Welcome to this week’s publication of the Market’s Compass Crypto Candy Sixteen Research #223. The Research tracks the technical situation of sixteen of the bigger market cap cryptocurrencies. Each week the Research will spotlight the technical modifications of the 16 cryptocurrencies that I monitor in addition to highlights on noteworthy strikes in particular person Cryptocurrencies and Indexes. As at all times, paid subscribers will obtain this week’s unabridged Market’s Compass Crypto Candy Sixteen Research despatched to their registered e mail Sundays*. Previous publications together with the Weekly ETF Research will be accessed by paid subscribers through The Market’s Compass Substack Weblog.

With apologies, as a result of journey commitments of the creator, right now’s publication of this week’s Research was delayed.

An evidence of my goal Particular person Technical Rankings and Candy Sixteen Complete Technical Rating go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose “crypto candy 16”. What follows is a Cliff Notes model* of the total rationalization…

*The technical rating system is a quantitative strategy that makes use of a number of technical concerns that embody however should not restricted to development, momentum, measurements of accumulation/distribution and relative energy. The TR of every particular person Cryptocurrency can vary from 0 to 50.

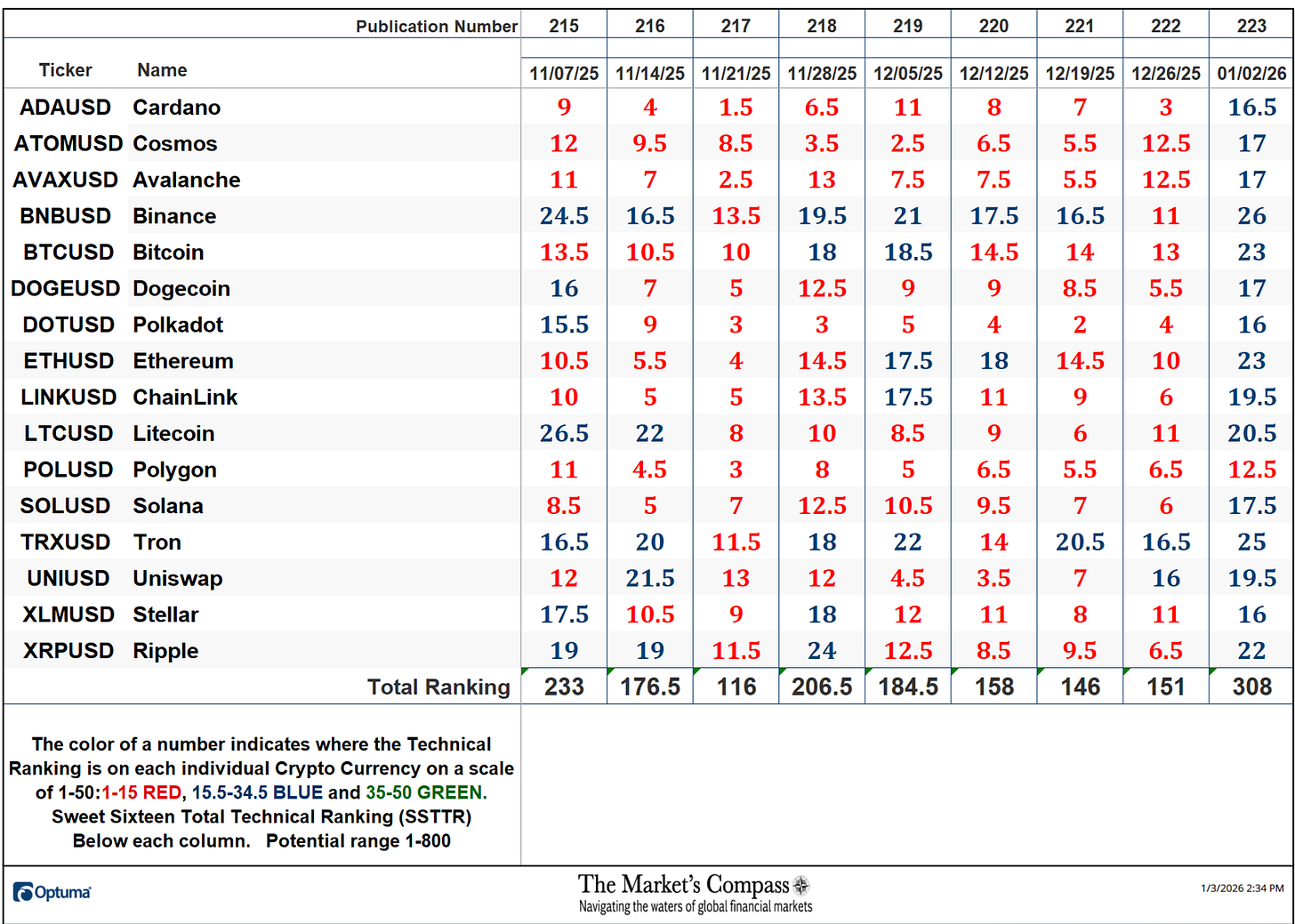

The Candy Sixteen Complete Technical Rating rose sharply final weeklast week, up +103.97% to 308 from 151 the earlier week which was up +3.42% from 146 the week earlier than that.

