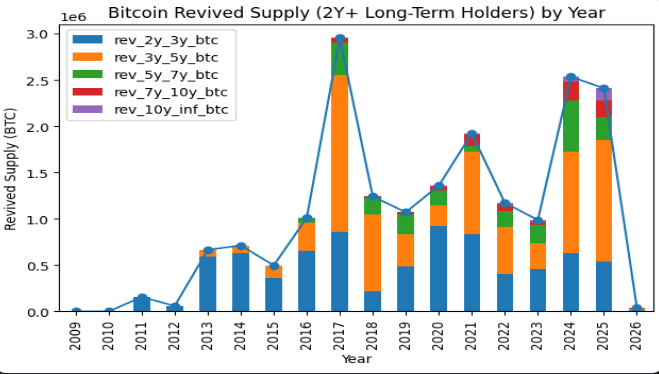

In line with on-chain trackers, an enormous wave of previous Bitcoin has began transferring after lengthy dormancy. Cash that sat untouched for greater than two years have been transferred in numbers bigger than what was seen throughout previous peaks in 2017 and 2021.

Associated Studying

CryptoQuant analyst Kripto Mevsimi mentioned on-chain knowledge exhibits that 2024 and 2025 marked the largest launch of long-held Bitcoin provide ever recorded. He tracks “revived provide,” or cash that stayed dormant for greater than two years earlier than being moved.

That type of motion normally means deep-pocketed holders are altering their plans, not small merchants chasing a fast acquire.

A Shift With out A Celebration

Studies say this launch of long-held provide arrived with little fanfare. There was no mass retail mania. Costs didn’t spike in a frenzy. As a substitute, the transfers got here throughout a stretch when the market has been beneath regular stress from broader monetary stress.

A few of these older cash have been seemingly offered for revenue. Some might have been moved for different causes — custody upgrades, personal trades, or to again monetary merchandise. On-chain alerts present the cash moved, however they don’t write the explanations on the blockchain.

Lengthy-Time period Holders Change Course

Based mostly on reviews from analysts monitoring these flows, the sample suggests a altering of the guard. Early adopters who held via a number of cycles and pointed to shortage and self-control have been trimming positions.

New consumers are showing who watch worth swings and macro headlines. Establishments, recent giant accounts, and price-driven merchants are actually shaping a lot of the market’s short-term exercise.

World Danger Pressures Danger Belongings

Studies have linked current weak point in Bitcoin to rising world threat. Analysis ties a part of the pullback to tariff strikes by US President Donald Trump, which have pushed buyers away from dangerous belongings.

Tariffs can dent company earnings, fire up inflation uncertainty, and alter how the market views future charges — all of which hits sentiment. When huge markets wobble, crypto usually follows. That stress helps clarify why long-held cash moved with out the standard hype.

New Patrons Step Ahead

In accordance To on-chain and worth knowledge, establishments and new “whales” are getting into the gaps left by sellers. Bitcoin has been buying and selling close to the excessive $80k vary, with current figures round $89,140 as markets take a look at demand. The previous holders might have taken positive aspects, however the market didn’t collapse. That exhibits there may be nonetheless urge for food, even whether it is totally different from the previous.

Associated Studying

This cycle feels totally different as a result of promoting got here with out euphoria, and shopping for appears extra tactical. That doesn’t imply the story is over. The market may be shifting towards price-sensitive members and outdoors monetary forces.

Or the current calm may very well be a pause earlier than recent shopping for. Both means, these on-chain strikes matter. They modify the place the cash sit, and that modifications how future worth swings might play out.

Featured picture from Unsplash, chart from TradingView