At present I current you an outline of trades made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD forex pairs for the week from February 9 to 13, 2026. The report covers all trades generated by the system’s indicators, making an allowance for strict threat administration and predefined entry and exit ranges.

For comfort and well timed receipt of indicators I exploit the Owl Sensible Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the development course of the upper timeframe.

EURUSD assessment

The primary commerce on the EURUSD forex pair was opened by the sign of the Owl Sensible Ranges indicator on Tuesday, February 10, 2026.

The sign shaped a purchase. The entry, cease loss, and goal ranges had been set prematurely primarily based on the wave construction and Fibonacci ranges. Nonetheless, the situation did not work out: the value returned to the cease loss degree, so the commerce closed with a loss on the pre-set threat.

Fig. 1. EURUSD BUY, Lot = 18.75, OpenPrice = 1.19040, StopLoss = 1.18960, TakeProfit = 1.19300, Revenue = -$1 500.00

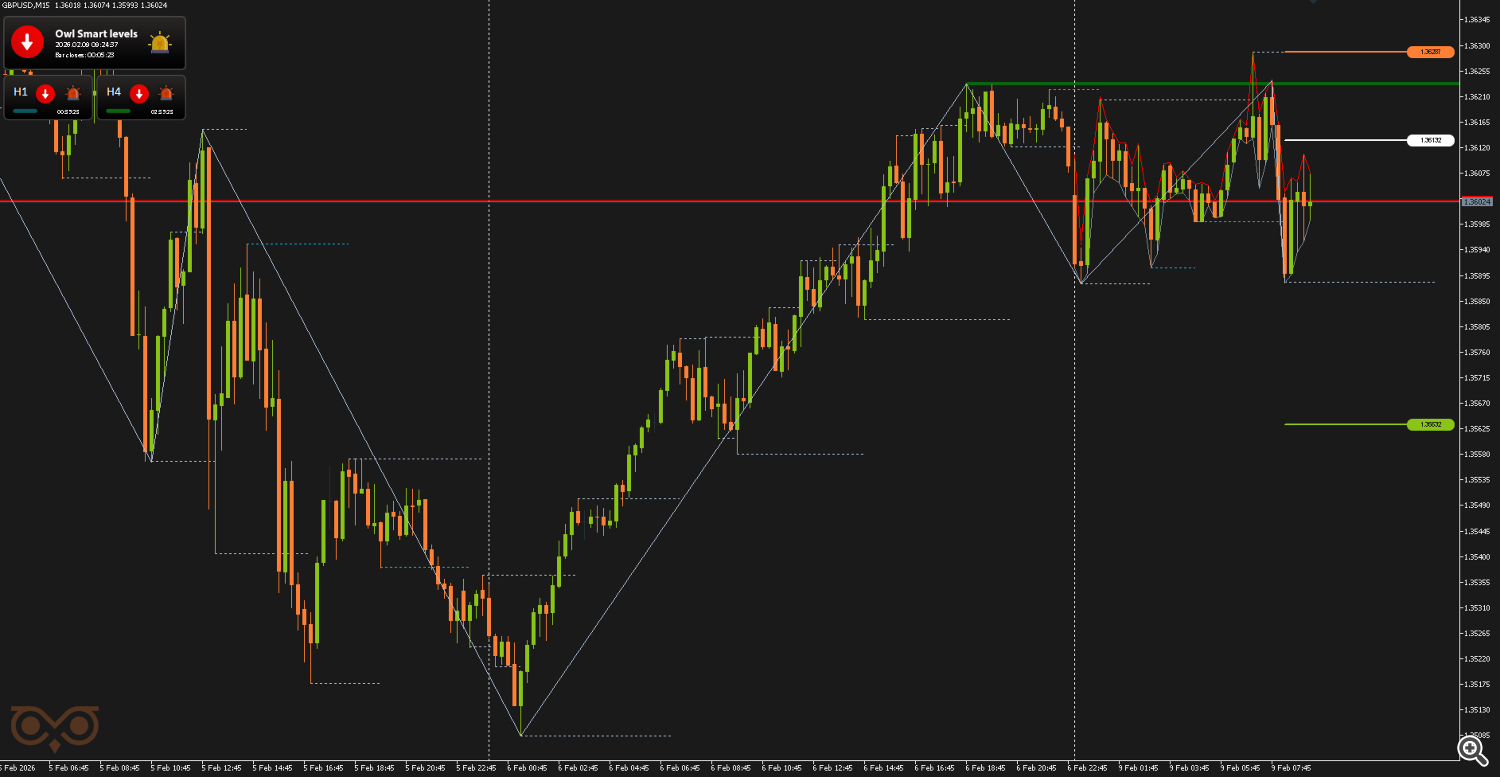

GBPUSD assessment

The primary commerce on the GBPUSD forex pair this week was opened by the sign of the Owl Sensible Ranges indicator on February 6, 2026.

The entry was executed as a promote from the pre-marked ranges of the system. Because the earlier commerce was closed at Cease Loss, the danger on this commerce was elevated by 0.25% (from 1.5% to 1.75%). After opening, the market did not proceed to say no: the value returned to the Cease Loss degree, and the place was closed with a loss in keeping with the calculated threat.

Fig. 2. GBPUSD SELL, Lot = 12.77, OpenPrice = 1.36132, StopLoss = 1.36267, TakeProfit = 1.35632, Revenue = -$1 723.75

AUDUSD assessment