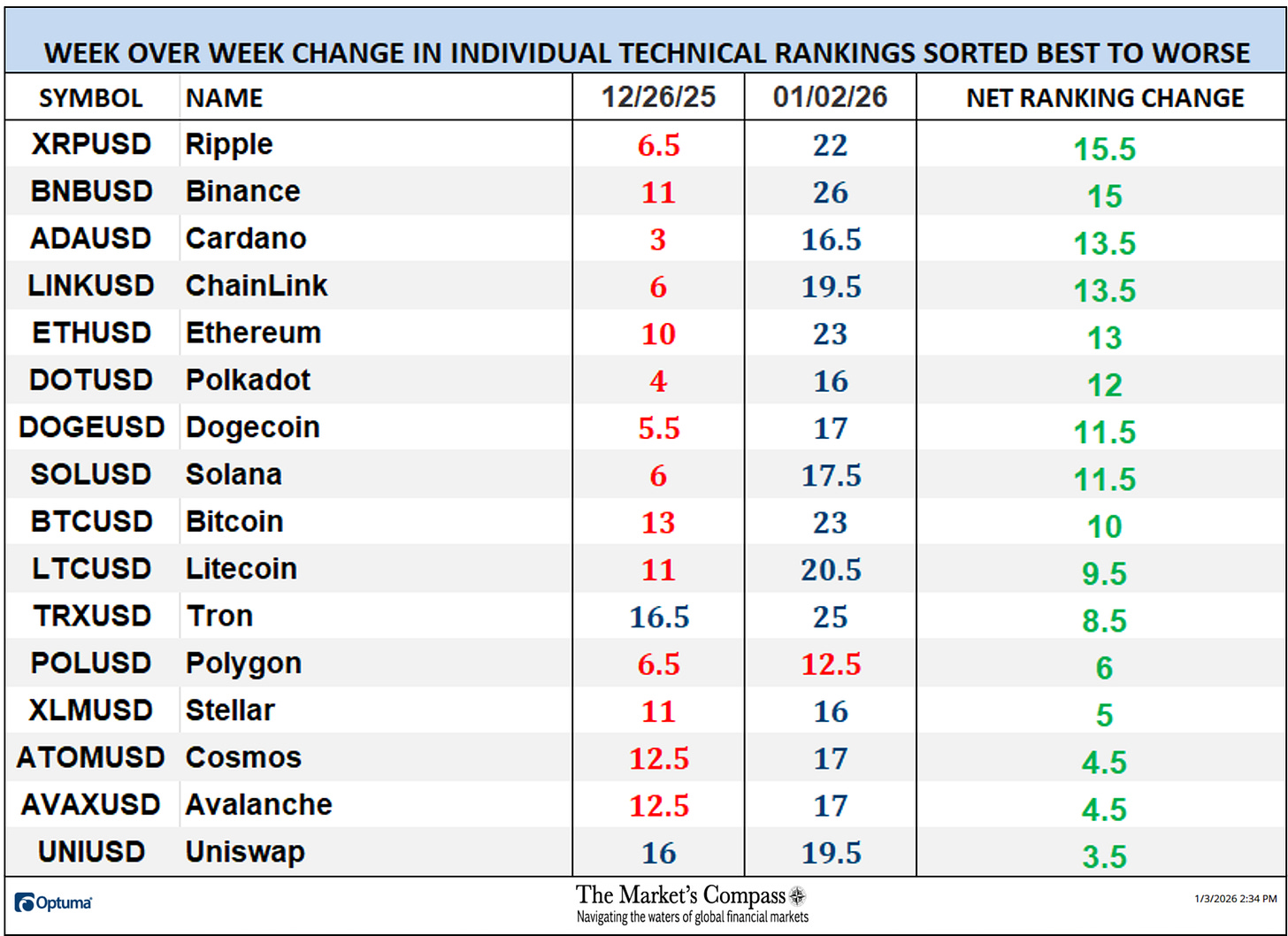

All of the Candy Sixteen made beneficial properties of their TRs final week vs. the earlier week when seven marked beneficial properties of their TRs, and 9 moved decrease. The typical Candy Sixteen TR achieve was +9.81, vs. the common TR achieve of +0.31 the earlier week. As soon as once more for the twelfth week in a row there have been zero TRs within the inexperienced zone final week. That stated, 13 of the Candy Sixteen TRs find yourself rising into the “blue zone” (TRs between 15.5 and 34.5) from the “purple zone” (TRs between 0 and 15) in a really spectacular affirmation of the broader market rally with Uniswap (UNI) and Tron (TRX) holding their floor within the “blue zone”. The earlier week two had been within the “blue zone” (TRs between 15.5 and 34.5) and fourteen had been within the “purple zone” (TRs between 0 and 15).

*The CCi30 Index is a registered trademark and was created and is maintained by an impartial staff of mathematicians, quants and fund managers lead by Igor Rivin. It’s a rules-based index designed to objectively measure the general development, each day and long-term motion of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding secure cash (extra particulars will be discovered at CCi30.com).

