KEY

TAKEAWAYS

- Expertise leapfrogs again into high 5 sectors, changing financials

- Continued volatility suggests lack of sustainable pattern

- Weekly RRG reveals energy in know-how, blended indicators in different high sectors

- Efficiency hole between high 5 sectors and SPY widens to 7%

This Time Expertise Beats Financials

After per week of no adjustments, we’re again with renewed sector actions, and it is one other spherical of leapfrogging.

This week, know-how has muscled its approach again into the highest 5 sectors on the expense of financials, highlighting the continuing volatility out there.

Communication Providers and Shopper Staples have swapped locations since final week, whereas Expertise has entered at quantity 5, pushing Financials all the way down to sixth. The remaining sectors from seven to eleven stay unchanged.

This fixed shuffling is a transparent indicator of the market’s indecision. Imho, such volatility often would not accompany a sustainable pattern, and that is exactly what’s hurting trend-following fashions proper now.

- (1) Industrials – (XLI)

- (2) Utilities – (XLU)

- (4) Communication Providers – (XLC)*

- (3) Shopper Staples – (XLP)*

- (6) Expertise – (XLK)*

- (5) Financials – (XLF)*

- (7) Actual-Property – (XLRE)

- (8) Supplies – (XLB)

- (9) Shopper Discretionary – (XLY)

- (10) Healthcare – (XLV)

- (11) Power – (XLE)

