James Simons — mathematician, professor, and founding father of one of the vital profitable hedge funds in historical past.

His fund, Renaissance Applied sciences — notably its closed, algorithmic Medallion Fund — generated over $25 billion in internet income for buyers over three a long time. But Simons by no means relied on basic evaluation, technical indicators, or market forecasts.

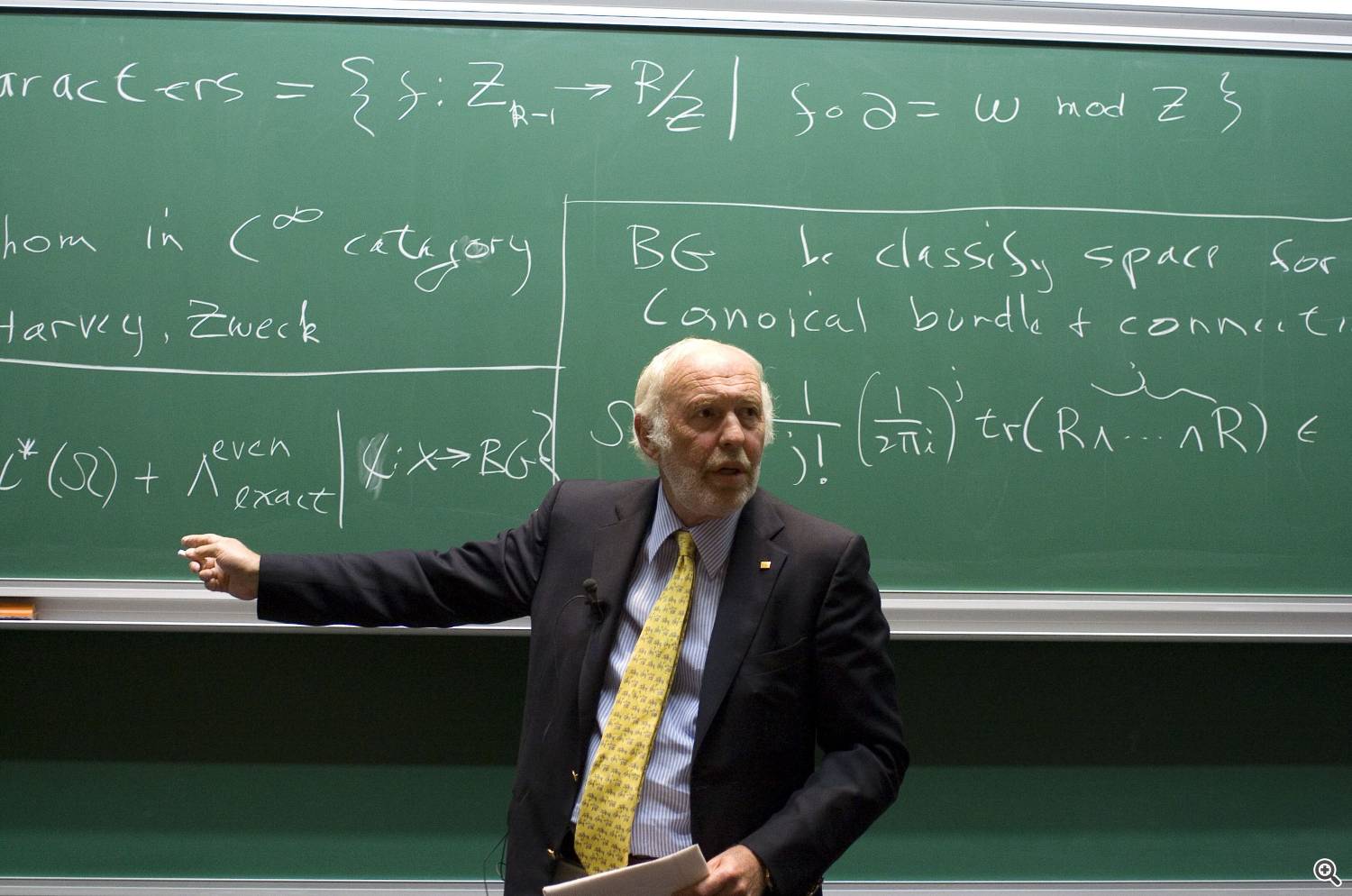

His path to monetary revolution didn’t start on a buying and selling flooring, however in a laboratory. Within the Sixties, he labored for the NSA, breaking Soviet codes in the course of the Chilly Conflict — an expertise that taught him to see hidden constructions the place others noticed solely chaos. Later, in protest in opposition to the Vietnam Conflict, he left intelligence work and returned to pure arithmetic, turning into a professor of geometry at Stony Brook. There, he solved a pivotal drawback in differential geometry — a discovery now enshrined in textbooks because the “Chen-Simons Theorem.”

But at age 44, with not a single day of buying and selling expertise, he concluded that markets weren’t economics — they had been arithmetic. In 1982, he based Renaissance Applied sciences and assembled a staff not of merchants, however of physicists, statisticians, cryptographers, and even astronomers. Not a single finance skilled. Their process was easy in phrases, unprecedented in apply: uncover hidden statistical patterns in historic value, quantity, and time-series knowledge — no matter their financial interpretation.

Medallion by no means tried to foretell the market. It sought arbitrage alternatives — tiny, fleeting imbalances between belongings lasting solely milliseconds. These indicators had been invisible to people, but detectable via superior machine studying fashions, cross-validation, and massive knowledge processing. The fund traded throughout all asset courses — from currencies and futures to bonds and equities — throughout all timeframes, from seconds to days.

Medallion’s methods had been so secretive that even workers had no entry to the total fashions. Every scientist labored on a single element of the system — like a lab the place nobody is aware of the entire experimental design. This was not secrecy for management; it was a precept of scientific rigor: to keep away from overfitting, emotion, and bias, the method needed to be damaged into remoted, testable parts.

