The Energy of Line Break Charts in Buying and selling: Unveiling Readability in Volatility

That is the trial model of Line Break, get the complete model right here.

⬇⬇⬇ [FREE DOWNLOAD AT BOTTOM OF PAGE] ⬇⬇⬇

Within the tumultuous world of economic markets, merchants are consistently in search of instruments that may assist them filter out the noise and determine true developments. Whereas candlestick charts dominate the panorama, different charting strategies typically supply distinctive views that may considerably improve evaluation. Amongst these, Line Break Charts stand out as a strong, but typically underutilized, instrument. This essay will delve into the historical past of Line Break Charts, discover their present challenges and options inside MetaTrader 5, spotlight the distinct benefits of utilizing precise Line Break candles over mere overlays, focus on bare buying and selling methods, and eventually, current varied indicator-based approaches, empowering merchants to unlock new dimensions of their evaluation.

A Glimpse into Historical past: The Genesis of Line Break Charts

The origins of Line Break Charts, very like their Japanese counterparts similar to Renko and Kagi charts, could be traced again to Japan, the place they have been developed to investigate rice costs within the seventeenth century. Whereas particular particular person attribution is usually tough for these historical charting strategies, their collective emergence displays a profound want amongst early merchants to maneuver past easy time-based value plots. As a substitute of specializing in each minute fluctuation, these strategies aimed to spotlight vital value actions, thereby decreasing market noise and presenting a clearer image of underlying developments.

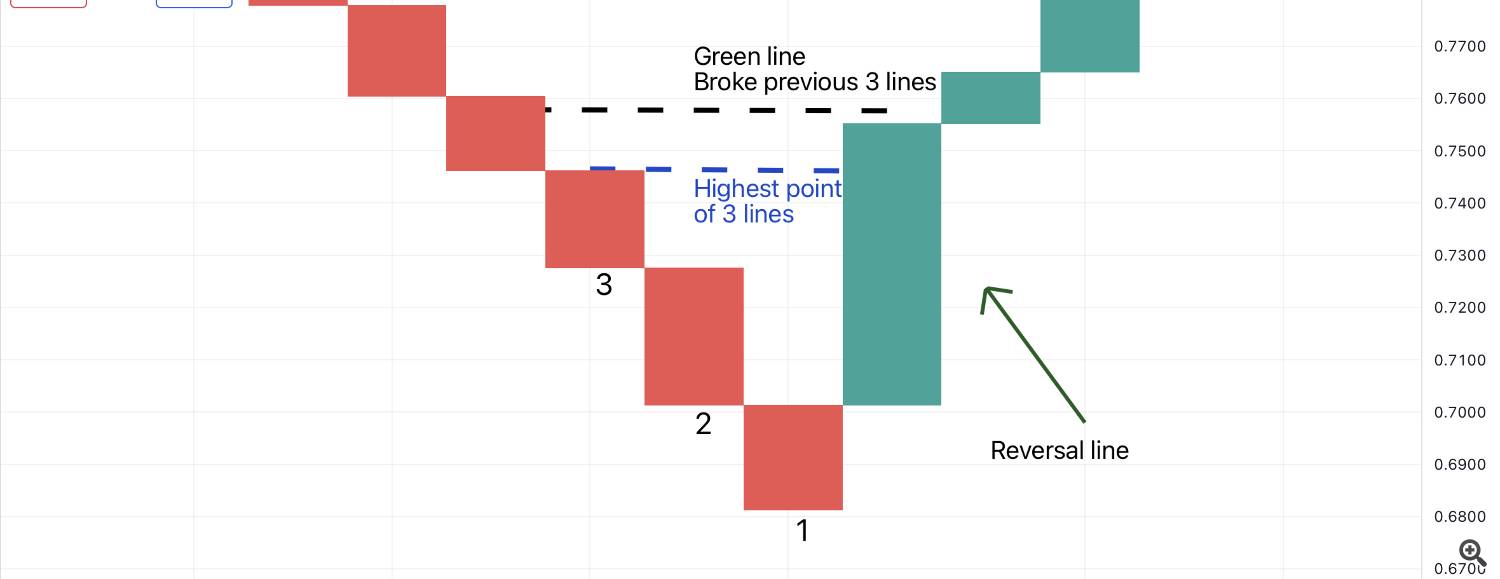

Line Break Charts, particularly, function on a precept of “strains” or “breaks.” A brand new line is drawn solely when the value strikes by a predefined variety of “breaks” or items in the other way of the present development. If the value continues in the identical course, the present line extends. This ingenious technique successfully filters out minor corrections and focuses solely on substantial shifts in market sentiment, presenting a smoother, extra digestible view of value motion.

Line Break Charts in MetaTrader 5: The Indicator Conundrum

Regardless of their historic significance and analytical energy, MetaTrader 5 (MT5), a preferred buying and selling platform, doesn’t natively assist Line Break Charts as a regular chart sort. This presents a major hurdle for merchants accustomed to the platform’s sturdy charting capabilities. Consequently, the market has seen a proliferation of “Line Break Chart indicators.” Whereas these indicators try to copy the visible essence of Line Break Charts, they usually perform as overlays, plotting the Line Break value motion straight onto a standard candlestick chart.

This strategy, whereas offering some visible illustration, comes with a important limitation: these indicators don’t generate precise Line Break candles or a real Line Break chart. They merely draw strains or shapes on prime of the prevailing time-based candlesticks. This basic distinction has profound implications for a dealer’s analytical toolkit.

The Professional Advisor Resolution: Forging True Line Break Candles

The answer to MT5’s native Line Break Chart deficiency lies within the growth and utilization of an Professional Advisor (EA). An EA particularly designed for Line Break Charts operates by changing uncooked value information (e.g., from a regular 1-minute chart) into true Line Break candles after which plotting these on a customized chart inside MT5.

This is how such an EA usually features:

- Knowledge Assortment: The EA runs on any timeframe, consistently monitoring incoming tick information.

- Line Break Logic: It applies the Line Break chart logic, figuring out when a brand new “break” has occurred based mostly on a user-defined variety of strains (e.g., a 3-line break chart means a reversal solely prints after 3 earlier strains are violated).

- Customized Chart Era: When a brand new Line Break candle is shaped, the EA writes this processed information to a customized chart. This practice chart then shows the true Line Break candles, unbiased of time.

This EA-driven strategy is paramount as a result of it offers merchants with a real Line Break chart, the place every “candle” (or line, extra precisely) represents a major value motion relatively than a set time interval.

The Plain Benefit: Precise Candles vs. Overlays

The distinction between buying and selling on an precise Line Break Chart generated by an EA and counting on an overlay indicator just isn’t merely aesthetic; it’s basically purposeful and strategic.

Benefits of Precise Line Break Candles:

