Welcome to The Market’s Compass US Index and Sector ETF Research, Week #571. As at all times it highlights the technical adjustments of the 30 US Index and Sector ETFs that I monitor on a weekly foundation and usually publish each third week. Previous publications will be accessed by paid subscribers through The Market’s Compass Substack Weblog*.

*This week, in celebration of the Hanukkah and Christmas Holidays additionally it is being despatched to free subscribers in a not so veiled try and lure them to turn out to be paid subscribers.

To grasp the methodology utilized in establishing the target U.S. Index and Sector ETF Particular person Technical Rankings go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”. What follows is a Cliff Notes model* of the complete rationalization…

*The technical rating system is a quantitative strategy that makes use of a number of technical issues that embody however are usually not restricted to development, momentum, measurements of accumulation/distribution and relative power of every particular person 30 U.S Index and Sector ETFs that may vary between 0 and 50.

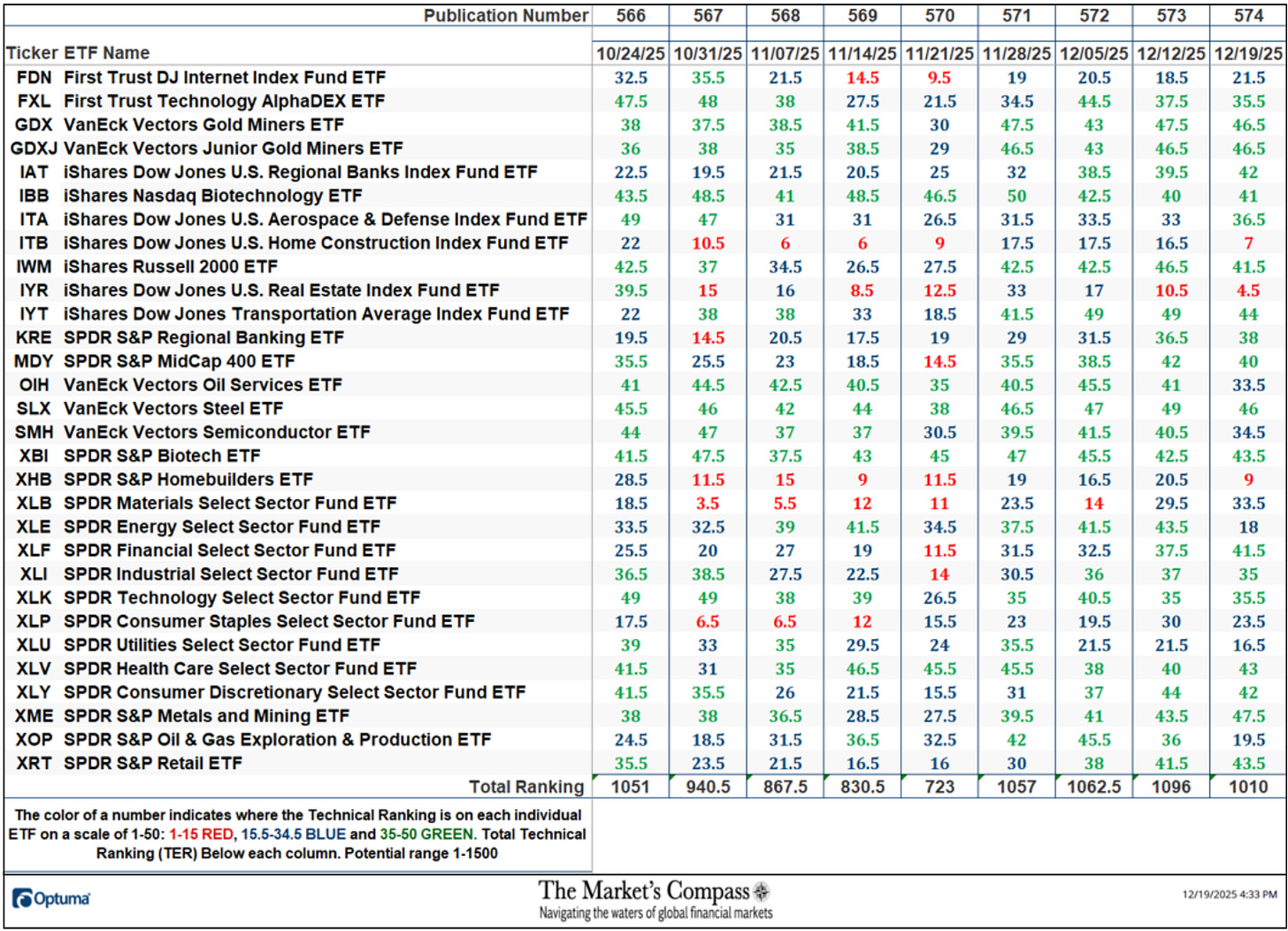

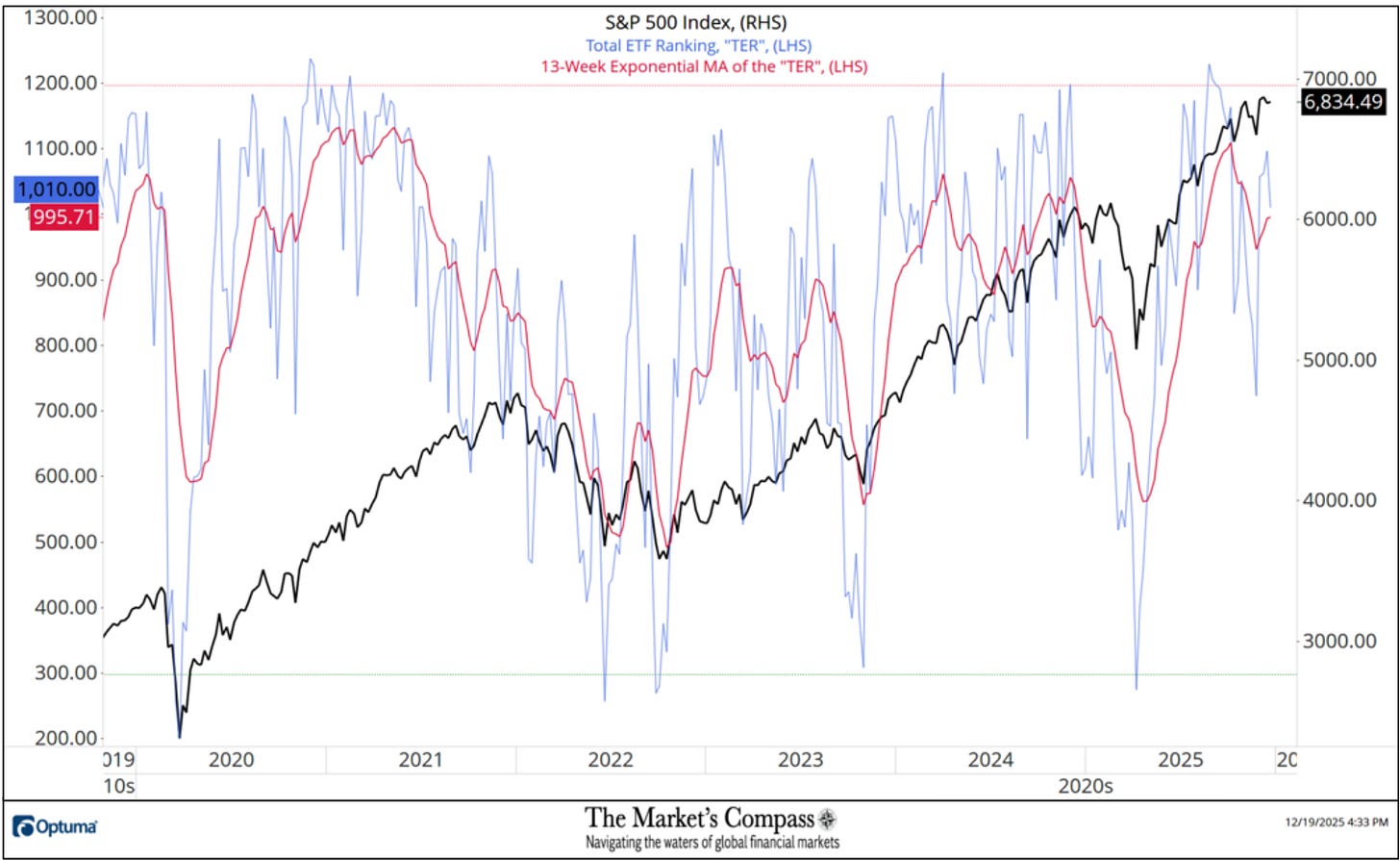

Complete US ETF Rating or “TER” fell final week, dropping 7.85% to 1010 from 1096 the week earlier than.