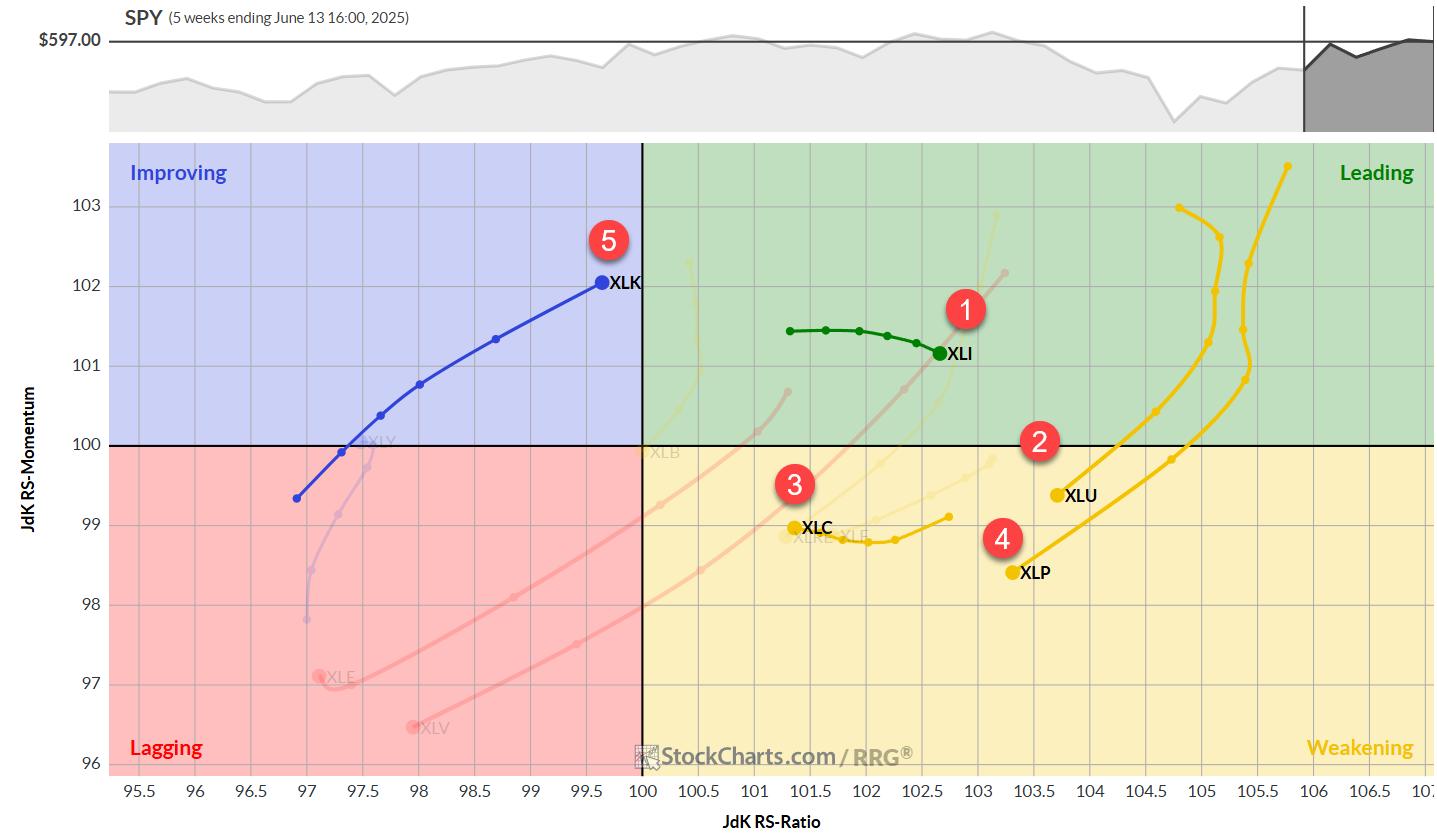

Weekly RRG Evaluation

On the weekly Relative Rotation Graph, the Expertise sector is exhibiting spectacular energy. Its tail is well-positioned within the enhancing quadrant, practically coming into the main quadrant with a robust RRG heading. This motion explains Expertise’s climb again into the highest ranks.

Industrials stays the one top-five sector nonetheless contained in the main quadrant on the weekly RRG. It continues to achieve relative energy, transferring larger on the JdK RS-Ratio axis, whereas barely dropping relative momentum. All in all, this tail continues to be in fine condition.

Utilities, Communication Providers, and Shopper Staples are all at present within the weakening quadrant. Utilities and Staples present unfavourable headings however keep excessive RS-Ratio readings, giving them room to probably curl again up. Communication Providers is dropping floor on the RS-Ratio scale however beginning to choose up relative momentum.

