KEY

TAKEAWAYS

- The broader inventory market indexes break their two day profitable streak.

- Gold costs hit a brand new all-time excessive.

- European shares are in a stable uptrend.

Tuesday’s inventory market motion marked a reversal in investor sentiment, with the broader indexes closing decrease. The S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Common ($INDU) are nonetheless beneath their 200-day easy transferring common (SMA). Investor anxiousness is elevated forward of the Fed’s end result of its two-day coverage assembly. The chance-off sentiment is again, with gold and silver costs rallying. However it could not all be as a result of risk-off mode, as decrease US Treasury yields and the decrease US greenback could have additionally performed a task within the valuable steel rally. The SPDR Gold Shares (GLD) hit a brand new all-time excessive and silver costs are on the rise.

Tuesday’s inventory market motion marked a reversal in investor sentiment, with the broader indexes closing decrease. The S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Common ($INDU) are nonetheless beneath their 200-day easy transferring common (SMA). Investor anxiousness is elevated forward of the Fed’s end result of its two-day coverage assembly. The chance-off sentiment is again, with gold and silver costs rallying. However it could not all be as a result of risk-off mode, as decrease US Treasury yields and the decrease US greenback could have additionally performed a task within the valuable steel rally. The SPDR Gold Shares (GLD) hit a brand new all-time excessive and silver costs are on the rise.

Expertise and client discretionary had been Tuesday’s worst-performing sectors, whereas Vitality and Well being Care took the lead however rose modestly. General, it was a reasonably crimson day for U.S. equities (see the StockCharts MarketCarpet beneath).

FIGURE 1. A SEA OF RED. Tuesday’s StockCharts MarketCarpet was a sea of crimson with specks of inexperienced within the Vitality and Well being Care, Actual Property, Supplies, and Industrials sectors.Picture supply: StockCharts.com. For academic functions.

The Magazine 7 Unwind

The mega-cap, Magazine 7 shares stand out strongly in Tuesday’s MarketCarpet. The every day chart of the Roundhill Large Tech ETF (MAGS) beneath reveals how these shares are in a steep fall. The ETF fell beneath its 50-day SMA and struggled to retain its place above it. The autumn from the 50-day to the 200-day SMA was like an elevator trip down. MAGS managed to search out a bit resistance at its 200-day SMA, however that was short-lived.

FIGURE 2. ROUNDHILL BIG TECH ETF (MAGS) SLIDES BELOW 200-DAY MOVING AVERAGE. After sliding beneath its 50-day SMA, MAGS fell exhausting and continued sliding because it broke beneath the 200-day SMA.Chart supply: StockCharts.com. For academic functions.

The rise in quantity after MAGS fell beneath its 200-day SMA suggests there’s much more promoting than shopping for. The relative energy index (RSI) is hovering above 30, which suggests it is not oversold but. So there’s an opportunity MAGS might fall decrease, though it might reverse earlier than dipping into oversold territory.