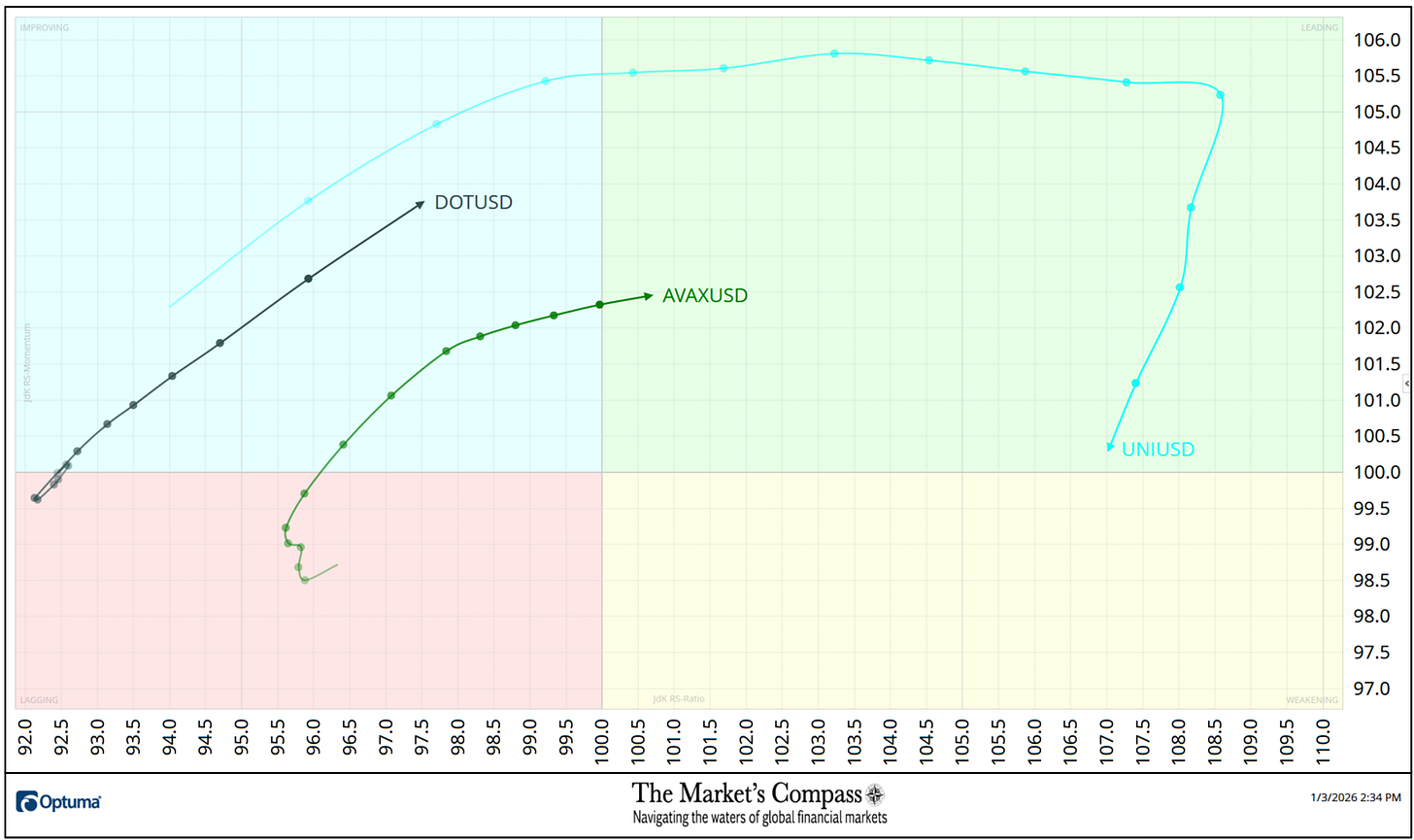

The chart beneath has two weeks, or 14 days, of relative knowledge factors vs. the benchmark, (the CCi30 Index) on the middle, deliniated by the dots or nodes. Not all the Candy Sixteen are plotted on this RRG Chart. I’ve accomplished this for readability functions. These which I consider are of upper technical curiosity stay.

Uniswap (UNI) has been and is noteworthy as will likely be seen not solely right here however within the “Tabulation Desk” beneath. UNI went on to new Relative Power excessive on Monday of final week (a ratio to the benchmark of the CCi30 Index of 108.6) till Relative Power Momentum started to “soften away” because it rolled over within the Main Quadrant leaving it solely in the future of contracting Relative Power Momentum from coming into the Weakening Quadrant. That stated it nonetheless holds the “pole place” of the very best Relative Power vs the Index at 107 as of final Friday. Avalanche (AVAX) has made a 3 Quadrant transfer, rising out of the Lagging Quadrant, driving by way of the Enhancing Quadrant final week to shut Friday within the Main Quadrant. Polkadot (DOT) has escaped the Laging Quadrant after a fast turnaround within the Lagging Quadrant and exhibited optimistic Relative Power Momentum on the finish of final week (notice the space between the each day nodes) because it rises in the Enhancing Quadrant.

