Indicators Out there right here:

MT4 Model:

https://www.mql5.com/en/market/product/160816/

MT5 Model:

https://www.mql5.com/en/market/product/160817/

Introduction

Order blocks present you the place huge establishments purchased or bought in measurement earlier than a significant worth transfer.

And right here’s the vital half:

When worth comes again to those self same areas later, it usually reacts once more — as a result of that’s the place sensible cash is keen to step in.

This information will present you:

-

What order blocks actually are

-

How one can spot them accurately

-

How one can keep away from unhealthy indicators

-

And tips on how to truly commerce them with confidence

What Are Order Blocks?

An order block varieties when worth strikes sideways in a really tight vary (normally 0.1% to 1%) whereas quantity quietly builds up.

That is establishments accumulating or distributing positions with out transferring the market an excessive amount of.

Then — growth — worth breaks out.

That quiet zone earlier than the explosion is your order block.

Consider it like this:

Huge gamers can’t simply purchase or promote abruptly. That might transfer worth towards them.

So as a substitute, they:

Whenever you spot that mixture, you’re in all probability institutional exercise.

There are two varieties:

Bullish Order Blocks

Bearish Order Blocks

The important thing thought:

It’s tough to identify pretend or true breakouts proper after an OB varieties. Trick is to attend and look ahead to bounce again.

Value may not bounce again, however as a substitute undergo the block, wherein case it was not a robust SR space and can thus be deleted.

But when worth does bounce, it should begin forming a spread close to it. Greatest trades are to attend for this vary after which a robust worth reversal candle:

Core Options (Fast Overview)

This indicator offers you:

-

Computerized detection of consolidation zones

-

Quantity filtering to take away noise

-

A number of quantity calculation strategies

-

Computerized elimination of invalidated blocks

-

Ahead projection of blocks

-

Entry and exit Orderblock alerts

Confluence Is King 👑

Order blocks work greatest when mixed with:

Extra confirmations = stronger commerce

Quantity Issues

Greatest Settings by Timeframe

Scalping (15M+)

Notice that this indicator is extra dependable over H1+ for longer trades. However if you happen to want it for decrease timeframes, solely use for scalping very fast trades.

Day Buying and selling (H1)

Swing Buying and selling (4H/Day by day)

-

Consolidation: 4–5 bars

-

Quantity lookback: 20–30

-

Threshold: 3x – 0 (take away higher threshold by setting to 0)

-

Allow Prolong Until Present Bar

Development Following (4H)

How the Indicator Works (In Easy Phrases)

Consolidation Detection

Tight ranges = managed, skilled accumulation

Quantity Calculation Strategies

Quantity Power Filtering

You possibly can select to solely present blocks between:

This helps:

-

Keep away from weak indicators

-

Keep away from suspicious spikes

-

Give attention to the candy spot

Block Extension

If Prolong Until Present Bar is enabled, all blocks lengthen to the current candle.

Mitigation (Invalidation)

If worth absolutely breaks via a block, it will get:

Routinely eliminated.

No extra buying and selling useless ranges.

Full Settings

Essential Settings

Quantity Settings

-

Methodology: Easy / Relative / Weighted

-

Lookback: Often 20

-

Threshold Vary: Your acceptable quantity power

-

Refresh Price: Velocity vs CPU utilization

Extension Settings

Colours & Alerts

Why Order Blocks Truly Work

Establishments don’t chase worth.

They:

Order blocks allow you to see precisely the place that occurred.

So as a substitute of guessing:

You’re buying and selling the place huge cash already dedicated.

