What do pants and cease losses have in frequent? Little or no, really, however as Will Ferrell so hilariously demonstrates in this video on tight pants, they don’t seem to be the prettiest factor on the planet, in truth pants which are too tight can harm you. Cease losses which are too tight can even harm you, however in a a lot totally different approach, financially…

What do pants and cease losses have in frequent? Little or no, really, however as Will Ferrell so hilariously demonstrates in this video on tight pants, they don’t seem to be the prettiest factor on the planet, in truth pants which are too tight can harm you. Cease losses which are too tight can even harm you, however in a a lot totally different approach, financially…

I’m positive you already know that the place you place your cease loss is vital. Nonetheless, typically talking, wider cease losses are going to result in buying and selling success a lot sooner than tighter cease losses. In in the present day’s lesson, we’re going to focus on and see the significance of putting wider cease losses as an alternative of tighter ones.

After greater than 15 years of buying and selling and having talked with over 20,000 members of my value motion buying and selling group, it’s clear to me that many merchants can efficiently name the course of the market, nevertheless, they typically get stopped out of their trades approach too quickly, typically proper earlier than the market reverses within the right course, sound acquainted???

The explanation this normally occurs is as a result of merchants place their cease losses too tight or too near the present market value. Thus…

In terms of cease losses, dimension issues…

Earlier than we actually get into the ‘meat’ of in the present day’s lesson, I simply have to say that tight cease losses have their place in some types of buying and selling and a few market situations. However, in the present day I need to deal with each day chart buying and selling and longer commerce maintain instances of days to weeks (place buying and selling), which is my foremost model of buying and selling and what has made me essentially the most cash over time.

I need to begin by discussing the truth that markets transfer a mean vary every day and week, it is a truth that’s mirrored by way of the ATR or common true vary indicator, which is one thing you’ll be able to apply to your charts within the metatrader 4 platform. When specializing in the each day or weekly charts, we want to pay attention to this ATR vary, primarily in order that we are able to be sure that our cease loss is positioned outdoors of it. It actually is mindless to have a cease loss inside this vary as a result of it means we danger being stopped out merely as a result of regular day-to-day fluctuations in value volatility.

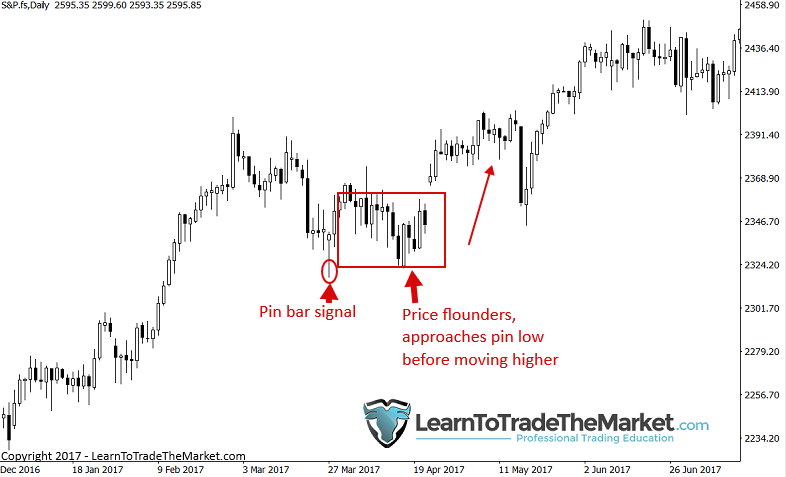

Within the chart instance beneath, we are able to see that:

- The ATR is bearing in mind a number of days of value motion, the final 14 on this instance. together with a number of days that have been properly over 100 pips. So, the ATR on the time of our entry provides us an excellent baseline variety of pips to ensure our cease loss is larger than. On this case, the ATR was about 100 pips on the time of the pin bar purchase entry in level 2.

- The pin bar sign at level 2 on the chart beneath had a variety of simply 75 pips – however an enormous mistake many merchants make is simply setting their cease loss at 75 pips – or the gap from the pin bar entry (close to the excessive possible) to the low. Since we all know the ATR is 100, we need to have a cease loss that’s higher than 100, ideally someplace between 100 – 150 pips, the broader the higher.

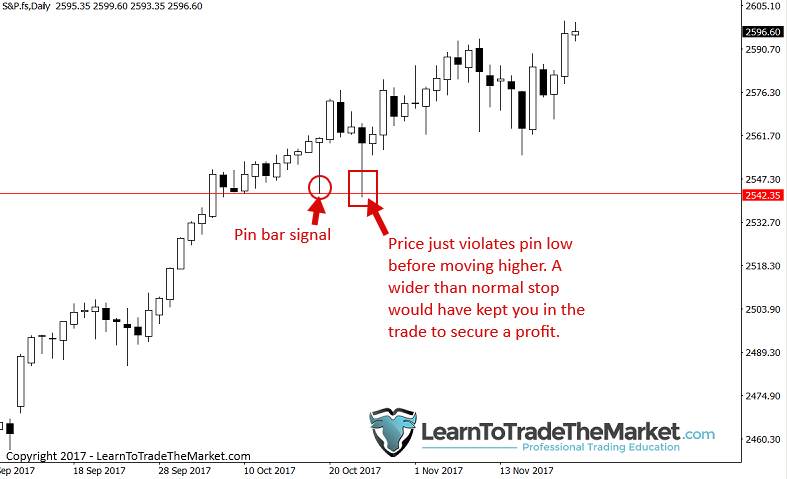

- You possibly can see at level 3 how this might have labored out – a wider than regular cease loss would have stored you on this commerce for a revenue, regardless of value violating the pin bar low briefly. THIS is the distinction between winners and losers in Forex.