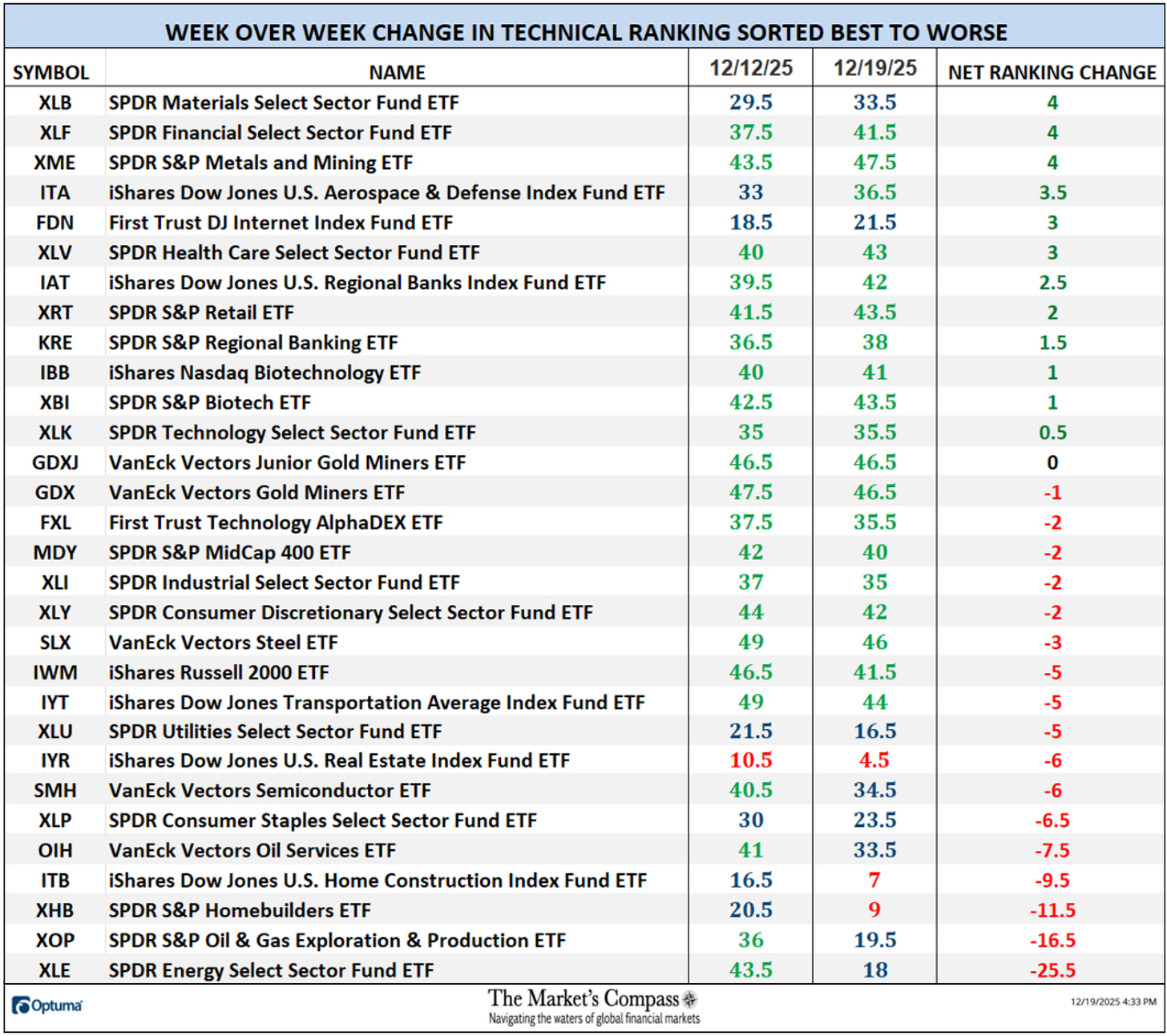

Twelve ETF TRs gained floor final week, one was unchanged, and seventeen had TRs that fell with three dropping double-digits. Nineteen ETF TRs ended the week within the “inexperienced zone” (TRs from 35 to 50), eight ended the week within the “blue zone” (TRs from 15.5 to 34.5) and three ended within the “crimson zone” (TRs between 0 and 15) vs. the earlier week when there was twenty two within the “inexperienced zone”, seven within the “blue zone”, and just one was within the “crimson zone”. The common TR loss on the week was -3.07 vs. the week earlier than common TR acquire of +1.22. Power and Homebuilding ETFs drove the Common TR loss decrease final week. Excluding the underside 5, the common TR loss would have been -0.81.