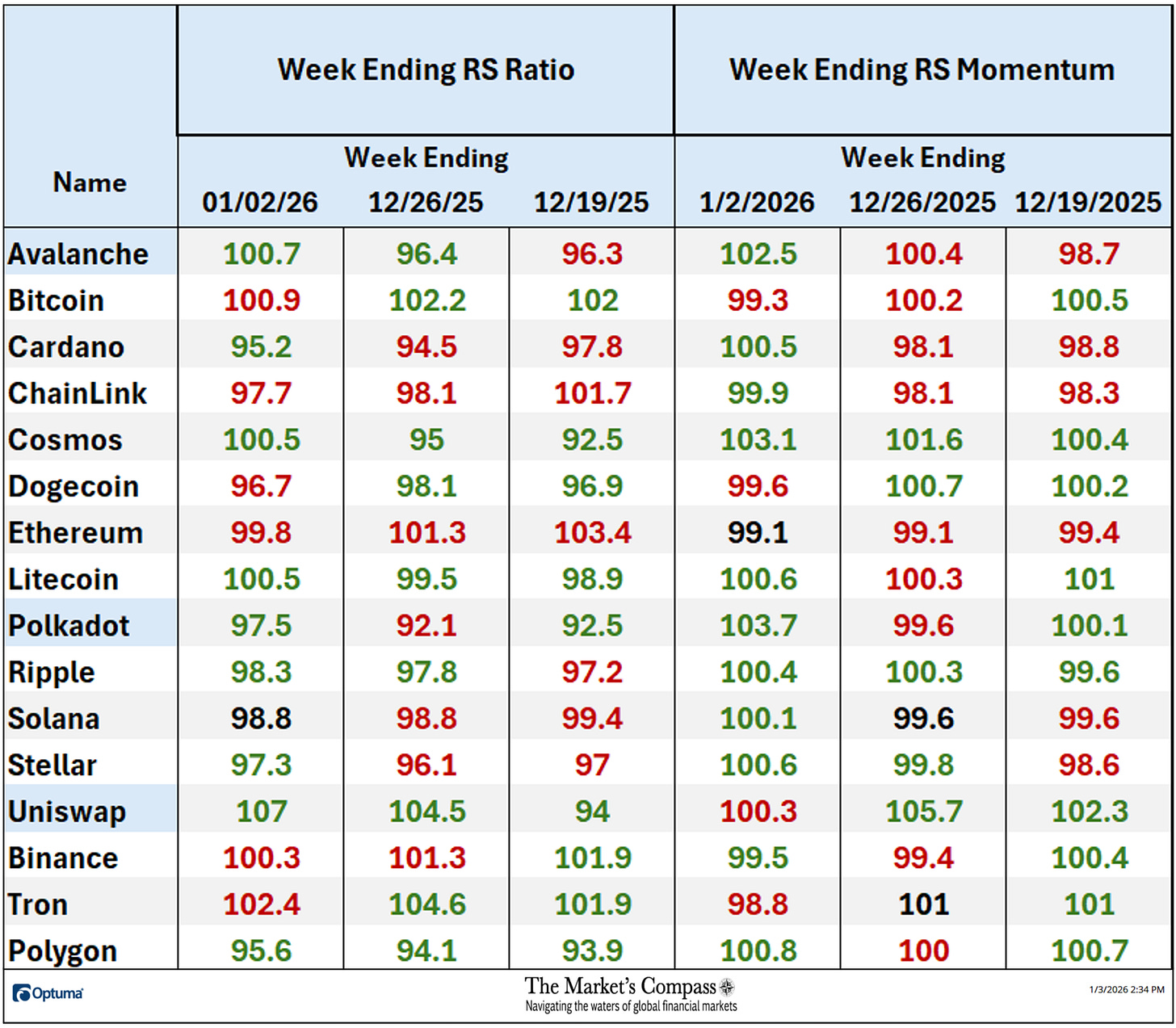

The “Tabulation Desk” beneath marks the Relative Power and Relative Power Momentum readings of the Candy Sixteen vs. the CCi30 Index on the finish of final week and the 2 previous weeks. If there was an enchancment in both the Relative Power Ratio or the Relative Power Momentum studying for the reason that previous week, I’ve highlighted it in inexperienced. If there was a contraction in each it’s highlighted in purple and an unchanged studying in both will stay black. The colour-coding system has served as a warmth map over the previous three weeks highlighting both the continued enchancment, deterioration, or stasis vs. the benchmark CCi30 Index. The crypto currencies which are within the feedback beneath the RRG chart are highlighted in blue.

*Friday December twenty sixth to Friday January 2nd.

