Ever questioned how some merchants all the time appear to be in sync with the market?

Have they got a mystic capability to foretell the place the value is headed subsequent?

Though it might sound supernatural, there are actually no miracles happening…

Their secret lies in utilizing tried-and-tested strategies like multi-timeframe evaluation (MTA) to higher perceive why the market is shifting in a sure course.

As soon as merchants grasp the artwork of analyzing a number of timeframes, they get a clearer, extra correct image of the market—resulting in smarter, extra worthwhile choices.

At first look, MTA might sound overly technical or overwhelming, however when you grasp the core rules, it might make an enormous distinction in the way you method the market.

On this article, I’ll break down the necessities of multi-timeframe evaluation and present how this method can dramatically enhance your buying and selling.

By studying to the tip, you’ll be taught to identify high-probability commerce setups and keep away from widespread pitfalls.

Right here’s what you’ll cowl intimately:

- What’s Multi-Timeframe Evaluation?

- The issue of 4 to six: Choosing the proper timeframes

- Utilizing worth patterns in MTA for higher commerce entries

- Methods to establish stacked ranges for stronger commerce setups

- Limitations of Multi-Timeframe Evaluation

Prepared to reinforce your buying and selling technique?

Let’s dive in!

What’s Multi-Timeframe Evaluation?

Nicely, it’s all about taking a look at worth actions throughout totally different timeframes that can assist you make smarter buying and selling choices.

As an alternative of specializing in only one chart, you’re zooming out and in, taking a look at each the massive image and the finer particulars.

It’s a bit like having each a telescope and microscope with you on the similar time!

Utilizing this system, you get a a lot clearer concept of general market developments, key support and resistance ranges, and the place the value may be headed.

Combining totally different timeframes is a good way to higher time your trades, whether or not you’re getting in or out.

Why Use Multi-Timeframe Evaluation

The entire concept is to get a fuller image.

As an alternative of counting on only one chart to decide, you’re getting affirmation throughout a number of timeframes, which helps you keep away from false alerts.

Think about this: You see a breakout on the 4-hour chart and suppose it’s time to leap in…

NZD/USD 4-Hour Chart:

Appears to be like like an incredible breakout, proper?

However what in the event you zoomed out a bit first and seemed on the each day image?…

NZD/USD Every day Chart:

Are you able to see that the value is approaching a each day resistance degree quickly?

Whereas there could possibly be a doable commerce from the setup you’ve discovered, it won’t be the perfect because you’d be shopping for simply earlier than a powerful each day resistance zone.

Let’s see what occurs subsequent…

NZD/USD 4-Hour Chart Every day Resistance:

Have a look at that.

Value rejected the each day resistance space and fell again to its unique help degree!

See how MTA helps you keep away from getting caught in a nasty commerce?

By syncing up with the general pattern and bigger help and resistance zones, you give your self the perfect likelihood to keep away from low-quality setups and await high-quality ones.

Multi-Timeframe Evaluation: An element of 4 to six for a Larger Timeframe

Right here’s how you determine which increased timeframe to make use of.

I wish to hold it easy by utilizing an element of 4 to six.

Which means you’re taking the decrease timeframe you’re buying and selling on and multiply it by 4 to six to get your increased timeframe.

For instance, if buying and selling on a 1-hour chart, you may use the 4-hour chart for the larger image.

In the event you’re working off a 5-minute chart, you may go as much as the 30-minute chart.

This method helps you keep in sync with the general pattern whereas nonetheless getting the small print you want for exact entries and exits.

By sticking with an element of 4 to six for multi-timeframe evaluation, you’ll be able to keep away from getting misplaced within the noise of decrease timeframes, too.

Nevertheless, it’s price noting that some merchants who work with decrease timeframes, such because the 5-minute or 15-minute charts, should still discover worth in analyzing the each day and 4-hour charts, too.

These increased timeframes can present helpful reference factors for the place the value may be attracted all through the buying and selling day or week.

Larger Timeframe: What to Look For

You may be asking, “Okay, so what ought to I even be searching for on the upper timeframe?”

Nicely, the upper timeframe is like your map.

It reveals you key areas equivalent to help and resistance ranges, consolidation zones, and earlier highs and lows—locations the place worth may react sooner or later.

