In buying and selling, you get widespread questions like:

“What’s one of the best indicator to make use of?”

“What timeframe ought to I commerce on?”

These are all legitimate, however numerous guides are on the market to reply them.

In fact, the solutions get extra difficult when fascinated with how a lot cash it is advisable to begin buying and selling.

Why?

As a result of cash is private.

A cushty place to begin for one dealer is perhaps an enormous hurdle for an additional.

Some merchants could have $1,000 mendacity round, prepared to make use of.

Whereas others would battle to search out $500 for buying and selling.

That’s why on this information…

I’ll discover each the emotional and technical facets of beginning with a small buying and selling account in foreign exchange.

Particularly, you’ll study:

- A very powerful factor to know earlier than you begin reside buying and selling

- The first metric it is advisable to perceive when deciding how a lot to begin buying and selling

- How a lot must you begin with, relying on the timeframe you commerce

- The key to managing and rising a small buying and selling account

Excited?

Nice, so let’s get began!

Two issues you could have earlier than buying and selling a small buying and selling account in foreign exchange

Out of all of the issues I’ll discuss on this information, this is perhaps the toughest for you.

To start out reside buying and selling, you could have two issues:

- Appropriate expectations

- A buying and selling plan

Permit me to clarify…

1. Appropriate expectations

Let me share with you a fast story…

Once I first began buying and selling, I used to be unemployed.

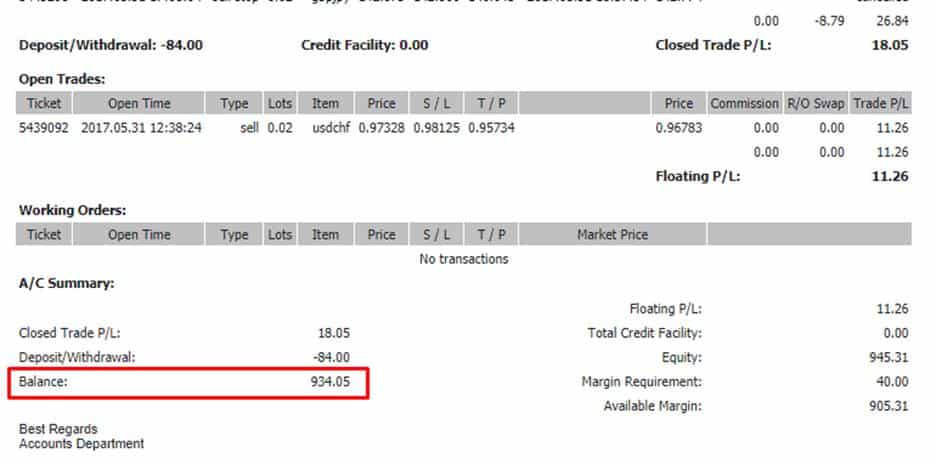

At the moment, I used to be privileged to be supported by my mother and father, buying and selling a $1,000 account…

However on the time, our household enterprise was failing.

And that $1,000 account contained greater than half of our household financial savings.

Are you able to see how all that is brewing into an ideal storm?

There are expectations…

There may be strain…

So, are you able to guess what occurs subsequent?

After three months, I misplaced half of that account…

I had the technique.

I had the chance administration.

However I didn’t have consistency or buying and selling psychology.

The basis trigger?

Flawed expectations!

As a result of right here’s the factor…

For those who see buying and selling:

- As a strategy to substitute your present revenue

- As a strategy to stop your job and commerce full-time

- As a strategy to repay your debt or needs

Then I’m afraid buying and selling isn’t for you.

Nevertheless…

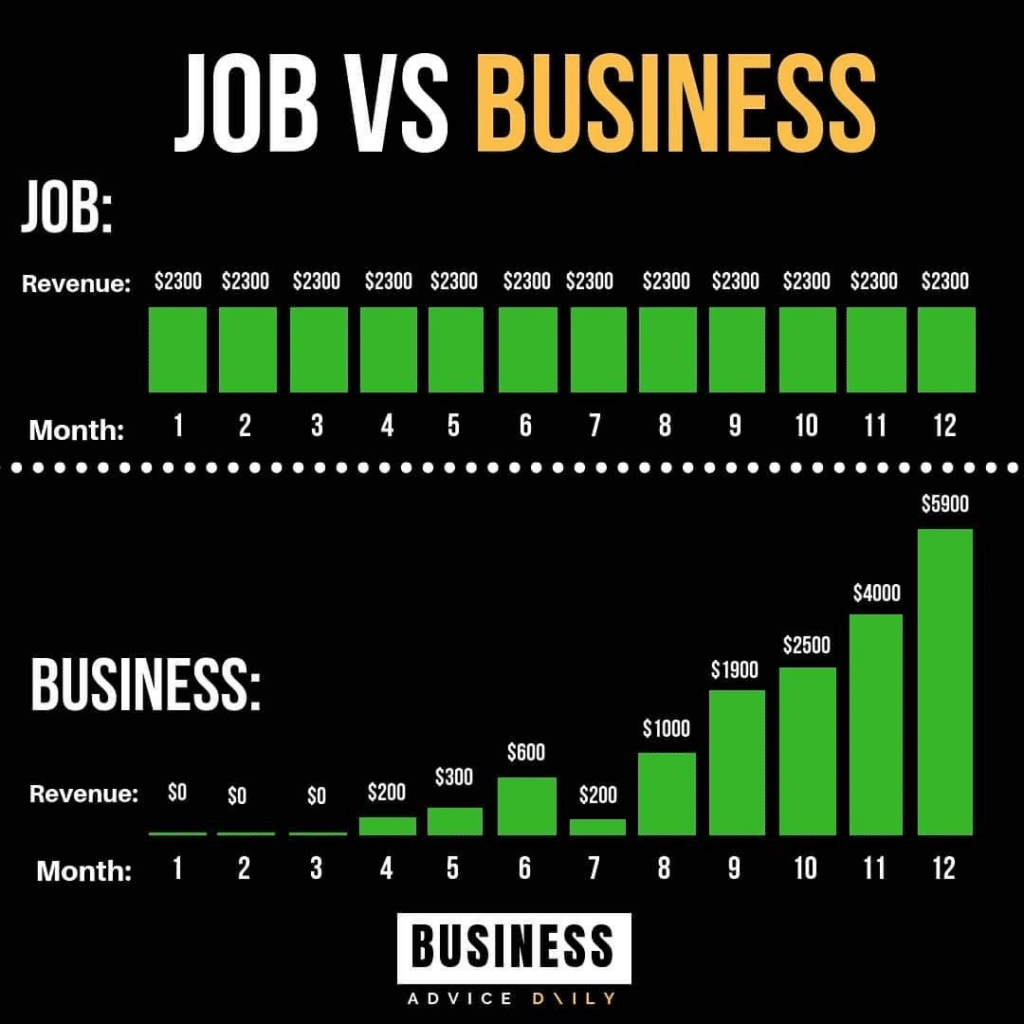

For those who see buying and selling as a enterprise as a substitute of a job, and as a strategy to develop your wealth in the long run, you then’re heading in the right direction.