The outcome? Medallion’s common annual return over 30 years exceeded 66% earlier than charges. Even throughout world crises — 2000, 2008, 2020 — the fund remained constantly worthwhile. This was not the product of luck or market timing. It was the end result of a scientific method: rejection of instinct, rigorous speculation testing, steady mannequin optimization on new knowledge, and the entire elimination of emotional selections.

Simons by no means revealed his methods, gave interviews about his strategies, or skilled merchants. His success was not rooted in secrecy — however in a basic rethinking of economic markets: they don’t transfer based mostly on information or sentiment, however obey hidden, recurring statistical patterns — if you know the way to measure them.

Immediately, James Simons stays one of many few who proved that most revenue on monetary markets just isn’t achieved via development evaluation, however via figuring out structural anomalies in knowledge — utilizing science, not instinct. His story just isn’t a fairy story about wealth, however an indication of how precision, self-discipline, and the scientific methodology can rewrite the principles of the sport.

And after amassing billions, he didn’t retreat into obscurity. By way of the Simons Basis, he has donated over a billion {dollars} to assist basic analysis in arithmetic, physics, and science.

Do you suppose an algorithm based mostly on statistical patterns can beat an skilled dealer? Share your ideas within the feedback.

When you’re occupied with how different legendary merchants approached the markets — via instinct, self-discipline, or techniques — you may learn my analytical profiles on:

Larry Williams — how $10,000 turned $1,100,000 via self-discipline;

Linda Raschke — Why Linda Raschke’s Guidelines Nonetheless Work Many years Later;

George Soros — How George Soros traded: the trades that made him $1 billion in a day.

When you desire ready-made technical options to handbook evaluation, I publish confirmed buying and selling instruments on my MQL5 channel, together with working indicators and skilled advisors for MetaTrader. These automated options are designed to establish high-probability setups based mostly on dependable market fashions: https://www.mql5.com/en/channels/trendscalper