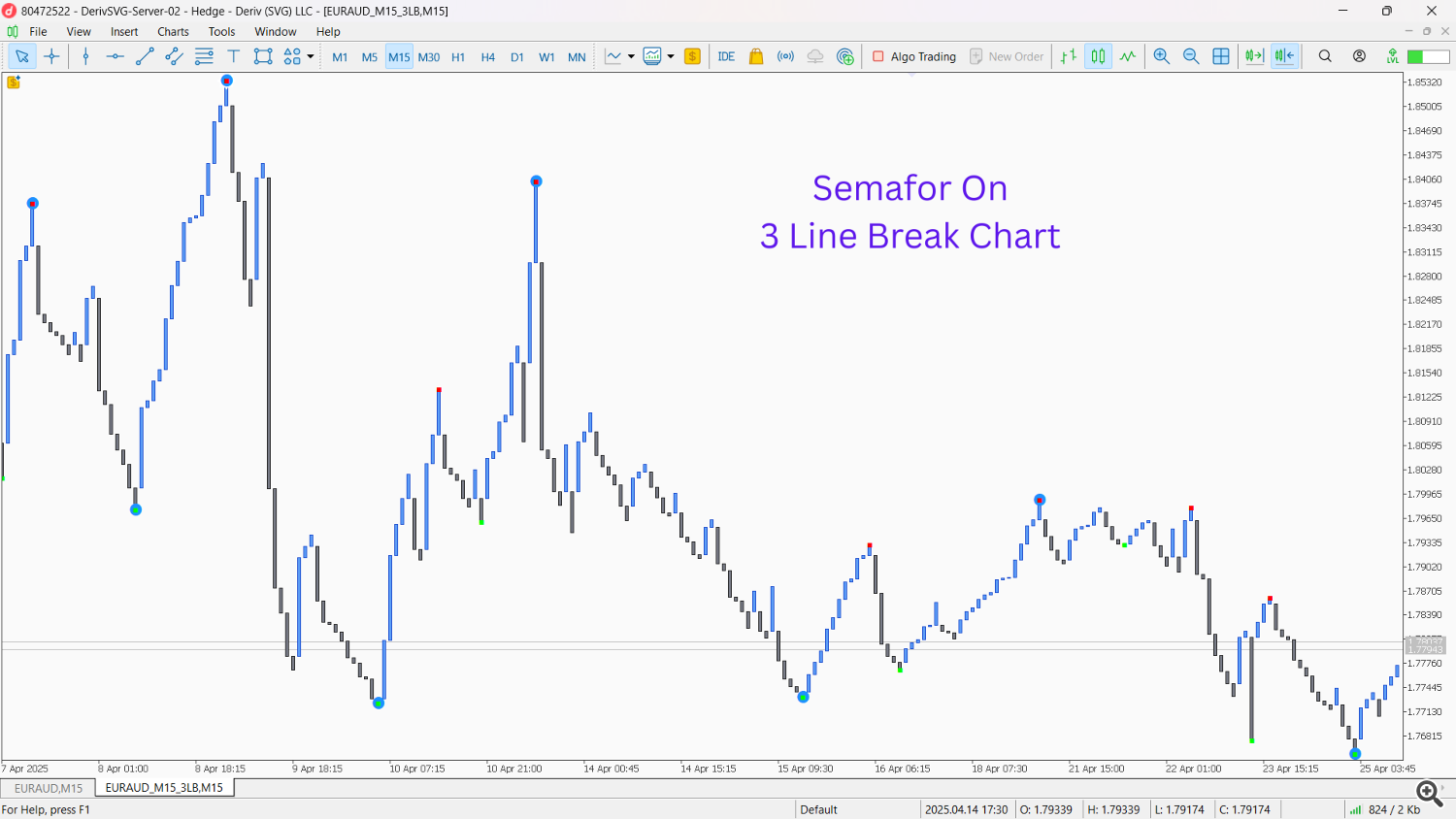

- Indicator Placement: That is arguably essentially the most vital benefit. When you’ve a real Line Break Chart, you’ll be able to apply any customary MT5 indicator straight onto these Line Break candles. Need to see how a Shifting Common seems to be on a Line Break chart? Apply it. Need to use RSI or Stochastic? Apply it. This opens up a world of analytical prospects, permitting you to mix the noise-filtering energy of Line Break Charts with the confirmatory indicators of your favourite indicators. With an overlay indicator, your indicators would nonetheless be calculating on the underlying time-based chart, not on the filtered Line Break value motion.

- Clearer Development Identification: Precise Line Break Charts inherently easy out value motion, making developments a lot simpler to determine. Uneven value motion on a time-based chart typically resolves into clear, directional strains on a Line Break chart, decreasing whipsaws and false indicators.

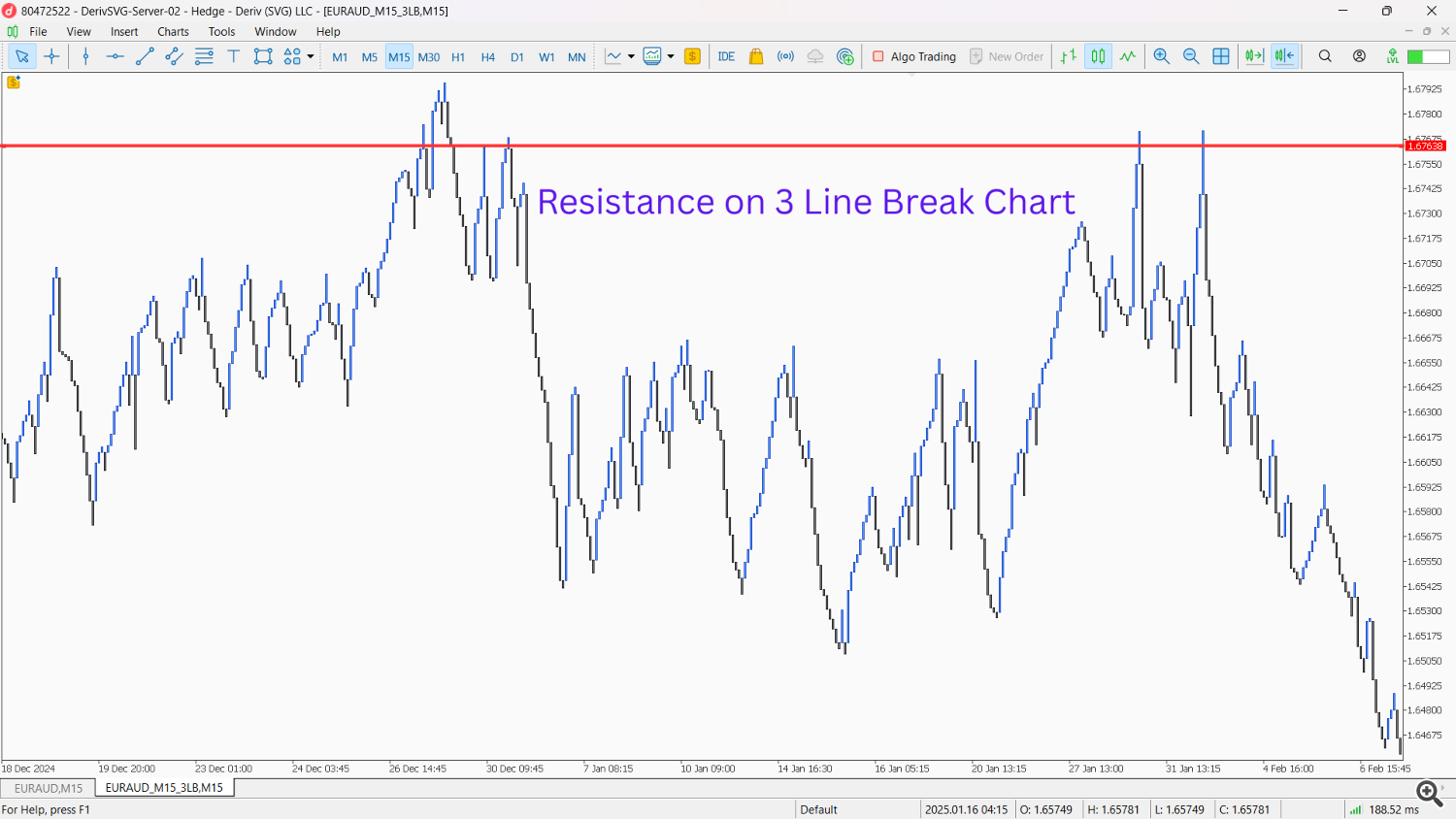

- Improved Help and Resistance: As a result of minor value fluctuations are filtered out, key assist and resistance ranges typically turn out to be extra pronounced and dependable on Line Break Charts.

- Outlined Reversal Indicators: The very nature of Line Break Charts implies that a brand new opposing line signifies a major reversal of momentum, making reversal indicators clearer and fewer ambiguous than on time-based charts.

- Concentrate on Value Motion: By eradicating the time aspect, Line Break Charts emphasize value motion itself. This permits merchants to focus solely on momentum shifts and structural modifications out there, relatively than being distracted by time-based volatility.

Bare Methods with Line Break Charts

Some of the compelling elements of Line Break Charts is their skill to disclose clear value motion, making them very best for “bare” buying and selling methods – those who rely solely on chart patterns and value habits with out further indicators.