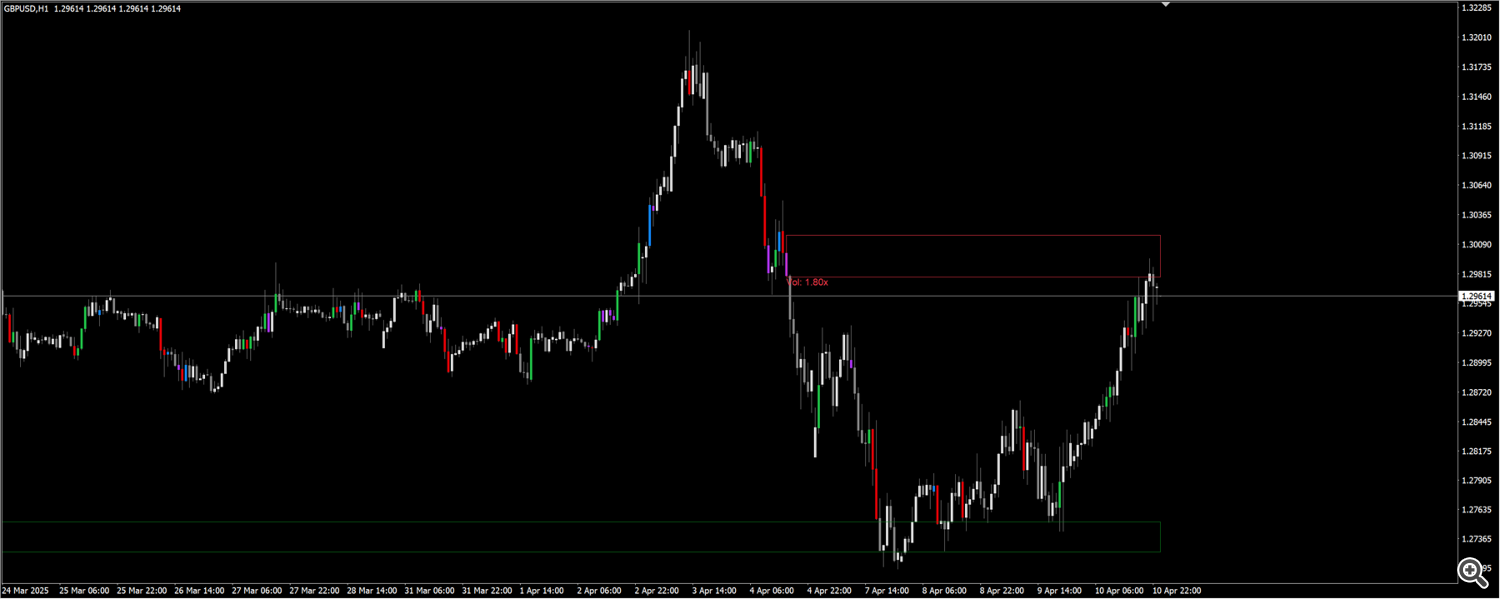

Good volatility sideways market, worth will hold closing the gaps between order blocks:

Frequent Questions

Which blocks ought to I commerce?

Touched vs Damaged?

Ought to I commerce each block?

No.

All the time test:

-

Development

-

Construction

-

Confluence

Greatest timeframe?

Debugging Identified Points:

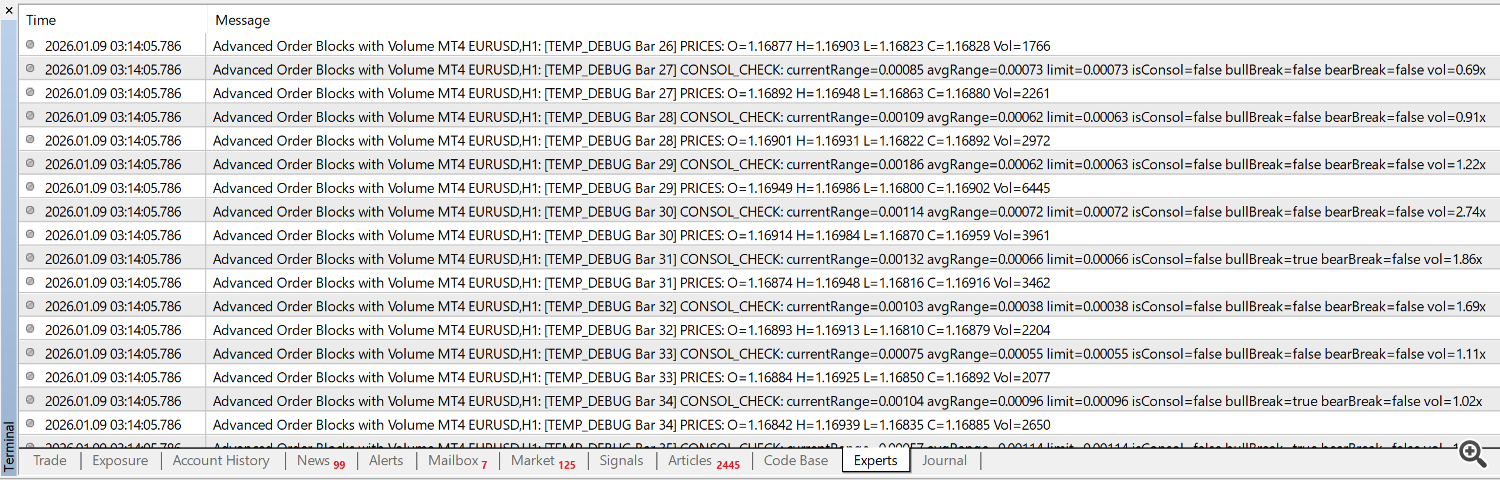

Completely different timeframes/pairs may have completely different quantity multipliers. Like EURUSD may have completely different quantity ranges than somethings much less traded like some shares and so on.

All default values are based mostly on foreign exchange.

Preserve Debug Buffers true. And set debugging bars. Then have a look at consultants tab logs:

Conclusion

Order blocks present you the place establishments truly did enterprise.

That’s a large edge.

However bear in mind:

The cash shouldn’t be in buying and selling each block.

The cash is in buying and selling one of the best blocks.

Begin by watching how worth reacts to completely different blocks. As a result of completely different pairs work greatest with completely different settings.

Even with out buying and selling, it will practice your eye quick.

And hold making .set recordsdata on your greatest settings. Will probably be superior if you happen to shared these proper right here with everybody.

Commerce with construction.

Commerce with quantity.

Commerce with order blocks! 😎