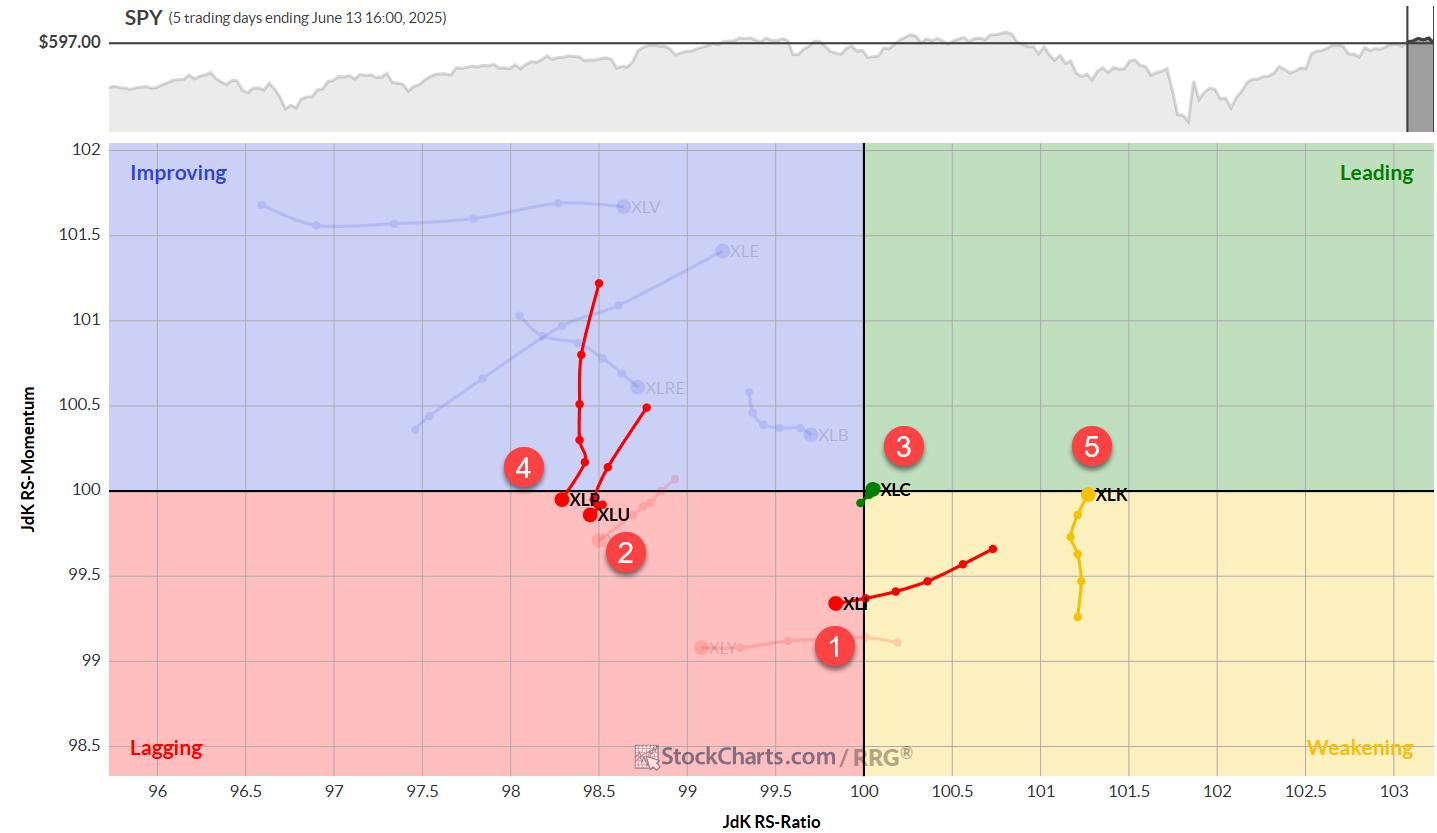

Each day RRG: A Completely different Image

Switching our focus to the day by day RRG reveals a considerably completely different story:

- Industrials has moved into the lagging quadrant, dropping floor on the RS-Ratio scale

- Utilities and Staples are rolling again into the lagging quadrant with unfavourable headings — not an ideal signal

- Communication Providers stays near the benchmark

- Expertise reveals the strongest tail, practically finishing a leading-weakening-leading rotation

This day by day view underscores the energy we’re seeing within the Expertise sector on the weekly timeframe.

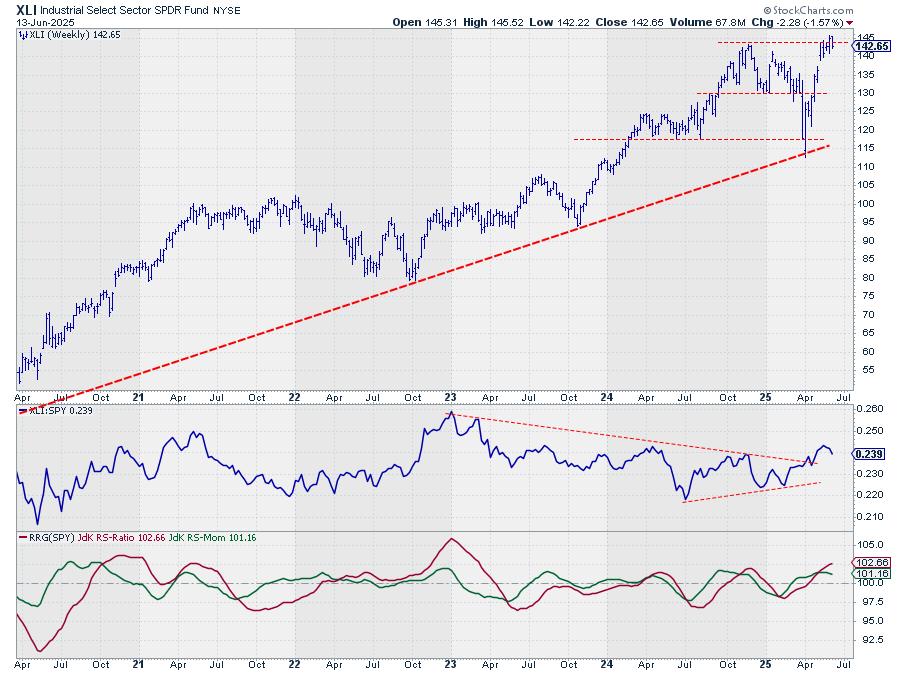

Industrials: Going through Resistance

XLI dropped again beneath its earlier excessive after a robust exhibiting the week prior. There’s vital resistance between $142.50 and $145.

