I get a variety of emails from merchants asking me whether or not or not my methods work on sure markets that is probably not mentioned usually on my website. The reply is principally, sure. The proprietary worth motion buying and selling methodology I exploit is relevant to many alternative international markets, not simply Foreign exchange.

Nonetheless, with Foreign currency trading changing into so widespread and simply accessible lately, many merchants assume I simply take a look at Forex, however this couldn’t be farther from the reality.

For us worth motion merchants, studying to learn the footprint of cash on the chart means we are able to commerce and return a revenue on nearly any market we wish. Nonetheless, I’m not saying exit and apply my methods to each worth chart on this planet, not even shut! In actual fact, I like to recommend and educate my college students to change into “specialists” in a choose handful of markets. This lesson discusses a number of the essential particulars and worth motion tendencies of my favourite markets so as to get a really feel for them and perceive why I commerce them.

Don’t Restrict Your Buying and selling Choices

Alternatives exist globally and I commerce a plethora of markets to make the most of these alternatives, from indices to commodities to Foreign exchange and generally even equities. You don’t wish to restrict your self to only one asset class as a result of doing so additionally limits your possibilities of long-term success within the markets.

Limiting your self to only Foreign exchange, for instance, means that you’re not going to do properly when the foremost Foreign exchange pairs are consolidating, and lots of occasions all of them consolidate directly. Increasing your focus to different markets and alternatives will increase potential alternatives and potential returns. For a lot of good causes, hedge fund merchants look to a diversified portfolio of devices and as non-public retail merchants we must always do the identical!

As well as, for these of you solely centered on Foreign exchange, the very fact is that volatility isn’t at all times current within the main FX pairs we take a look at. So, it stands to purpose that it is best to look outdoors of Forex usually so that you’re not with out alternatives to revenue. If there’s very low volatility there are going to be only a few buying and selling alternatives. In brief, you need to commerce what’s MOVING to make any cash as a dealer!

Understanding MetaTrader Product Specs

OTC, CFD, Spot, Futures, Foreign exchange, Commodities, Indices, to the start dealer all these totally different merchandise and acronyms can appear very complicated and considerably bewildering. Let’s simplify all of it right here and now….

Spot Markets – The “spot worth” of a market is quoted by central banks and brokers all all over the world, for instance, the present worth of the EURUSD Foreign exchange pair is quoted because the “spot worth”. OTC markets (this implies over-the-counter markets) haven’t any central trade and buying and selling is finished electronically, immediately between two events (reminiscent of a dealer and a retail dealer such as you) and this buying and selling is predicated on the spot worth of the underlying market. Contract sizes and the worth per level worth can differ from one dealer to the following.

CFD – This stands for Contracts For Distinction. It’s a product supplied by establishments or brokers which mirrors the underlying monetary product. So, if you’re buying and selling a CFD you aren’t dealing immediately with the underlying market, you’re buying and selling a ‘mirror’ market and that is how retail merchants generally entry it. These mirror markets are created ‘on high’ of a futures or spot market. So, you’ll be able to commerce a Gold CFD for instance, which mirrors the Gold futures market (referred to as a futures cfd) or you’ll be able to commerce a Gold CFD that mirrors the spot Gold market (referred to as a money cfd).

- Gold (and another markets) is traded as each a spot market and futures market and with MetaTrader you’ll be able to commerce a money CFD which is predicated on the spot market, over-the-counter the market. The precise futures product is on a regulated trade sometimes in Chicago, New York or London. Totally different contract sizes and totally different worth per level worth are widespread between brokers.

- Foreign exchange is just a spot market, nonetheless, there are forex futures traded on main exchanges however we don’t commerce these.

- Commodities and Indices might be supplied on a spot market or a futures market however the place you wish to commerce spot they flip right into a money CFD and the place you wish to commerce futures it’s a futures CFD.

Notice – To commerce the identical markets I focus on on this article, you’ll be able to entry them by way of the MetaTrader platform I exploit right here.

The Main Markets that I Commerce Are…

I usually take a look at and comply with the foremost Foreign exchange pairs, S&P500, SPI200 (and different main inventory indices), Crude Oil and Gold are my favourite commodities. These are the majority of the markets I prefer to actively watch and commerce however I do take a look at others every now and then. In recent times, these markets have contributed considerably to my buying and selling income and I additionally traded them within the latest buying and selling competitors that I received.

