Each month, monetary groups race in opposition to time – reconciliations, approvals, and experiences! The month-end shut can usually really feel like Groundhog Day, with groups working time beyond regulation to course of tons of of invoices, match numerous transactions, and catch any uncommon entries earlier than they develop into issues.

At present’s companies cannot afford to function in month-to-month cycles anymore.

That is why Sage Intacct, one of many main cloud monetary administration programs, has been incorporating AI options into their platform. With additions like Sage Copilot and GL Outlier Assistant, the corporate hopes to assist finance groups break away from the month-to-month shut lure and transfer towards steady, real-time monetary administration.

On this information, I’ll take you thru Sage’s completely different AI options and the right way to broaden Sage’s AI capabilities.

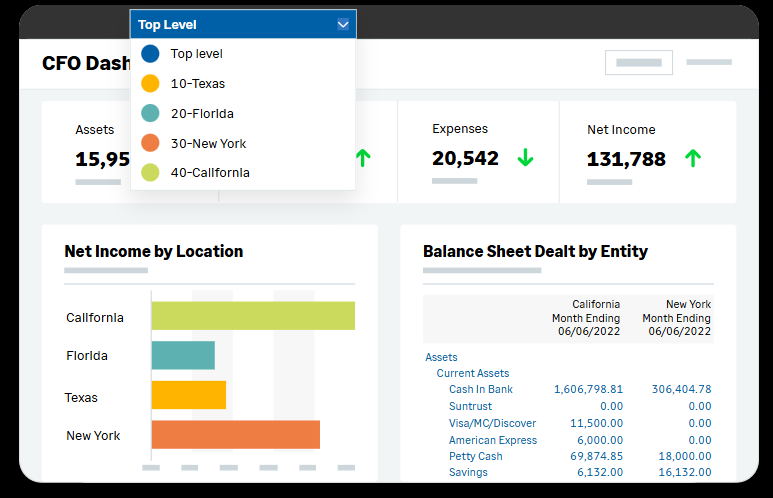

Sage Intacct AI: Native options defined

The way forward for accounting is not about sooner month-to-month closes. The main focus is steadily shifting to eliminating closing cycles. At the very least this has been the driving drive behind Sage’s latest updates.

The goal is to have AI continually monitor your monetary information, catching points earlier than they develop into issues and automating routine duties in real-time. Extra of steady accounting quite than periodic sprints.

Let me stroll you thru Sage’s native AI options:

1. GL Outlier Assistant

It’s an AI-powered system that displays transactions in your normal ledger for anomalies and potential errors. The concept is to forestall errors from impacting monetary statements by catching them at entry, quite than throughout month-end reconciliation.

The way it works:

- Opinions transactions in opposition to historic patterns

- Makes use of customizable thresholds primarily based on enterprise guidelines

- Routes suspicious entries again to those that submitted it

- Learns from corrections to enhance accuracy

For instance, in the event you mistakenly enter a month-to-month provide cost of $500 as $5,000, the system flags it instantly for correction, stopping downstream reconciliation points.

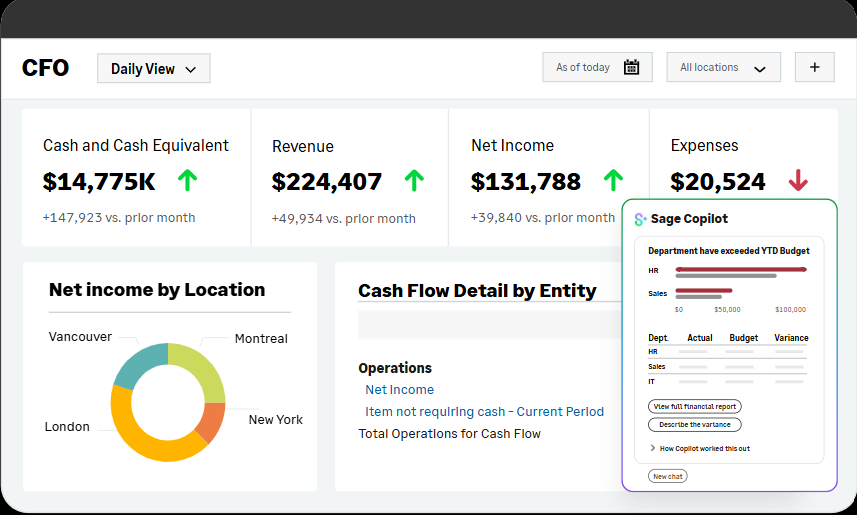

2. Sage Copilot

A few of you’ll have used Microsoft’s Copilot or at the very least seen it. Properly, now Sage too has a Copilot. It’s principally an AI assistant that automates monetary evaluation, reporting, and routine duties. It hopes to scale back time spent on guide monetary evaluation and report creation.