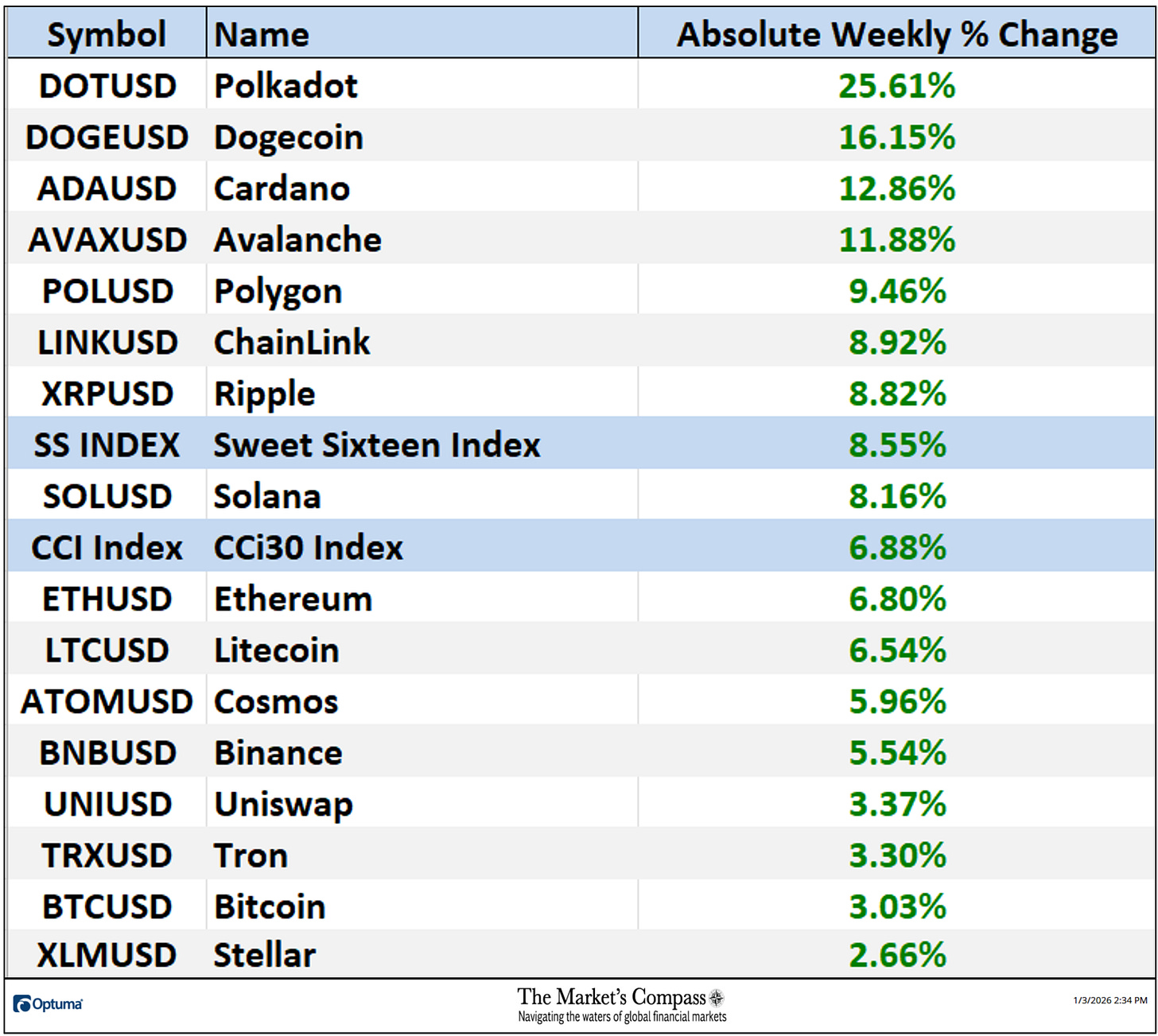

All Candy Sixteen gained floor over the previous seven days, 4 of which marked double-digit absolute value beneficial properties. Of these 4, Polkadot (DOT) led the pack, up +25.61% including to its +9.74% achieve the week earlier than (each day chart posted beneath). The week earlier than solely three gained absolute floor and 13 misplaced absolute floor. Final week the common absolute share achieve was +9.81% vs. the week earlier than when the common absolute achieve was +0.31%. Each weekly common strikes exclude the 2 Indexes.

Though not posted on the chart Polkadot closed the week at 2.1643.