Let’s have a look at some examples of what to search for on the next timeframe utilizing the each day chart…

AUD/NZD Every day Chart:

On this instance, you’ll be able to see two clearly outlined help and resistance zones.

Whereas there are smaller peaks and decrease timeframe help ranges, these two zones are appearing as the primary magnets for worth.

Maintain it easy and concentrate on worth returning to those zones relatively than getting caught up within the smaller timeframe highs and lows.

Let’s have a look at one other instance…

AUD/NZD Every day Chart Channel:

On the each day chart, you’ll be able to see that the value is shifting inside an uptrend channel.

This channel provides nice perception into the place costs may proceed heading, too.

As such, it’s necessary to align your bias with buys in the event you’re seeking to capitalize on this uptrend whereas additionally recognizing that there could also be an higher boundary.

The highest of the channel may present transient promote alternatives.

Now, I need to present you yet one more key use for the each day timeframe, which frequently will get missed.

As increased timeframes maintain extra weight, it is sensible that candlestick formations maintain extra significance on these timeframes, proper?…

AUD/NZD Every day Chart Candlesticks:

While you have a look at this chart, you’ll discover that as the value reaches this peak, there are clear inverted hammer candlesticks, indicating vital rejection over a number of days.

This tells you that worth isn’t simply briefly rejected for an hour or so—it’s being held at this degree day after day.

So, the probabilities are that costs will retrace when the each day patterns recommend they’ll.

This may present invaluable info, whether or not you’re in a protracted commerce seeking to exit at the absolute best space or contemplating a brand new purchase or promote place.

These candlestick patterns could possibly be the ultimate piece of knowledge it is advisable to resolve whether or not to execute the commerce.

Now that you’ve three clear examples of what to search for on the upper timeframe, what must you be searching for on the decrease timeframe?

Multi-Timeframe Evaluation: Aligning with the Larger Timeframe (Buying and selling Timeframe)

That is the place you make your strikes.

However right here’s the important thing: You’ve acquired to align your trades with what’s occurring on the upper timeframe.

In the event you don’t, you’re mainly flying blind!

Among the finest methods is to search for stacked ranges, which I’ll cowl in a while on this article.

Now, this timeframe is all about being affected person…

Bear in mind how I confirmed you earlier that sure ranges act as magnets? You have to await the value to be drawn to those key areas of worth.

When help or resistance traces up on each your buying and selling timeframe and the upper timeframe, that’s a high-probability zone for the value to react…

…and that is the place you need to be watching on your entry alerts!

Let’s check out how worth reacts at some beforehand recognized each day ranges on the 4-hour chart…

USD/CAD Every day Chart:

It’s a USD/CAD each day chart the place the value has just lately damaged out.

I need to present you what occurs within the decrease timeframe when the value finally comes again to this degree.

Let’s quick ahead and drop all the way down to the 4-hour timeframe to see what happens…

USD/CAD 4-Hour Chart:

See how the value returned to this magnet degree, paused, after which finally continued again up?

This isn’t only a coincidence. This each day degree was a powerful space of worth, and it’s the place consideration must be targeted whereas ready for an entry set off to provoke a commerce.

Robust bullish hammer candles right here would have offered an incredible entry set off.

So, are you able to see how being affected person and ready for each the 4-hour and each day charts to align would have helped you seize this transfer?

Multi-Timeframe Evaluation: Break of Construction within the Course of the Larger Timeframe

It’s clear now why it’s necessary to all the time commerce within the course of the upper timeframe.

One approach to verify that is by searching for a break of construction in your buying and selling timeframe that matches the pattern on the upper timeframe.

If the upper timeframe reveals an uptrend, you’ll need to see a break above a latest swing excessive on the decrease timeframe to substantiate that the pattern is continuous.

The identical goes for a downtrend—await a break under a latest swing low to make sure you’re not buying and selling towards the tide.

By ready for these breaks of construction, you’re aligning with the market’s general course and giving your self a greater likelihood of catching the larger strikes.