You need to use it to:

- Evaluate budgeted versus precise figures in real-time

- Get fast solutions to monetary queries by means of conversational search

- Streamline month-end shut processes

- Automate approval workflows and reconciliations

Say it’s essential to examine finances variances for this quarter. Now you’ll be able to merely ask Sage Copilot to provide the variations between budgeted and precise figures. You possibly can go a step additional and ask the place the numerous variances are. It would assist you to drill down into particular transactions.

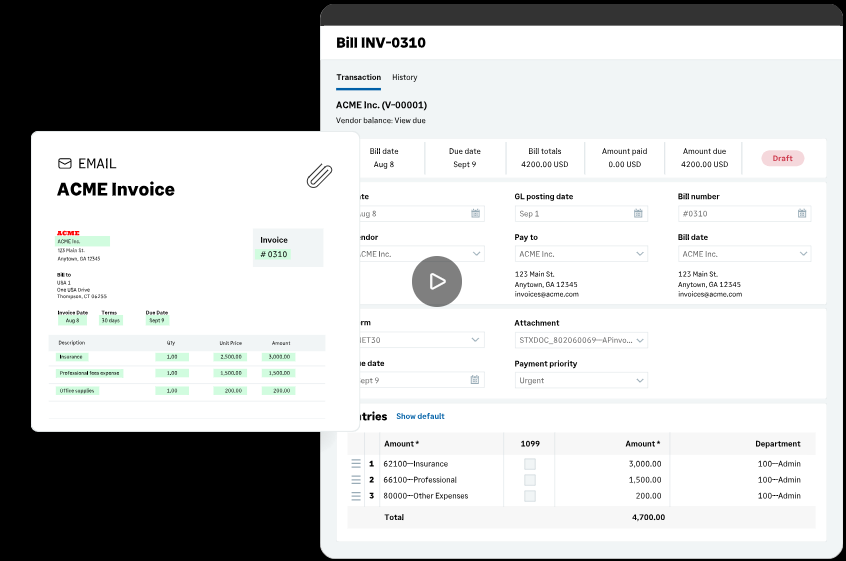

3. AP invoice automation

That is Sage’s native resolution for dealing with invoices. It goals to scale back the time your group spends on guide information entry and bill processing.

The way it works:

- Add payments immediately or ahead them to a devoted electronic mail tackle

- System creates draft payments utilizing AI to extract bill information

- Matches data in opposition to your chart of accounts

- Routes payments by means of your approval workflow

- Posts authorised payments mechanically to your GL

For instance, once you obtain an bill by way of electronic mail, you’ll be able to ahead it to your devoted Sage electronic mail tackle. The system reads the bill, creates a draft invoice with the seller particulars, quantity, and line objects already crammed in. You simply have to overview the small print and approve.

Now these native AI options from Sage Intacct could assist you to take first steps towards steady accounting. Nevertheless, you could quickly discover out that you just want extra complete automation. They work properly for fundamental bill processing and anomaly detection, however dealing with complicated AP workflows, managing a number of enter sources, or coping with various doc codecs usually requires extra capabilities.

That is the place integration options like Nanonets are available. Let me present you the right way to broaden Sage’s AI capabilities to deal with extra complicated monetary workflows.

[Image source: Sage’s official website]

The best way to broaden Sage’s AI capabilities

Nanonets is an Clever Doc Processing platform that integrates immediately with Sage Intacct. Whereas Sage’s native options deal with fundamental automation, Nanonets takes it additional by processing any sort of monetary doc and establishing automated workflows.

Let me present you the way Nanonets AI might help broaden your automation capabilities:

1. Automated doc import

The primary problem in any AP course of is doc consumption. Nanonets gives many add choices, permitting you to mechanically course of and add extracted information to Sage Intacct.

- Robotically captures invoices from electronic mail inboxes

- Screens particular folders in Google Drive, Dropbox, or your inside programs

- Accepts any doc format — PDFs, JPGs, PNGs, scanned paperwork, and handwritten paperwork

- Handles a number of doc sorts — invoices, buy orders, receipts, packing slips

You possibly can even use API integrations to mechanically feed paperwork out of your current programs immediately into the processing workflow. This ensures all monetary paperwork are captured and processed persistently, no matter their supply or format.

2. Clever information extraction and processing

As soon as paperwork are within the system, the following step is information extraction. That is the place Nanonets’ superior AI-OCR capabilities come into play.

You get to decide on between completely different AI fashions primarily based in your wants:

- Zero-shot fashions that work instantly with out coaching

- Instantaneous Studying fashions that adapt to your corrections in real-time

- Pre-built fashions for normal paperwork like invoices

- Customized fashions for distinctive doc sorts or particular necessities

You possibly can customise how the AI reads your paperwork by offering clear descriptions for every area. For instance, as an alternative of merely labeling a area as “invoice_number”, you’ll be able to specify “A singular alphanumeric identifier situated on the high proper, beginning with ‘INV-‘ adopted by 8 digits.”

The system gives subtle information extraction:

- Extracts information from any doc with excessive accuracy, no matter format or construction

- Processes each single-value fields (like bill numbers) and repeating information (like line objects)

- Acknowledges and matches vendor particulars together with your Sage information mechanically

- Learns from person corrections to repeatedly enhance accuracy

- Validates extracted information in opposition to predefined guidelines and flags discrepancies

Within the above GIF, you’ll be able to see how the AI immediately extracts customary fields and matches vendor names in opposition to your Sage vendor listing. You additionally get a dropdown to confirm or alter matches when wanted.

For line objects, it captures all particulars in structured tables and mechanically maps every line to your Sage GL accounts. You possibly can overview and alter these mappings by means of dropdowns, guaranteeing your information is validated earlier than it reaches your accounting system.

The AI mannequin builds understanding by means of context, not simply textual content recognition. When processing an bill, it:

- Distinguishes between completely different tackle sorts (billing vs delivery)

- Separates header data from line objects

- Acknowledges numerous tax classes and calculations

- Maintains relationships between associated information factors

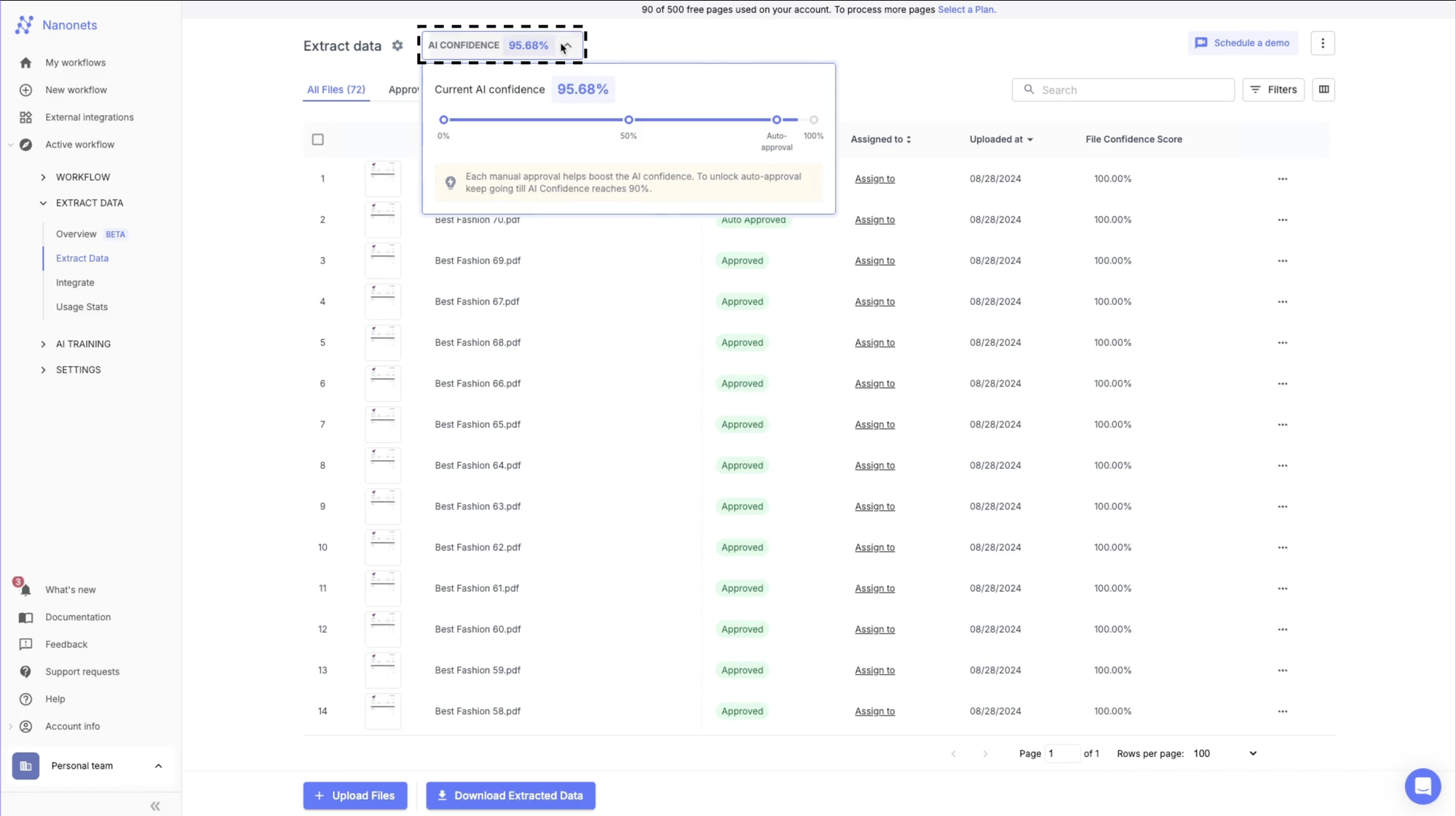

The system additionally tracks AI confidence ranges, exhibiting you precisely how dependable the extraction is for every doc. This helps you determine which paperwork want guide overview and which may be processed mechanically.

3. Automated GL coding and matching

Handbook coding of transactions and matching paperwork in opposition to buy orders are sometimes duties that no AP groups sit up for. They are often time-consuming and error-prone. That is the place Nanonets’ clever matching capabilities make a big distinction.

The system streamlines coding and matching by means of:

- Automated GL code ideas

- Good matching between invoices, POs, and receipts

- Actual-time validation in opposition to your corporation guidelines

- Customized routing for exceptions and discrepancies

- Steady studying out of your group’s corrections

You possibly can arrange completely different validation guidelines primarily based in your wants, like:

- Match line objects individually for detailed reconciliation

- Evaluate whole quantities for fast validation

- Test particular fields like tax charges or fee phrases

- Flag mismatches above sure thresholds

The influence may be important. It may scale back processing time, save time, scale back error charges, and dedicate extra time to exception dealing with. The system additionally maintains an entire audit path of all matches and exceptions, making it simpler to trace points and display compliance throughout audits.

