Staples and Tech Swap Positions Once more

The weekly sector rotation continues to color an image of a market in flux, with defensive sectors gaining floor whereas cyclicals take a step again. This week’s shifts underscore the continuing volatility and lack of clear directional commerce that is been attribute of current market conduct.

The sudden bounce in relative power for defensive sectors final week has pushed Shopper Staples again into the highest 5 at the price of Expertise.

- (1) Industrials – (XLI)

- (3) Utilities – (XLU)*

- (6) Shopper Staples – (XLP)*

- (2) Communication Providers – (XLC)*

- (4) Financials – (XLF)*

- (5) Expertise – (XLK)*

- (8) Actual-Property – (XLRE)*

- (9) Supplies – (XLB)*

- (7) Shopper Discretionary – (XLY)*

- (11) Healthcare – (XLV)*

- (10) Vitality – (XLE)*

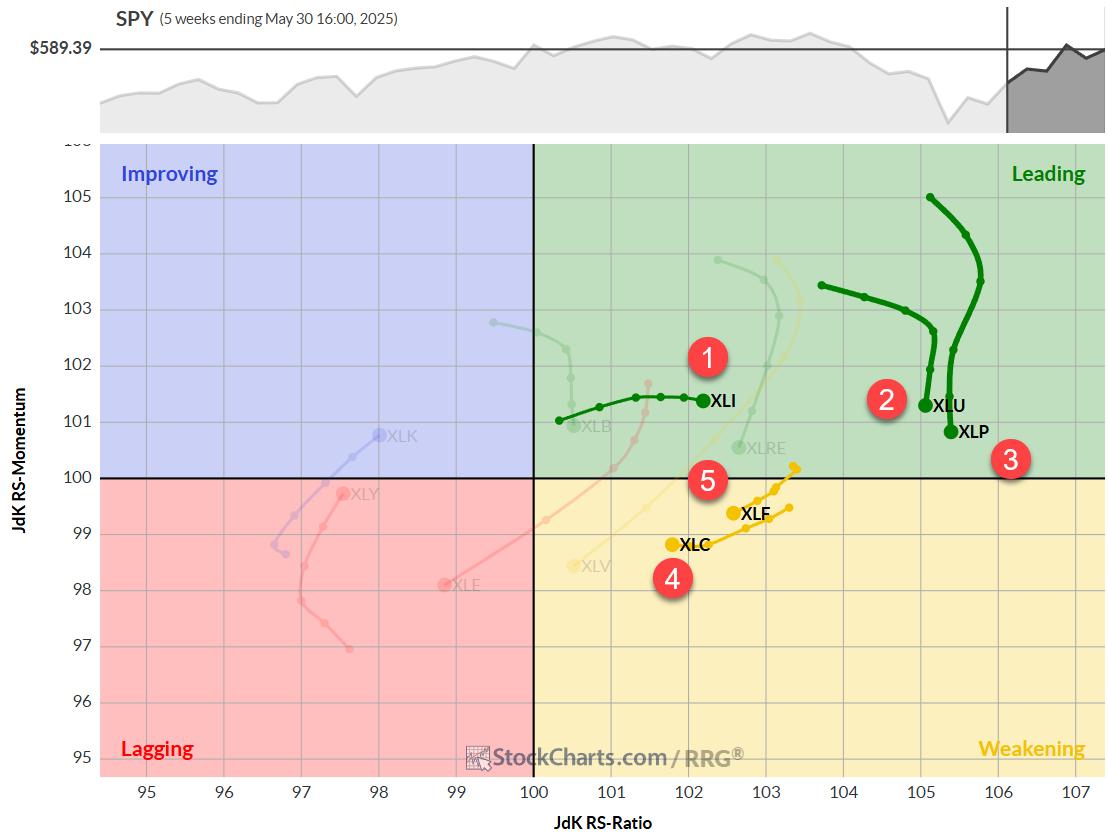

Weekly RRG

Trying on the weekly Relative Rotation Graph (RRG), we’re seeing some attention-grabbing actions. Industrials continues its upward trajectory on the RS-Ratio scale, solidifying its prime place.

In the meantime, utilities and shopper staples — our #2 and #3 sectors, respectively — are sustaining excessive RS-Ratio ranges regardless of a momentum setback.

Communication companies and financials, rounding out the highest 5, discover themselves within the weakening quadrant.

Nevertheless, they’re nonetheless comfortably above the 100 degree on the RS-Ratio scale. This positioning offers them a great shot at curling again into the main quadrant earlier than doubtlessly hitting lagging territory.

