By my 15+ years expertise in buying and selling, I’ve found that on the subject of figuring out the development of a market, there isn’t any magical instrument, no indicator and no algorithm that all the time work. As merchants, regardless of our greatest efforts to investigate the charts and punctiliously decide a bias on the charts and commerce in-line with the development of the market, finally the route of the market can rapidly change at any time. If issues don’t go to plan, we must always use the advantage of hindsight evaluation to dissect the chart and work out what we initially missed and what went unsuitable. Simply keep in mind that this isn’t an actual science, and generally, regardless of our greatest efforts to make sense of the charts, the market will simply transfer in the other way. Don’t beat your self up.

By my 15+ years expertise in buying and selling, I’ve found that on the subject of figuring out the development of a market, there isn’t any magical instrument, no indicator and no algorithm that all the time work. As merchants, regardless of our greatest efforts to investigate the charts and punctiliously decide a bias on the charts and commerce in-line with the development of the market, finally the route of the market can rapidly change at any time. If issues don’t go to plan, we must always use the advantage of hindsight evaluation to dissect the chart and work out what we initially missed and what went unsuitable. Simply keep in mind that this isn’t an actual science, and generally, regardless of our greatest efforts to make sense of the charts, the market will simply transfer in the other way. Don’t beat your self up.

To be clear, development evaluation is just one a part of the general buying and selling technique I make use of to enter and exit trades. It’s by no means a good suggestion to enter a commerce primarily based on one issue alone, which is why I search for as a lot proof as attainable to substantiate a commerce. In my very own buying and selling plan, I make use of an idea generally known as T L S confluence, an evaluation method which brings collectively; development evaluation, stage evaluation, and sign evaluation.

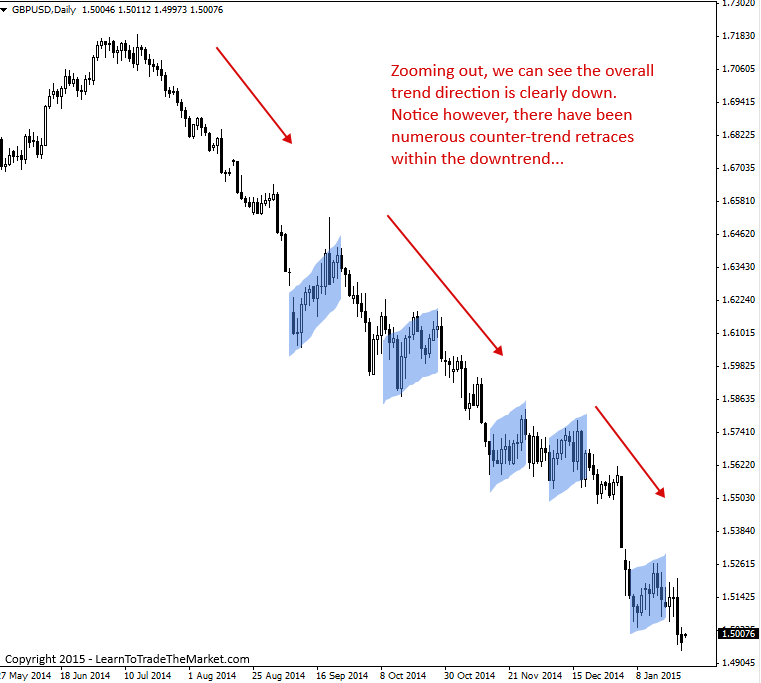

When studying right now’s lesson, take into account, I’m not speaking about “buying and selling the development” right here, I’m merely offering a set of filters and observations to establish the obvious route the market is prone to head. Additionally, the market might appear to be it’s trending in a single route, when in actual fact it’s truly trending within the different route. It’s because many markets expertise short-term retracements, which are likely to deceive merchants. Because of this, all the time zoom out and take a look at the larger image on the charts after which zoom in and drill down from there.

We are going to begin with the less complicated methods and work our solution to the extra superior methods.

1. Visible commentary is vital.

The very first thing to know about development identification is that it isn’t an ideal science. I attempt to hold it so simple as attainable and I begin off by simply visually observing a naked worth motion chart, with no indicators.

In case you ask totally different merchants, you’ll hear totally different variations of what the present development of a market is. Some offers you the short-term development, some the long-term and a few the mid-term. Nonetheless, an important development to establish is the obvious present dominant every day chart development. We are able to establish that utilizing each short-term and long-term evaluation, which begins by merely observing the charts.

I wish to ask myself, what’s the chart wanting like during the last 12 months or two, 6 months and three months? That reveals me the long-term, mid-term and short-term views, respectively. Doing this offers me a really clear thought of the general chart route transferring from left to proper. If all else fails, zoom out on a every day or weekly chart and take a step again and simply ask your self, “Is that this chart falling or rising?”. Don’t over complicate it!

By looking on the basic route of the value motion in a market during the last 3 month to 1 12 months, we are able to simply see whether or not it’s usually trending up, down and even sideways.

2. Establish the obvious swing highs and lows.

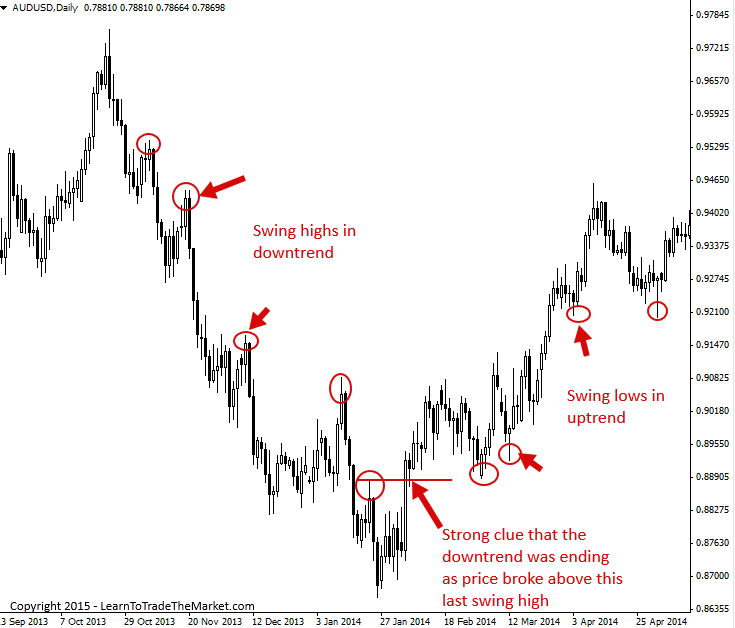

As markets development, they go away behind swing factors on a chart. By being attentive to these swing factors we are able to rapidly see which method a market is trending.

Within the chart under, discover we’ve got a transparent uptrend in place within the S&P500, one thing we’ve got been discussing for months now in our current S&P500 market commentaries. Discover the highlighted areas, these are swing lows inside the uptrend and in the event you simply deal with these highlighted areas you will notice they kind ‘steps’, stepping larger because the market strikes within the route of the development…

Word, in a down-trending market you’d be extra targeted on swing highs and seeing if they’re making a stepping sample to the draw back.

3. Greater Highs, Greater Lows, Decrease Highs and Decrease Lows

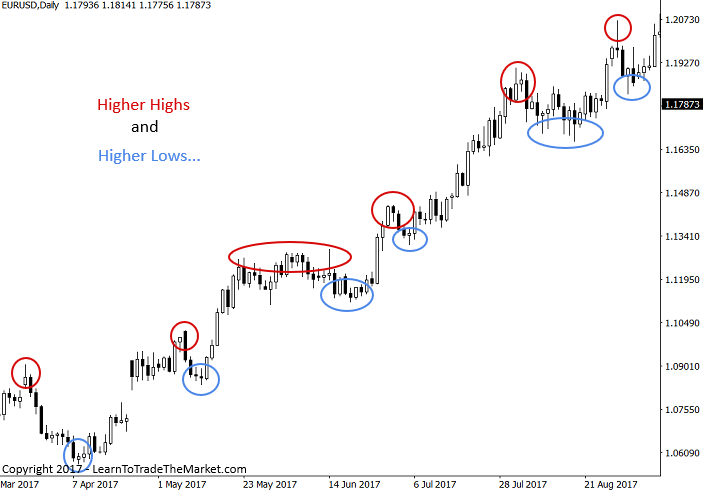

After you have drawn within the apparent swing factors on the chart, you’ll be able to then decide if the market is making HH and HL or LH and LL: HHHL – Greater Highs and Greater Lows, LHLL – Decrease Highs and Decrease Lows.

Typically, in an uptrend you will notice a reasonably apparent sample of HH and HL from the market’s swing factors, and in a downtrend you will notice a reasonably apparent sample of LH and LL from the market’s swing factors. We are able to see an uptrend was in place within the chart under, as you’ll be able to see from the clear sample of upper highs and better lows…

4. Is the market showing to ‘bounce from worth’?

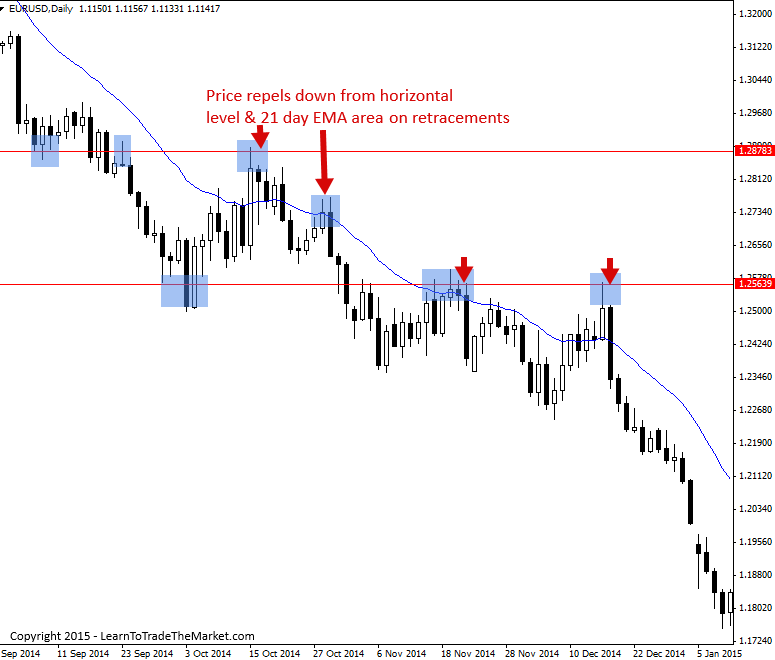

Test the habits of the value motion after retraces and test it because it approaches the long-term transferring averages reminiscent of 21 day ema (exponential transferring common) or a key horizontal resistance stage. Does the value motion repel down as in a downtrend or bounce up as in uptrend? This type of worth habits is an efficient clue to substantiate the underlying bias / development of the market.

Within the chart above, we are able to see that each one retraces larger to each horizontal resistance ranges and the 21 day EMA have been met with promoting strain because the dominant downtrend remained intact.

Put a 200 and 50 day ema in your chart and take a look at the long-term slope of those ema’s. It is a good fast solution to establish the general dominant development of a market. It’s best to take a look at how costs are reacting close to the transferring averages (worth zone), if the value is respecting these EMA ranges and repelling/bouncing away from them on a number of events, you’ve got good proof the market is trending (an idea I name a ‘good development’ and broaden on in additional extra element in my worth motion buying and selling programs). The chart under is a good instance for idea functions, simply don’t count on to see this day-after-day.

Discover within the chart above, the 50 and 200 interval EMA’s give us a great quick-view of the dominant every day chart development route.

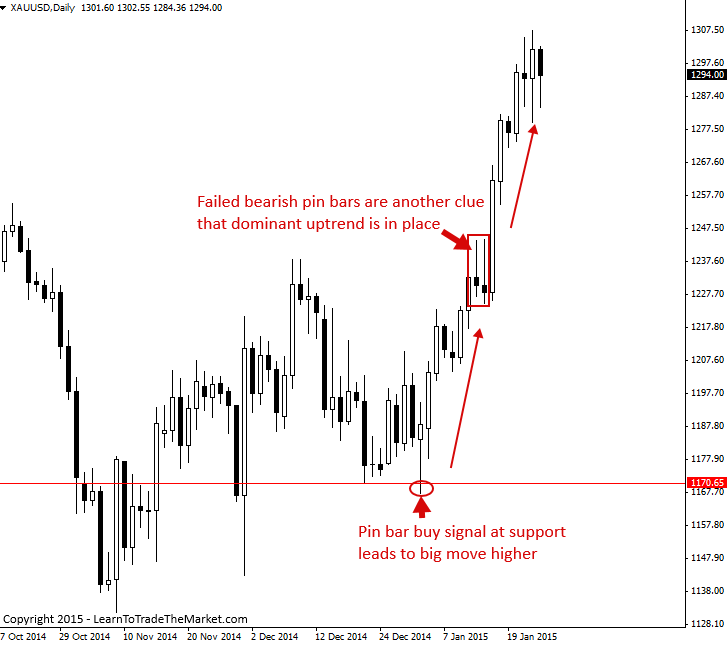

5. Are there worth motion alerts forming?

In case you see worth motion alerts which are producing substantial motion in-line with the development, that is one other confirming issue to your directional bias on a market. Additionally, keep in mind that repetitive failed worth motion alerts recommend the market goes the opposite method (and presumably altering development).

Within the chart above, discover how the bullish pin bar at assist actually kicked off the uptrend which was once more ‘confirmed’ by the failure of the bearish pin bars.

6. Change in development route

If a market is trending decrease, we need to pay shut consideration to the current swing highs, and in an uptrend we are going to deal with the current swing lows. We do that as a result of it not solely reveals us the general development, however it additionally reveals us by way of the value motion if the development continues to be intact or not.

For example, you probably have a collection of Greater Highs and Greater Lows as in an uptrend, once you see worth break down previous the earlier swing low, it’s a powerful indication that the uptrend is perhaps ending. Conversely, in a downtrend we see Decrease Highs and Decrease Lows, and when worth breaks above the earlier decrease excessive, it’s a powerful indication that the downtrend is perhaps ending.

Conclusion

As soon as you’re assured you’ve got recognized the development / directional bias of a market, you then search for a sign or space / stage of the chart to enter. We name that confluence and it’s an idea that might require one other lesson to elucidate, try a lesson on buying and selling with confluence right here.

Discovering the market bias or development is difficult, particularly for starting merchants, and most merchants will discover this to be a sticking level of their buying and selling improvement. It’s OK to know numerous entry triggers and setups, however in the event you’re buying and selling in opposition to the dominant market bias, your chances of earning money lower dramatically. There may be all the time a bias, and as newbie merchants particularly, you’d be properly served to keep it up.

In my skilled buying and selling programs, I broaden in better element on how we establish and commerce numerous types of developments utilizing worth motion alerts as affirmation.

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW 🙂

Any questions or suggestions? Contact me right here.