Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum transaction prices have fallen to their lowest level in 5 years. The drop comes as customers pull again from the community amid financial considerations, based on information from Santiment, an on-chain analytics platform.

Associated Studying

Ethereum Transaction Prices Plummet To Simply 17 Cents

The typical charge to course of a transaction on Ethereum now stands at roughly $0.168. This steep decline matches a sample of lowered exercise, with fewer folks sending Ether or utilizing good contracts on the blockchain. Brian Quinlivan, advertising director at Santiment, defined the state of affairs in an April 17 weblog put up.

Market Uncertainty Retains Merchants On Sidelines

In response to Quinlivan, low community charges usually seem earlier than worth rebounds. Nonetheless, many merchants appear to be ready for international financial inquiries to clear up earlier than they return to their regular buying and selling patterns.

🚨💸 BREAKING: Ethereum charges are at a 5-year low, with transactions at present costing simply $0.168. That is the most affordable day by day value of constructing $ETH transfers since Could 2, 2020. We briefly break this down in our newest perception. 👇https://t.co/fg5CfRgsHn pic.twitter.com/QlLwyzdm1F

— Santiment (@santimentfeed) April 16, 2025

Hesitation continues after market worries that had began from April 2 with US President Trump asserting sweeping tariffs. Conventional markets turned out to be hit alongside cryptocurrency, the place most property languish under pre-announcement values.

Pectra Improve Set For Launch On Could 7

Regardless of this market disaster, Ethereum improvement is on the transfer. Pectra is lastly scheduled to go dwell on Could 7 after some delays owing to the configuration hiccups in addition to an unknown attacker inflicting issues in the course of the testnet trials.

The primary a part of Pectra will carry quite a few enhancements to the community corresponding to a rise to layer-2 blob capability from three to 6, transaction charge discount, alleviation of community congestion, and likewise enable customers to pay charges with stablecoins like USDC and DAI. The improve may also improve the utmost staking restrict from 32 ETH to a a lot bigger 2,048 ETH.

A second part deliberate for late 2025 or early 2026 will add new information constructions for higher storage effectivity. It’s going to additionally create a system that helps nodes confirm transaction information with out storing the complete dataset.

Lengthy-Time period Holders Start Promoting Positions

In the meantime, information from Lookonchain exhibits that long-term Ethereum holders at the moment are promoting their positions, even after holding by way of earlier market cycles. These gross sales are occurring within the $1,500 to $1,700 worth vary.

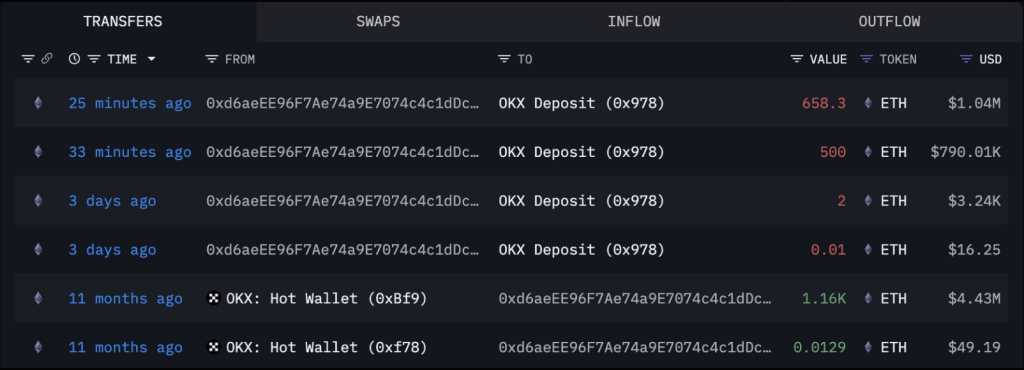

After holding $ETH for 11 months, this man capitulated and bought all 1,160 $ETH($1.83M) at a lack of $2.6M(-58.6%)!

11 months in the past, he withdrew 1,160 $ETH($4.43M) from #OKX at $3,816, and deposited it to #OKX at $1,580 ~half-hour in the past, shedding $2.6M(-58.6%).… pic.twitter.com/Cl0ebXie1f

— Lookonchain (@lookonchain) April 16, 2025

The promoting exercise has created combined alerts for market watchers. Some analysts view this as a warning signal of a possible sell-off forward. Others imagine it might result in market stabilization.

Associated Studying

This promoting comes at an fascinating time, with community utilization at multi-year lows however main technical upgrades on the horizon. Based mostly on Quinlivan’s evaluation, lowered retail curiosity mixed with ongoing improvement might create circumstances for “an eventual shock rebound with little resistance.”

Ethereum worth has dipped by greater than 11% during the last two weeks. Based mostly on figures from CoinMarketCap, this cryptocurrency is now buying and selling slightly below $1,600. The value has remained unchanged during the last 24 hours.

Featured picture from Capital One, chart from TradingView