your speculation.

This shift in mindset may also help you keep away from chasing false indicators and enhance your total buying and selling consistency.

Now, let’s increase on this concept additional!

Over-Reliance on VWMA

Though Quantity Weighted Transferring Common is a extremely insightful and dynamic instrument, over-relying on it might result in poor buying and selling selections.

Whereas it’s extra responsive than conventional shifting averages, it ought to by no means be used alone.

As an alternative, use it as a part of a whole buying and selling technique, together with trendlines, help and resistance ranges, candlestick patterns, and different volume-based indicators.

A standard mistake is pondering that each worth interplay with VWMA will end in a reversal or bounce.

However this utterly ignores how advanced the market actually is!

Considering again to the earlier VWMA instance – worth minimize under, then straight again above the VWMA, proper?

Nicely, because of inventory information, costs could maintain slicing by means of VWMA like that – with out respecting it as a help or resistance degree…

It’s all about market context.

In the event you rely solely on Quantity Weighted Transferring Common indicators with out contemplating different elements, you threat getting into trades based mostly on false indicators or getting whipsawed out by noise.

To mitigate this, use VWMA as one piece of the puzzle.

Lagging Nature of VWMA

Like all shifting averages, Quantity Weighted Transferring Common is a lagging indicator, because it depends on historic information to calculate its values.

This lag could make it much less efficient in fast-moving markets or throughout sharp worth reversals, the place real-time sentiment and momentum can shift quickly.

In risky situations, relying solely on VWMA to foretell future worth actions can result in missteps, so use it as a benchmark slightly than a predictive instrument in these instances.

For instance, in trending markets, VWMA can verify the path of the pattern or spotlight key pullback zones.

Nevertheless, in extremely risky or uneven situations, its lagging nature could render it much less dependable for timing exact entries or exits.

Consider an organization asserting actually unhealthy gross sales for its quarterly report.

VWMA can’t issue that information in till the value has already reacted to it.

Differentiating Brief-Time period and Lengthy-Time period Makes use of

Some of the frequent errors merchants make is failing to tell apart between Quantity Weighted Transferring Common’s short-term and long-term functions.

Though VWMA may be calculated over any timeframe, the way in which it’s interpreted relies upon considerably on the interval being analyzed.

For instance, utilizing intraday VWMA is especially helpful for figuring out buying and selling exercise and quantity shifts inside a single session.

Alternatively, calculating VWMA over a number of days or even weeks may give perception into broader market developments and key ranges of buying and selling exercise over an extended horizon.

However maintain them separate.

These longer-term VWMA calculations gained’t imply as a lot when utilized to short-term buying and selling methods and vice versa.

Complicated these functions can result in inaccurate conclusions about market path or vital worth zones.

So, in case your buying and selling model includes fast scalps or intraday trades, utilizing a multi-day VWMA may not align along with your targets!

Equally, should you’re swing buying and selling or investing, counting on a single-session Quantity Weighted Transferring Common might miss the larger image.

As such, it’s essential to obviously perceive what your targets are earlier than making use of VWMA.

By deciding on VWMA settings that match your strategy, you make sure that the indicator offers you the most effective insights on your selections.

Identical to a compass, VWMA is unbelievable for figuring out instructions, however it might’t present your entire map.

Profitable navigation of the markets requires combining it with different indicators, market context, and a well-rounded buying and selling plan.

Conclusion

The Quantity Weighted Transferring Common (VWMA) is a strong instrument that may significantly improve your market evaluation and buying and selling selections!

By getting buying and selling quantity into the equation, VWMA offers you a extra responsive and correct image of worth actions.

It might aid you establish key developments and worth ranges with better accuracy, too.

When used together with different technical indicators, VWMA can present an edge, permitting you to make extra knowledgeable, higher-probability trades whereas avoiding frequent pitfalls.

Nevertheless, like every other instrument, it’s greatest used with a stable buying and selling technique and disciplined execution!

On this article, you’ve realized:

- What makes VWMA distinctive, and the way it differs from different shifting averages

- Tips on how to apply VWMA in numerous market situations and with totally different volatilities

- Tips on how to use VWMA to seize developments and execute reversion to the imply trades by means of real-life examples

- Frequent errors merchants make when deciphering VWMA and how one can keep away from them

Always remember that VWMA is only one piece of the puzzle, however mastering it may be a game-changer on your buying and selling strategy.

Now, should you’re able to dive deeper into VWMA, I encourage you to experiment with it in your individual buying and selling!

Strive it in several market situations and on totally different timeframes.

And, should you’ve already used Quantity Weighted Transferring Common, inform me about your expertise with it!

Share your ideas and questions within the feedback under!