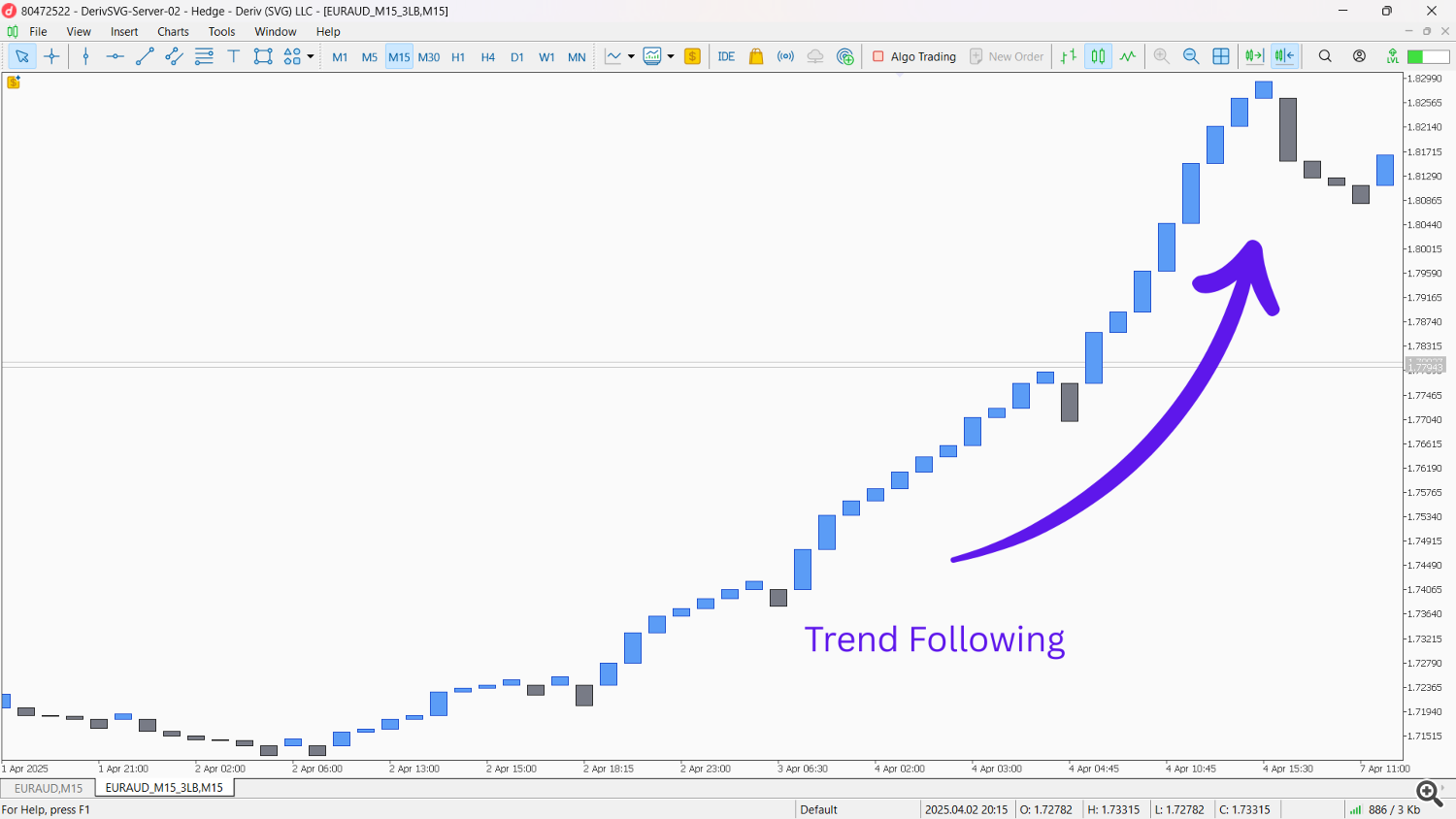

- Development Following (Pure Line Break): That is essentially the most simple technique. Establish the course of the present line (up or down). Enter trades within the course of the prevailing Line Break development. For instance, should you see a collection of consecutive white/inexperienced (up) strains, you’d search for lengthy alternatives. Exit or take revenue when a brand new opposing line kinds.