EURUSD – Euro/Greenback Foreign exchange forex pair

The EURUSD, also referred to as the Euro/greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I exploit. The spot worth of the EURUSD at any given time displays the present trade price between the Euro and the U.S. greenback. For instance, if the speed is 1.1700, which means 1 euro is value 1.1700 U.S. {dollars}, in different phrases, the euro is stronger than the greenback (as it’s now).

- Market conduct & worth motion tendencies

The EURUSD tends to be essentially the most closely traded forex pair. Because of this, in can get considerably uneven extra so than the GBPUSD or AUDUSD for instance. That stated, worth motion indicators, particularly on the 4-hour and every day chart timeframe are inclined to repay very often on this pair. It tends to respect assist and resistance ranges fairly properly and is marked by sustained trending durations adopted by considerably prolonged durations of sideways motion particularly inside massive buying and selling ranges. The EURUSD is a favourite market of mine primarily as a result of so many individuals commerce it that most of the apparent indicators are typically “self-fulfilling”

GBPUSD – Sterling/Greenback Foreign exchange forex pair

The GBPUSD, also referred to as the Sterling/greenback or Pound/greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I exploit. The spot worth of the GBPUSD at any given time is displaying the present trade price between the British pound and the U.S. greenback. For instance, if the speed is 1.3100, which means 1 British pound goes to get you 1.3100 U.S. {dollars}, in different phrases, the pound is stronger than the greenback (as it’s now).

- Market conduct & worth motion tendencies

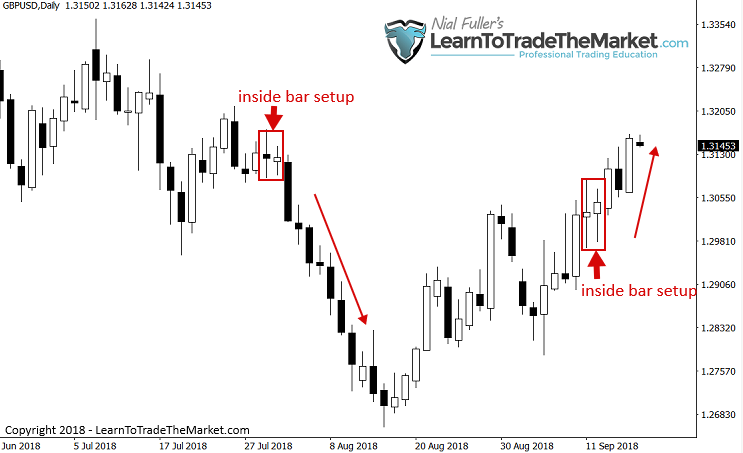

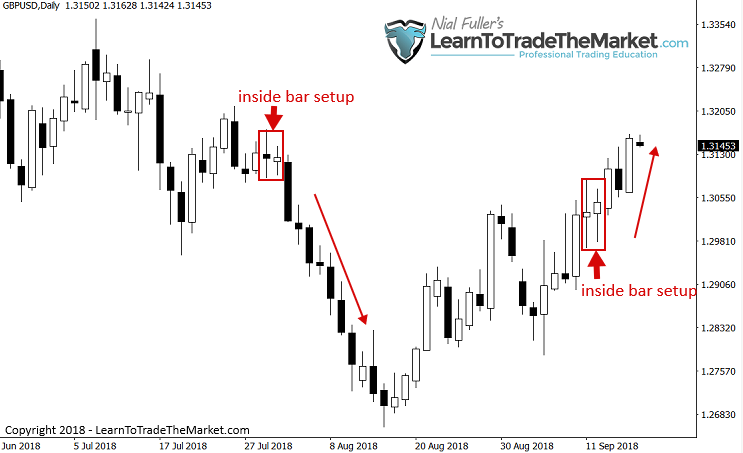

The GBPUSD tends to have increased volatility than the EURUSD, for instance. This implies it tends to amplify strikes, larger breakouts, larger tendencies, and so forth. The value motion indicators are sometimes bigger / extra pronounced on this pair than different FX pairs. General, I actually get pleasure from buying and selling the GBPUSD and since it’s not fairly as well-liked because the EURUSD and has increased volatility, it tends to maneuver extra and consolidate a bit much less, which interprets into extra potential profitable trades for a talented worth motion dealer.