In a worst-case situation, I feel XLI may even retreat to the hole space between $137.50 and $139.

The uptrend stays intact, however extra shopping for energy is required for a convincing break to new highs.

Utilities: Vary-Sure

XLU is now buying and selling in a variety between roughly $80 on the draw back and $83 on the upside.

It wants to interrupt above the previous excessive to proceed constructing relative energy.

The uncooked RS line has returned to its buying and selling vary, dragging each RRG traces decrease — not the strongest outlook for this defensive sector.

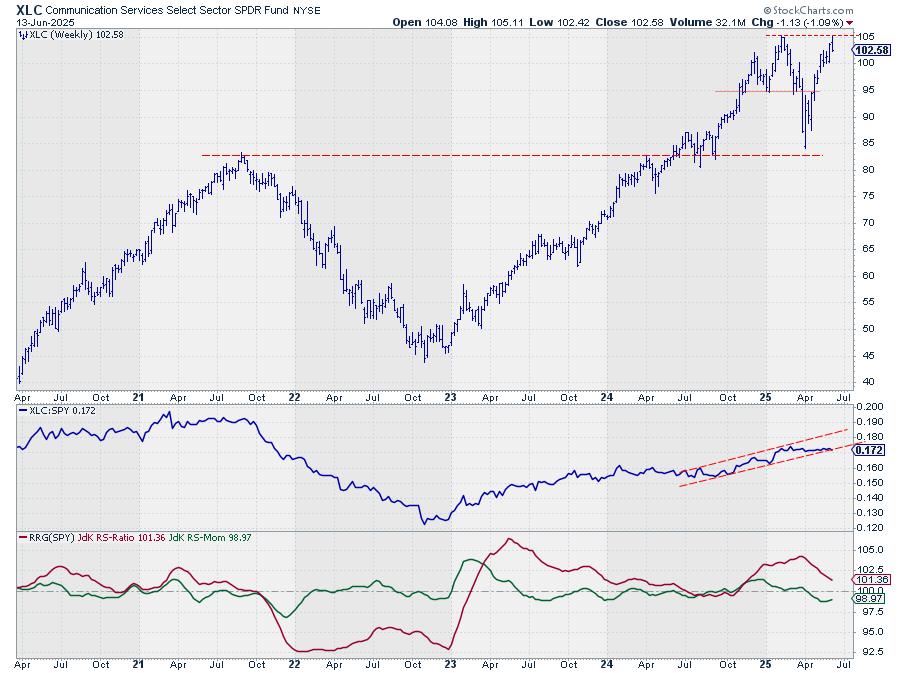

Communication Providers: Testing Resistance

The sector peaked nearly precisely at resistance supplied by its earlier excessive round $105, then closed on the decrease finish of the bar.

The uncooked RS line is managing to remain inside its rising channel, albeit horizontally.

A sustained upward worth motion is essential for sustaining relative energy right here.