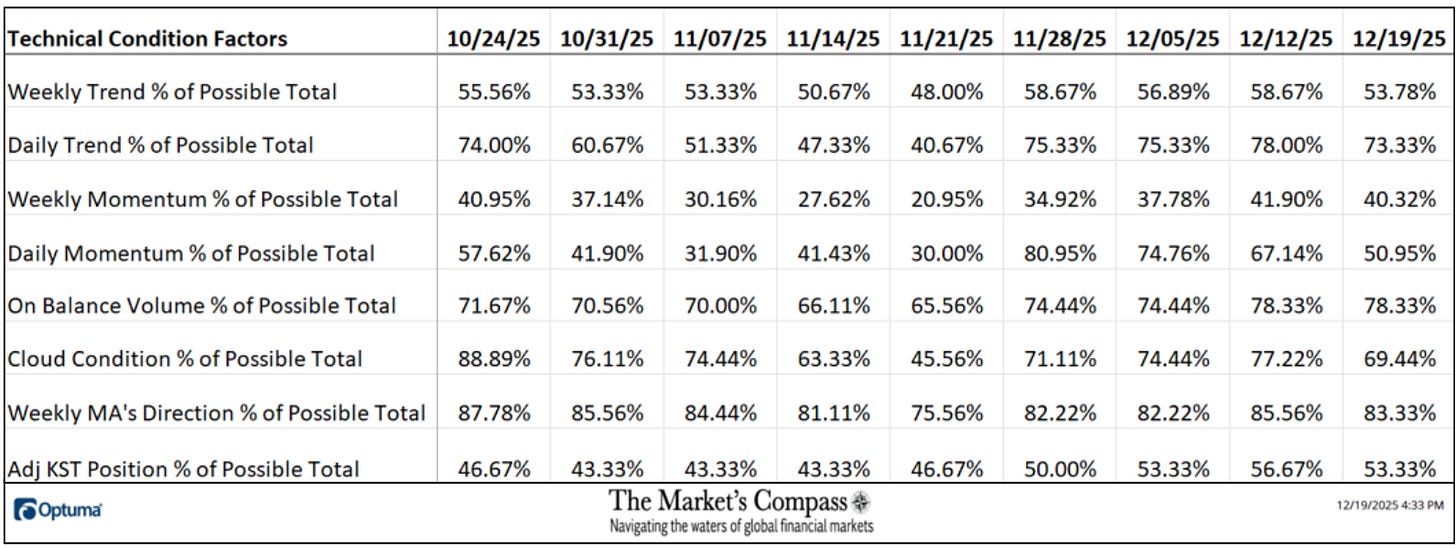

*The Technical Situation Components are derived from a calculation of the whole Particular person US Index and Sector ETF Technical Rankings. What’s proven within the excel panel beneath is the whole TCFs of all thirty TRs. Just a few TCFs carry extra weight than the others, such because the Weekly Development Issue and the Weekly Momentum Consider compiling every particular person TR of every of the 30 ETFs. Due to that, the excel sheet beneath calculates every issue’s weekly studying as a proportion of the doable complete.

To totally perceive the development the of The Technical Situation Components go to the MC’s Technical Indicators web page at www.themarketscompass.com and go to “us etfs”.

One technical takeaway can be for instance, if the DMC Issue or DMCTF rises to an excessive between 85% and 100%, it might counsel a short-term overbought situation. Conversely, a studying within the vary of 0% to fifteen% would counsel an oversold situation was growing. This previous week a studying of fifty.95% was registered within the DMCTF or 107 out of a complete of 210 optimistic factors, which was down from 67.14% the earlier week.

As a affirmation instrument, if all eight TCFs enhance on every week over week foundation, extra of the 30 ETFs are enhancing internally on a technical foundation confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fell over the week it confirms a transfer decrease within the broader market. Final week seven TCFs misplaced floor and one was unchanged

The Complete US ETF Technical Rating (“TER”) Indicator is a complete of all 30 ETF rankings and will be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator.