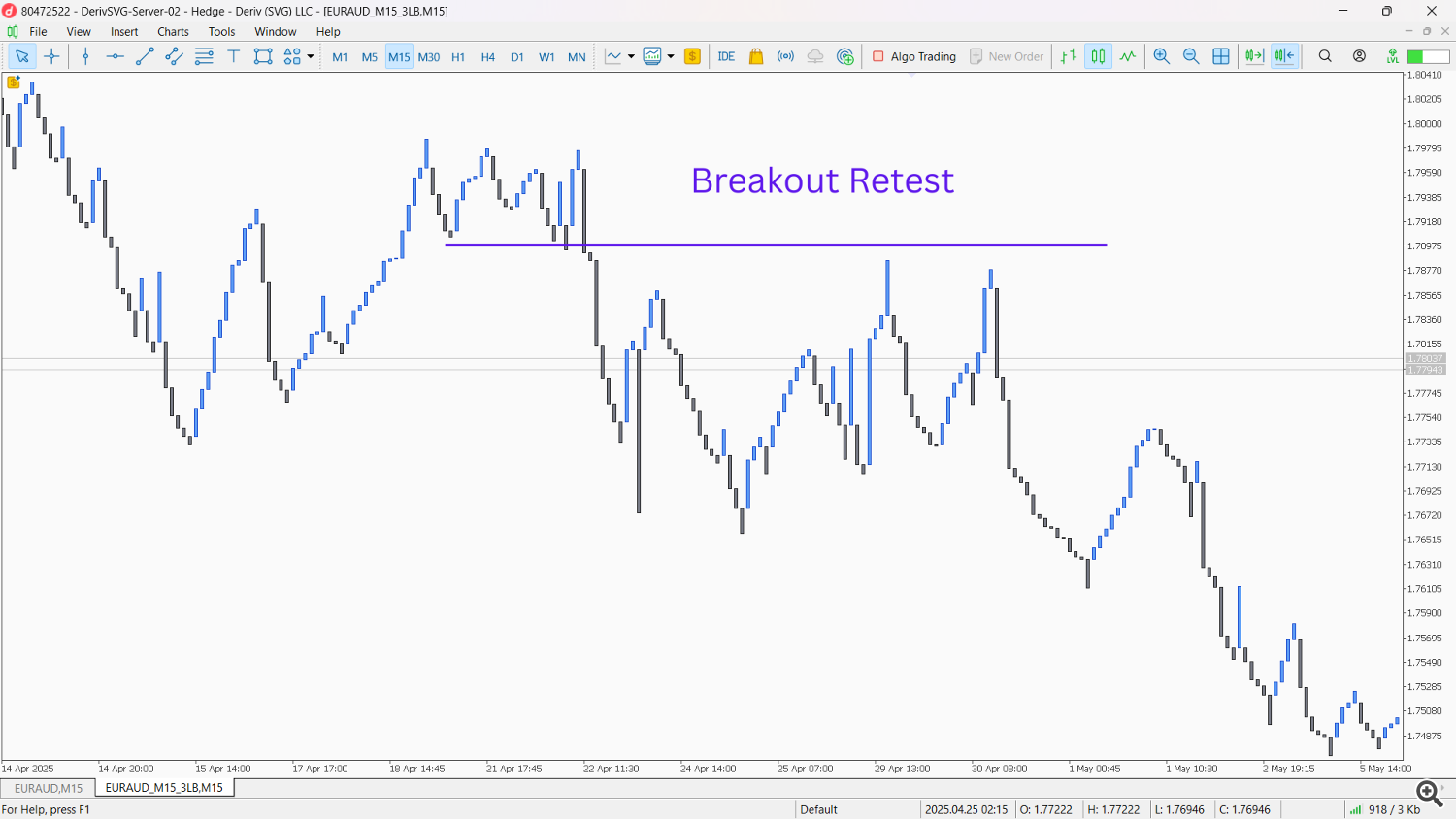

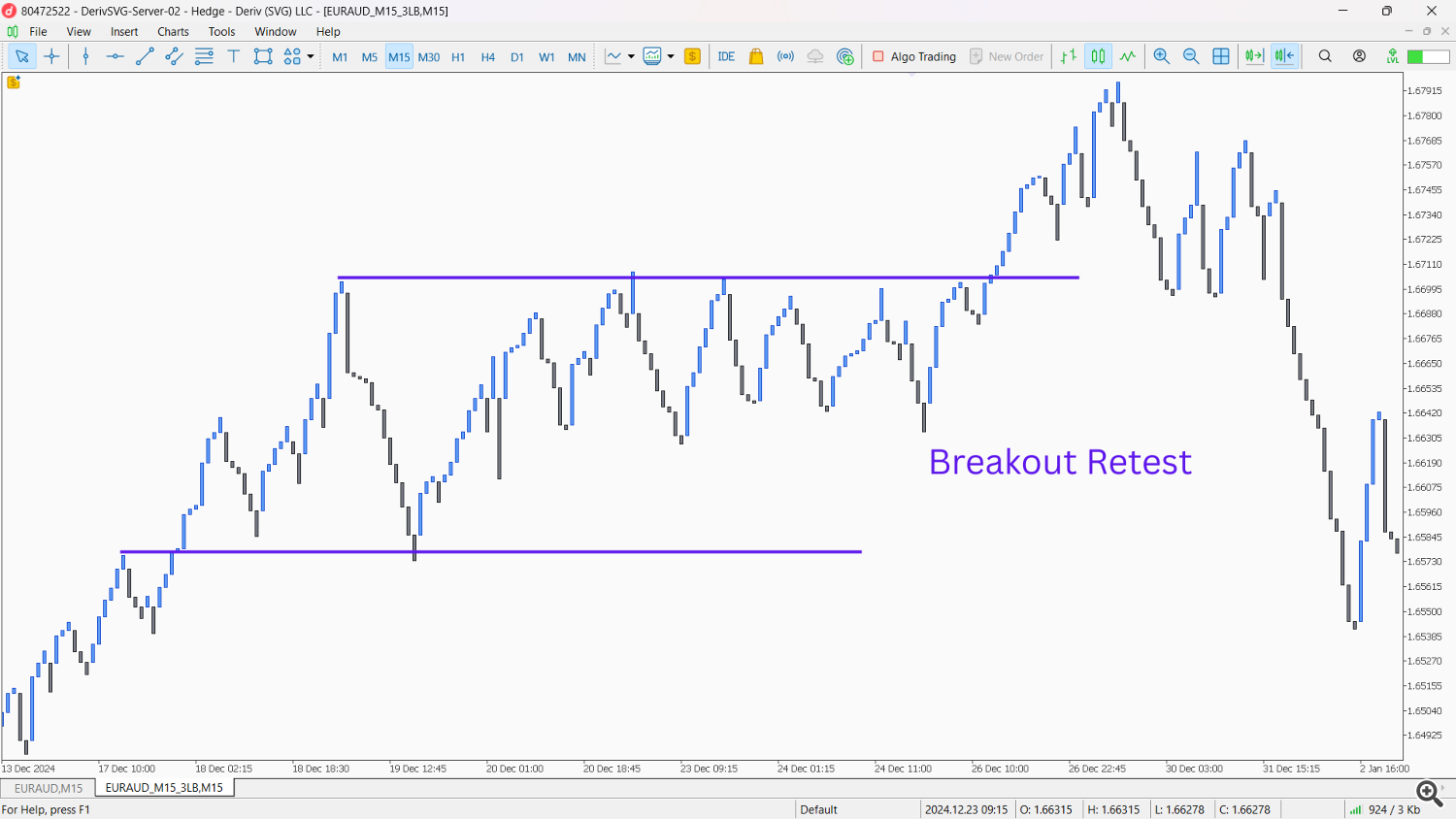

- Help and Resistance Breaks: With the clearer definition of great value ranges, merchants can determine robust assist and resistance. A break of a key stage by a brand new Line Break candle (particularly if it extends past earlier highs/lows) can sign a continuation of momentum or a major development change.

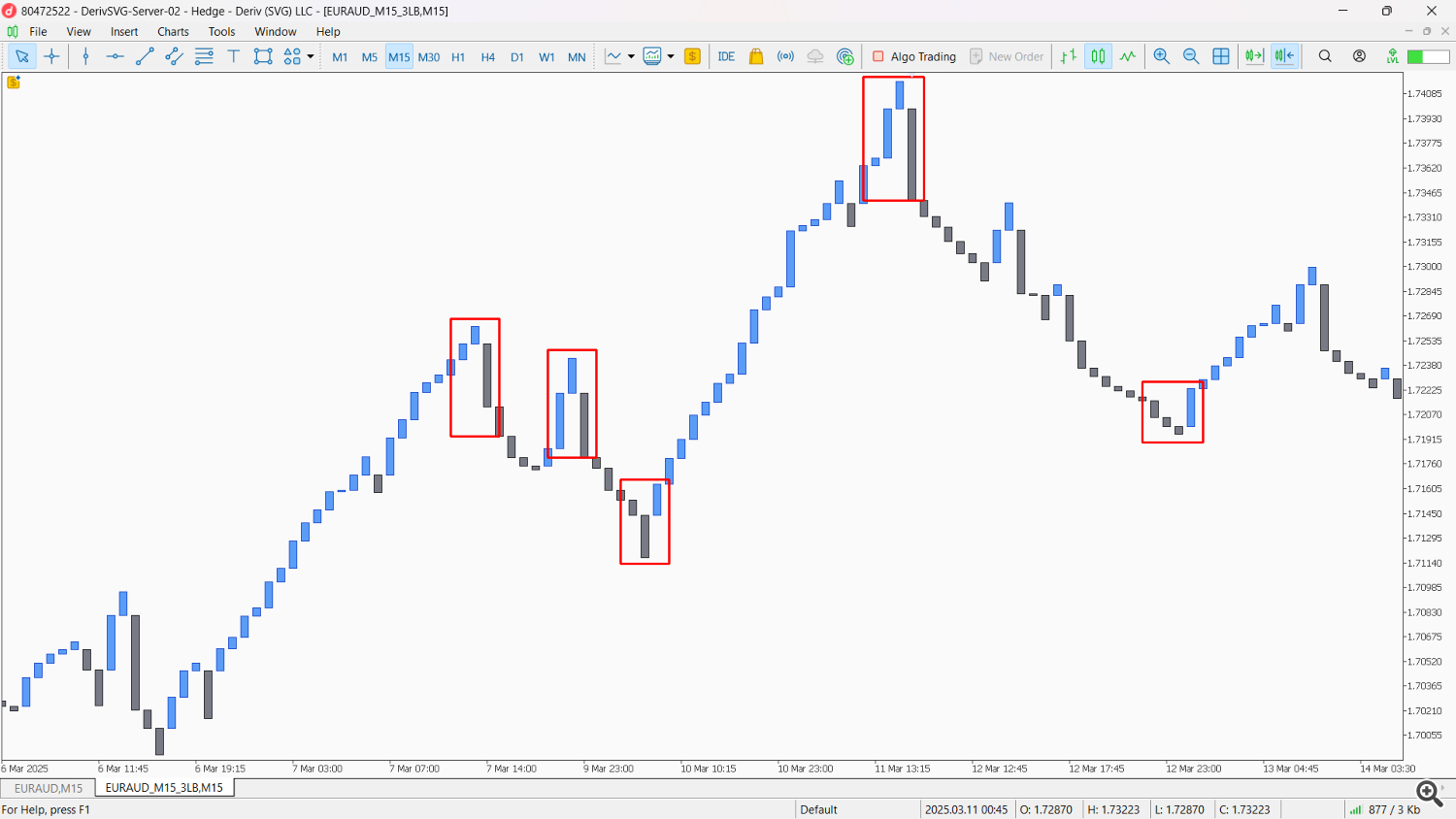

- Double High/Backside (Line Break Model): Search for conventional double prime or double backside patterns shaped by the Line Break strains. As an example, after an uptrend, two peaks of comparable peak adopted by a robust down-break Line can sign a reversal. These patterns are sometimes a lot cleaner on Line Break Charts as a result of noise discount.