What do I imply by that?

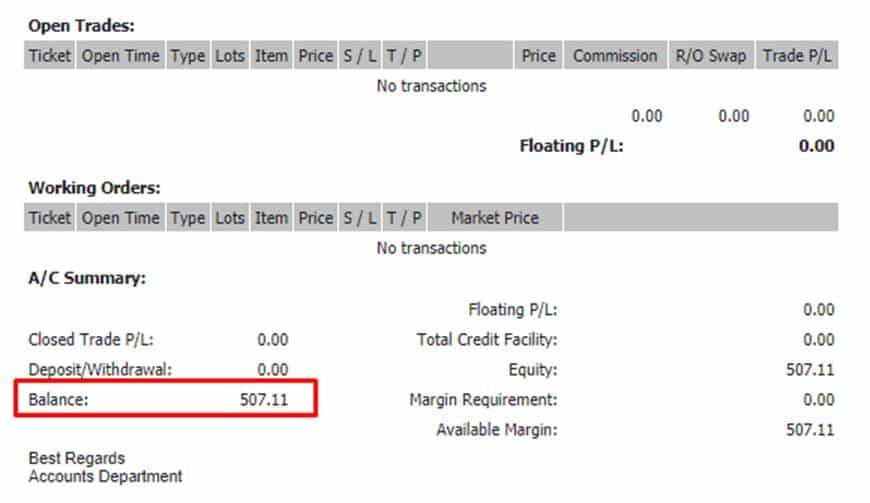

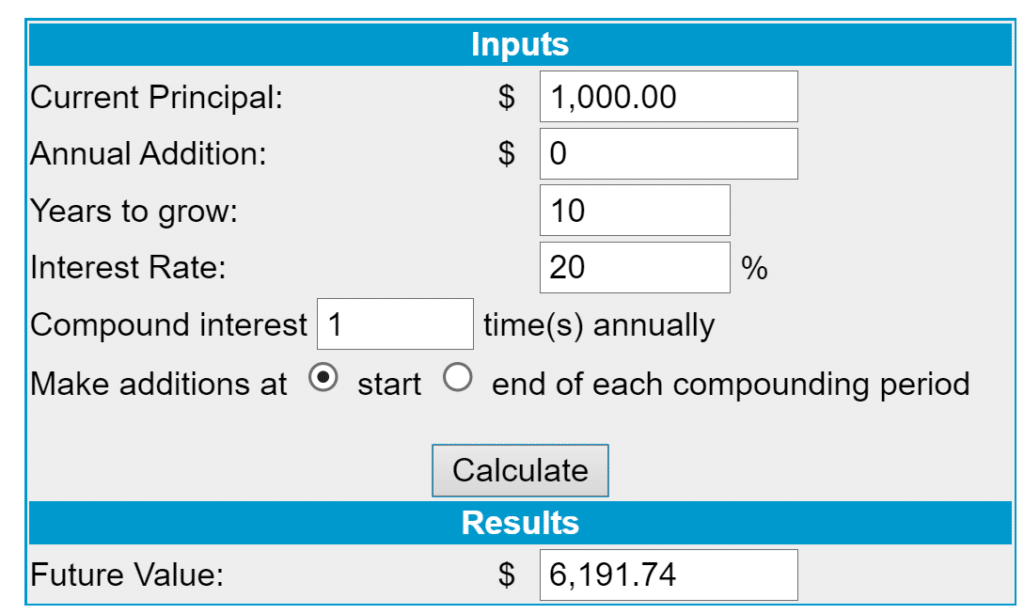

Let’s say that you’ve a technique that makes 20% a 12 months on common.

…and, that you simply begin buying and selling with $1,000 the identical method as I did…

In 10 years, that will develop to $6,000, as you possibly can see right here…

Positive, such a return gained’t change something drastically.

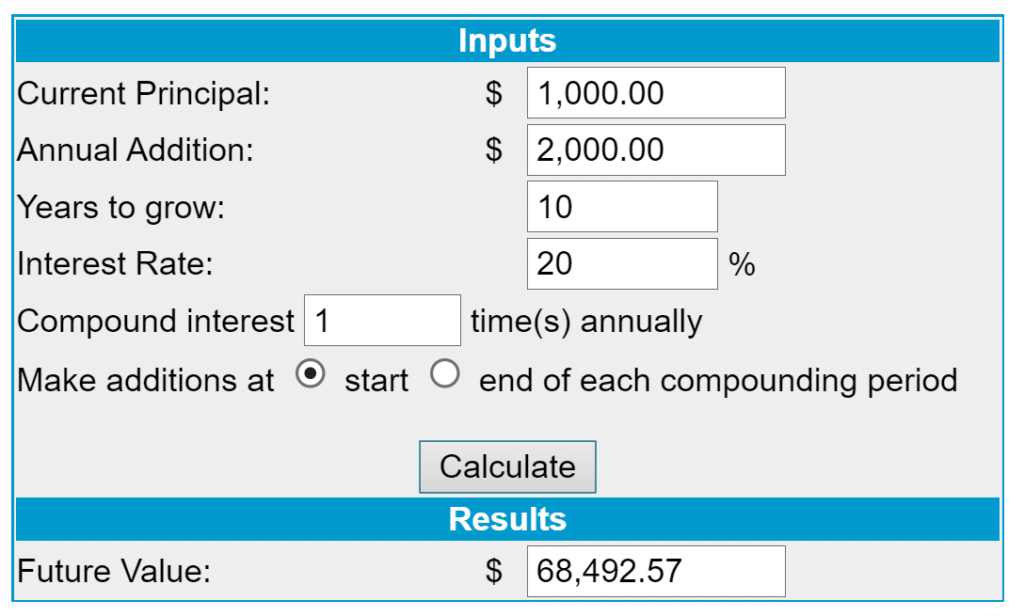

However when you achieve consistency and confidence in buying and selling, and also you begin including one other $2,000 into your account every year, for instance…

…then after 10 years, your account would develop to virtually $70,000!…

Now that’s one thing, proper?

So, in case you see buying and selling as a enterprise and one thing you propose to develop and compound in the long term to construct critical wealth…

Then, you’re heading in the right direction.

I do know that for some, ten years is just too lengthy.

However you’d be stunned at how a lot you possibly can obtain in even 3-5 years.

Bear in mind, that is solely the tip of the iceberg in relation to buying and selling psychology.

However these are the learnings that made the largest distinction on my buying and selling journey after that “incident” occurred 7 years in the past.

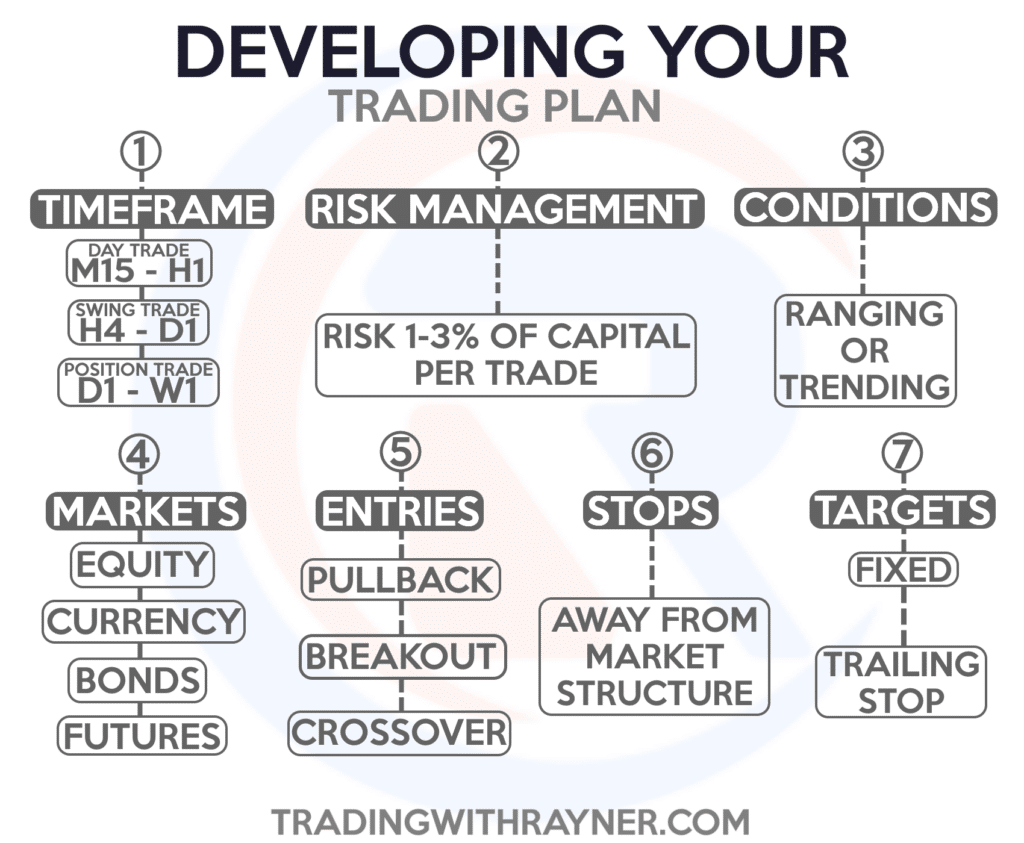

2. Buying and selling plan

Repeat after me:

“Buying and selling is a enterprise and never a job”

In order for you a greater grasp on what I imply, then check out this illustration under…

Supply: Enterprise Recommendation Every day

The extra you see buying and selling as a enterprise that may develop your wealth in the long run and never within the quick time period, the higher off you’ll be.

Nevertheless, in case you deal with buying and selling as a pastime or as playing, then the sooner you’ll lose cash within the short-term.

So, let me ask you, what does each enterprise have?

Appropriate, a marketing strategy!

And it’s the identical as buying and selling, you could have a buying and selling plan.

All that is one thing you could have earlier than you begin buying and selling.

However to offer you a tenet, right here’s one thing you should utilize…

If you wish to study extra about it, you possibly can take a look at this information right here:

Find out how to be a Worthwhile Dealer Throughout the Subsequent 180 Days

Now…

I do know that I’ve shared numerous data with you on this part.

However these ideas turned the catalyst that has saved me buying and selling and rising my account for over 7 years now.

And I imagine that these ideas will go a great distance whenever you begin with a small buying and selling account in Foreign exchange.

With that stated…

Let’s get to the technical facet of issues now, lets?

Small Buying and selling Account: What are lot sizes and why are they vital?

Once I first began buying and selling, I used to be launched to the inventory markets.

Because of this shopping for 100 shares and even 1,000 shares on some shares is regular.

Once I was launched to the foreign exchange markets, I created a demo account.

And now comes the twist…

I didn’t know what lot sizes have been!

So, my naive ass was considering again then:

“Eh, why not check the waters and enter 10 shares”

What occurred subsequent to my tiny $500 demo account?

It received obliterated!

I immediately received Margin referred to as!

As a result of I didn’t perceive that I used to be coming into with 1,000,000 items (10 heaps) and never 10 “shares.”

(Nicely, thank goodness it was on a demo account!)

So, to be sure to don’t endure the identical destiny, hold this “cheat sheet” in thoughts:

- 1,000 items (0.01 nano lot)

- 10,000 items (0.10 micro lot)

- 100,000 items (1.0 lot)

- 1,000,000 items (10 heaps)

Now, you is perhaps questioning,

“Alright, how is that this related to having a small buying and selling account in foreign exchange?”

Two phrases…

There are two methods to go about this.

First is danger administration with the protection mode on, and yet another superior, which might be very useful when you begin to scale up your buying and selling account.

So, let’s get began…

Danger administration: Security mode

The explanation why I’m calling this the protection mode is for many who need to get began as quickly as attainable in buying and selling.

Even in case you don’t have a buying and selling plan or in case you don’t know what the hell you’re doing.

So, you possibly can take into account this a “fool-proof” technique for not blowing your account as a newbie.

Sound good?

This security mode comes right down to what number of lot sizes you’ll enter per commerce relying in your account measurement.

So, when you’ve got an account measurement of:

- $500 to $1,000 then enter 0.01 lot per commerce

- $2,000 to $3,000 then enter 0.03 lot per commerce

- $5,000 to $7,000 then enter 0.07 lot per commerce

- $8,000 to $10,000 then enter 0.10 lot per commerce

This checklist is related in case you commerce the 4-hour and the every day timeframe.

However mainly, it is a generalization of how a lot lot measurement it is best to enter.

Within the later sections, I’ll share the precept behind the checklist with you and clarify how one can be extra versatile with it.

P.S. For those who commerce the decrease timeframes then multiply the lot sizes on the checklist by 1.5

Danger administration: Superior mode

There isn’t a query…

When you begin constructing your buying and selling plan, you will want to understand how and the place to position your cease loss.