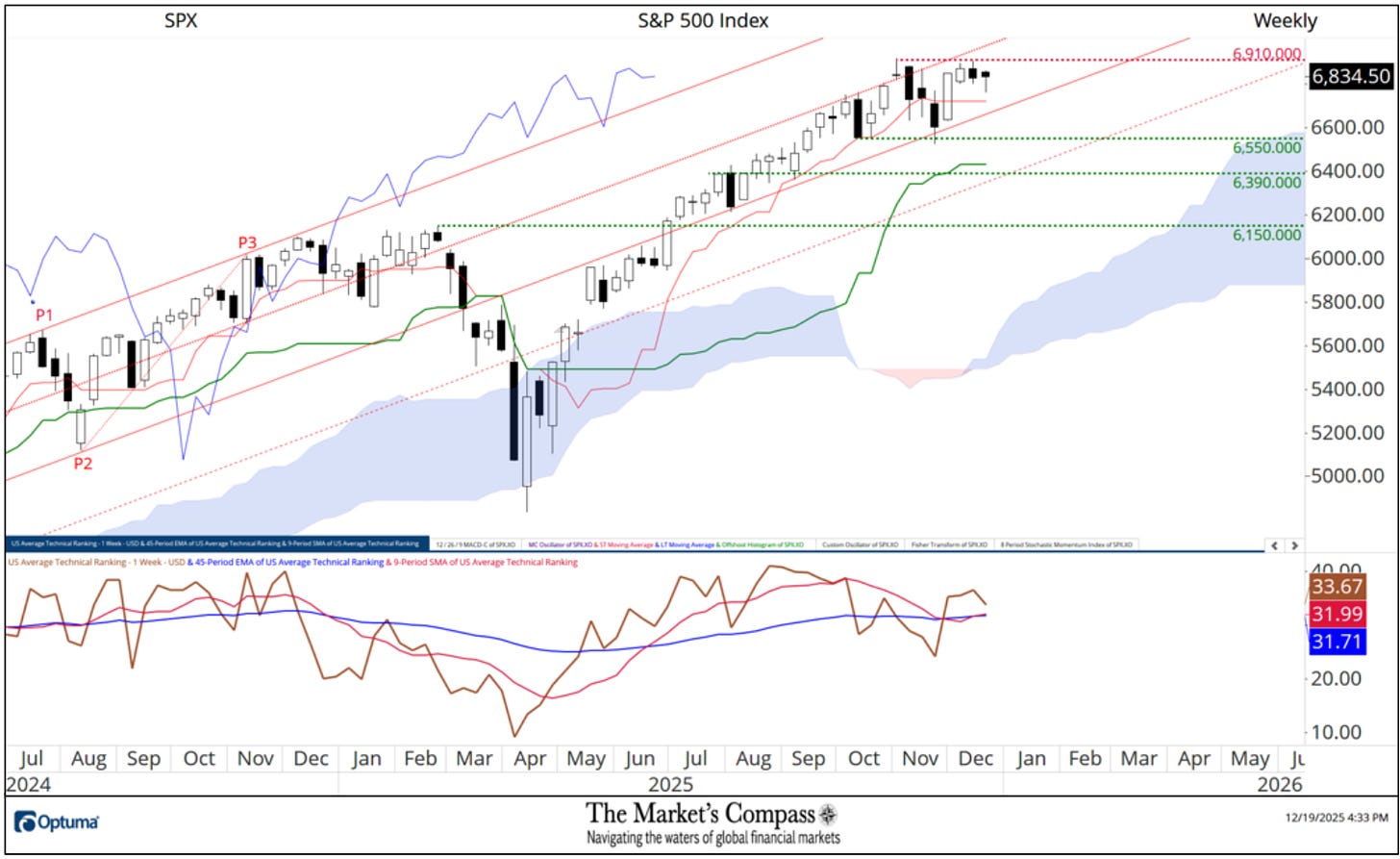

The collection of upper weekly closing lows and better weekly closing highs since April stays intact and three weeks in the past the S&P 500 Index registered a document weekly closing excessive. But the Complete US ETF Rating or “TER” failed to substantiate the excessive.

The Weekly Common Technical Rating (“ATR”) is the common Technical Rating of the 30 US Index and Sector ETFs we monitor. Just like the TER, it’s a affirmation/divergence in addition to an overbought/oversold indicator.

For the previous three weeks costs have struggled to overhaul the October intra-week highs however have continued to carry above assist supplied by the Decrease Parallel (stable crimson line) of the Schiff Modified Pitchfork (crimson P1-P3) on a weekly closing foundation since early July giving me the boldness to counsel the Median Line (crimson dotted line) shall be overtaken within the weeks to return. That stated, the Common Technical Rating Oscillator didn’t verify the late October highs and the 9-Week Easy Transferring Common (crimson line) is contending with resistance on the longer-term 45-Week Exponential Transferring Common (blue line).

