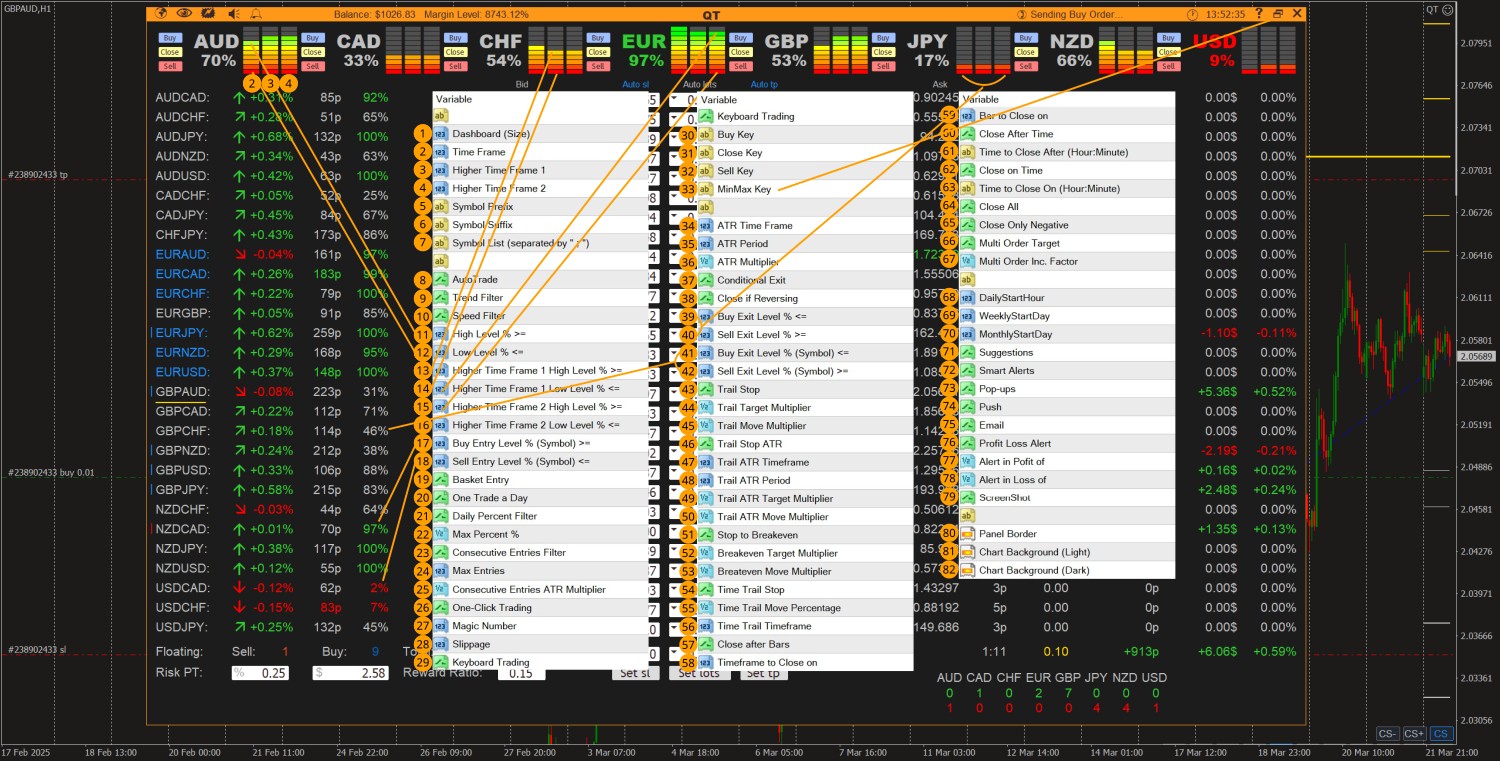

Settings Introduction for Quant Terminal:

LOT SIZE: 0.01 lot measurement is really helpful for $1000 account if buying and selling on all pairs. Select accordingly if buying and selling on particular pairs.

1. Defines measurement of the dashboard window, default set to Compact.

2. Entry Timeframe on which commerce entries shall be executed.

3. First greater Timeframe for pattern filter.

4. Second greater timeframe for pattern filter.

5. Add image Prefix if dealer have added prefix in marketwatch symbols title.

6. Add image Suffix if dealer have added prefix in marketwatch symbols title.

7. Symbols checklist you wish to add to the terminal window.

8. Allow/Disable Auto-trade.

9. Allow/Disable Development Filter.

10. Allow/Disable Pace Filter.

11. Excessive Degree for Entry Timeframe.

12. Low Degree for Entry Timeframe.

13. First Larger Timeframe Excessive Degree for Development Filter.

14. First Larger Timeframe Low Degree for Development Filter.

15. Second Larger Timeframe Excessive Degree for pattern filter.

16. Second Larger Timeframe Low Degree for pattern filter.

17. Pair’s Purchase Proportion Degree on entry in Every day, Weekly or Month-to-month Timeframe.

18. Pair’s Promote Proportion Degree on entry in Every day, Weekly or Month-to-month Timeframe.

19. Allow/Disable Basket Entry the place terminal will open positions on all pairs in case any foreign money is in robust pattern.

20. Allow/Disable one entry per pair per day.

21. Allow/Disable Every day Proportion Filter to forestall entries at day’s excessive or low for pattern entries.

22. Specify Max Proportion stage for Every day Proportion Filter.

23. Allow/Disable Consecutive Entry Filter.

24. Specify Max Entries per pair.

25. Distance for consecutive entries in ATR Proportion of every day, weekly or month-to-month timeframe.

26. Allow/Disable One Click on to commerce with out consent.

27. Specify Magic Quantity.

28. Max Slippage allowed.

29. Allow/Disable Keyboard Buying and selling on present chart.

30. Specify Purchase Entry key.

31. Specify Shut key.

32. Specify Promote Entry key.

33. Specify Window Reduce/Maximize key.

34. Timeframe for calculating all ATR values.

35. ATR Interval.

36. ATR Multiplier.

37. Allow/disable exit of trades on numerous situations even earlier than TP or SL hit.

38. Allow/disable exit of trades if Pair is Reversing.

39. Exit Purchase commerce when pair’s foreign money share fall under this stage.

40. Exit Promote commerce when pair’s foreign money share goes above this stage.

41. Exit Purchase commerce when pair’s share fall under this stage on Entry Timeframe.

42. Exit Promote commerce when pair’s share goes above this stage on Entry Timeframe.

43. Allow/Disable Stoploss Trailing.

44. Begin Trailing Stoploss when pair’s value attain this share of preliminary TakeProfit.

45. Transfer TrailStop by this share of preliminary TakeProfit.

46. Allow/Disable ATR based mostly Stoploss Trailing.

47. ATR Timeframe for Stoploss path.

48. ATR Interval for Stoploss path.

49. Begin Trailing Stoploss when pair’s value attain this share of ATR.

50. Transfer TrailStop by this share of ATR.

51. Allow/Disable whether or not to show Stoploss to Breakeven.

52. Flip Stoploss to Breakeven when Value reached this share of preliminary Takeprofit.

53. Breakeven buffer from entry value concluding spreads and swaps.

54. Allow/Disable Stoploss Path on fastened time intervals.

55. Proportion of preliminary Stoploss path has to maneuver.

56. Timeframe to maneuver on.

57. Allow/Disable shut commerce after specified variety of bars have handed since commerce was opened.

58. Timeframe to rely bars on.

59. After what number of bars to shut after.

60. Allow/Disable shut commerce after specified time has handed in hours and minutes.

61. Specify Hours and Minutes to shut after.

62. Allow/Disable shut trades at specified time of the day in Hours and Minutes.

63. Specify time for trades to shut at specified time of the day in Hours and Minutes.

64. Allow/Disable whether or not to Shut All Trades.

65. Allow/Disable whether or not to Shut Solely Damaging Trades.

66. Allow/Disable one goal for all positions on any pair in any path.

67. Increment issue for one goal utilized to preliminary Takeprofit of particular person entry.

68. Hour of the Day to begin engaged on for Entry Timeframe.

69. Day of the Week to begin engaged on for Entry Timeframe.

70. Day of the Month to begin engaged on for Entry Timeframe.

71. Allow/Disable Options Alerts.

72. Allow/Disable Sensible Filter for Alerts.

73. Allow/Disable Pop-ups Alerts.

74. Allow/Disable Push Alerts.

75. Allow/Disable E-mail Alerts.

76. Allow/Disable Alerts when complete P/L reaches specified quantity.

77. Specified quantity for Revenue at which Alert get triggered.

78. Specified quantity for Loss at which Alert get triggered.

79. Allow/Disable whether or not to take screenshots on entries and exits (Solely Allow when testing, might overload terminal).

Now you recognize each parameter and understood it’s operations, it’s time to get it to give you the results you want in a “set and neglect mode”. However earlier than going stay, please take a look at it on demo to grasp extra of the way it function on stay market situations.

Be at liberty to ask something about Quant Terminal EA.