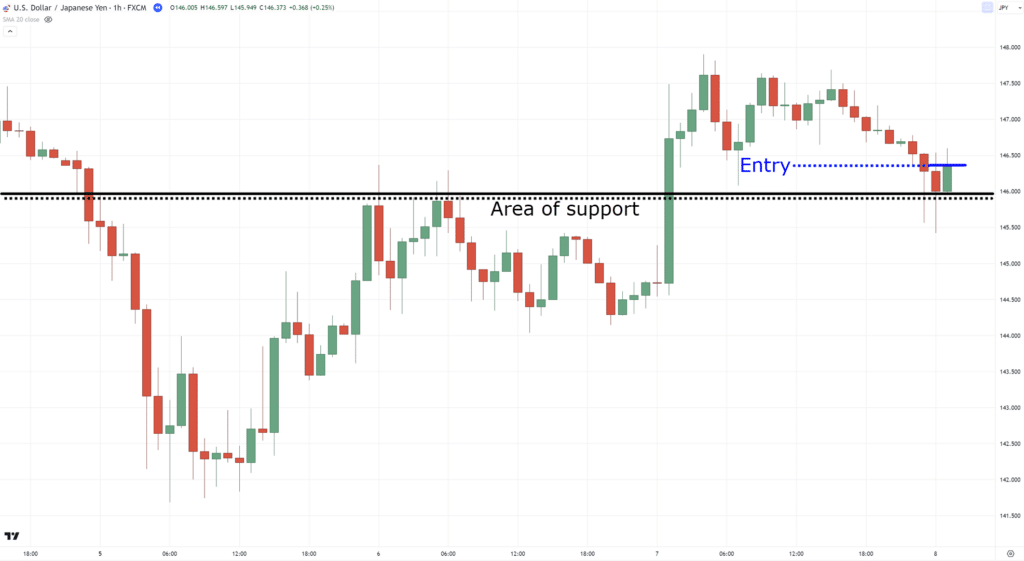

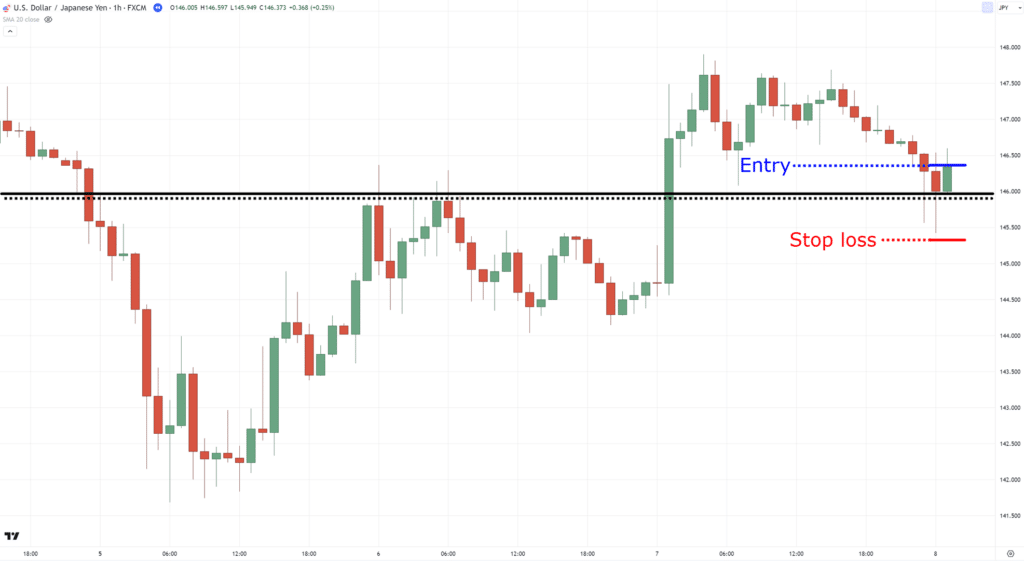

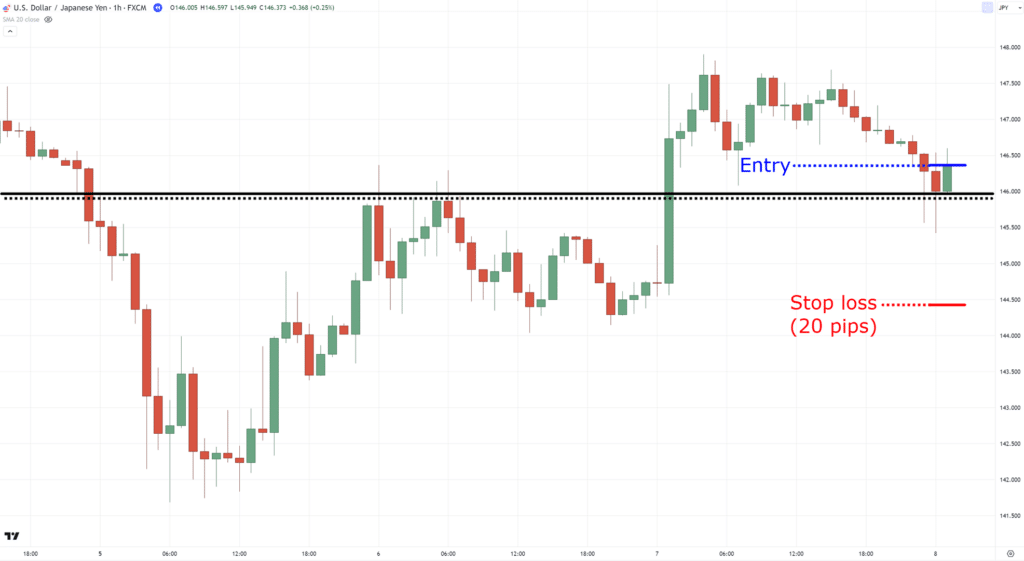

For example, let’s say that you’ve a pullback buying and selling setup within the space of assist…

And you then resolve to position your cease loss under the lack of assist…

The subsequent step is to measure the gap between your entry and the cease loss stage.

Now, if we have been buying and selling the inventory markets…

…then we’d measure when it comes to percentages.

However since we’re studying how you can go about managing a small buying and selling account in Foreign exchange…

…we measure based mostly on “Pips”…

The primary query that we are attempting to reply is:

“How can I danger a most of 1 p.c of my capital if the worth hits my cease loss?”

Fortunately, we have already got position-size calculators accessible for us to make your life simpler.