*An in-depth complete lesson on Pitchforks is accessible on my web site…

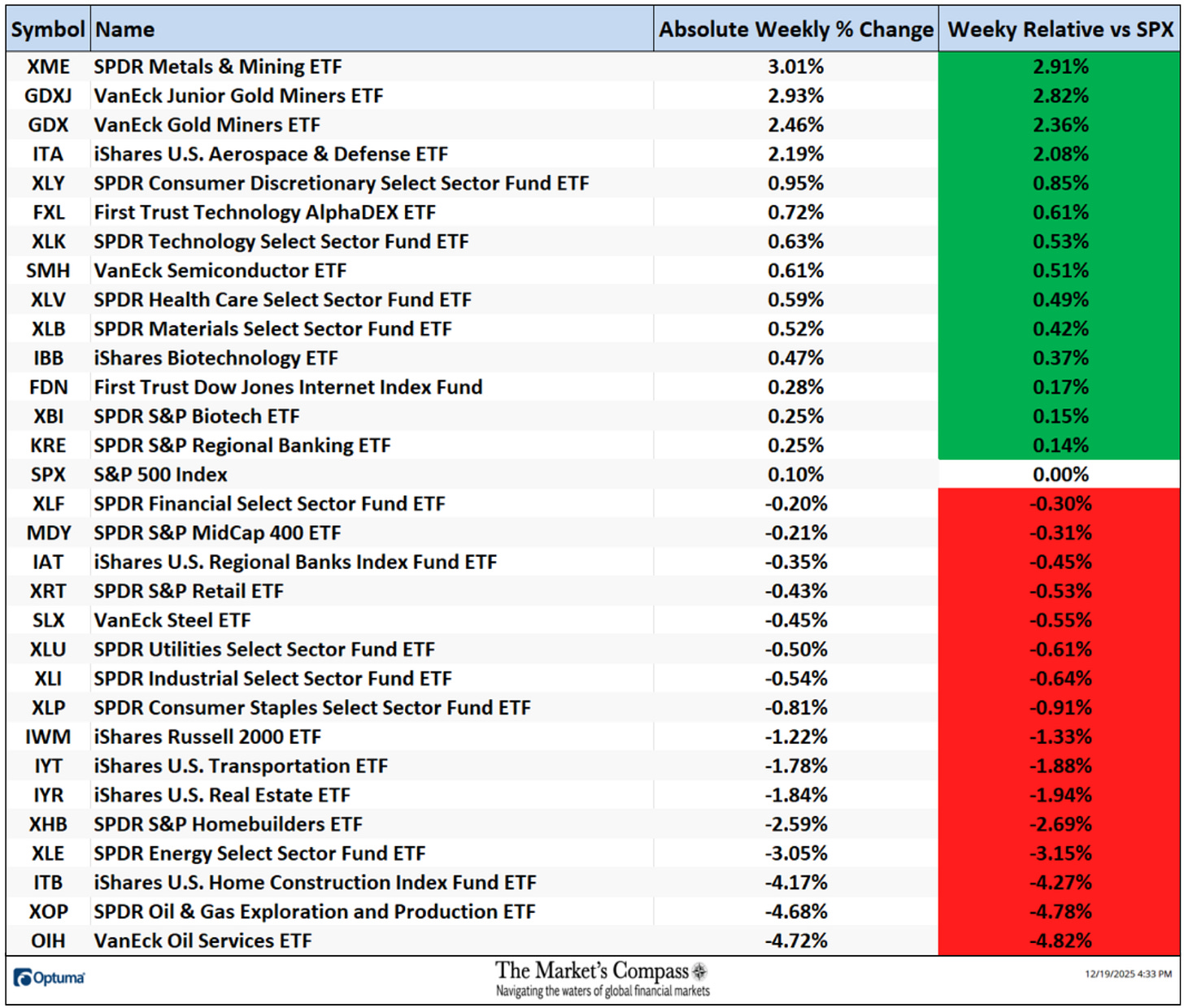

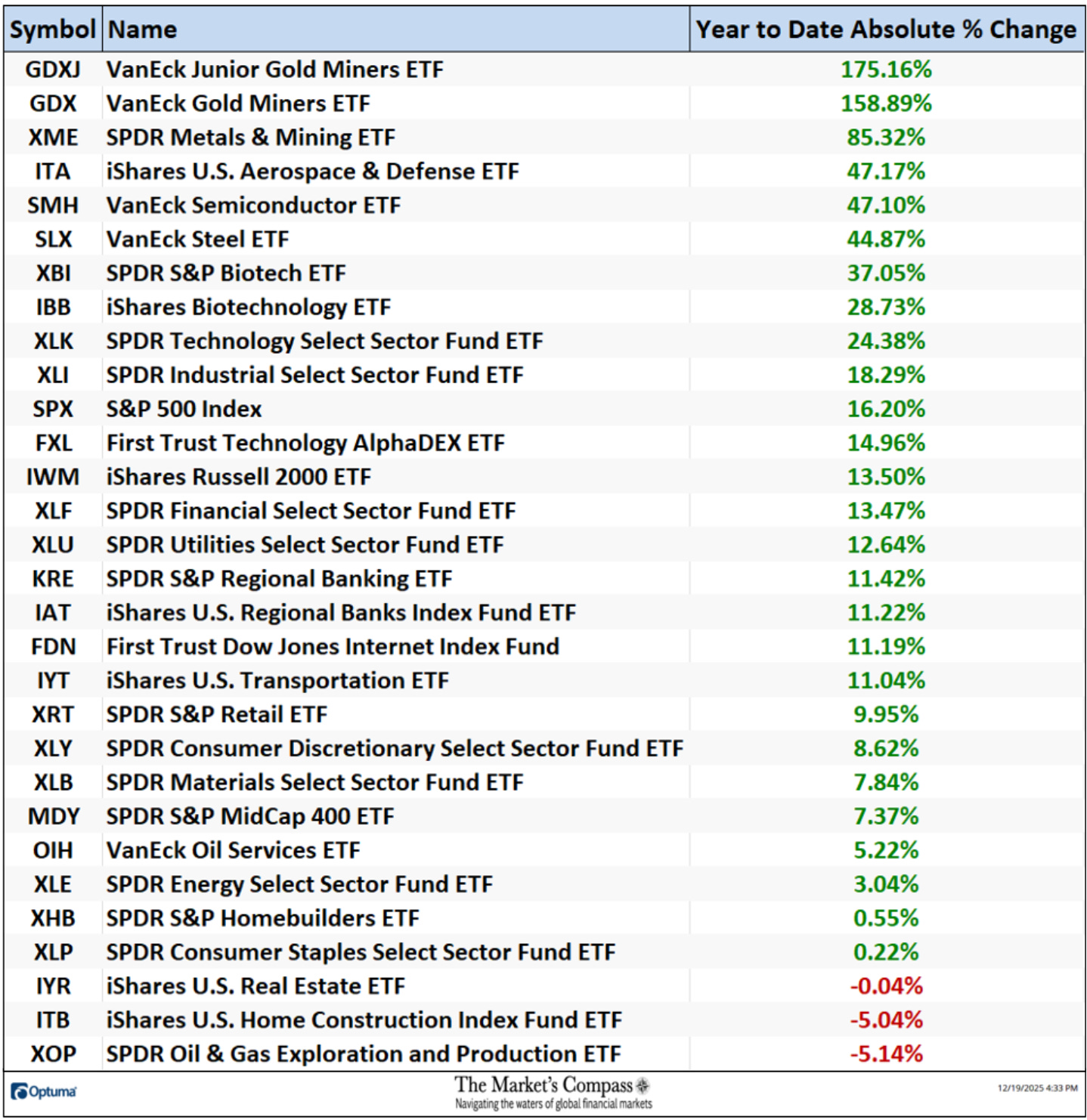

Fourteen of the US Index and Sector ETFs that I monitor on this Research gained floor on an absolute foundation final week bettering the +0.10% acquire within the SPX Index. Sixteen underperformed the S&P 500 Index on a relative foundation. The standout gainers final week had been the metals and mining ETF (XME) and gold ETFs (GDX and GDXJ).