Let’s check out this idea…

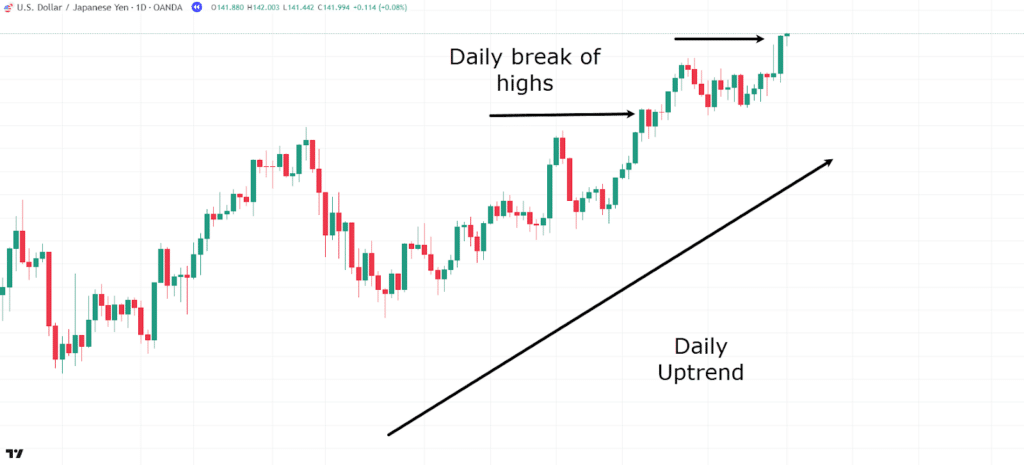

USD/JPY Every day Chart:

Right here, you have got a transparent each day uptrend, as the value is making a collection of upper highs and better lows.

As the value breaks the highs, I need you to additionally discover the kind of candles that seem after the break.

To do that, let’s go all the way down to the buying and selling timeframe of the 4-hour chart and see what it appears like in additional element…

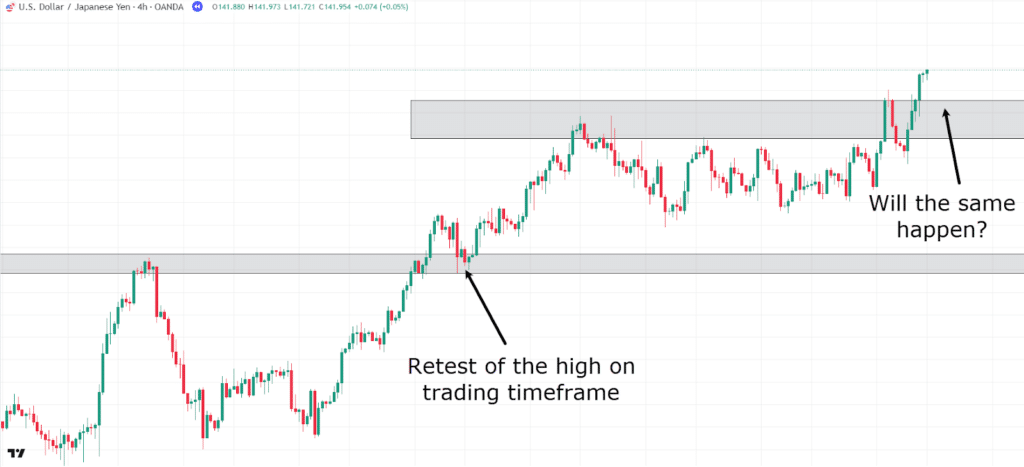

USD/JPY 4-Hour Chart:

Discover how when the value breaks the excessive on the each day timeframe, you have got affirmation of the pattern persevering with in favor of the general course.

Nevertheless, this doesn’t all the time current an instantaneous alternative to enter a commerce.

It does, nevertheless, present a buying and selling alternative if the value makes a quick pullback.

Within the first occasion, the value broke the each day excessive, and on the each day chart, the each day candle closed above the excessive, confirming a brand new increased excessive.

When the pattern continues with momentum, the highs typically don’t simply barely break the earlier excessive; they kind a major new excessive.

So, searching for an entry on the timeframes under can typically nonetheless present nice buying and selling alternatives.

Let’s check out what occurs the second time…

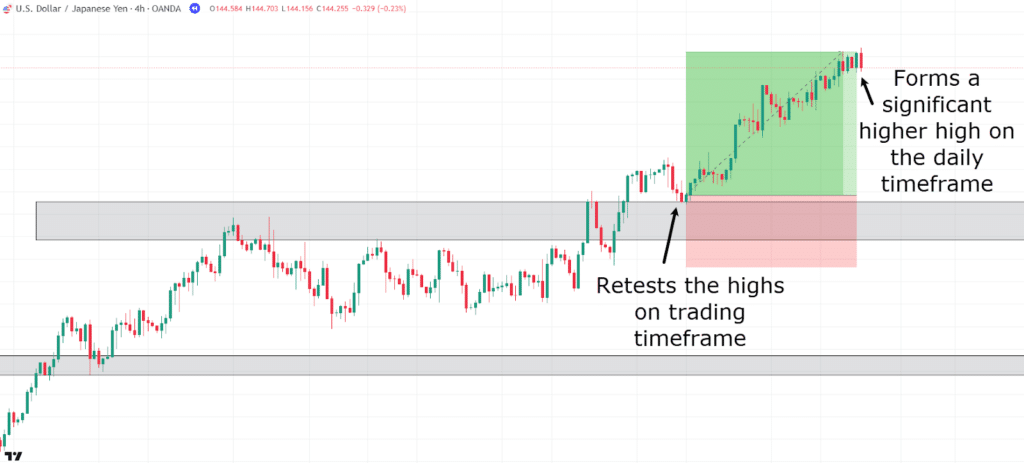

USD/JPY 4-Hour Chart Retest:

The retest happens on the buying and selling timeframe, after which worth strikes to kind a brand new increased excessive on the each day timeframe.

This method comes with its dangers, as you aren’t technically shopping for on the swing low of the each day chart.

Nevertheless, it gives you with affirmation that the each day momentum needs to proceed upward.

If yow will discover an entry alternative in your buying and selling timeframe that offers clear factors for entries and exits, it may be price contemplating a commerce.

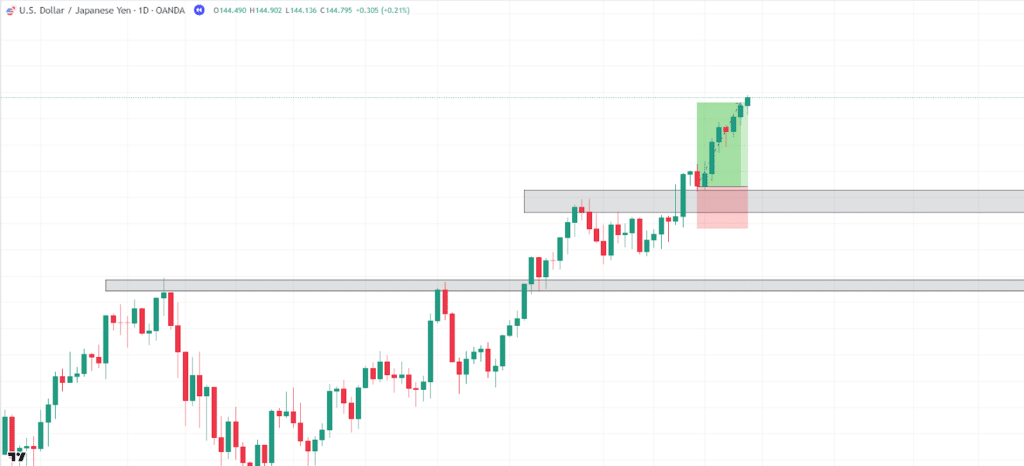

Under is what the profitable commerce appears like on the each day timeframe chart…

USD/JPY Every day Chart Commerce End result:

Acquired it?

Nice!

Subsequent, I need to focus on worth patterns throughout a number of timeframes, as that is a particularly useful gizmo for doubtlessly capturing the beginning of latest increased timeframe developments!

Value Patterns in Multi-Timeframe Evaluation

That is one other highly effective device that may help your buying and selling method.

Value patterns are like roadmaps; they provide you clues about what may occur subsequent out there.

While you mix these patterns with multi-timeframe evaluation, it might tremendously improve your capability to search out higher commerce setups.

Breaking it down: in the event you discover a worth sample forming on the next timeframe, just like the each day or weekly chart, it’s often an indication of one thing larger occurring out there.

Basic patterns like head and shoulders, double tops, or triangles typically carry extra weight on these increased timeframes, as they mirror broader market sentiment and often contain a bigger variety of merchants.

Right here’s the place MTA is useful, as you’ll be able to zoom in to a decrease timeframe, just like the 4-hour or 1-hour chart, to fine-tune your entries and exits.

For instance, if a double backside is forming on the each day chart, that’s a sturdy reversal sign.

As an alternative of getting into the commerce instantly, you’ll be able to await the value to interrupt a key degree or verify the reversal on a smaller timeframe.

This fashion, you’re not simply reacting to the sample; you’re being affected person and letting the market present a cleaner entry level.

One other nice good thing about utilizing multi-timeframe evaluation with worth patterns is that it helps you keep away from false alerts.

Patterns on decrease timeframes, like a 5-minute or 15-minute chart, may look promising, however they will typically be noise within the bigger market image.

If these patterns don’t align with what’s occurring on the next timeframe, they won’t be price buying and selling in any respect.

By aligning patterns throughout totally different timeframes, you improve your odds of success and keep away from getting caught up in short-term market fluctuations.

In brief, combining worth patterns with MTA provides you a strategic edge.

Let’s check out an instance…

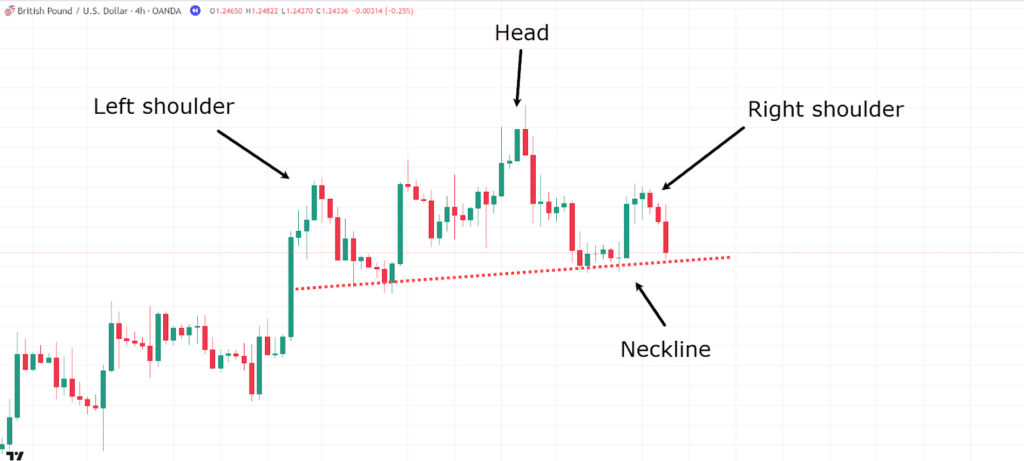

GBP/USD 4-Hour Chart:

Think about you recognized a head and shoulders sample on the 4-hour timeframe throughout your increased timeframe evaluation.

It appears like an incredible likelihood to leap all the way down to your buying and selling timeframe chart and search for any indications that worth may transfer down from this sample.

You’ll be able to trust understanding that the upper timeframe evaluation aligns along with your quick bias on the decrease timeframe.

So, let’s see what occurs…

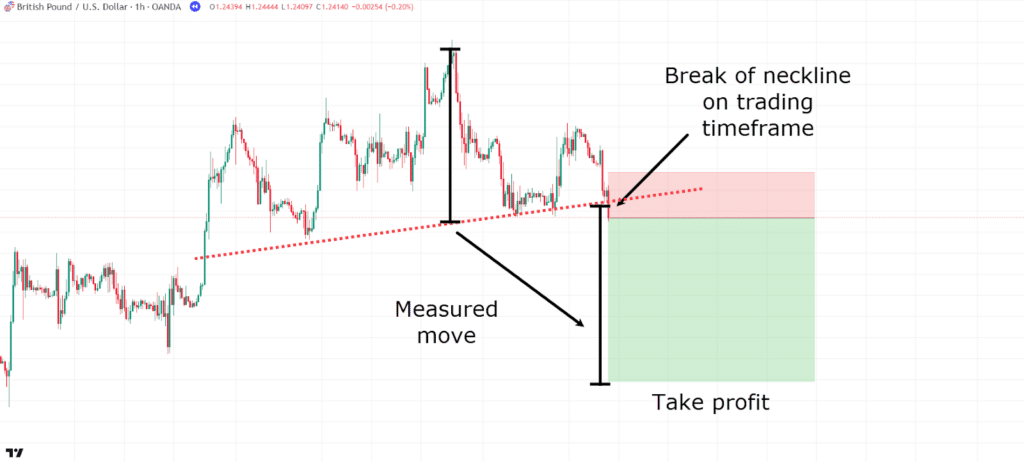

GBP/USD 1-Hour Chart:

Value breaks the neckline on the decrease timeframe, presenting a chance to get in firstly of the transfer.