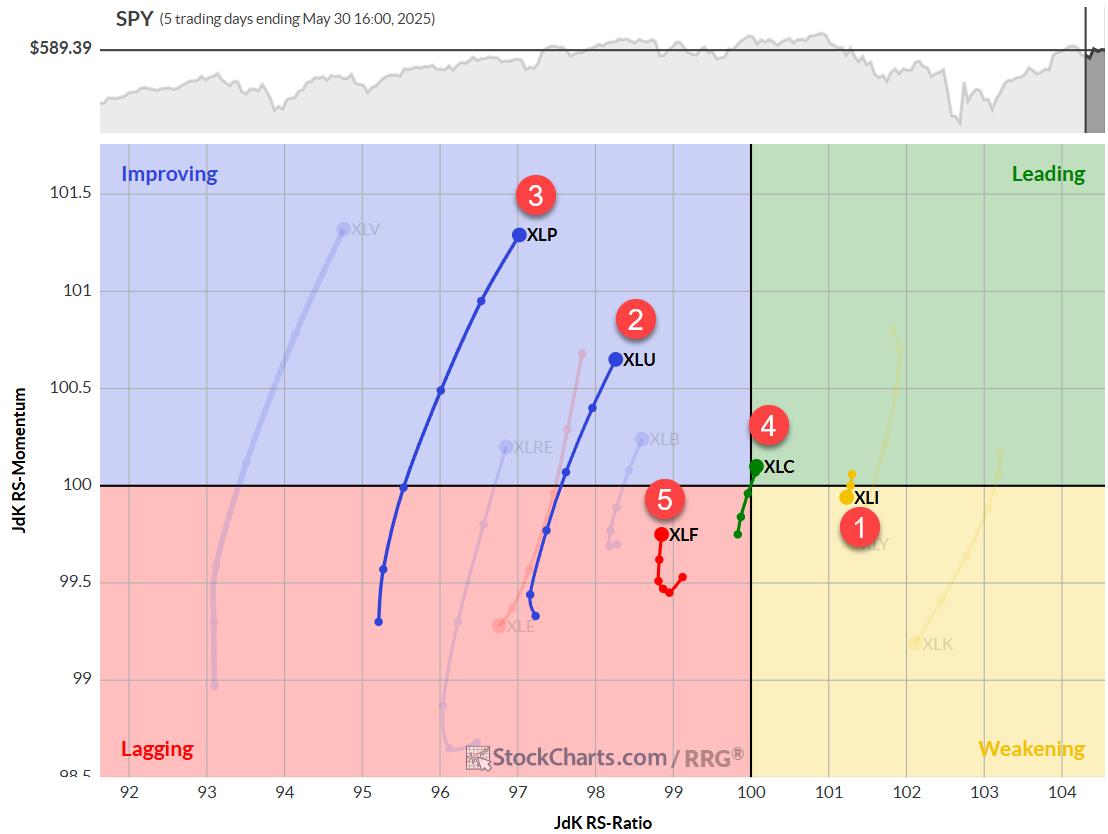

Each day RRG

Switching to the each day RRG, we will see some vital strikes over the previous week.

Shopper staples have made a substantial leap, touchdown deep within the enhancing quadrant with the best RS-Momentum studying. This surge explains its return to the highest 5.

Utilities is not far behind, additionally making a robust transfer into the enhancing quadrant.

Financials, whereas within the lagging quadrant, are displaying much less dramatic motion in comparison with staples and utilities.

Its shorter tail on the RRG signifies a much less highly effective transfer, however its excessive place on the weekly RRG is holding it within the prime 5 — for now.