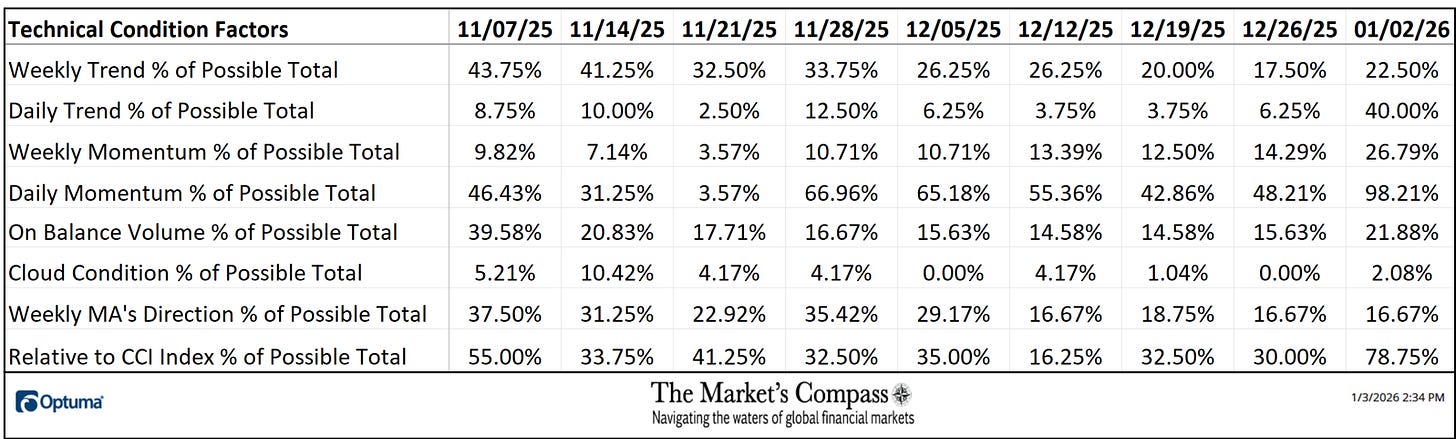

The Technical Situation Components or TCFs are utilized within the calculation of the Particular person Crypto Currencies Technical Rankings. What’s proven within the excel panel beneath is the overall TCFs of all sixteen TRs. A number of TCFs carry extra weight than the others, such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 16 Cryptocurrencies. Due to that, the excel sheet beneath calculates every issue’s weekly studying as a share of the potential whole.

A full rationalization of my Technical Situation Components go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and choose Crypto Candy 16.

The Day by day Momentum Technical Situation Issue or “DMTCF” rose to 98.21% or 110 out of a potential 112 (marking an overbought situation in Day by day Momentum for the primary time since September) from 48.21% or 54 on the finish of earlier week when it rose after 4 weeks of declines.

As a affirmation software, if all eight TCFs enhance on per week over week foundation, extra of the 16 Cryptocurrencies are bettering internally on a technical foundation, confirming a broader market transfer larger (consider an advance/decline calculation). Conversely, if extra of the TCFs fall on per week over week foundation, extra of the “Cryptos” are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week seven of the TCFs rose and one was unchanged, confirming the broad-based rally within the Crypto markets.

*The “TSSTCF” Oscillator tallies the eight goal Technical Situation Components into one overbought / oversold indicator that ranges between 0 and eight.

On the finish of final week, the CCi30 Index, which had rallied +6.88% over the earlier seven days, was difficult first resistance on the 15,265.00 degree (on the time of publication the Index was above that degree). The Complete Technical Situation Issue has escaped oversold territory the place it was trapped beneath the shorter-term 5-Week Shifting Common (purple line) which till the tip of final week had been in a gradual down development since late August. A observe by way of to final week’s flip in value and advance by way of the Tenkan Plot (strong purple line) which is at 16,241, would recommend that the downtrend in weekly costs has reversed and on the very least a measurable countertrend rally has begun.

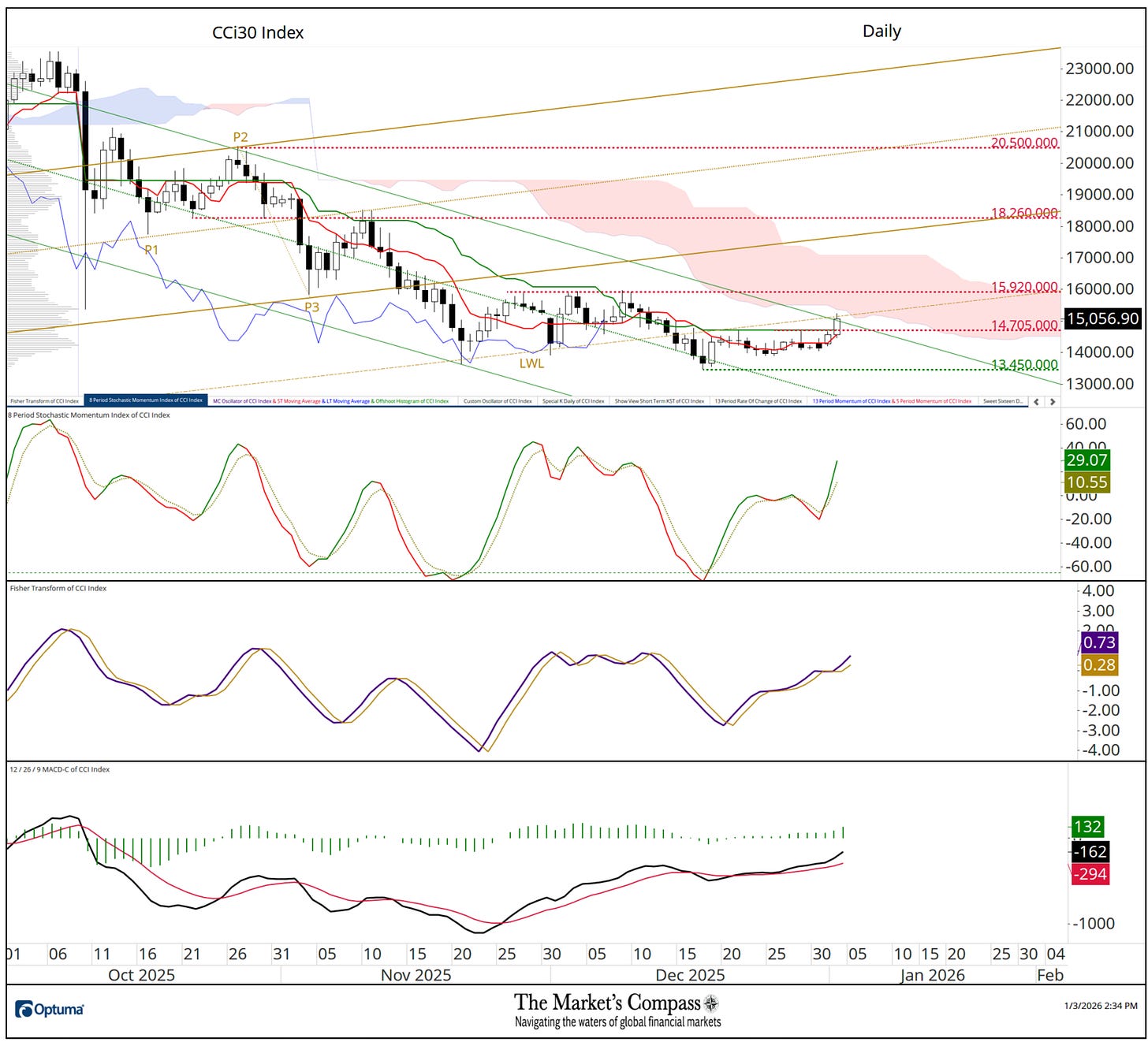

The Day by day chart of the CCi30 Index provides the long-suffering Crypto bulls a ray of hope that the downtrend in costs might have run its course (at the very least quickly). For 2 weeks the Index had been trapped in a sideways buying and selling vary till Friday’s breakout and shut above the 14,705 degree. With that, the Index closed the week proper on the Higher Parallel (strong inexperienced line) of the longer-term Customary Pitchfork (inexperienced P1-P3) and just under the Decrease Warning Line (gold LWL) of the shorter-term Customary Pitchfork (gold P1 by way of P3). These two Pitchfork options, plus the underside of the Cloud will likely be a cluster of key resistance however as each the Stochastic Momentum Index and MACD recommend there’s a flip in value momentum that signifies that if that degree is overtaken the resistance at 15,920 might be challenged.

The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

An in-depth complete lesson on Pitchforks and evaluation in addition to a primary tutorial on the Instruments of Technical Evaluation is out there on my web site…