The primary commerce on the AUDUSD forex pair was opened by the sign of the Owl Sensible Ranges indicator on February 10, 2026. On the time of the sign formation, the system confirmed an upward development on the upper timeframes, so the entry was made for a purchase from a pre-marked degree.

Because the two earlier trades had been closed at Cease Loss, the danger on this commerce was elevated by 0.25% to 2.00% (in accordance with the rule of accelerating threat after stops). The entry, cease loss, and take revenue ranges had been set instantly — primarily based on the wave construction and the system’s calculated ranges, with out guide changes after opening. After a slight pullback, the value returned to the primary motion, continued to develop, and reached Take Revenue, fixing the revenue in keeping with the plan.

Fig. 3. AUDUSD BUY, Lot = 32.26, OpenPrice = 0.70705, StopLoss = 0.70645, TakeProfit = 0.70912, Revenue = +$6 677.56

The second commerce on the AUDUSD forex pair was opened by the sign of the Owl Sensible Ranges indicator on February 12, 2026. The entry was made for a purchase from a pre-marked degree of the system.

Because the earlier commerce closed with a revenue, the danger was returned to the usual worth of 1.5%. After opening, the value didn’t proceed rising and shortly returned to the Cease Loss degree, so the place was closed at a loss.

Fig. 4. AUDUSD BUY, Lot = 14.15, OpenPrice = 0.71300, StopLoss = 0.71194, TakeProfit = 0.71642, Revenue = -$1 500.00

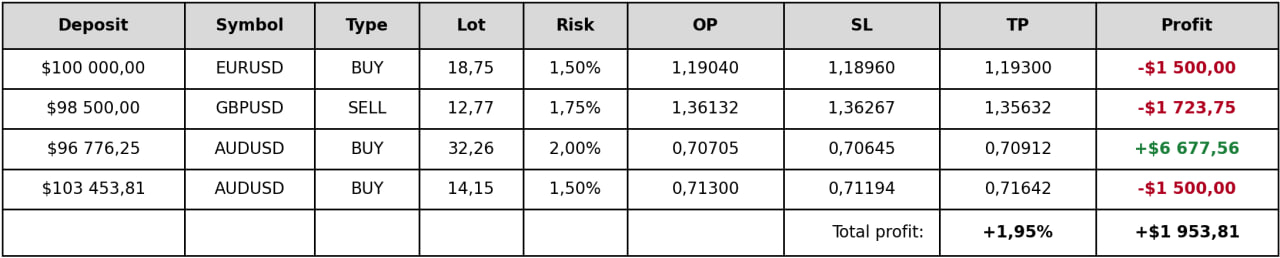

Abstract:

There have been 4 trades made primarily based on Owl Sensible Ranges indicators in the course of the previous buying and selling week. Even though the market was in consolidation for a lot of the week and confirmed little directional motion, the general consequence for the week remained constructive. The consequence for the week: +$1953.81, which is +1.95% of the deposit. The detailed information are introduced within the closing desk.

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.