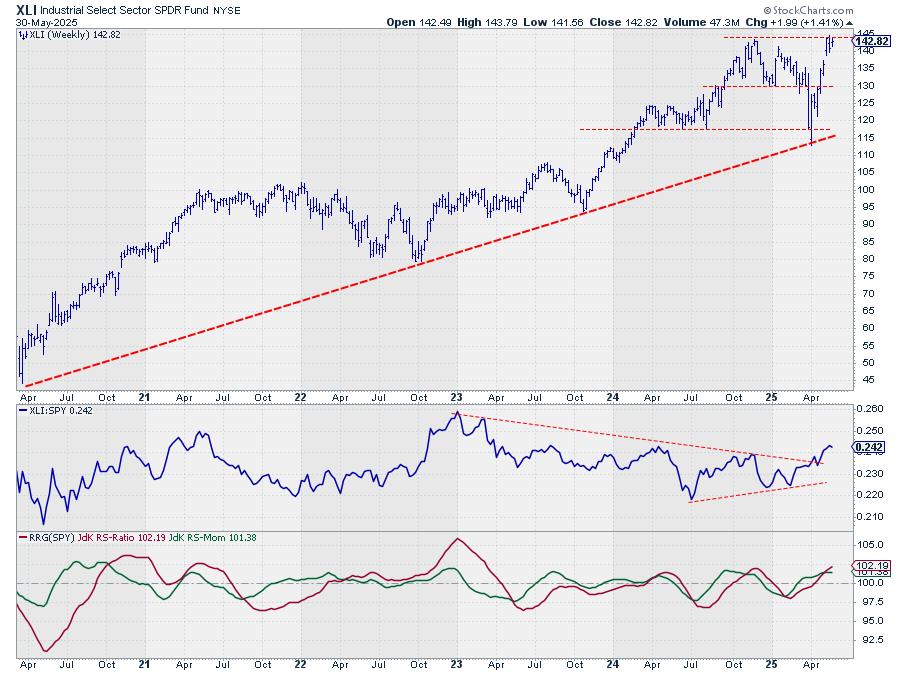

Industrials: Energy Confirmed

The #1 sector is pushing towards overhead resistance round 143 for the third consecutive week.

A break above this degree may set off an acceleration increased.

The relative power chart vs. the S&P 500 has already damaged out, persevering with to tug the RRG strains upward.

Utilities: Bouncing Again

After a weak displaying two weeks in the past, utilities closed final week on the prime of its vary.

There’s nonetheless resistance lurking slightly below 85 (round 84), however a break above may spark a rally.

The uncooked RS line is grappling with the higher boundary of its sideways buying and selling vary, inflicting the RRG strains to roll over whereas remaining within the main quadrant.

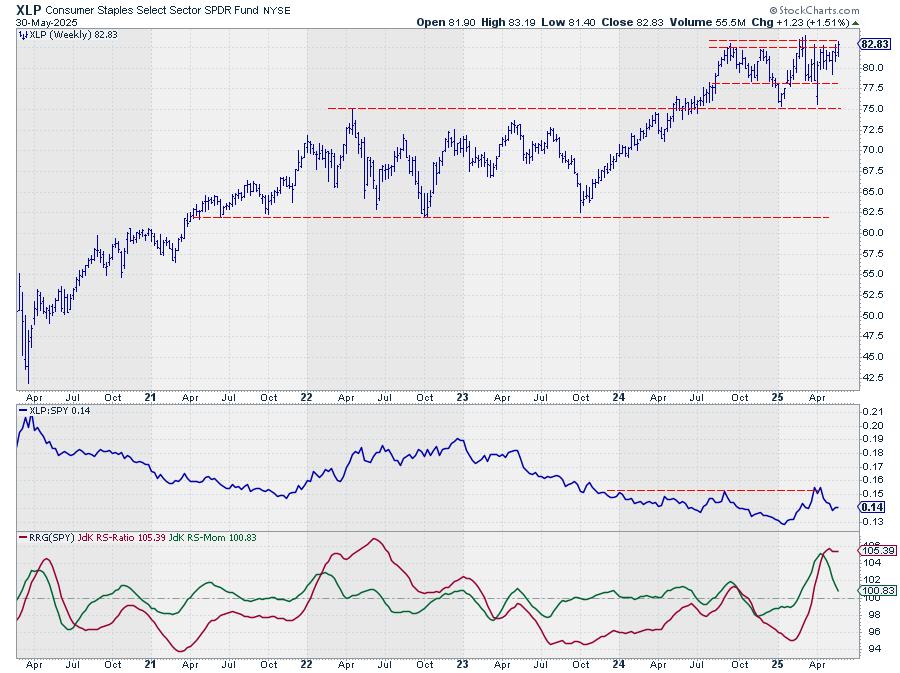

Shopper Staples: Testing Resistance

Staples has rebounded to the higher boundary of its buying and selling vary, with key resistance between 82 and 83.50.

A spike to $83.90 represents the current high-water mark. Breaking above this barrier may speed up the transfer increased.

The uncooked RS line has peaked towards overhead resistance and must type a brand new low to assist the RRG strains.

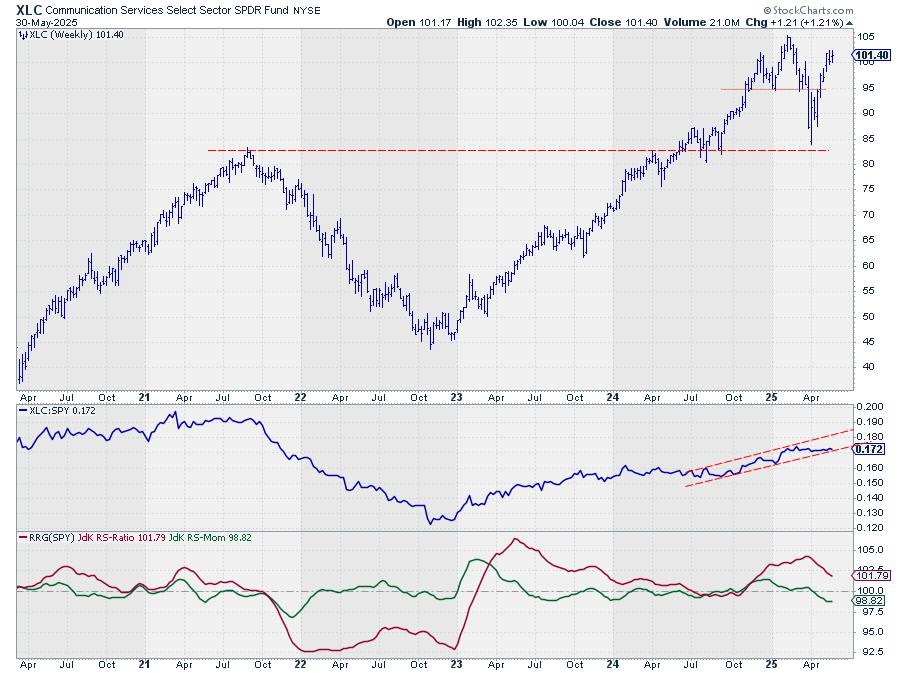

Communication Providers: Holding Regular

XLC is buying and selling round $ 101.40, with overhead resistance a number of {dollars} away, close to $ 105.

The uncooked RS line stays inside its rising channel, however we’ll must see improved relative power quickly to take care of this optimistic pattern.

The sector sits within the weakening quadrant however has the potential to push again into main territory with a robust relative power (RS) rally.

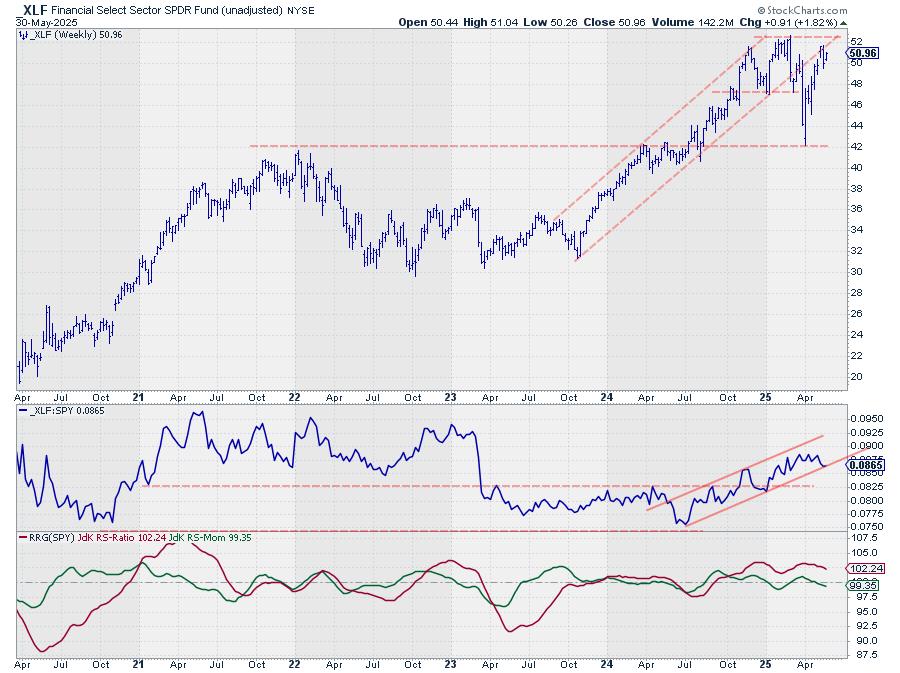

Financials: At a Crossroads

The monetary sector is scuffling with previous resistance that is now appearing as assist.

Its RS line is testing the decrease boundary of its rising channel.

Financials wants a few robust weeks in each value and relative power to take care of its prime 5 place.

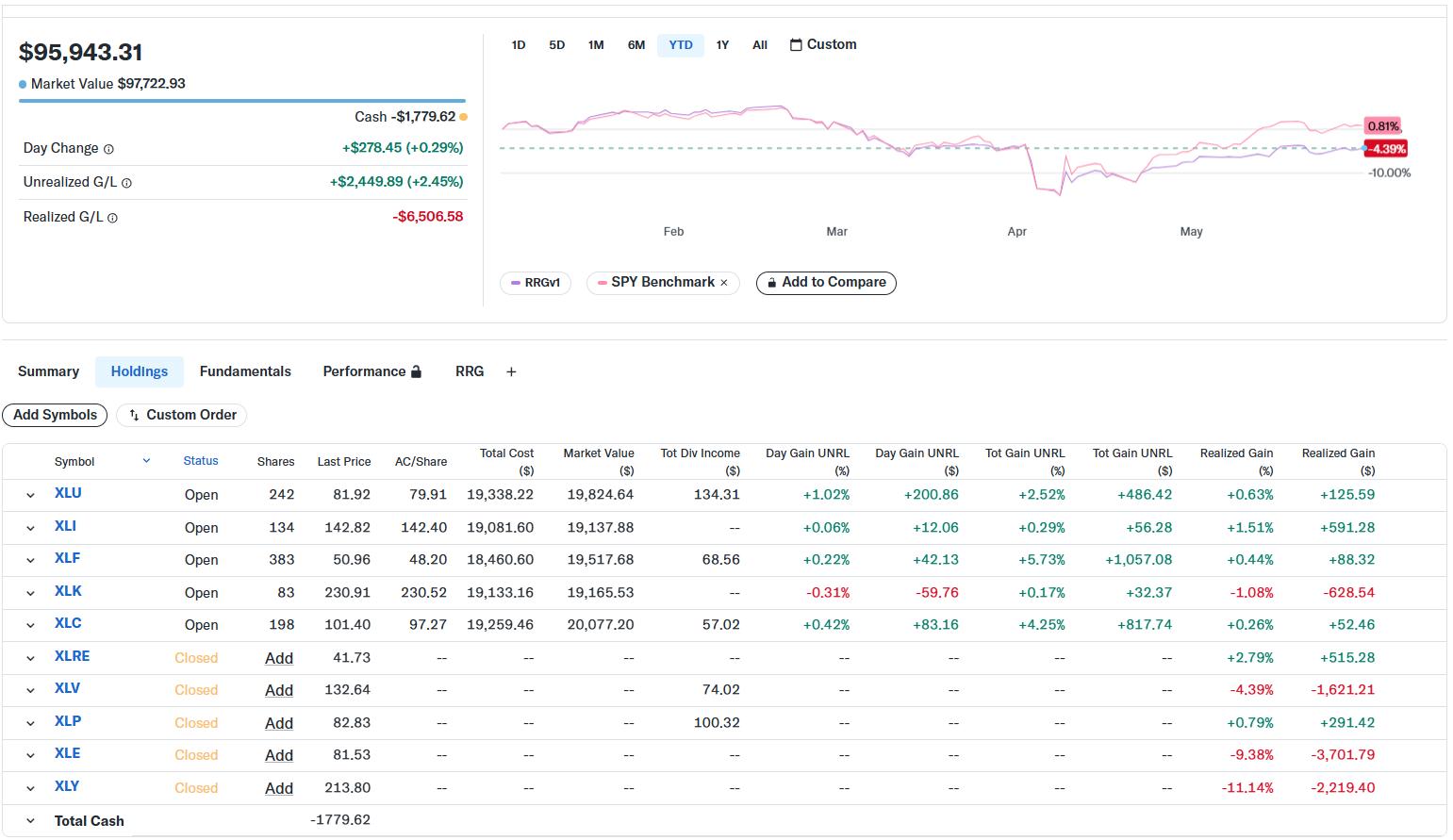

Portfolio Efficiency

As of final Friday’s shut, our mannequin portfolio is lagging the S&P 500 by simply over 5%.

This efficiency hole has widened barely from final week however stays in step with the risky sector rotations we have been seeing.

The present market surroundings presents an obvious dilemma for sector rotation methods. Whereas defensive sectors are gaining prominence, cyclicals are taking a again seat — a minimum of for now.

This flip-flop state of affairs is widespread in risky markets looking for route, nevertheless it’s inflicting extra frequent trades in our mannequin than we might sometimes count on.

For significant developments to emerge, the market must stabilize and set up a transparent directional bias. Till then, we’re prone to see continued back-and-forth motion as traders grapple with combined financial alerts and shifting sentiment.

#StayAlert and have a fantastic week. –Julius