USDJPY – Greenback/Yen Foreign exchange forex pair

The USDJPY, also referred to as the Greenback/Yen is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I exploit. The spot worth of the USDJPY at any given time is displaying the present trade price between the U.S. greenback and Japanese Yen. For instance, if the speed is 110.00, which means 1 U.S. greenback will internet you 110.00 Yen, in different phrases, the greenback is stronger than the Yen (as it’s now).

- USDJPY market conduct and worth motion tendencies

I would be the first to confess the USDJPY generally is a uneven market to commerce. It could actually make some erratic strikes even on the upper time frames. That stated, it does get into some sustained and really predictable tendencies generally, and worth motion indicators are inclined to work properly on this pair. It’s also a really technical market, which means, it tends to respect key ranges very predictably and precisely. Simply be careful for the “chop”.

AUDUSD – Aussie/greenback Foreign exchange Forex Pair

The AUDUSD, also referred to as the Aussie/Greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I exploit. The spot worth of the AUDUSD at any given time is displaying the present trade price between the Australian greenback and U.S. Greenback. For instance, if the speed is 0.7200, which means 1 Australian greenback will internet you .72 cents of a U.S. greenback, in different phrases, the USD is stronger than the Aussie greenback (as it’s now).

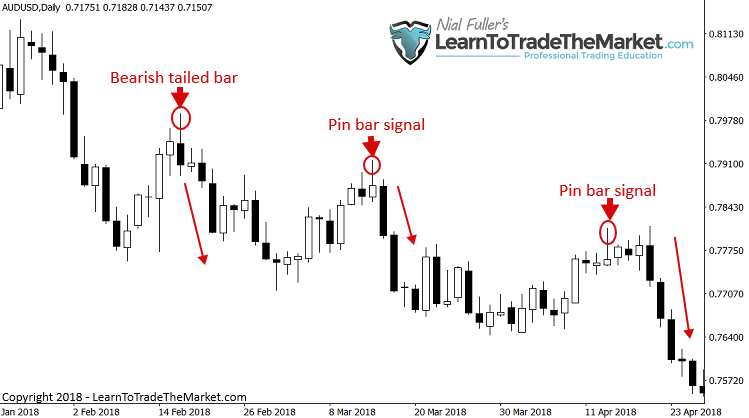

- AUDUSD market conduct and worth motion tendencies

Being from Australia, the AUDUSD might be my general favourite forex pair to commerce. As I wrote in my article on why it is best to have a favourite market, I recommend you choose one Foreign exchange pair that you just actually really feel snug with (maybe your native forex vs. one other main) and actually get “intimate” with that pair. As I stated within the intro, changing into a specialist dealer is the way you make cash. It’s not totally different than some other subject, whether or not it’s medication, sports activities, enterprise or investing; the extra of a specialist you change into, the extra money you’re going to make. The AUDUSD tends to be a bit decrease in volatility than the GBPUSD and EURUSD however it’s a really technical market. When it tendencies it’s very good to commerce and it respects ranges very properly. Day by day chart indicators have a tendency to come back off very properly. I really like buying and selling the AUDUSD.

NZDUSD – Kiwi/Greenback Foreign exchange Forex Pair

The NZUDUSD, also referred to as the Kiwi/Greenback is obtainable as a spot FX (foreign exchange) product on the Metatrader platform that I exploit. The spot worth of the NZDUSD at any given time is displaying the present trade price between the New Zealand0 greenback and U.S. Greenback. For instance, if the speed is 0.6500, which means 1 kiwi greenback will internet you .65 cents of a U.S. greenback, in different phrases, the USD is stronger than the kiwi greenback (as it’s now).

- NZDUSD market conduct and worth motion tendencies

KIWI similar to the AUDUSD. Clearly, New Zealand and Australia are subsequent door neighbors so they have an inclination to have comparable catalysts for what strikes their currencies, for this reason the NZDUSD and AUDUSD charts usually look fairly comparable. Nonetheless, be aware that the NZDUSD can have very uneven durations, this chart will transfer sideways about 50% of the time. For that reason, I favor the AUDUSD over the NZDUSD in most conditions, however the NZDUSD remains to be an excellent main FX pair to look and commerce when a sign presents itself.