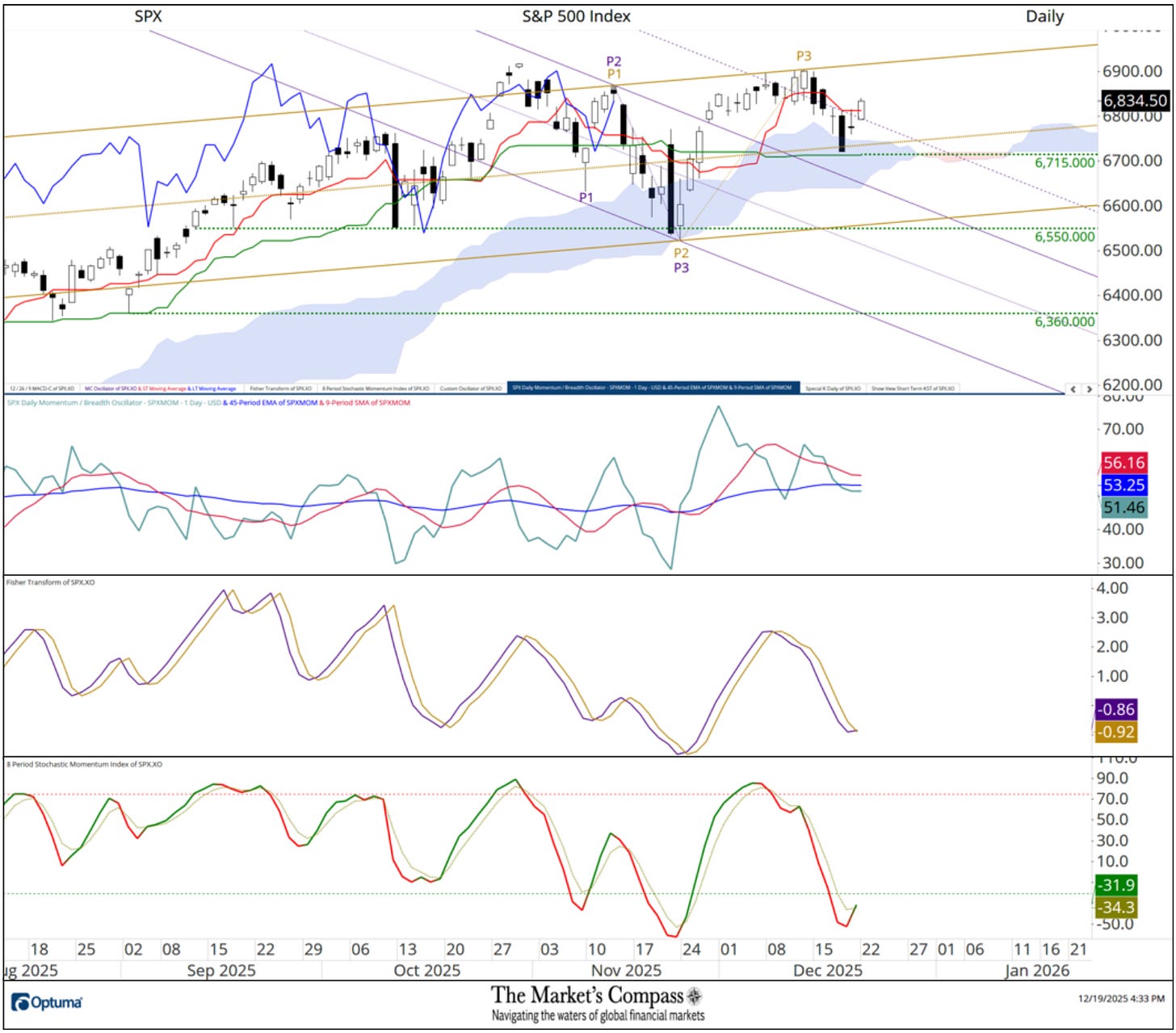

Every week in the past, final Friday, the SPX Index rolled over, and the selloff deepened final Wednesday with the massive cap index falling beneath Cloud assist main me to attract the brand new Schiff Modified Pitchfork (gold P1-P3). Wednesday’s drop fell wanting a full check of assist on the Kijun Plot (inexperienced line at 6715.00) and over the subsequent two days recovered from the short-term oversold situation as witnessed by the Stochastic Momentum Index within the backside chart panel. With it, the Fisher Remodel (middle momentum panel) is hinting at a flip. The SPX Each day Momentum / Breadth is impartial with the shorter-term Transferring Common (crimson line and longer-term Transferring Common (blue line) each monitoring sideways. Barring a break of assist on the Median Line and the Kijun Plot I consider {that a} problem of the Higher Parallel (stable gold line) is within the playing cards.

The YTD Common Absolute Worth precentage fell barely to +27.55% final week from +27.59% the earlier week.

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of the SPX can avail themselves of a quick tutorial titled, Instruments of Technical Evaluation and an in-depth complete lesson on Pitchforks is accessible on my web site…

Charts are courtesy of Optuma whose charting software program permits the Technical Rankings to be calculated and again examined.

To obtain a 30-day trial of Optuma charting software program go to…