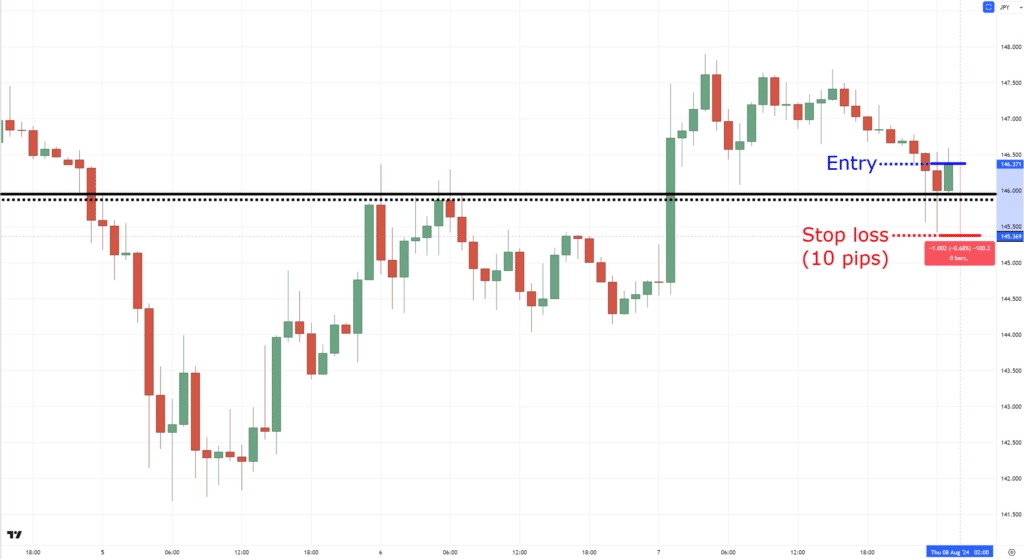

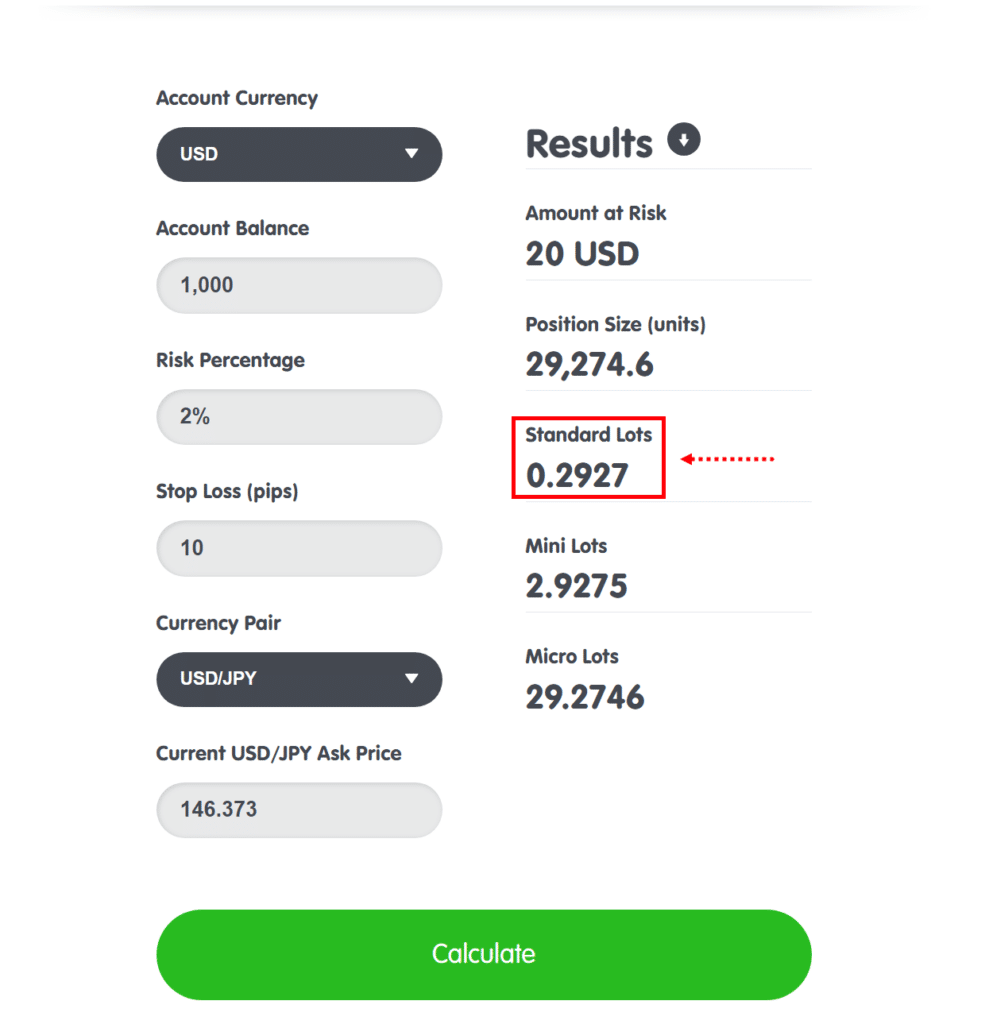

So, When you’ve got a $1,000 capital and also you need to danger 2% per commerce with a ten pip cease loss based mostly in your commerce…

What number of heaps must you purchase?

Nicely, if we plug within the numbers on our calculator right here…

Then it is best to enter 0.29 heaps on this commerce.

Because of this if the worth hits your cease loss, you’ll not lose greater than $20 on this commerce.

Now, what makes this proportion danger administration technique good is that even in case you change your cease loss worth, you possibly can nonetheless preserve your most danger per commerce.

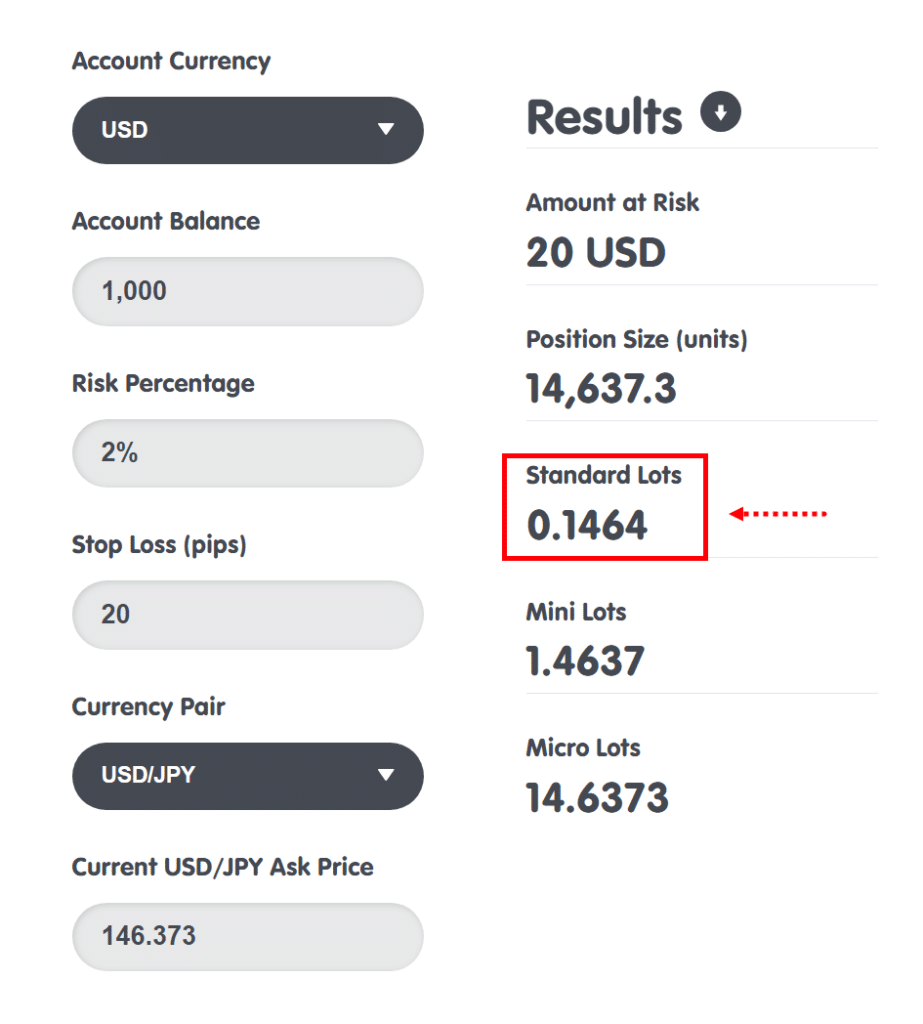

So for instance, if we go for a cease lack of 20 pips as a substitute, which widens your cease loss…

And also you’re nonetheless risking $20 on this commerce or 2% of your capital…

…in case you plug within the numbers on the calculator, you’re going to get this worth…

This implies in case you enter 0.14 heaps in your commerce with a cease lack of 20 pips…

You’ll not lose greater than $20 on this commerce if the worth hits your cease loss.