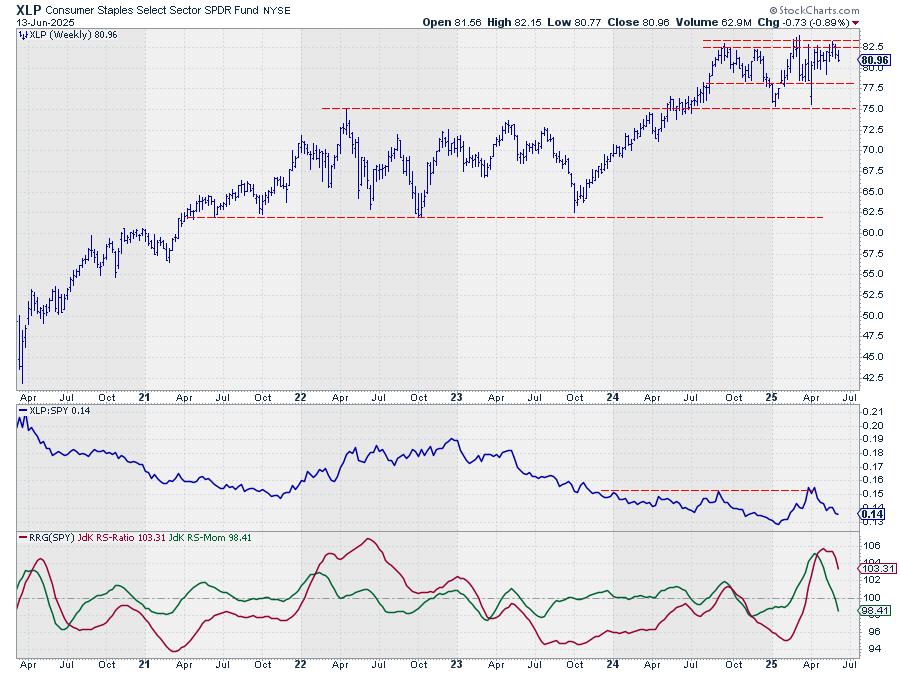

Shopper Staples: Struggling to Break Larger

XLP continues to face heavy overhead resistance between $82 and $83.

Its lack of ability to interrupt larger is beginning to harm relative energy.

The uncooked RS line has moved down from a current excessive, dragging the RRG traces decrease.

The RS-Momentum line has already crossed beneath 100, positioning the weekly tail contained in the weakening quadrant.

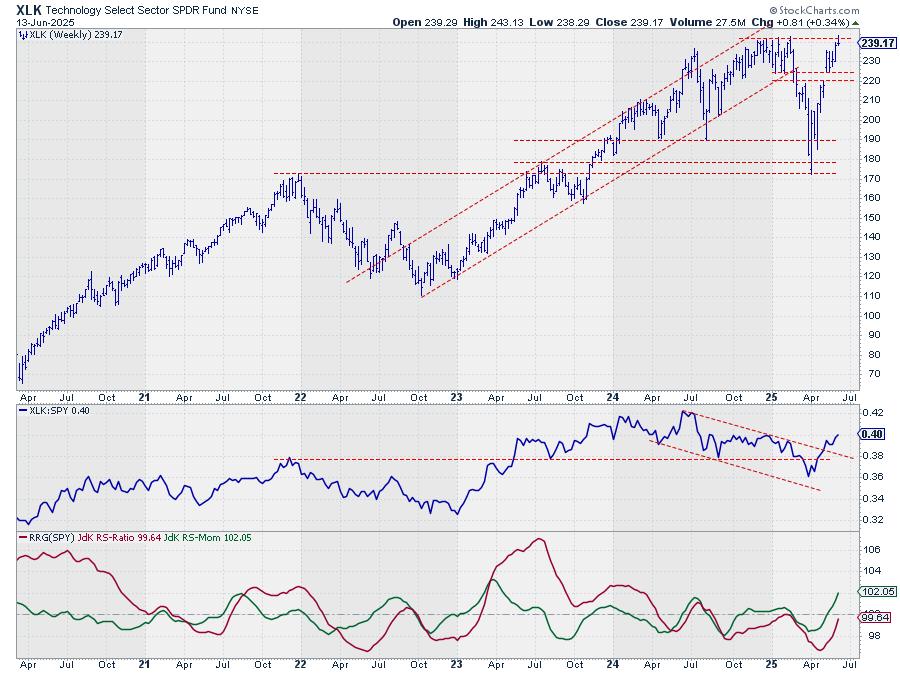

Expertise: The Comeback Child

XLK, the brand new child on the block (once more), examined its overhead resistance stage round $244, peaking barely above it final week earlier than closing decrease.

Latest energy has pushed the uncooked RS line convincingly larger, taking out its earlier peak from mid-December.

Each RRG traces are pointing strongly upward, with RS-Momentum already above 100 and RS-Ratio quickly approaching 100.

