KEY TAKEAWAYS

- Tech shares, particularly semiconductors, proceed to steer the inventory market larger.

- Semiconductors are displaying robust technical momentum.

- With StockCharts, you may create customized ChartLists of semiconductor shares by drilling down by means of the Expertise sector.

Comparatively wholesome earnings reviews from the large banks and a June inflation report that got here according to analyst expectations did not give the inventory market a lot of a raise, because the S&P 500 ($SPX) and Dow Jones Industrial Common ($INDU) each ended the day decrease. The one main index to shine was the Nasdaq Composite ($COMPQ), which closed at a report excessive.

Expertise shares have been the celebs of the present. It wasn’t a blowout rally, however the sector nonetheless managed to complete within the inexperienced. Why? There have been a few key developments that gave tech a pleasant increase.

First, semiconductors obtained some respiratory room. Restrictions on chip gross sales to China have been relaxed, and that gave huge names like NVIDIA Corp. (NVDA) and Superior Micro Units (AMD) a cause to rally.

Second, there is a push from the federal government to spend money on AI and vitality initiatives in Pennsylvania. One of many greatest winners was Tremendous Micro Laptop, Inc. (SMCI), which jumped 6.9% — the largest proportion acquire within the S&P 500. You may see from the StockCharts MarketCarpet for the S&P 500 shares that, apart from the top-weighted shares within the index, it was largely a sea of purple.

FIGURE 1. MARKETCARPET FOR TUESDAY, JULY 15. Expertise was the clear chief, with the most important cap-weighted shares main the sector larger.

Picture supply: StockCharts.com. For academic functions.

Semiconductors Present Energy

For those who’ve been watching semiconductors, you could have seen that the SPDR S&P Semiconductor ETF (XSD) has been on a roll. Since April, the ETF has stayed above its 20-day exponential transferring common (EMA). The relative efficiency of XSD towards the SPDR S&P 500 ETF (SPY) has been enhancing, and its relative power index (RSI) is at round 62, a sign that momentum is at wholesome ranges (see chart beneath). It is necessary to notice that since Could, the RSI has remained above 50, which is supportive of XSD’s upside motion.

Observe: StockCharts members can entry this chart from the Market Abstract web page or the Market Abstract ChartPack (beneath US Industries > Bellwether Industries).

FIGURE 2. DAILY CHART OF XSD. Since April, XSD has been trending larger and is now buying and selling above its 21-day EMA.

Chart supply: StockCharts.com. For academic functions.