For the take revenue, let’s use the measured transfer of the neckline-to-head distance, and for this instance, set the cease loss above the neckline, the place the commerce would turn out to be invalid.

Let’s check out what occurs…

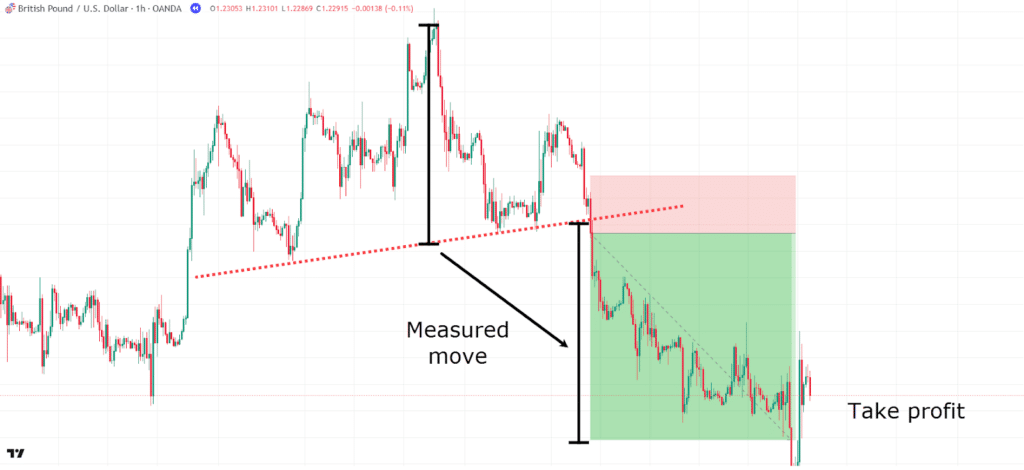

GBP/USD 1-Hour Chart Commerce End result:

Wow! A pleasant 3.5RR commerce.

Not dangerous, contemplating you have been capable of take the commerce understanding the upper timeframe aligned along with your entry.

What turns into obvious by this instance is that the upper timeframe serves as a reminder of the place worth may be within the larger image.

It permits you to execute trades in your buying and selling timeframe with way more confidence, understanding that the broader image aligns along with your entry set off whereas additionally enabling you to enter firstly of patterns to seize as a lot of the transfer as doable.

Lastly, let’s contact on the superior idea of stacked ranges.

Multi-Timeframe Evaluation: Stacked Ranges

Alright, right here comes stacked ranges!

That is while you spot main help and resistance zones throughout a number of timeframes.

It’s like discovering an intersection the place two roads meet – solely right here, it’s the place worth ranges overlap.