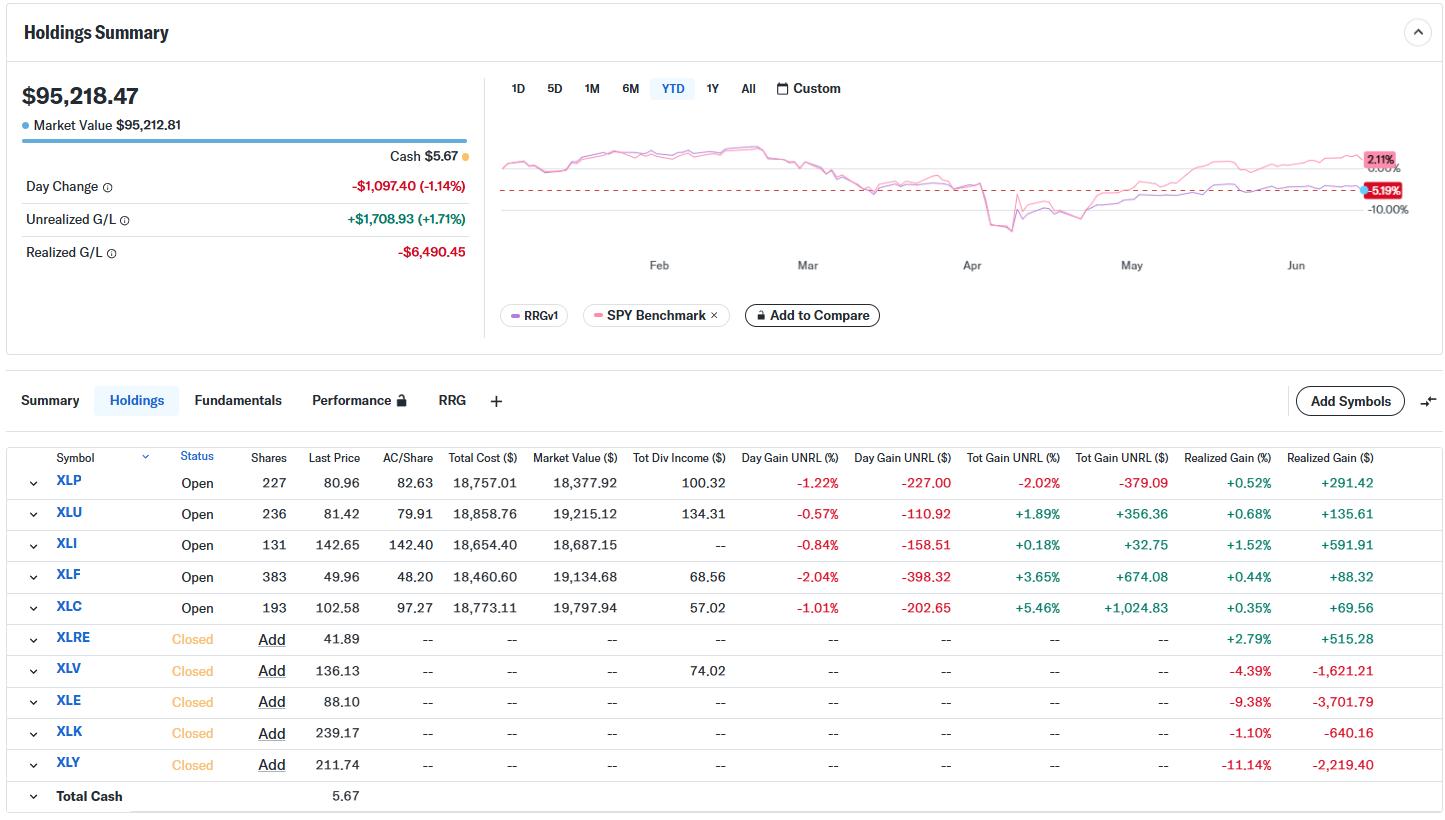

Portfolio Efficiency

With all this sector leapfrogging, particularly involving the heavyweight Expertise sector, the hole between the highest 5 sectors’ efficiency and SPY has widened to round 7%.

The drawdown continues, however I am sticking with this experiment and trusting the mannequin to come back again and begin beating SPY once more.

Sure, a 7% lag sounds vital (and it’s), however it might probably change quickly in such a concentrated portfolio. One or two robust weeks may simply flip this efficiency round, notably if huge sectors like Expertise and probably Shopper Discretionary turn out to be a part of the highest 5.

#StayAlert and have an ideal week. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to answer each message, however I’ll actually learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra