Bitcoin is as soon as once more underneath heavy stress, sliding towards the $103,000 stage because the broader crypto market undergoes a pointy downturn. After days of volatility and failed restoration makes an attempt, BTC has misplaced key help, triggering renewed worry and accelerating sell-offs throughout altcoins. Most main property are displaying deep losses, with merchants and traders now questioning whether or not the market has entered a deeper corrective part.

Associated Studying

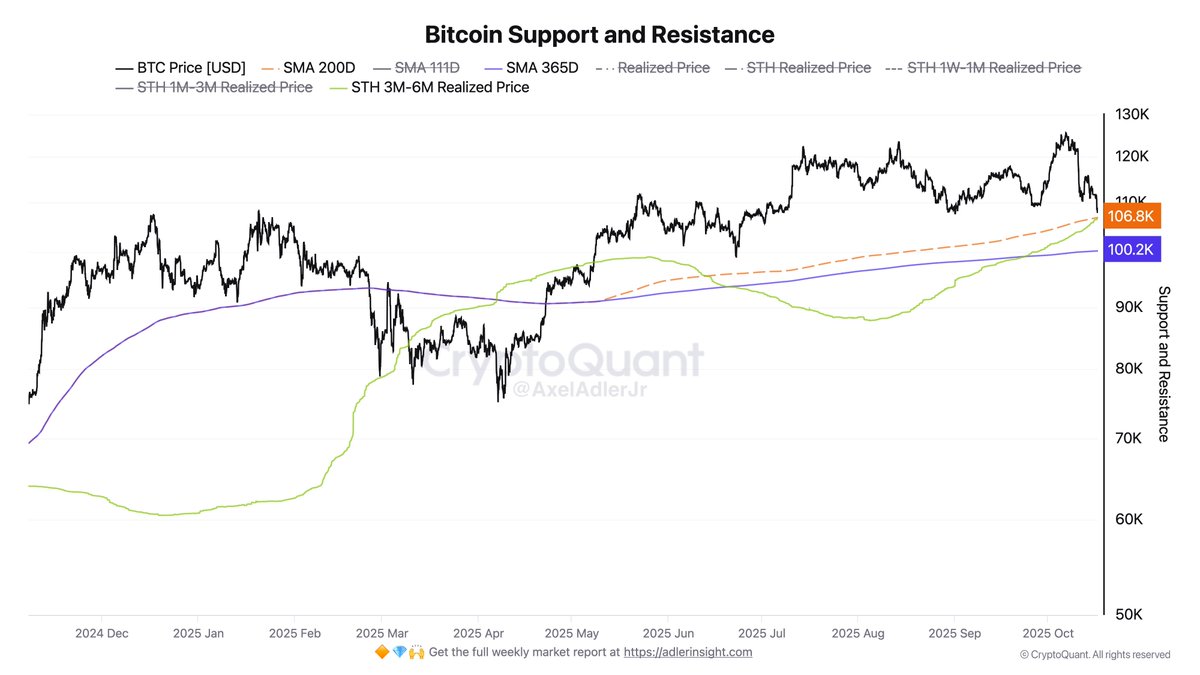

In response to prime analyst Axel Adler, Bitcoin’s most important help zone lies between $106,000 and $107,000, a spread outlined by the Brief-Time period Holder (STH) 1M–3M Realized Value and the 200-day easy transferring common (SMA 200D). This important space represents a confluence of each on-chain and technical help ranges the place earlier corrections have traditionally discovered equilibrium.

Nonetheless, the present momentum reveals mounting weak spot. As panic spreads and liquidity dries up, all eyes at the moment are on the $106K–107K vary — a decisive battleground that might outline Bitcoin’s short-term trajectory and set the tone for the remainder of the crypto market.

Bitcoin’s Market Construction Faces a Essential Take a look at

Adler highlights {that a} lack of the $106K stage would seemingly set off a transfer towards $100,000, the place the yearly transferring common (SMA 365D) at the moment aligns — a stage that has traditionally acted as a springboard for main reversals throughout earlier market cycles.

Regardless of the rising worry, Adler notes that the macro construction stays bullish so long as the $100K base holds. This area represents long-term purchaser curiosity, and defending it may reset overheated leverage and pave the way in which for a extra secure restoration. Nonetheless, Bitcoin is already buying and selling under the $106K mark, elevating considerations that the market may very well be making ready for a deeper take a look at of this important ground.

Analysts throughout the area at the moment are intently watching the day by day candle closes, which can decide whether or not the transfer under help is merely a liquidity sweep or affirmation of a bearish continuation. If Bitcoin fails to reclaim the $107K stage quickly, a broader shift in sentiment may unfold — one that will delay the consolidation part and take a look at investor conviction.

In distinction, a powerful rebound from the $100K zone would reinforce the argument that the correction is a part of a wholesome reset inside an ongoing bull market. The approaching days will due to this fact be decisive: both Bitcoin holds this base and rebuilds momentum, or it breaks decrease, signaling that the present cycle’s most aggressive part of volatility is way from over.

Associated Studying

Bitcoin Assessments Help Zone Amid Continued Weak spot

Bitcoin continues to slip, with the most recent chart displaying worth motion hovering round $106,000, now testing one of the important help zones in months. After failing to reclaim the $115,000 and $117,500 resistance ranges earlier this week, BTC prolonged its losses, touching an intraday low close to $103,500 earlier than recovering barely. The market stays tense as merchants watch whether or not the 200-day transferring common (SMA 200D) — at the moment round $107,500 — will maintain.

This stage represents the Brief-Time period Holder (STH) realized worth area and coincides with the realm recognized by analysts as a significant structural base. A confirmed breakdown under it may open the door to a take a look at of $100,000, the place the yearly transferring common (SMA 365D) aligns, serving as the subsequent main help.

Associated Studying

Momentum indicators recommend that BTC remains to be underneath robust bearish stress. The 50-day and 100-day transferring averages are trending downward, indicating a lack of short-term momentum. Until Bitcoin can shut day by day candles again above $107K, market sentiment is more likely to stay cautious.

Featured picture from ChatGPT, chart from TradingView.com