Because the market soars with bullish momentum, crypto theft has additionally seen a record-breaking efficiency in the course of the first half of this 12 months. A current report revealed that stolen funds from companies thus far have surpassed the numbers from earlier years.

Associated Studying

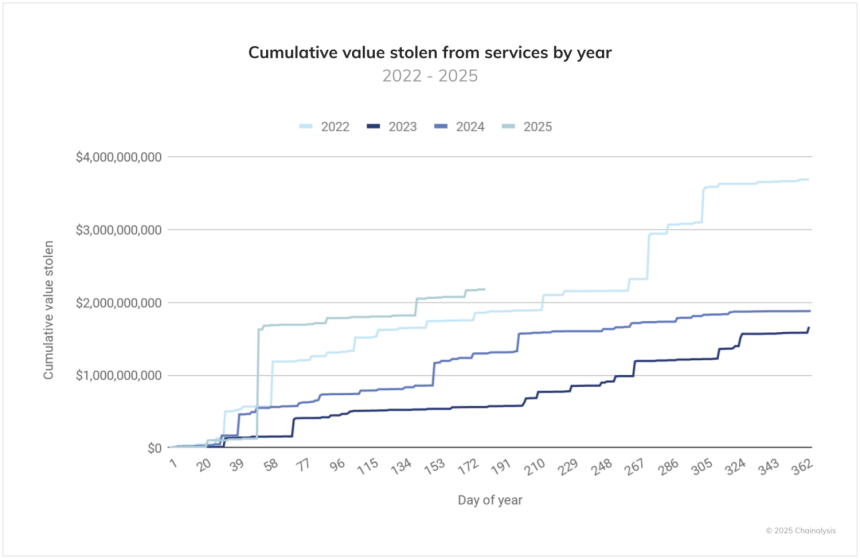

Stolen Crypto Service Funds Hit $2B In 6 months

On Thursday, Chainalysis shared its “2025 Crypto Crime Mid-12 months Replace,” revealing that digital property theft this 12 months has been “extra devastating” than the whole thing of 2024, with over $2.7 billion value of funds stolen from crypto companies thus far.

The report famous that, by the top of June, extra worth had been stolen year-to-date (YTD) than throughout the identical interval in 2022, the earlier worst 12 months on file, suggesting that theft from crypto companies might doubtlessly enhance one other 60% by 12 months’s finish.

2025’s YTD exercise exhibits a considerably steeper trajectory into the top of the primary half than any earlier 12 months, with an alarming velocity and consistency. 2022 required 214 days to hit the $2 billion mark in worth stolen from companies, whereas 2025 reached comparable theft volumes in 142 days.

Moreover, 2025 is 17.27% worse than 2022 throughout the identical six-month interval, whereas 2023 and 2024 noticed extra average and regular accumulation patterns. The surge within the cumulative development worth from crypto companies theft “paints a stark image of 2025’s escalating risk atmosphere.”

In keeping with the report, “If this development continues, we might see 2025 finish with greater than $4.3 billion stolen from companies alone.” Nonetheless, it’s value noting that the North Korean-linked $1.5 billion hack of Bybit accounts for many of the service losses.

The huge breach, which is the biggest crypto hack in historical past, alerts a “broader sample of North Korean cryptocurrency operations, which have change into more and more central to the regime’s sanctions evasion methods.”

Final 12 months, recognized North Korean-related losses reached their highest quantity, with the worth reaching $1.3 billion. Nonetheless, Bybit’s February hack surpassed it, making 2025 the worst 12 months up to now.

Private Pockets Assaults Surge

Amid the shifting panorama, the report highlights that the surge in crypto thefts represents an instantaneous risk to individuals. Notably, attackers are more and more concentrating on particular person customers, as private pockets incidents symbolize a rising share of complete ecosystem theft.

YTD, these compromises account for 23.35% of all stolen funds actions in 2025, with Bitcoin (BTC) theft accounting for a considerable share of stolen worth. Chainalysis additionally discovered that the common loss from compromised private BTC wallets has elevated, suggesting a deliberate goal on higher-value particular person holdings.

Furthermore, the variety of particular person victims on non-Bitcoin and non-EVM chains, like Solana, is rising. This means that Bitcoin holders expertise bigger losses by way of worth taken, regardless of being much less more likely to fall sufferer to focused theft.

Associated Studying

Inside the private pockets incidents, a violent subsection has additionally seen a dramatic surge this 12 months, displaying a correlation with BTC worth actions and suggesting opportunistic concentrating on throughout high-value intervals.

The forward-looking implication is that, if the worth of native property will increase, the worth compromised from private wallets can even doubtless rise.

Per the report, theft utilizing bodily violence or coercion towards people, also called “wrench assaults,” might doubtlessly hit twice the variety of 2021, the subsequent highest 12 months on file.

As of this writing, Bitcoin is buying and selling at $119,807, a 14.8% enhance within the month-to-month timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com