Your danger remains to be maintained!

Fairly cool, proper?

So, now that you understand essentially the most primary and superior strategy to handle your danger…

Within the subsequent part, I’ll give you full context on how a lot capital you actually need to begin buying and selling the foreign exchange markets.

And sure, the whole lot that you’ve realized up to now will make an enormous distinction in what you’re about to study subsequent!

How your small buying and selling account in foreign exchange is determined by your buying and selling type

This half is essentially the most “difficult” in relation to realizing how small your buying and selling account ought to be.

However the precept is that this:

The upper the timeframe you commerce, the broader your cease loss might be, due to this fact, the larger your capital ought to be.

I’ll present you an instance.

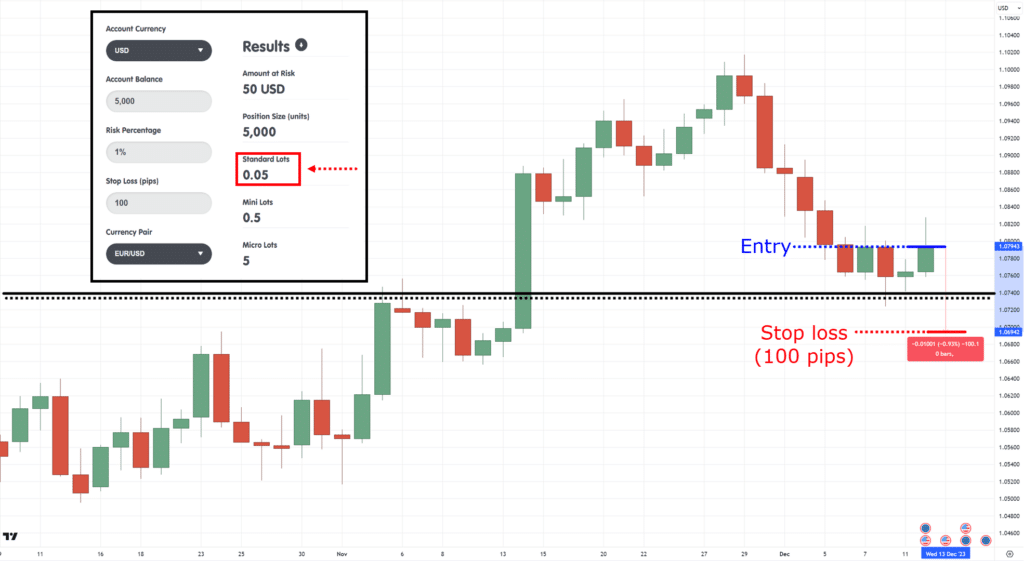

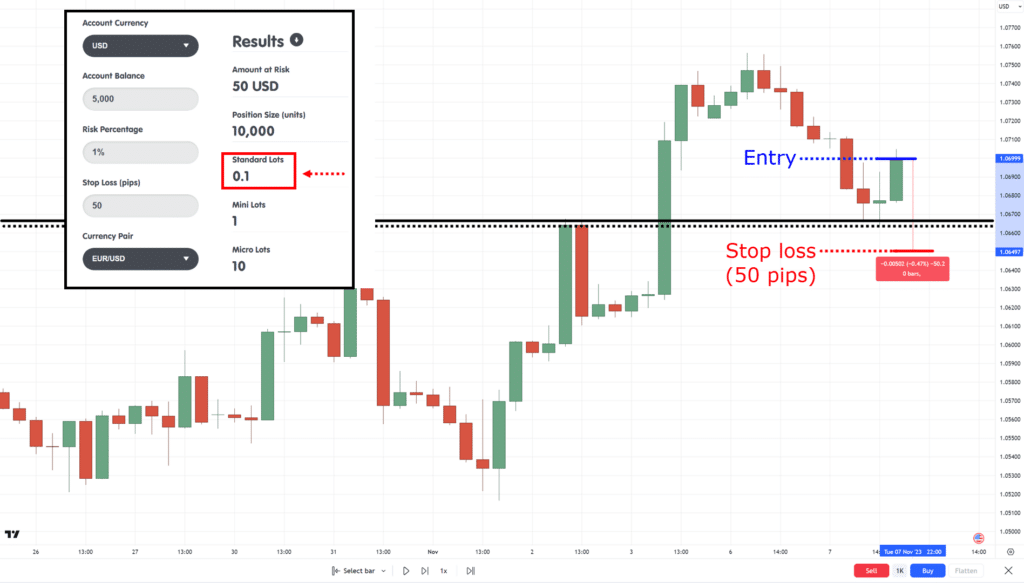

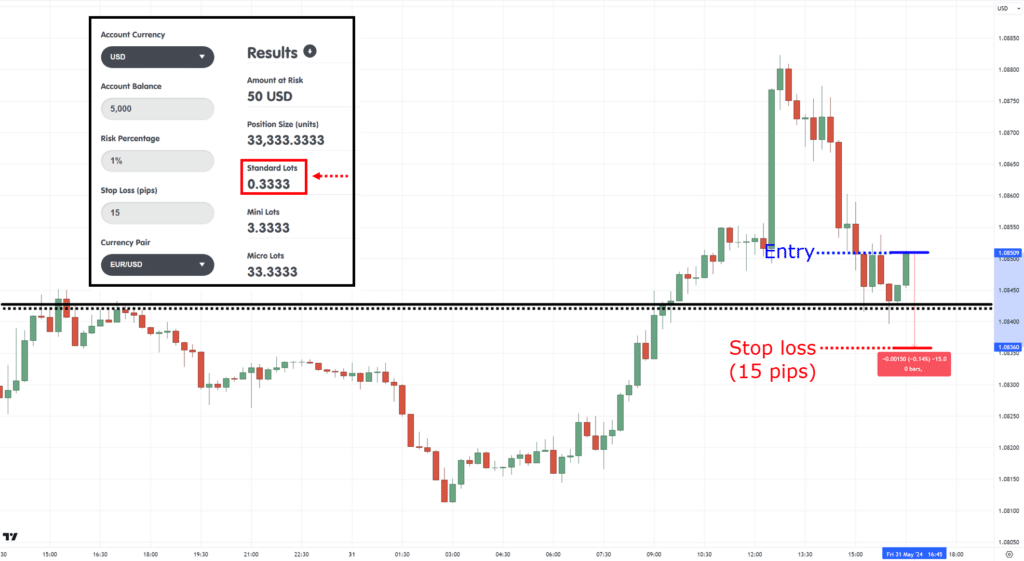

Let’s say you have got a $5,000 account and the chance per commerce is $50 which is 1% of that account.

So now, let me share with you a similar buying and selling setup on three completely different timeframes the place earlier resistance turns to assist…

USDCAD Every day Timeframe (100 pips):

USDCAD 4-hour timeframe (50 pips):

USDCAD 15-minute timeframe (15 pips):

The explanation why I selected these timeframes is as a result of they’re probably the timeframes you’d select in case you resolve to be a:

Now, in case you look again on the examples what do you discover?

That’s proper!

The “tighter” your cease loss is, the extra concentrated your buying and selling place is.

And the “wider” your cease loss is, the much less concentrated your buying and selling place is.

What this implies is that the tighter your cease loss is…

…the extra it will possibly accommodate you buying and selling on a smaller account.

However the wider your cease loss is, the larger the account ought to be.

Make sense?

So, to sum issues up, you possibly can discuss with the next:

- Place buying and selling with cease loss higher than 100-200 pips = $3,000 to $5,000 account

- Swing buying and selling with cease loss starting from 50-100 pips = $1,500 to $3,000 account

- Intraday buying and selling with cease loss starting from 10-30 pips = $500 to $1,000 account

Be aware: These numbers are based mostly on my expertise buying and selling the Foreign exchange markets and through the use of the chance administration technique I shared with you

What the checklist means is that there’s no particular quantity on how a lot it is best to begin with.

As a result of buying and selling with a “small buying and selling account” actually is determined by your buying and selling type.

Because of this if you’re a swing dealer, then buying and selling with a $1,500 is what you possibly can take into account a “small” account.

However for intraday merchants, that $1,500 is greater than sufficient to begin buying and selling whereas apply correct danger administration!

Now…

Right here’s one other query I often get:

“What if I solely have $100 to commerce the markets?”

I do know that is one thing you may not need to hear.

However one of the best ways to go about it’s to make use of that $100 to spend money on your schooling in buying and selling.

Once more…

Spend that cash on schooling!

(or save up)

At any price, the precise quantity it is advisable to begin with a small buying and selling account in Foreign exchange is determined by your buying and selling type.

However as you understand, the buying and selling journey doesn’t finish there.

As a result of when you begin reside buying and selling…

What’s subsequent?

How will you handle a small buying and selling account and develop it?

In any case, buying and selling is a protracted recreation, proper?

Let me reply these questions for you within the subsequent part.

A method on how you can commerce a small account

Right here’s the reality:

Beginning with a small buying and selling account is one of the best ways to begin buying and selling!

Because of this it doesn’t matter if you have already got $5,000 or $10,000 in your checking account.

What issues is that you simply begin small.

Try my reasoning…

Why it is best to begin buying and selling with a small account

You see, some merchants will attempt to begin with an enormous account…

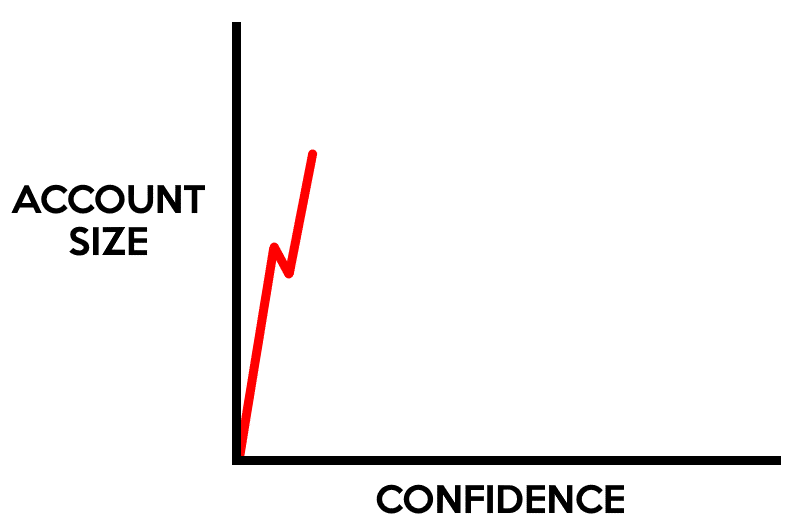

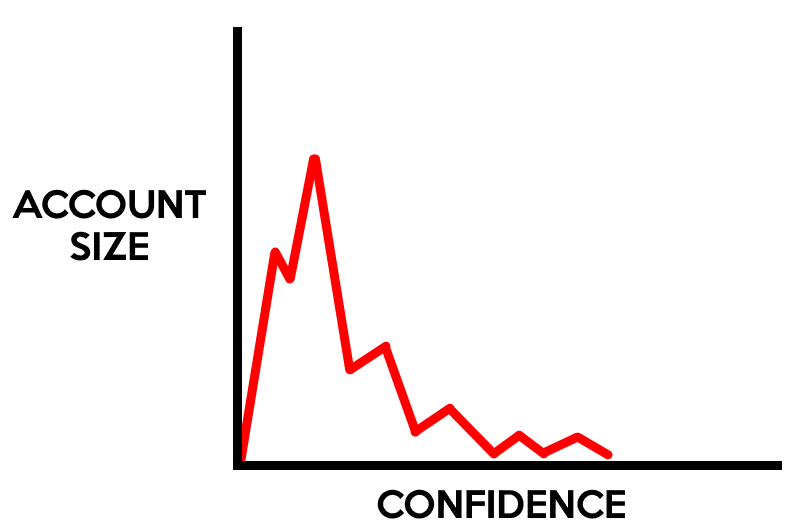

However the factor is, each dealer begins with virtually zero buying and selling confidence.

And what occurs when you’ve got an enormous account measurement with little to no confidence?

That’s proper, your account dwindles as time goes on…

So as a substitute, what must you do?

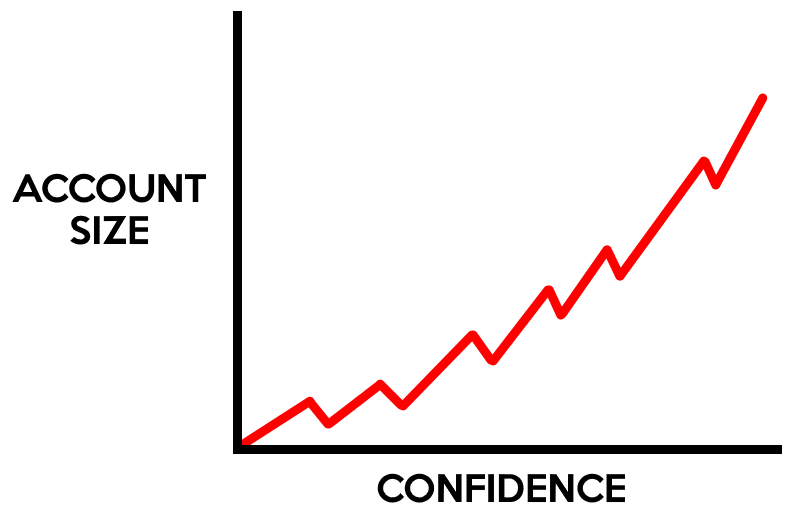

Begin with a small account whereas your confidence is small!…

So, as you begin placing in good trades one by one persistently…

…not solely does your confidence develop, but in addition your buying and selling account…

Briefly, you need to match your account measurement to your confidence!