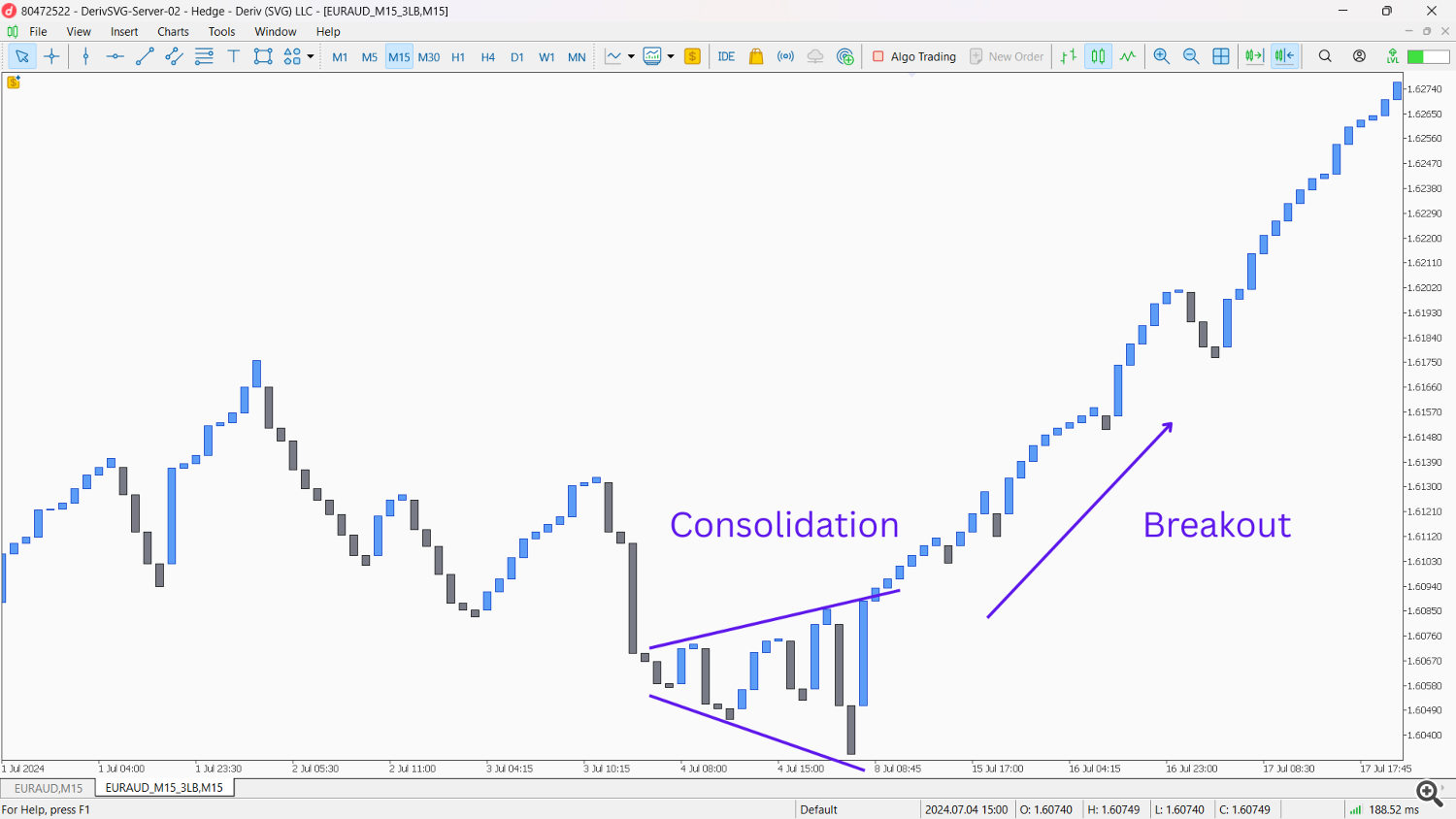

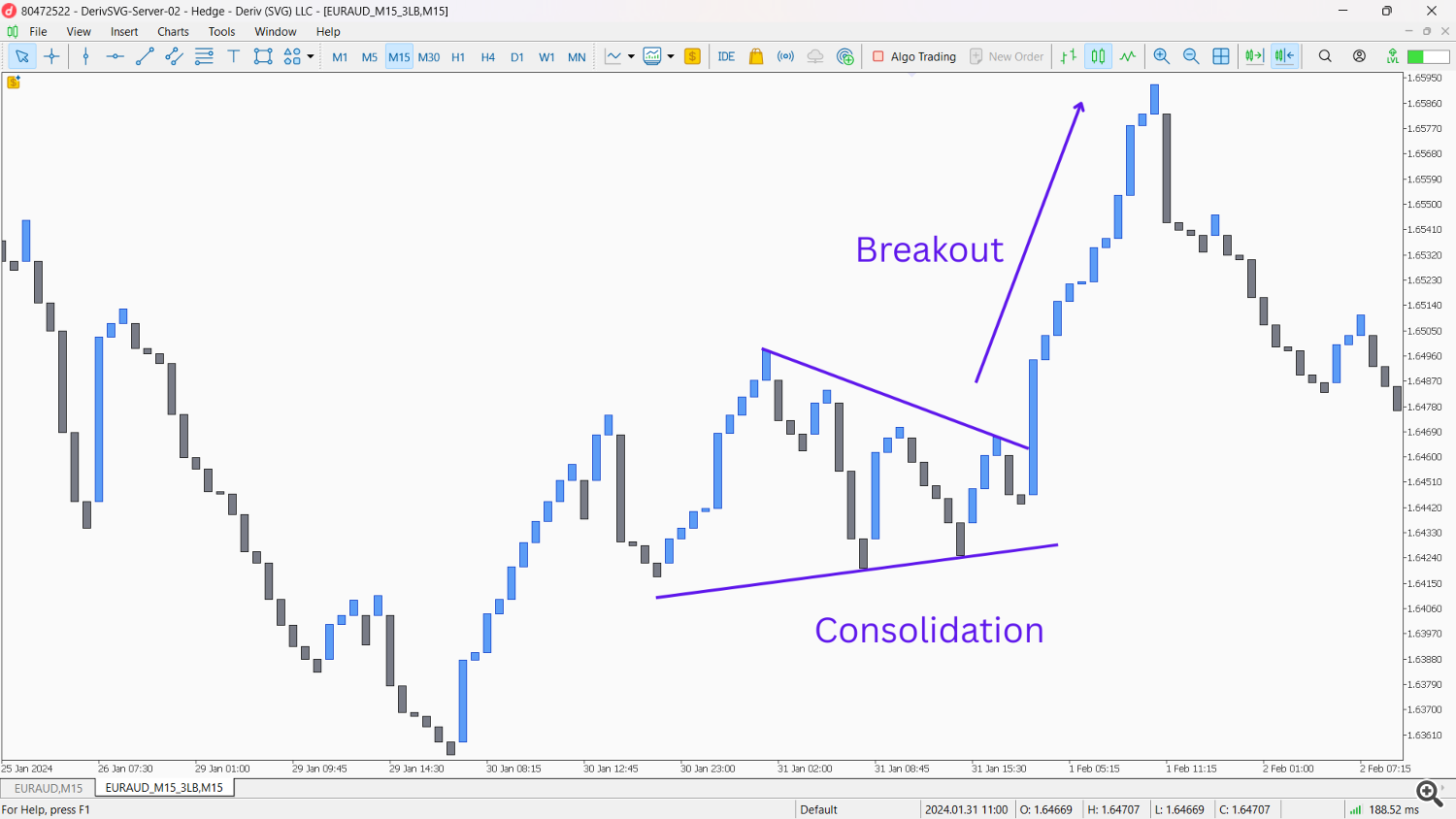

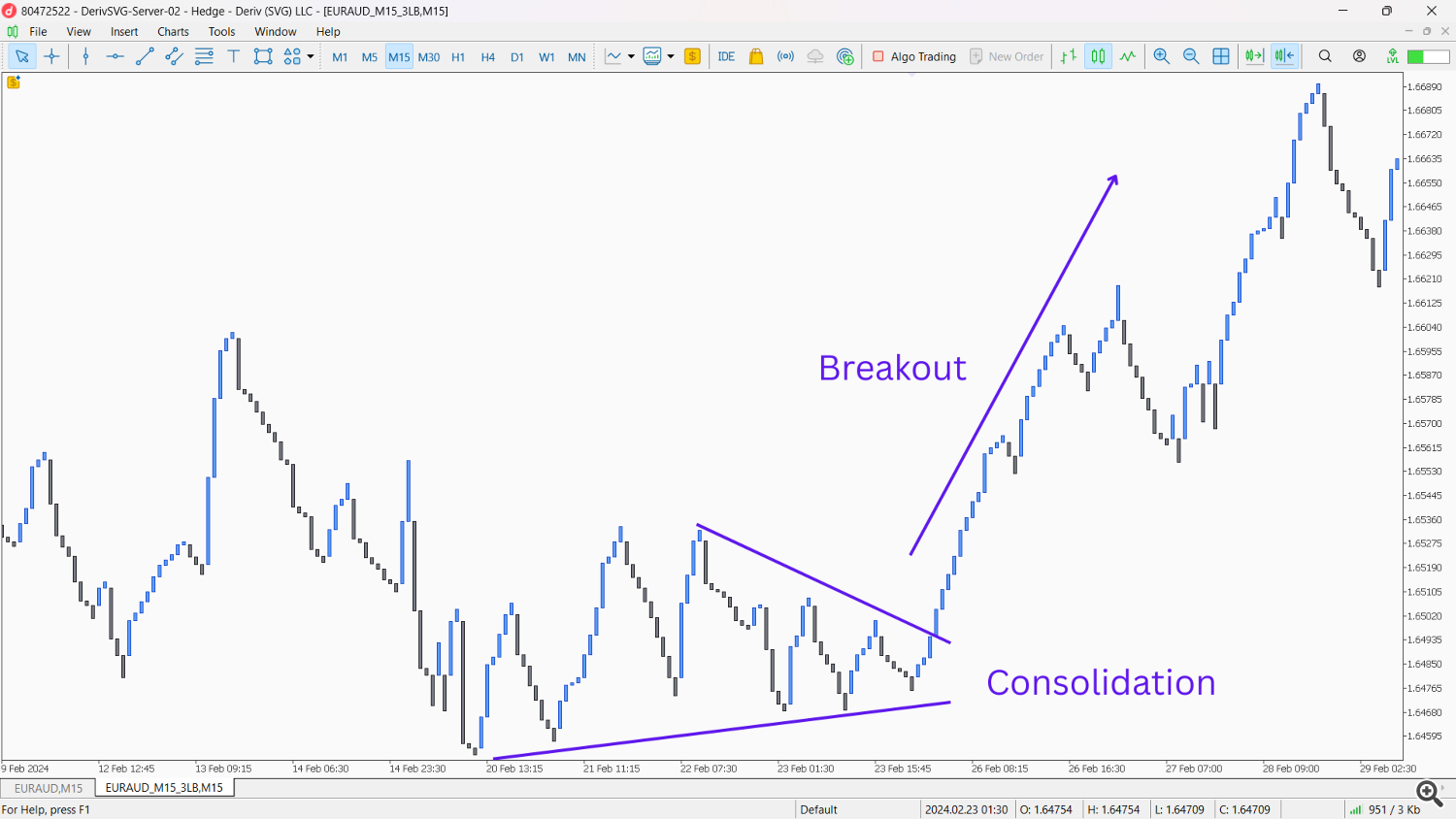

- Line Break Consolidation Breakouts: Observe durations the place Line Break strains turn out to be flat or oscillate inside a slim vary. A powerful Line Break candle breaking out of this consolidation suggests a brand new directional transfer.

Methods with Indicators: Enhancing Line Break Indicators

Whereas Line Break Charts present glorious standalone insights, combining them together with your favourite indicators on the precise Line Break chart can create extremely potent methods.

Continuation Methods:

- Shifting Common Crossover (on Line Break Chart):

- Setup: Apply two Exponential Shifting Averages (EMAs) – e.g., 20-period and 50-period – straight onto your Line Break Chart.

- Entry: For a continuation of an uptrend, await the shorter EMA to cross above the longer EMA on the Line Break chart, confirming the present upward Line Break development. For a downtrend, the shorter EMA crosses beneath the longer.

- Affirmation: The EMAs must be sloped within the course of the Line Break development.

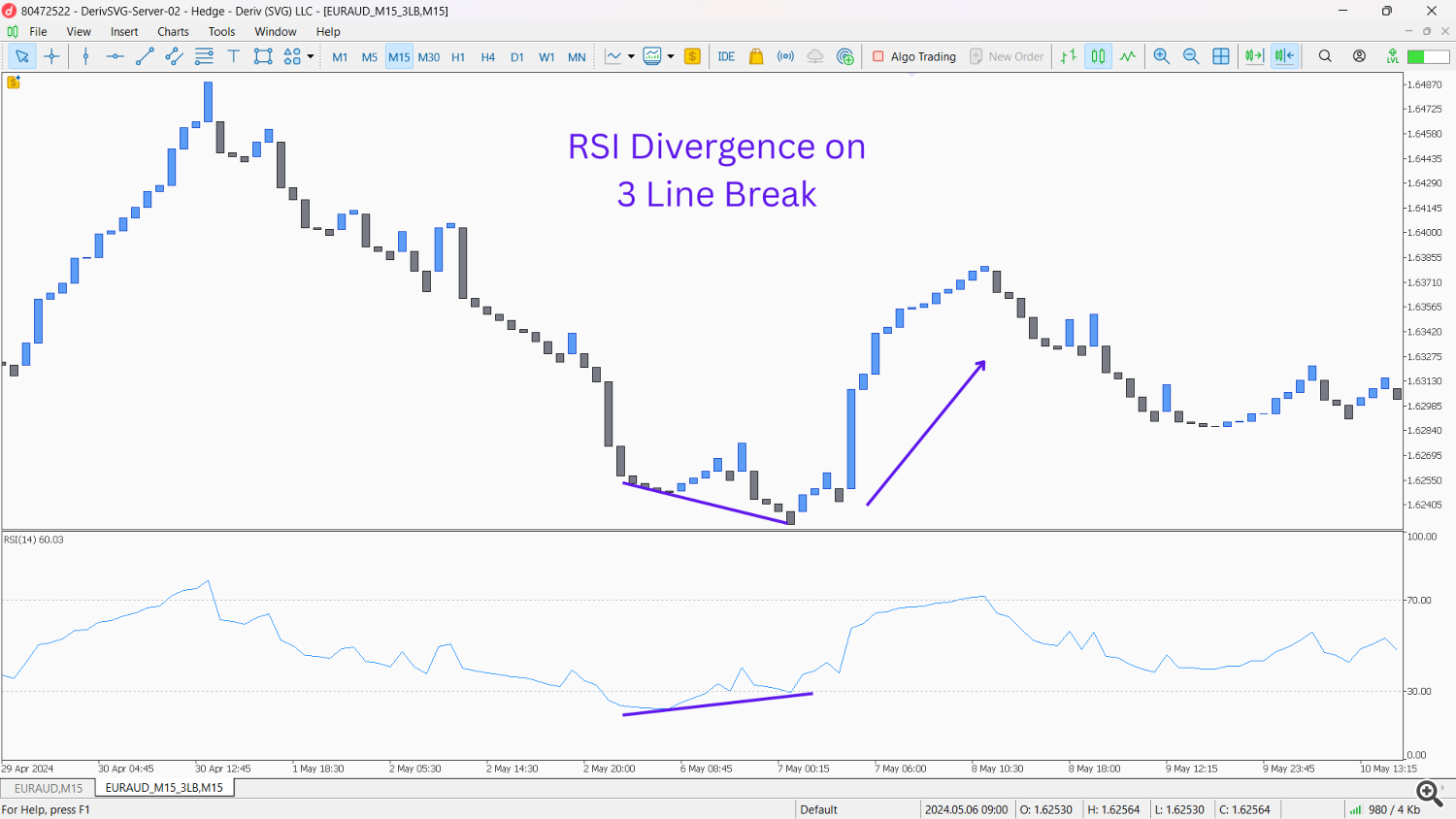

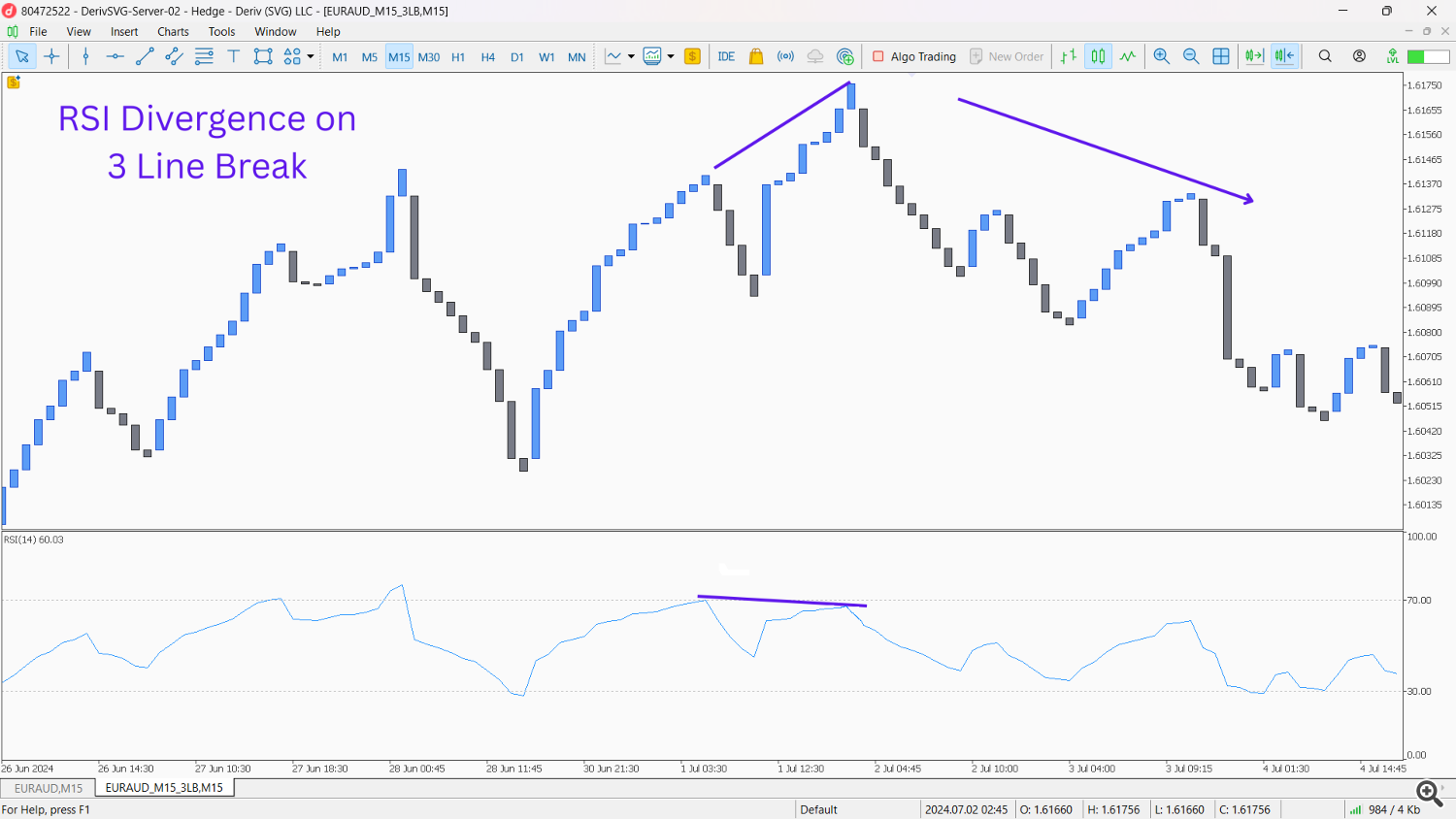

- Line Break & RSI Divergence (on Line Break Chart):

- Setup: Apply the Relative Energy Index (RSI) indicator (e.g., 14-period) to your Line Break Chart.

- Entry: Search for hidden bullish divergence throughout an uptrend: Value on the Line Break chart makes a better low, however RSI makes a decrease low. This means underlying energy and a possible continuation of the uptrend after a pullback. For bearish continuation: Value makes a decrease excessive, RSI makes a better excessive.

- Affirmation: The Line Break chart ought to resume its development course after the divergence.

Reversal Methods:

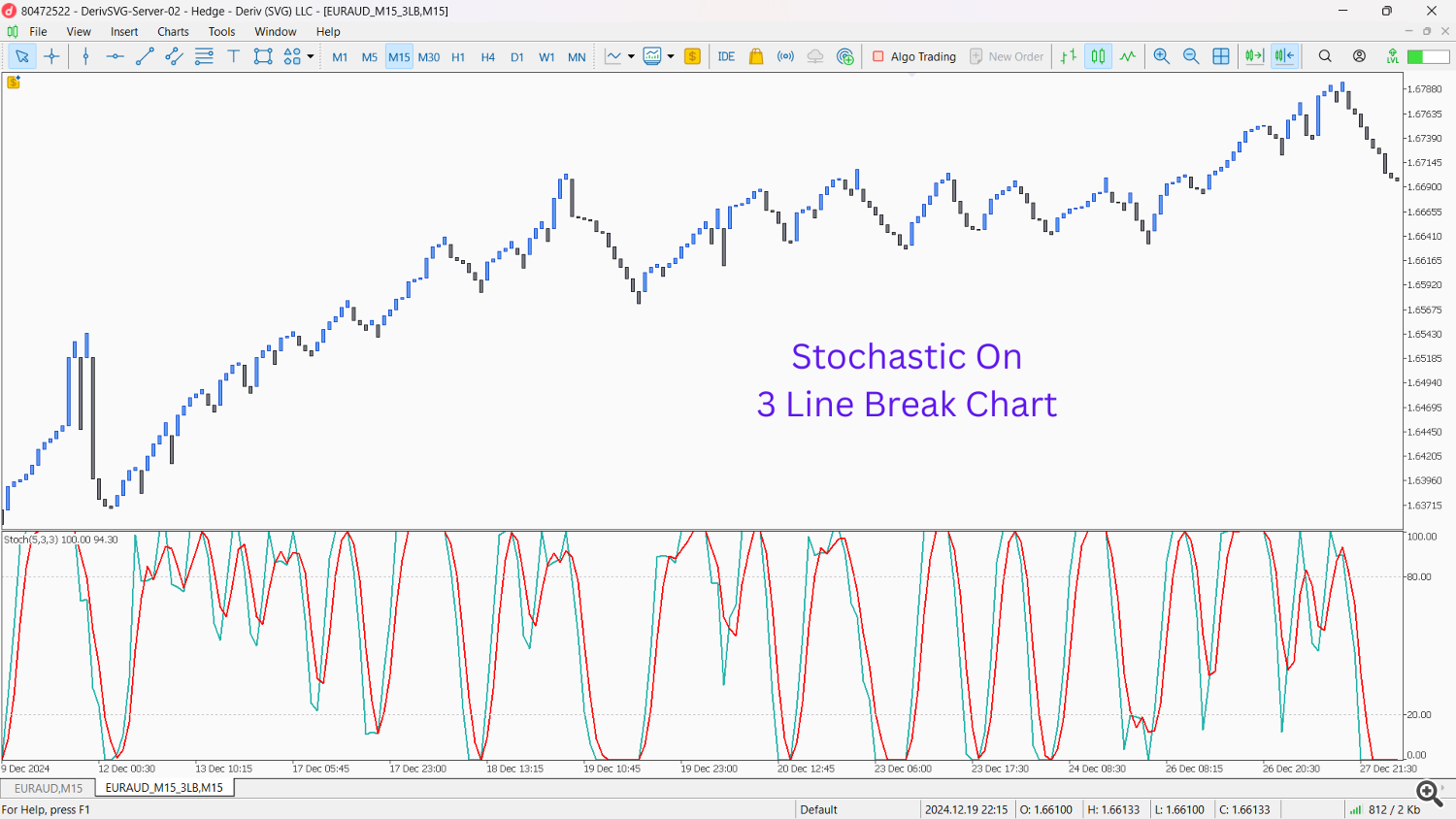

- Line Break & Stochastic Crossover (on Line Break Chart):

- Setup: Apply the Stochastic Oscillator (e.g., 14, 3, 3) to your Line Break Chart.

- Entry: After a chronic Line Break development, search for overbought (above 80) or oversold (beneath 20) situations on the Stochastic. A cross of the %Okay line beneath the %D line from overbought territory (for a bearish reversal) or above from oversold (for a bullish reversal) concurrently with an opposing Line Break candle forming indicators a high-probability reversal.