The each day chart produces highly effective alerts, however as I say typically, trades take time to play out. So, if trades normally take time to play out in our favor, then if our cease is simply too tight we danger it being hit earlier than the sign begins to repay. Have you ever ever seen the market chop round for days or even weeks and even transfer down in direction of the cease stage after which rapidly snap again the opposite approach? It occurs rather a lot as you most likely know, and also you need to keep away from being stopped out prematurely when this occurs….

Shifting on, it’s vital we set our cease loss past areas or ranges on the chart that the professionals, like banks and bigger gamers, might attempt to squeeze us out of. This can normally present itself by a pointy transfer beneath the highs / lows of the tails of candles or key swing ranges. For instance, typically you will notice value simply barely violate the tail of a clear pin bar sign earlier than reversing again within the course of the pin bar commerce. Within the instance beneath we are able to see this, notice the pin bar after which the transfer decrease a number of days later, which might have stopped out many merchants for a loss simply earlier than shifting greater once more. For that reason, it’s good follow to place your stops outdoors of the ATR (as talked about above) and a secure distance past a pin bar’s tail, not merely one pip above or beneath.

Merchants typically place cease losses at arbitrary locations on the chart only for the sake of getting a cease in, with no actual rhyme or purpose to the place they positioned it. That is dangerous. A cease loss ought to ALWAYS be based mostly on logic and technique, i.e., an space or stage on the chart that nullified the commerce sign, reminiscent of, above or beneath the sign highs or lows or past a key chart stage reminiscent of horizontal resistance, a swing level or perhaps a shifting common.

With a wider cease loss, you’ll not solely keep in good trades and never get stopped out earlier than they transfer in your favor, however additionally, you will give the market an opportunity to provide you an actual exit sign reasonably than being taken out of the commerce at an arbitrary level.

By doing this, we obtain 2 issues: One, the market has room to maneuver and Two, the market has loads of area to supply an opposing sign or sample that may lead us to exit the commerce with a smaller loss or perhaps a revenue.

Within the chart instance beneath, I’ve put the ATR on. It exhibits that on the time of the pin bar entry purchase sign, the ATR was close to 100 pips. As I stated earlier, you need your cease outdoors of the ATR, so on this case it might be a cease higher than 100 pips, which might have stored you on this commerce even after value violated the pin bar low. It went on to develop into a winner and even produced a counter-trend pin bar that you possibly can have used as an apparent exit level.

MYTH: One MYTH about bigger cease losses that I should be positive and dispel earlier than I finish in the present day’s lesson, is the parable that claims wider stops imply bigger losses. Many starting merchants suppose this and it’s just because they don’t perceive place sizing. You will want to modify place sizing of trades as you modify your cease loss, on this approach you retain your greenback danger fixed.

Conclusion

I hope that from in the present day’s lesson you’ll be able to clearly see the significance of wider cease losses over tight ones. It could sound cliché, however cease losses actually do make or break a dealer. A dealer who places extra time into his or her cease loss placement than their commerce entries is more likely to be a way more worthwhile dealer than those that simply briefly contemplate cease loss placement. A superb rule of thumb concerning danger administration and cease loss placement is: When unsure (whether or not it’s a few commerce entry or the place to position a cease or place dimension) elect for LESS contracts and WIDER STOP.

Maybe essentially the most useful facet of wider stops is that they offer your trades time to play out, as most merchants are normally proper with the market course however improper on cease losses. That means, the more room you give a commerce (wider stops) the extra time you might be giving the market to doubtlessly play out in your favor. There’s nothing worse than being proper in regards to the market however improper in your cease loss placement, leading to a loss that ought to have been a win!

Any dealer on the market who has been across the block for any vital interval will let you know that commerce entry and commerce administration go collectively to kind a profitable long-term buying and selling method. The ‘wheels’ will fall off the wagon for those who neglect one or the opposite. Cease loss placement doesn’t should be annoying, if something, it ought to cut back your stress as a result of for those who do it accurately you’ll be able to go about your each day enterprise with out worrying about each up and down tick of the market.

My programs deal with not solely discovering commerce entries however far more, together with putting stops and goal ranges to handle danger / reward successfully and the right way to convey all of it collectively right into a complete buying and selling plan. My method to buying and selling is to simplify, however not only for the sake of simplicity, it’s primarily as a result of easy is healthier concerning all points of buying and selling and it’s what results in worthwhile buying and selling. From commerce entries to cease loss placement, danger administration and psychology, the easy, minimalistic method is what works.

PLEASE LEAVE A COMMENT BELOW & GIVE ME YOUR FEEDBACK…

Any questions or need to discuss ? Contact me right here.