Gold – Commodity (treasured metallic)

I commerce spot Gold (XAUUSD) which is in reality a money CFD. Gold is clearly the most well-liked treasured metallic on this planet and can also be essentially the most extensively traded.

- Gold market conduct and worth motion tendencies

Gold tends to development extraordinarily properly in between durations of consolidation. The consolidation might be very uneven and tough to commerce at occasions, nonetheless. Gold might be unstable and huge directional strikes usually are not unusual, this implies large potential for revenue, but additionally for loss if you’re not expert and well-prepared. Gold is one in every of my favourite commodities to commerce.

Crude Oil – Commodity (power)

Crude oil is obtainable as a money CFD (spot image – USOIL) or a futures CFD (image – WTI.fs), both one is okay to commerce simply bear in mind that the costs are totally different. Crude Oil is the most well-liked power commodity to commerce and together with Gold is one in every of my high two favourite commodities.

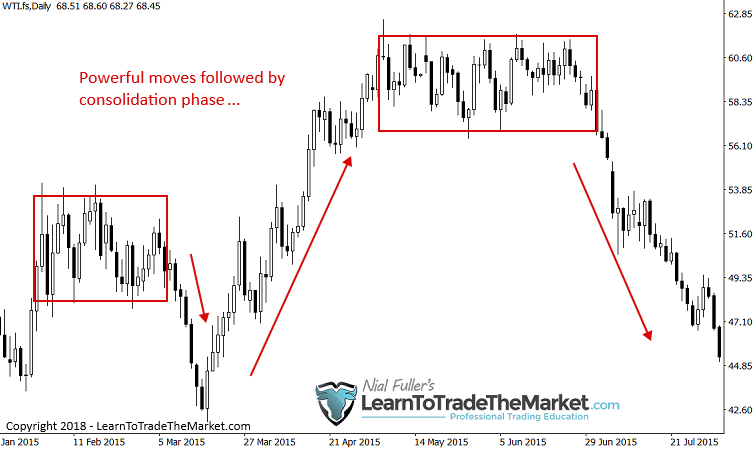

- Crude Oil market conduct and worth motion tendencies

Crude Oil is a market I commerce fairly incessantly, in all probability much more so than Gold. I’d say it’s my favourite commodity to commerce, and for good purpose. Crude tends to expertise extended durations of sturdy trending / directional strikes and it additionally respects key assist and resistance ranges very properly, sometimes. Oil might be very unstable nonetheless, so it’s not for the beginner or inexperienced dealer.

- Crude oil will usually consolidate for weeks or months after an enormous transfer

S&P500 – U.S. Inventory Index S&P500

The S&P500 is obtainable as a futures or money CFD on the Metatrader platform I commerce on. You will notice the futures cfd image as S&P.fs and the money CFD image is US500.

The S&P500 is comprised of 500 of the largest and most essential, predominantly U.S.-based firms and is taken into account to be the world’s main benchmark for traders of every kind. All shares within the S&P 500 index are traded on the New York Inventory Change and NASDAQ.

- S&P500 market conduct and worth motion tendencies

The S&P500 is one other market that I commerce very often. It’s a superb market to ‘purchase and maintain’ as U.S. shares are inclined to wish to development increased. Nonetheless, in occasions of recession or financial turmoil, this market can sell-off extraordinarily rapidly, wiping out features quick. So, while it’s a comparatively ‘straightforward’ market to commerce, it does take a stable understanding of worth motion and market dynamics to revenue in it over the long-run.

SPI200 – Australian inventory index

The SPI 200 Futures contract is the benchmark fairness index futures contract in Australia, based mostly on the S&P/ASX 200 Index. It offers all the normal advantages of fairness index derivatives. The SPI 200 is ranked within the high 10 fairness index contracts in Asia when it comes to traded quantity.

The SPI200 is obtainable as a futures or money CFD and you will note the futures CFD image as SPI200.fx and the money CFD image is AUS200.

