A pointy rise in crypto liquidations is sending a louder message of how some merchants are utilizing extra leverage in latest months.

Associated Studying

Common day by day wipeouts have jumped from roughly $28 million in lengthy bets and $15 million in shorts over the last cycle to about $68 million lengthy and $45 million quick within the present cycle, based on a brand new Glassnode and Fasanara report. That shift has made single sell-offs way more violent.

Early Black Friday Shock

Reviews have disclosed that Oct. 10 was the clearest signal of the change. On that day, greater than $640 million per hour in lengthy positions had been liquidated as Bitcoin plunged from $121,000 to $102,000.

Open curiosity fell about 22% in lower than 12 hours, sliding from near $50 billion to $39 billion. Merchants felt the transfer quick. Positions had been closed out on a scale Glassnode referred to as one of many sharpest deleveraging occasions in Bitcoin’s historical past.

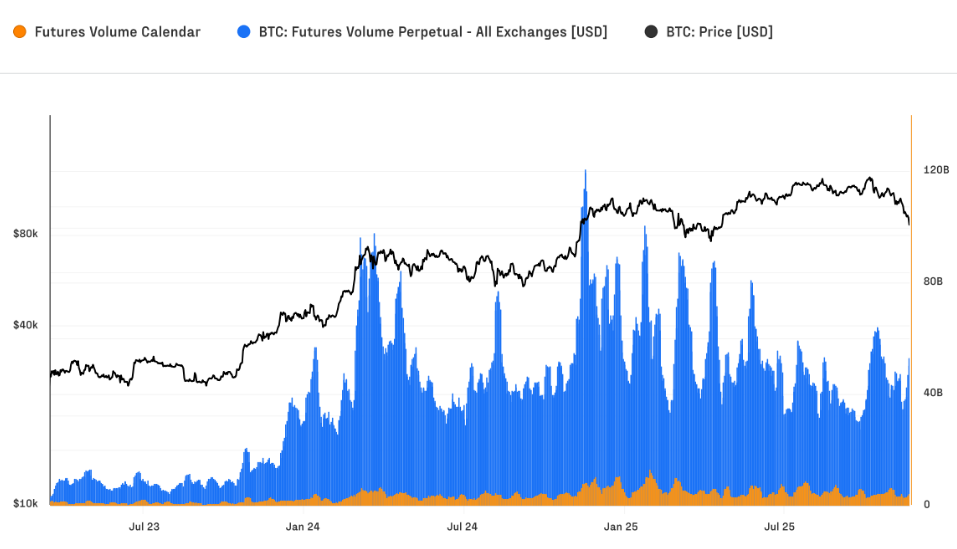

Futures Exercise Hits Information

Futures markets have swelled. Open curiosity climbed to a file $68 billion and day by day futures turnover topped $69 billion in mid-October.

Perpetual contracts now account for greater than 90% of that exercise, which concentrates threat in devices that reset repeatedly.

Common day by day futures wipeouts rising to $68 million lengthy and $45 million quick exhibits the prices when large swings happen.

Spot Buying and selling Doubles

Based mostly on studies, spot buying and selling has additionally turn out to be extra energetic. Bitcoin’s spot quantity has climbed into an $8 billion to $22 billion day by day vary, roughly double what was seen within the prior cycle.

In the course of the Oct. 10 crash, hourly spot quantity spiked to $7.3 billion, with many merchants stepping in to purchase the dip somewhat than run for the exits. That stream has helped shift the place worth discovery occurs.

Capital Flows And Market Share

Month-to-month inflows into Bitcoin have different from $40 billion to $190 billion, pushing realized market capitalization to a file $1.1 trillion.

Roughly $730 billion has flowed into the community for the reason that November 2022 low — greater than all earlier cycles mixed.

Because of this, Bitcoin’s share of total crypto market cap rose from 38% in late 2022 to 58% immediately, primarily based on the report’s figures.

Associated Studying

Bitcoin As Settlement Rail

In the meantime, there’s one other hanging stat: over the previous 90 days the Bitcoin community processed practically $7 trillion in transfers. That throughput exceeded what main card networks dealt with in the identical window.

This has been cited as a motive some individuals view Bitcoin not simply as a retailer of worth, however as an more and more vital settlement rail.

Bitcoin Value Motion

On the time of writing, Bitcoin was buying and selling at $93,165, up 6.5% and practically 7% within the day by day and weekly timeframes.

Featured picture from Unsplash, chart from TradingView