Now…

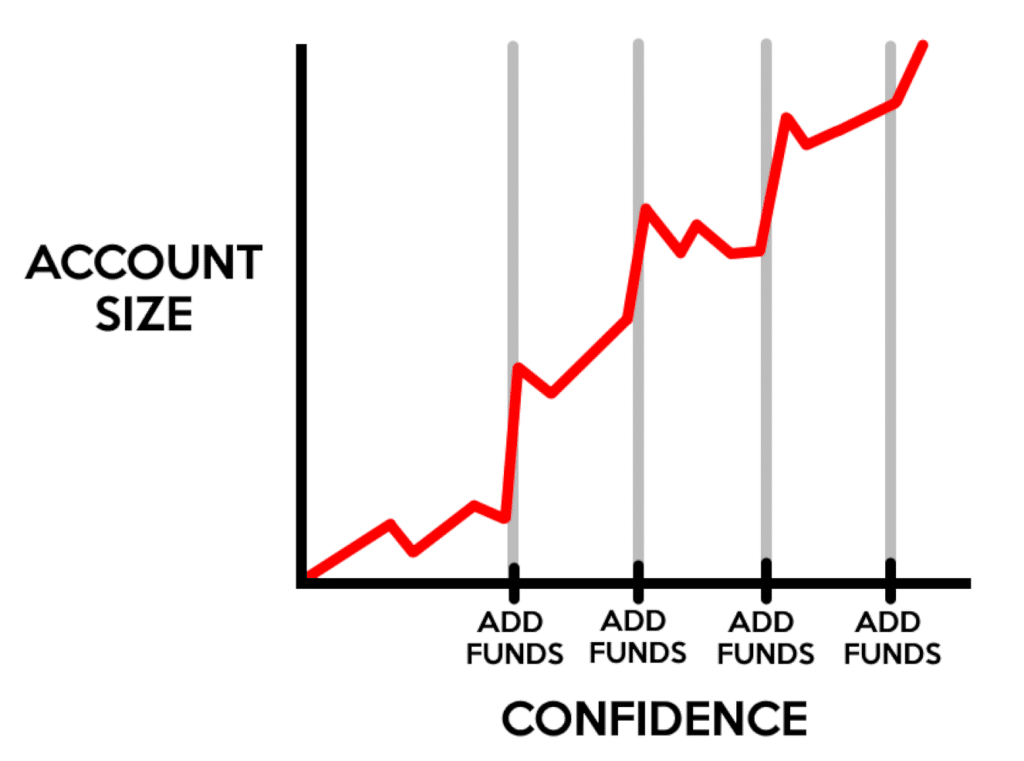

What when you’ve got a $5,000 account, and also you truly do have additional funds to place into your buying and selling account?

The important thing now could be to know when so as to add them.

“Speed up” your buying and selling account by including extra funds

One of the best time so as to add funds to your account is when you find yourself most assured and beginning to see the positive factors.

Do you agree?

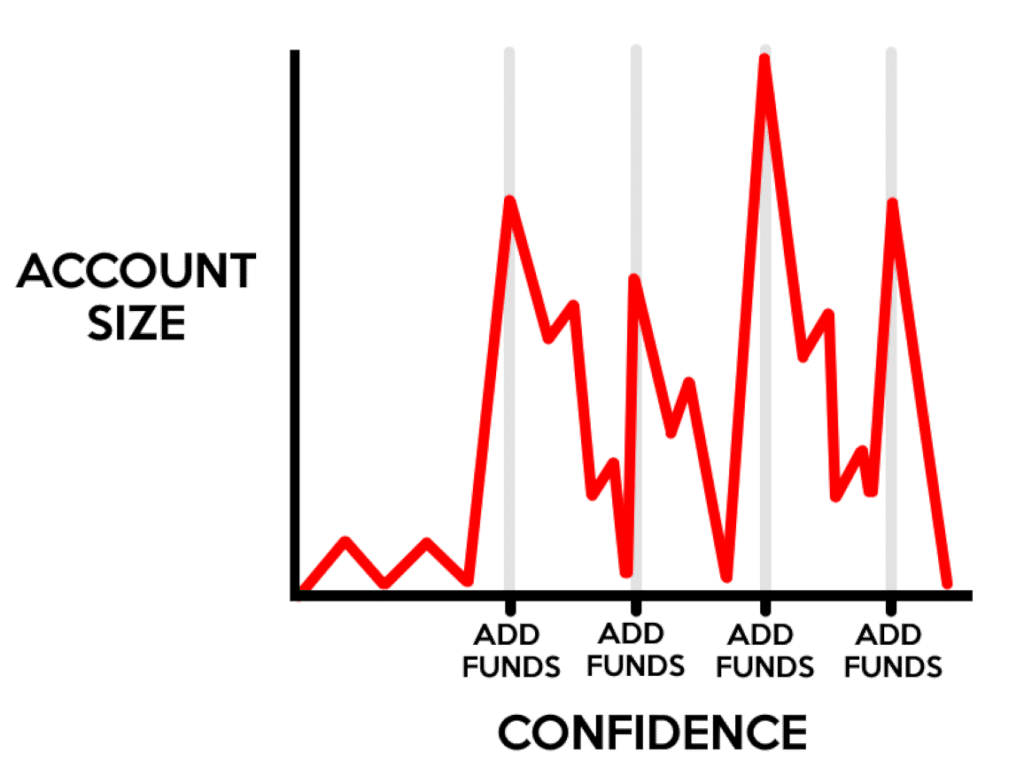

Because of this in case your small buying and selling account doesn’t work out…

…then merely don’t add extra funds!

As a result of it’s higher to go bust on a small account than an enormous one, proper?

Nevertheless, when you achieve consistency in buying and selling, then it pays so that you can add extra funds by betting extra into your buying and selling confidence and outcomes…

That method, you not solely develop your account from beginning small, however you speed up it!

As a result of once more…

You don’t need to be including extra funds in case you solely hold sabotaging your self (due to this fact affecting your confidence in buying and selling)…

It’s such as you’re simply including extra gas to the fireplace!

To sum it up…

In case your small buying and selling account isn’t doing effectively, then don’t add funds and overview your buying and selling journal to see what went flawed.

In case your small buying and selling account is beginning to do anyplace above breakeven and your buying and selling actions have been constant…

…then take into account including funds.

You solely need to guess on one thing that works!

Or quite, guess on your self at your greatest in buying and selling!

Obtained it?

Conclusion

In right this moment’s information…

I made certain to equip you with information on how you can begin a small buying and selling account in foreign exchange but in addition the mindset to handle it.

Total, right here’s what you’ve realized for right this moment:

- Buying and selling isn’t a job however a enterprise; having the best expectations in buying and selling is the important thing to lasting lengthy on this recreation

- Understanding lot sizes is the important thing to managing danger on a small buying and selling account in foreign exchange

- A small buying and selling account quantity is determined by what sort of buying and selling type you want to undertake in your buying and selling

- Beginning with a small account is the best way to go when beginning in buying and selling, and finally including extra funds as you grow to be extra constant

To be sincere, it is a buying and selling information I made that I want I had learn 7 years in the past…

…so, I hope that you simply loved studying by it!

However truly, I need to hear your story…

The place are you proper now in your buying and selling journey?

Do you propose on beginning a small buying and selling account in foreign exchange quickly?

If that’s the case, how do you propose to go about it?

Let me know within the feedback under!