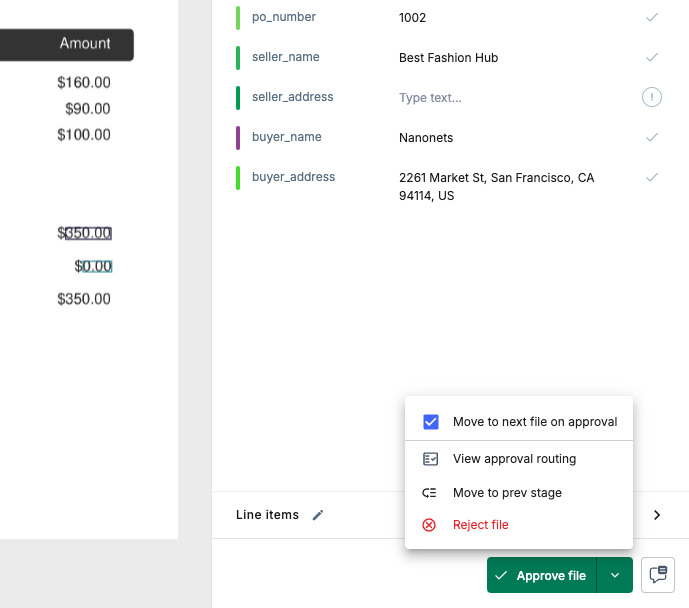

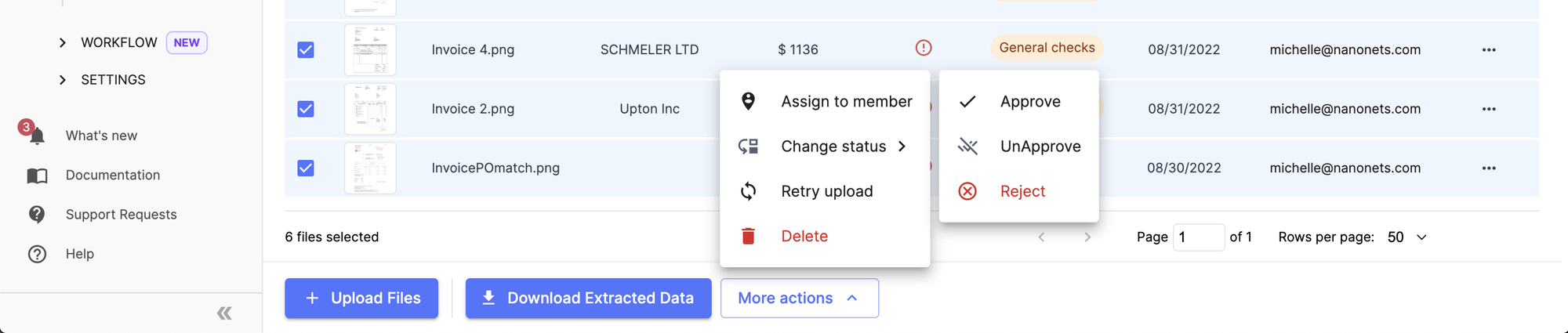

4. Approval workflows

Getting invoices authorised is commonly the place bottlenecks happen. You may need distributors chasing funds whereas invoices sit in somebody’s inbox ready for approval. Nanonets addresses this by means of clever workflow automation.

The system handles approvals by means of:

- Customized routing guidelines primarily based on quantity, vendor, or division

- Multi-channel notifications (electronic mail, Slack, Groups)

- One-click approvals from any gadget

- Automated reminders for pending objects

- Actual-time visibility into approval standing

You possibly can arrange approval workflows that match your corporation wants. For instance:

- Route invoices over $10,000 to senior administration

- Ship IT purchases to your IT group first

- Require a number of approvals for particular distributors

- Arrange parallel approvals for sooner processing

The system maintains an entire audit path of who authorised what and when, making it straightforward to trace duty and guarantee compliance together with your approval insurance policies.

5. Getting your information into Sage Intacct

As soon as paperwork are processed and authorised, it’s essential to get this information into Sage. Nanonets gives a number of methods to export your processed information:

- Obtain as CSV recordsdata for customized reporting

- Use APIs for customized workflow integration

- Direct sync with Sage

- Automated information compilation primarily based in your guidelines

The Sage Intacct-Nanonets devoted integration lets you:

- Create invoice information mechanically

- Sync vendor data in real-time

- Keep constant coding throughout programs

- Present detailed sync standing updates

- Use accomplice SenderID for seamless connectivity

The platform is designed for finance groups to handle independently, with out requiring technical experience.

Seems to be good on paper? Properly, let me share an actual instance of how an organization reworked their AP processes utilizing Nanonets’ AI-powered workflows.

Asian Paints, a number one producer of paints and coatings, automated their whole AP workflow utilizing Nanonets. Earlier than automation, their AP group spent hours manually processing invoices, matching paperwork, and updating their accounting system. Every doc took about 5 minutes to course of, and errors had been frequent regardless of their finest efforts.

After implementing clever automation:

- Processing time dropped to 30 seconds per doc

- Groups saved 192 hours month-to-month

- Accuracy improved considerably

- Employees may lastly concentrate on strategic duties

- Buyer satisfaction reached 8/10

The system begins delivering worth instantly with Zero Shot fashions, whereas Customized and Instantaneous Studying fashions enhance accuracy over time as they be taught out of your corrections.

What to do subsequent? In the event you’re seeking to minimize your bill processing time and save hours on AP duties, you’ll be able to schedule a personalised demo with us. We’ll present you precisely how Nanonets suits into your particular Sage Intacct workflows and assist automate your AP course of end-to-end.