Let’s have a look at an instance…

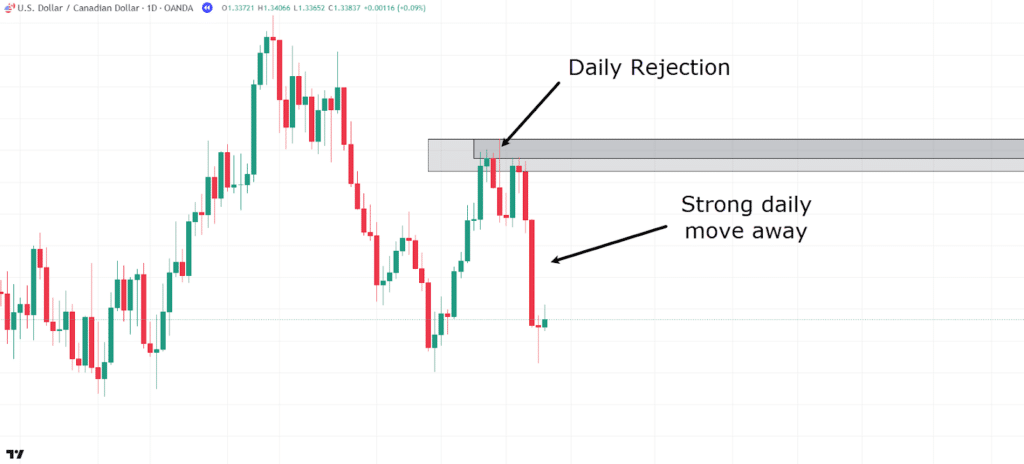

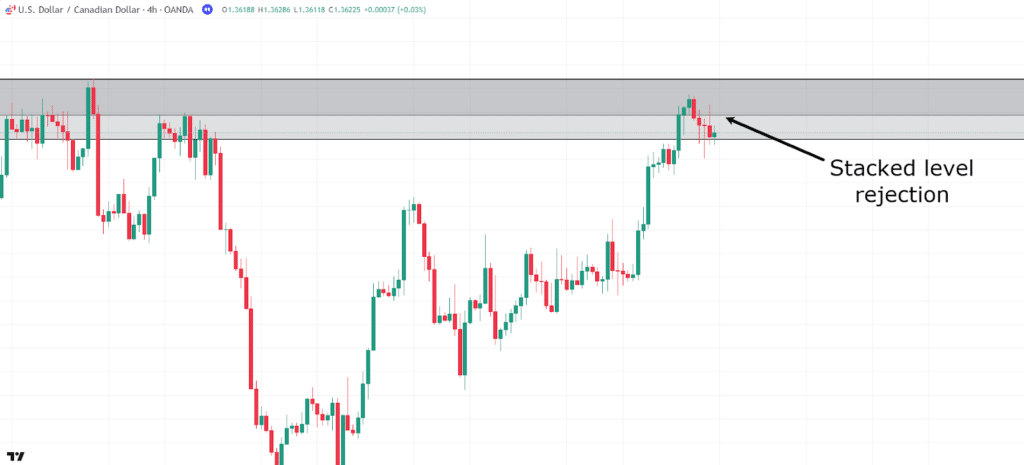

USD/CAD 4-Hour Chart:

Say you see a resistance degree forming on the 4-hour timeframe, however you’re uncertain if it can maintain a lot weight going ahead.

Let’s test the each day chart, which could possibly be your increased timeframe (HTF), and see what it reveals…

USD/CAD Every day Chart:

As you’ll be able to see, the extent is obvious on the each day chart as effectively.

There’s a bearish rejection candle on the zone, adopted by a powerful transfer away.

This degree has turn out to be vital and is an space you need to control.

Now, let’s observe some extra and see what occurs…

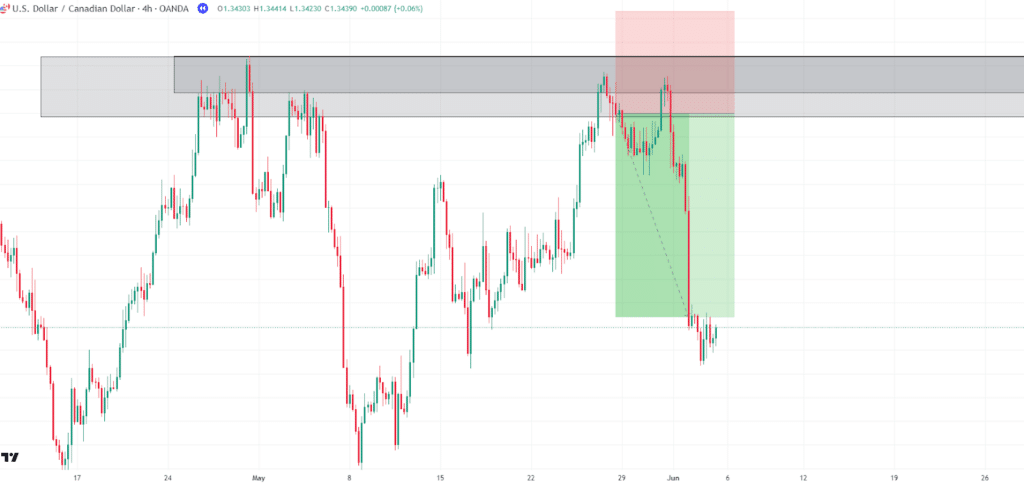

USD/CAD Stacked Degree Rejection:

Right here, you’ll be able to see worth starting to pause on the degree. On this buying and selling timeframe, there’s a possible setup with a 4-hour rejection.