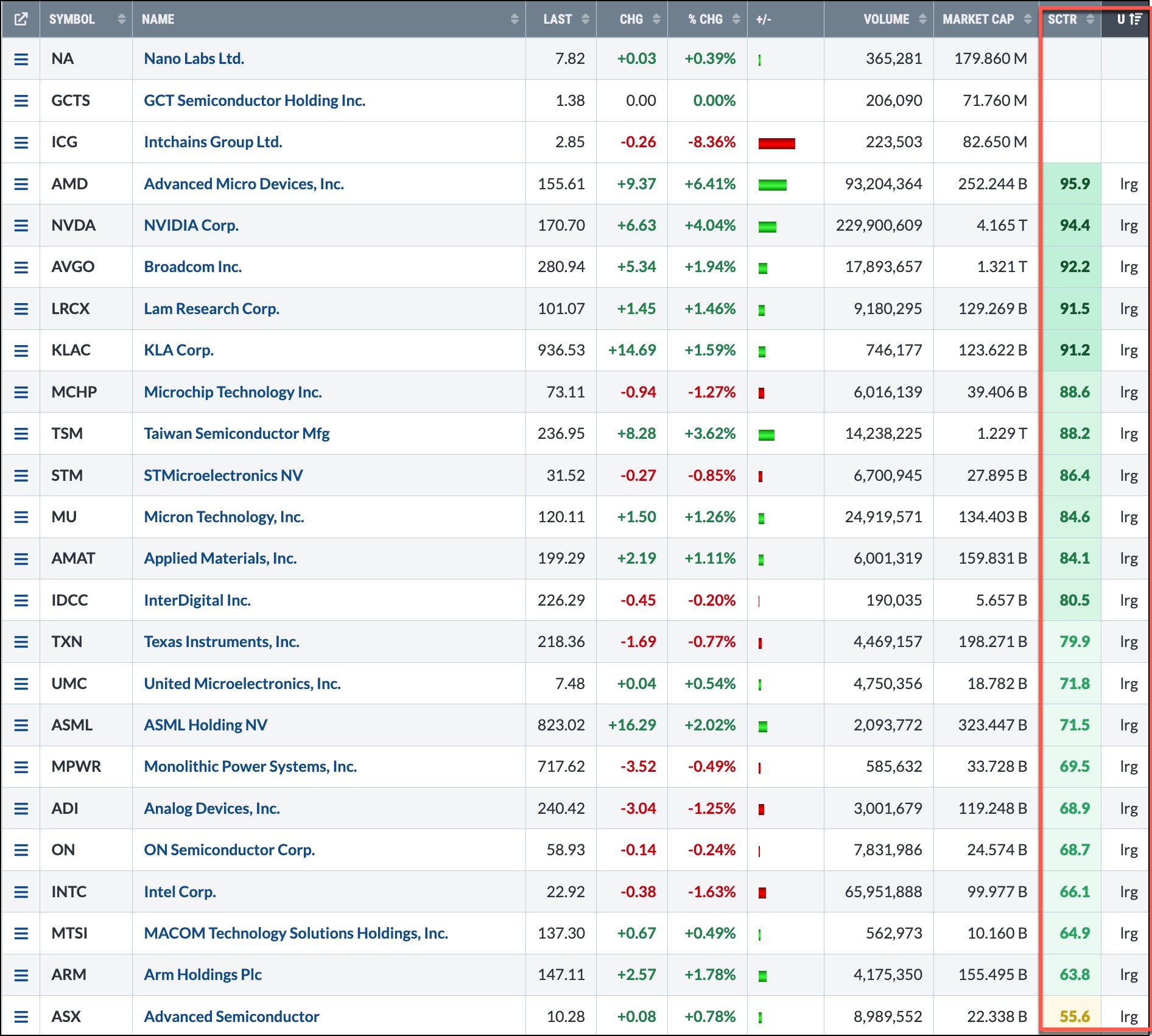

Easy methods to Observe Semiconductor Shares

If the setting for semiconductors stays robust, there could possibly be extra upside for shares in that house. A easy option to hold tabs on the shares utilizing StockCharts instruments is to create a ChartList of semiconductor shares you are considering proudly owning.

- Start by heading to the US Sectors panel within the Market Abstract web page or the Sector Abstract web page in your Dashboard.

- Click on Sector Drill-Down > Expertise Sector Fund > Semiconductors.

- You will see the listing of semiconductor shares that make up the business group.

From there, I favor to type the information by the Universe (U) column, beginning with the massive caps after which the StockCharts Technical Rank (SCTR) rating to seek out large-cap technically robust shares. You may then view the charts on the listing. For those who see a chart that seems to have a good risk-to-reward ratio, it can save you it to your Semiconductor ChartList.

FIGURE 3. SEMICONDUCTOR STOCKS TO REVIEW. The sector drill-down will uncover shares in main sectors or business teams. Scroll down the listing to determine charts that meet your funding or buying and selling standards.

Picture supply: StockCharts.com. For academic functions.

As you assessment the charts in your ChartList, you may determine potential help and resistance ranges and set alerts to inform you when costs attain your key ranges. It is an effective way to remain proactive.

The Backside Line

The sort of top-down evaluation helps you keep one step forward of the market. Begin with the broad market, then slim right down to sectors, then business teams, after which particular person shares. By taking a proactive strategy to managing your investments, you are all the time making ready for the inventory market’s subsequent transfer.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

About The Writer:

Jayanthi was the Managing Editor of Technical Evaluation of Shares & Commodities journal for greater than 15 years. At StockCharts, she works to coach buyers and discover methods to make technical evaluation extra approachable and intuitive.