09 Feb Privateness Layers: From Privateness Cash to Privateness Infrastructure

Whereas the late-2025 rally in privateness cash like Zcash (ZEC) and Monero (XMR) has since cooled, demand for nameless, permissionless digital cash — the cypherpunk imaginative and prescient that motivated early Bitcoiners — is unlikely to vary.

What has modified is the place privateness innovation is being directed.

Fairly than present primarily as standalone cash and separate networks, privateness is more and more being explored as infrastructure: confidentiality embedded instantly into high-liquidity public blockchains, paired with selective disclosure mechanisms meant to face up to regulatory scrutiny.

The current launch of Arcium’s Mainnet Alpha on Solana, with Umbra deploying as its first software, is one sign of that broader shift — not as a result of both of them essentially “solves” privateness however as a result of they mirror the place consideration is transferring.

For many of crypto’s first decade, privateness largely meant privateness cash: purpose-built networks designed to make base-layer exercise tougher to surveil. That mannequin nonetheless issues, significantly for customers who need privateness by default and outdoors of institutional frameworks.

Market construction, nonetheless, has modified. Liquidity, functions and day-to-day workflows have turn out to be more and more focused on a small variety of main L1s. In consequence, privateness innovation is being pulled towards the place capital, customers and integrations exist already.

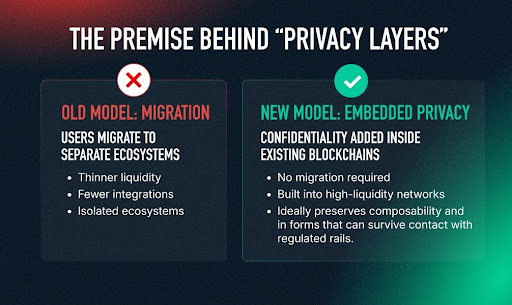

That is the premise behind so-called “privateness layers”: as a substitute of asking customers emigrate to separate ecosystems with thinner liquidity and fewer integrations, the purpose turns into including confidentiality inside present networks — ideally with out breaking composability and in types that may survive contact with regulated rails.

Arcium and Umbra are well timed examples of this strategy on Solana. Arcium positions itself as a confidential computation community — an “encrypted supercomputer” — meant to let functions course of delicate knowledge with out inserting that knowledge instantly onto the general public ledger, whereas nonetheless returning verifiable outcomes to the principle chain. Umbra, positioned as a “shielded monetary layer,” is an early software constructing on high of that infrastructure, with an preliminary deal with shielded transfers and encrypted swaps.

Umbra’s key industrial framing is selective disclosure: privateness by default, with a mechanism to disclose related particulars to an auditor, counterparty, or authority the place legally required.

The purpose is just not that these launches symbolize an endpoint for privateness. It’s that they illustrate how the class is being redefined — away from remoted privateness venues and towards confidentiality expressed as infrastructure inside main ecosystems.

As soon as privateness strikes into the principle venues, precision issues. Not all “privateness layers” are trying the identical factor.

Confidential transactions are a slim strategy centered on hiding values (and typically asset particulars) whereas nonetheless permitting the community to validate that guidelines had been adopted. They map cleanly to settlement: transferring worth with out broadcasting quantities to the market. As a result of the scope is constrained, there may be sometimes much less that may go incorrect — and it’s simpler to be exact about what’s and isn’t protected.

The Liquid Community’s Confidential Transactions are a main instance on Bitcoin: settlement-first privateness with a intentionally bounded design that has operated for years with out attracting regulatory scrutiny.

Confidential computation, as employed by Arcium, targets a broader drawback. Fairly than simply hiding quantities, it goals to maintain delicate inputs and intermediate software state non-public whereas nonetheless producing appropriate, verifiable outcomes. In apply, that is non-public smart-contract-style execution — logic that runs with out revealing commercially delicate knowledge.

Framed by Arcium as a step towards “encrypted capital markets,” the institutional angle is pretty simple: not merely hiding balances, however enabling commercially-sensitive methods and execution to run with out broadcasting intent to your complete market, whereas outcomes nonetheless decide on a public chain.