Let’s take the commerce and see the way it pans out!…

USD/CAD Stacked Degree Take Revenue:

Discover how, by utilizing multi-timeframe evaluation, these stacked ranges spotlight high-probability areas the place the value is extra more likely to react – both bouncing off or breaking by.

One other instance of this could possibly be in the event you had a each day trendline converging with a decrease timeframe help or resistance degree.

These staked ranges offer you a a lot increased likelihood of worth reacting at that space of worth.

With all that being stated, let’s discuss a few of the limitations inside MTA.

Limitations of Multi-Timeframe Evaluation

Evaluation Paralysis

Let’s get actual for a second— multi-timeframe evaluation isn’t good.

One of many predominant points I’ve personally skilled is over-analyzing.

You’ve acquired all these totally different timeframes supplying you with varied alerts, and it’s straightforward to get caught in evaluation paralysis.

Generally, the each day chart says one factor, the hourly chart says one other, and you find yourself not understanding what to do.

A whole lot of the time, you may even do nothing and watch the commerce you had deliberate slowly tick towards your revenue targets with out you.

To keep away from this, I favor to maintain my concentrate on the upper timeframe for the general pattern and chart patterns whereas utilizing the decrease timeframe for entries.

Don’t attempt to discover good alignment throughout each single chart, otherwise you’ll drive your self loopy!

Bear in mind, the upper timeframe is supposed to offer context relatively than being a science.

Get a really feel for what the market is doing on the upper timeframe and execute on the decrease timeframe.

Busy Charts

One other problem? You’ll discover tons of help and resistance ranges throughout totally different timeframes.

This may muddle your chart and make it onerous to determine which ranges actually matter.

You don’t need your chart to appear like a five-year-old acquired maintain of their favourite coloring set and went wild!

Give attention to the strongest ranges to simplify issues, particularly these on the upper timeframes.

These ranges must be tremendous apparent; decide those your eyes are immediately drawn to as a result of, likelihood is, the vast majority of merchants are specializing in the identical ranges.

Longer Commerce Instances

One final limitation of multi-timeframe evaluation is that trades will are inclined to take barely longer to play out.

It is because your focus shifts from a single decrease timeframe to the broader general market. This may restrict merchants seeking to be out and in of trades rapidly.

While you use MTA, you may choose to focus on the upper timeframe ranges relatively than simply the only buying and selling timeframe goal.

This may result in issues in relation to taking income, as it could stop you from taking cash off the desk as a result of focusing on the next timeframe degree.

This gained’t all the time work out in your favor, as the upper timeframe setup could by no means be full.

So, it’s necessary to know the place you need to take income, whether or not that be partially alongside the way in which or on the increased timeframe goal.

Conclusion

Clearly, multi-timeframe evaluation (MTA) is a useful method for merchants seeking to enhance their market evaluation and timing.

By integrating MTA into your buying and selling technique, you achieve a a lot better concept of the market’s general course, in addition to extra exact entry and exit factors.

When used alongside different technical instruments, MTA gives a major edge, serving to merchants spot higher-probability trades and keep away from widespread pitfalls.

To summarize, on this article, you’ve:

- Found what Multi-Timeframe Evaluation is and why it issues

- Explored the Issue of 4 to six and the way to decide on the appropriate timeframes for evaluation

- Gained perception into utilizing worth patterns in MTA for extra correct commerce entries

- Discovered learn how to establish stacked help and resistance ranges for stronger commerce setups

- Examined the restrictions of MTA, together with over-analysis and the problem of ready for setups to play out

MTA goes far past what’s coated right here, however by mastering these foundational rules and integrating them along with your different buying and selling strategies, you’ll be effectively in your approach to turning into a extra assured and strategic dealer.

If MTA resonates with you, I strongly encourage you to analysis additional into it!

Now, I’m curious to listen to your ideas on Multi-Timeframe Evaluation!

Do you employ it in your buying and selling?

How has it helped you enhance your methods?

Share your ideas and experiences within the feedback under!