- SPI200 market conduct and worth motion tendencies

The SPI200 is a specialty of mine, so to talk. I’ve been following it and buying and selling it for greater than a decade. This market tends to rotate from key ranges and so is one which we wish to look to ‘fade’ usually, in different phrases, when worth makes a transfer right into a key stage, we glance to commerce the opposite route or fade that stage. This will throw many merchants off as a result of simply because it’s beginning to make a powerful transfer it can usually reverse strongly, the opposite route. However for a well-versed worth motion dealer, these sturdy actions from key chart ranges are sufficient to make your mouth water.

DAX – German Inventory Index

The DAX (German inventory index)) is a blue chip inventory market index consisting of the 30 main German firms buying and selling on the Frankfurt Inventory Change.

The DAX is obtainable as each a futures and money CFD on Metatrader, and you will note the futures image as DAX30.fs and the money CFD image is GER30.

- DAX market conduct and worth motion tendencies

The DAX trades much like the S&P500 in that it’s going to usually development upwards fairly properly and generally for a sustained interval, then, seemingly out of nowhere the market will nose-dive 10 – 15% in a couple of days. Not for the faint of coronary heart to make certain. Nonetheless, this volatility is a blessing when you perceive it and know the way to learn the worth motion and get in after which exit your trades correctly.

Why I Don’t Take a look at EVERY MARKET…

One factor that’s in all probability in your thoughts is why don’t I commerce many alternative markets? In any case, I might commerce tons of of merchandise you’re pondering! Properly, I slender it all the way down to essentially the most liquid merchandise after which I slender it down additional to the markets that I see the worth actions indicators producing extra constant outcomes in, so I do know I’ve an edge.

Let’s take a look at a pair examples of why I select the foremost market over the extra ‘obscure’ or less-traded counter-part:

GBPUSD vs. EURGBP:

Beneath, we see a every day GBPUSD chart. Discover the highly effective down and up strikes and the inside bar indicators which have labored out properly to date. That is simply the present every day chart view of the previous few months and we are able to see it’s shifting properly and never very uneven in any respect.

Examine the GBPUS chart above to the EURGBP chart beneath, displaying the identical time interval, and you may see it’s a way more complicated and barren chart to commerce (not many good indicators, if any). This chart appears to be like ugly and when you had been following this one on a regular basis and making an attempt to commerce it, you’d in all probability lose.

Gold vs. Silver:

I favor Gold over silver. It’s extra liquid and extensively adopted and it strikes higher, and who wouldn’t wish to commerce Gold? It tends to swing lots and development lots (good issues for worth motion merchants) and the indicators that kind are typically fairly pronounced.

Within the every day Gold chart beneath, discover the great development and the clear indicators that fashioned inside that development. Examine this to the Silver chart beneath it (displaying the identical time interval) and you will note fairly a distinction.

This chart is messy and uneven, therefore it’s a lot tougher to commerce this than the Gold chart above, it doesn’t take a rocket scientist to determine why…

Conclusion

The proprietary worth motion buying and selling methodology I work with is relevant to many alternative international markets, not simply Foreign exchange, as you’ll be able to see by the above examples. Nonetheless, simply because there are actually tons of of various markets you’ll be able to commerce doesn’t imply it is best to commerce all of them. I’ve discovered that changing into a specialist on sure markets, you’ll considerably improve your possibilities of long-term buying and selling success. You possibly can commerce each single treasured metallic on the market, however why? I commerce Gold, as a result of it’s the largest and one of the best treasured metallic market to commerce and it’s worth motion indicators produce essentially the most constant outcomes.

If you need my weekly and every day evaluation on the above markets, I analyze their worth motion and focus on potential commerce indicators in my members every day commerce setups publication. Additionally, all my course teachings and methods can and ought to be used on indices, commodities and Foreign exchange, as mentioned above, and might even be utilized to main equities. As I discussed above, if you be taught to learn and commerce off the “footprints” left behind by the worth motion on a chart, the alternatives are close to limit-less. Nonetheless, not all alternatives are created equal and that’s the reason you want to change into a specialist!

Notice – If you wish to commerce the identical markets I’ve mentioned on this article, you’ll be able to entry them by way of the MetaTrader platform I exploit right here.

What did you consider this lesson? Please depart your feedback & suggestions beneath!