That ambition additionally introduces extra complexity — and extra trade-offs.

The Belief Commerce-Offs Behind Confidential Computation

As soon as methods transfer from hiding values to hiding execution, the central design query turns into easy: what are you keen to belief, and the place does failure focus?

Arcium’s strategy is MPC-based. Multi-party computation splits delicate knowledge into cryptographic “shares” throughout operators so no single occasion sees the complete enter. Privateness breaks provided that sufficient operators collude (or are compromised) to reconstruct the underlying knowledge.

TEE-based designs, corresponding to these related to Secret Community, a privateness layer on Cosmos, push the belief boundary into {hardware} enclaves: operators might not see plaintext, however confidentiality now depends upon enclave safety and the {hardware} provide chain.

Completely different designs commerce off efficiency, belief assumptions, decentralisation and integration — and people trade-offs turn out to be central when you begin speaking about confidential execution somewhat than simply confidential settlement.

That is additionally the place the “regulator-tolerable” wager turns into actual.

Selective disclosure is without doubt one of the most intriguing components of the brand new privateness narrative. The pitch is straightforward: privateness by default, with the power to disclose particular particulars at any time when there’s a lawful want. However selective disclosure doesn’t take away compliance strain; it relocates it. If view rights exist, somebody controls them. The arduous questions are operational and authorized — who can grant disclosure, who may be compelled to grant it, and the place legal responsibility sits when disclosure is demanded or refused.

Completely different designs push duty onto totally different actors — the consumer, builders, infrastructure operators, or intermediaries — and every selection creates a distinct enforcement floor.

That’s why “regulator-tolerable” is greatest handled as an open speculation somewhat than a settled end result. The market is just not solely testing cryptography; it’s testing governance and incentives beneath actual strain.

No dialogue of privateness infrastructure is full with out acknowledging Twister Money, as a result of it illustrates how privateness instruments can turn out to be enforcement flashpoints with penalties that outlast any single authorized occasion. The mechanism is just not solely deterrence. It’s ecosystem constriction: entrance ends, integrators, custodians and repair suppliers disengage, participation shrinks, and the sensible properties privateness methods rely upon weaken.

One thing can stay technically purposeful whereas turning into commercially unusable as soon as the encompassing ecosystem turns into risk-averse.

In Europe, the Anti-Cash Laundering Regulation (AMLR), set to come back into drive in 2027, provides a concrete timeline round nameless wallets and “anonymity-enhancing” devices for regulated suppliers. The unresolved problem is how broadly these ideas shall be utilized, and whether or not app-layer confidentiality infrastructure shall be handled as distinct from mixer-style instruments or privateness cash as soon as regulators deal with outcomes somewhat than architectural nuance.

The implicit wager behind privateness infrastructure is that confidentiality framed as market construction, paired with workable auditability pathways, shall be handled in another way from instruments perceived primarily as obfuscation. Whether or not that distinction holds will rely much less on technical sophistication and extra on real-world outcomes: how methods are used, the place enforcement leverage may be utilized and whether or not disclosure mechanisms perform beneath strain.

If privateness is transferring from an asset class to an embedded functionality, the following section will come down to a couple sensible exams.

Adoption issues as a result of privateness is partly statistical. If solely a skinny slice of exercise makes use of confidential rails, utilization stands out and safety weakens. Composability issues as a result of DeFi assumes clear state; confidential execution has to coexist with pricing, analytics, liquidations and danger monitoring, or it stays a distinct segment facet pocket. And selective disclosure issues as a result of will probably be judged beneath actual audits and enforcement strain: too weak and controlled rails step again; too sturdy or too centralised and it recreates the choke factors privateness methods had been meant to keep away from.

Arcium and Umbra are simply two elements of an evolving story by which privateness is being pulled towards the chains the place liquidity already exists, and more and more framed as an try to make confidentiality appropriate with compliance.

Whether or not that compromise holds — technically, economically and legally — is the last word take a look at.