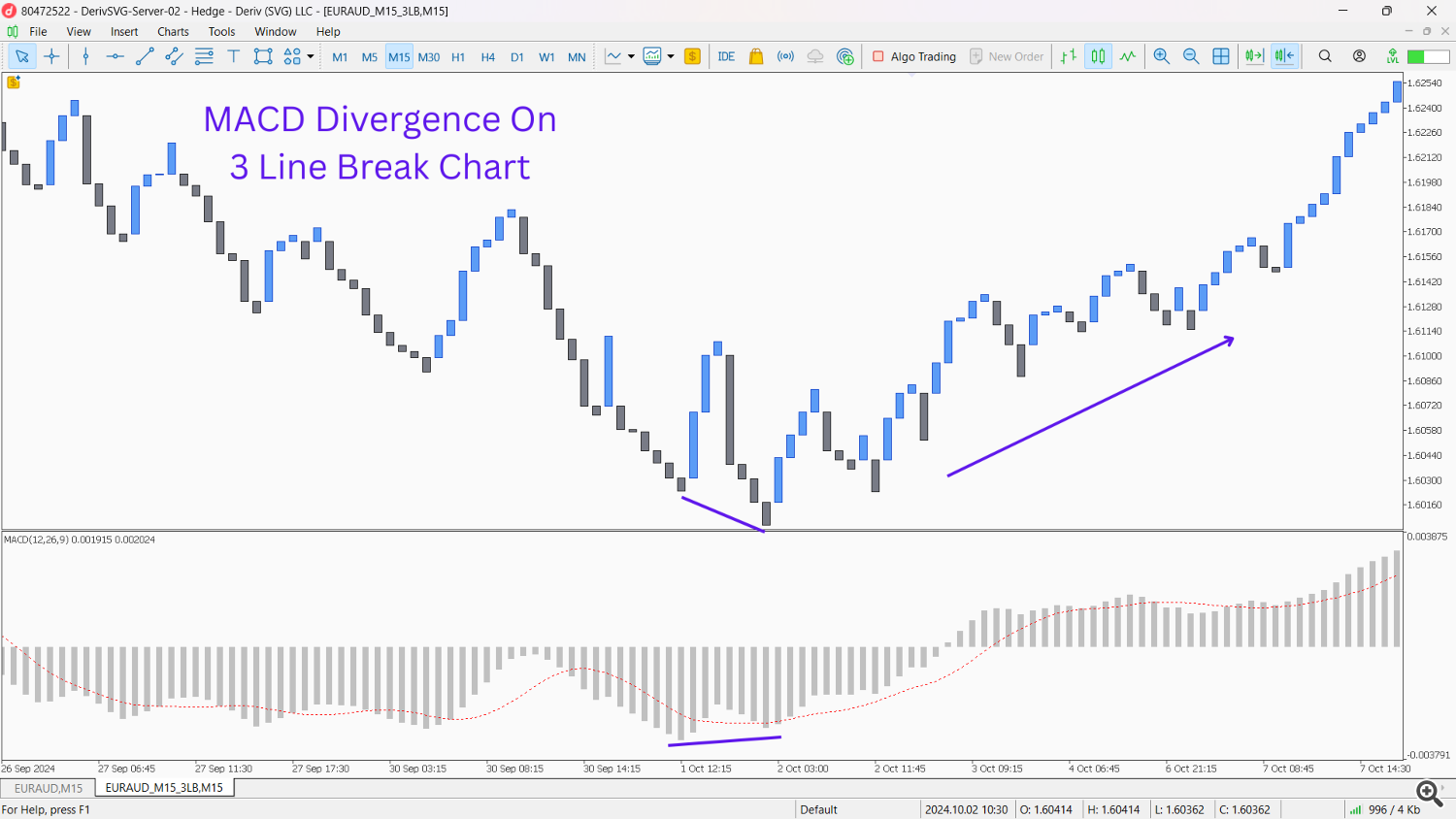

- Line Break & MACD Divergence (on Line Break Chart):

- Setup: Apply the Shifting Common Convergence Divergence (MACD) indicator (e.g., 12, 26, 9) to your Line Break Chart.

- Entry: Search for basic bullish divergence: Line Break Chart makes a decrease low, however MACD makes a better low. This means weakening bearish momentum and a possible bullish reversal. For bearish divergence: Line Break Chart makes a better excessive, however MACD makes a decrease excessive.

- Affirmation: A powerful opposing Line Break candle forming after the divergence confirms the reversal.

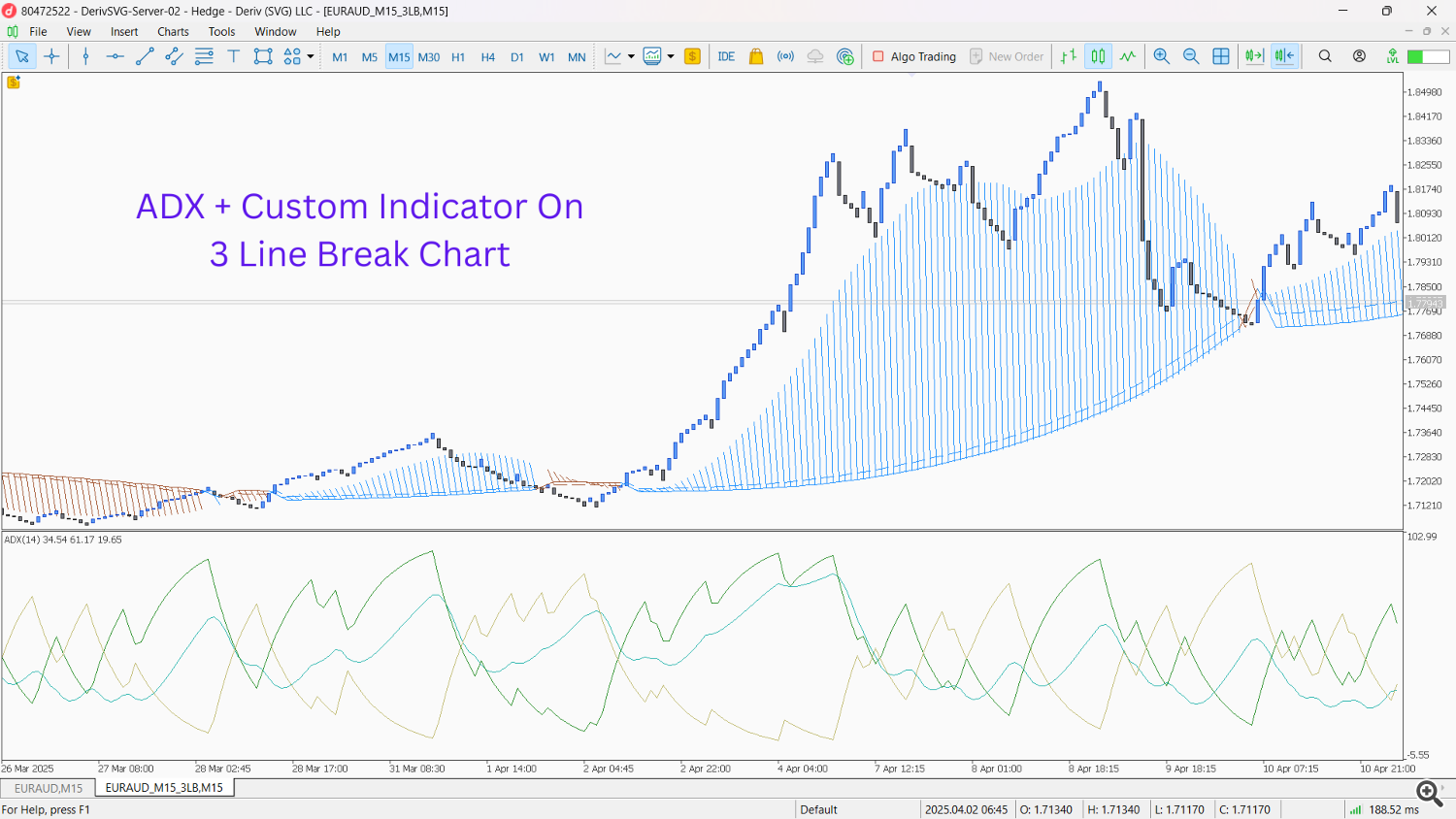

- Line Break & Common Directional Index (ADX) Development Exhaustion (on Line Break Chart):

- Setup: Apply the ADX indicator (e.g., 14-period) with its +DI and -DI strains to your Line Break Chart.

- Entry: When the ADX line (representing development energy) on the Line Break chart may be very excessive (e.g., above 60-70), it suggests the present development is turning into exhausted. Search for a subsequent opposing Line Break candle to kind, particularly if the +DI and -DI strains are beginning to cross within the course of the potential reversal.

- Affirmation: A excessive ADX adopted by a transparent Line Break reversal typically indicators a major turning level.

Conclusion: Embrace the Readability

Line Break Charts supply a novel and highly effective solution to view market dynamics, stripping away temporal noise and highlighting true value momentum. Whereas MetaTrader 5’s lack of native assist presents an preliminary hurdle, using a devoted Professional Advisor can unlock the complete potential of those charts, permitting merchants to overlay their favourite indicators straight onto the filtered value motion.

Rule of Thumb: Whereas Line Break Charts excel at clarifying developments and decreasing noise, do not forget that they inherently filter out minor value fluctuations and don’t present each single market motion. Due to this fact, at all times train warning when planning trades and take into account combining Line Break evaluation with a broader market context or larger timeframe evaluation to achieve a extra full understanding of volatility and value motion.

By understanding the historic context, appreciating the important distinction between precise candles and mere overlays, and exploring each bare and indicator-assisted methods, merchants can considerably improve their analytical edge. I encourage you, the reader, to obtain or create an EA for Line Break Charts, experiment together with your beloved indicators, and observe how they behave on these refined charts. You may simply uncover fully new methods and insights that rework your buying and selling strategy. Good luck, and completely satisfied charting!

Trial Vs Professional Model

|

Trial |

Professional |

|

Fastened Historic Knowledge |

Limitless Historic Knowledge |

|

No Market E-book Replace |

Market E-book Replace |