Worldwide Markets

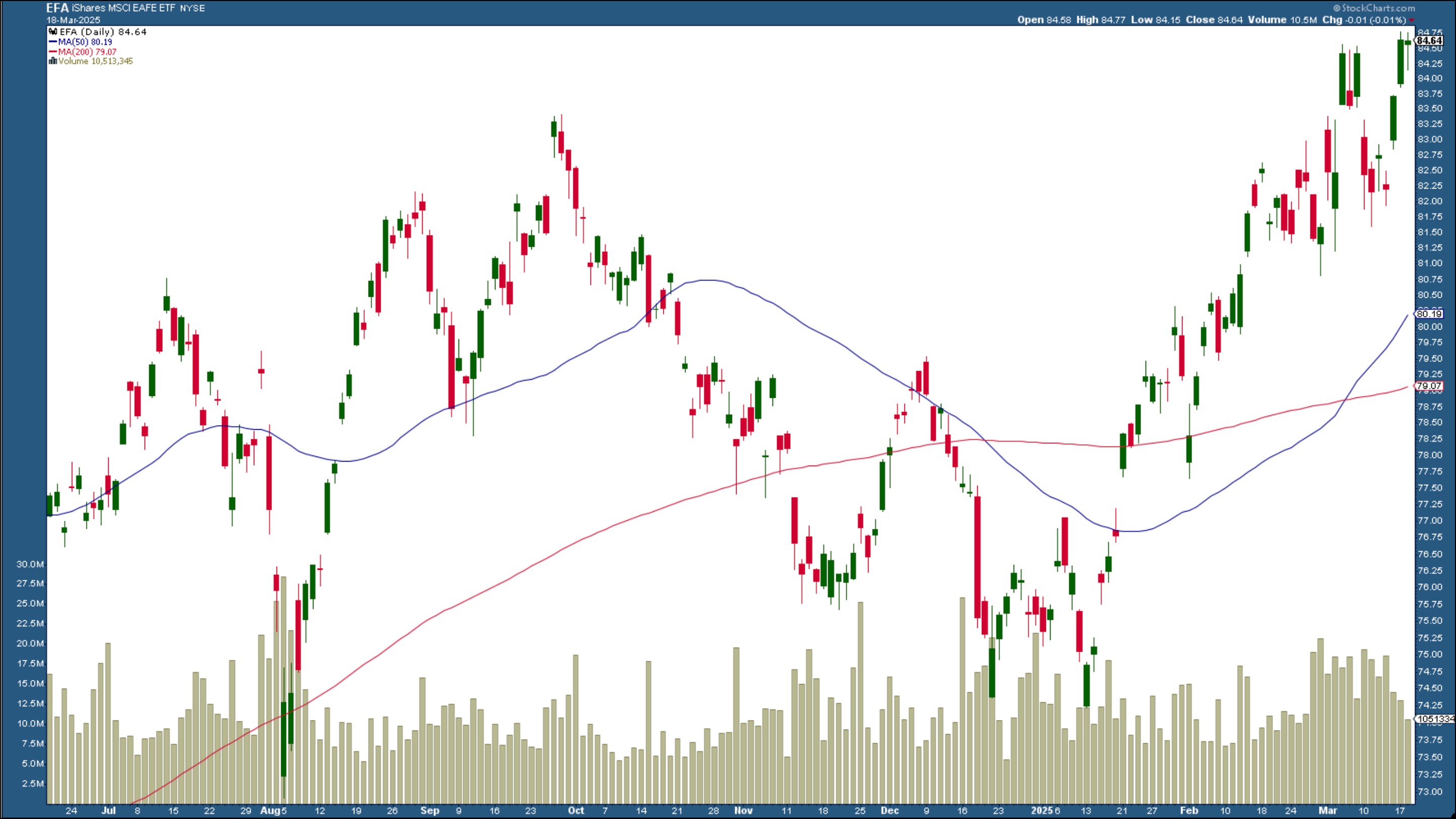

In the meantime, the iShares China Giant-Cap ETF (FXI), iShares MSCI Germany (EWG), iShares MSCI Italy ETF (EWI), and different European inventory ETFs are rising. The every day chart of the iShares MSCI EAFE ETF (EFA), which has its high 10 holdings in European firms, is hitting all-time highs (see beneath).

FIGURE 3. DAILY CHART OF ISHARES MSCI EAFE ETF. European shares have been rising since early 2025. The 50-day SMA has crossed above the 200-day and worth is properly above the 50-day SMA.Chart supply: StockCharts.com. For academic functions.

With elevated tariff uncertainty, a slowdown within the U.S. financial system, and declining U.S. client confidence, it should not be stunning to see buyers diversifying their holdings throughout totally different asset teams. This reiterates the significance of getting a diversified portfolio unfold throughout totally different sectors, valuable metals, worldwide shares, and bonds.

The Closing Bell

Tuesday’s reversal after a two-day profitable streak suggests investor uncertainty stays outstanding. The Federal Reserve coverage assembly ends on Wednesday. Chairman Powell’s press convention is the primary occasion to hearken to on Wednesday, however actually, any headline might rock the markets in both route. The perfect you are able to do is keep diversified.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra