Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is at present dealing with a pivotal second because it continues to consolidate beneath the $3,000 degree. Bulls are concentrating on a breakout above this key resistance zone, which might set off a serious upward transfer. Nonetheless, broader market situations stay fragile. Geopolitical tensions—significantly the continued battle between Israel and Iran—proceed to create a high-risk macroeconomic setting, resulting in elevated volatility and intermittent promoting stress throughout danger property.

Associated Studying

Regardless of these challenges, ETH has proven resilience by holding above the $2,500 help zone. The worth has remained locked in a slim buying and selling vary for weeks, reflecting market indecision and warning amongst individuals. In line with a technical evaluation shared by prime analyst Daan, Ethereum continues to commerce inside this very tight vary, with worth wicks on each side persistently getting absorbed. This sort of worth motion alerts rising compression, typically a precursor to a robust directional transfer as soon as one facet offers in.

Merchants at the moment are intently monitoring the construction for a better timeframe shut above $2,800, which might validate bullish momentum and open the trail towards $3,000 and past. Till then, the market seems balanced, and any shift in geopolitical developments could rapidly tilt sentiment in both course.

Ethereum Prepares For Breakout as Market Awaits Affirmation

Ethereum stays over 60% beneath its 2024 excessive of $4,100, however the asset is displaying indicators of restoration after months of downward stress and indecision. Bulls have struggled to regain management all year long, however current worth motion signifies the beginning of a possible rally. This restoration, nonetheless, stays tentative and would require affirmation by means of a better timeframe shut above important resistance ranges, significantly the $2,800–$3,000 vary.

The broader setting continues to weigh closely on sentiment. Escalating geopolitical tensions within the Center East, coupled with macroeconomic uncertainty—together with rising U.S. Treasury yields and considerations about inflation—are creating headwinds for danger property, Ethereum included. Regardless of this, ETH has managed to carry key help above the $2,500 degree, an indication that bulls are defending their floor.

In line with technical evaluation shared by analyst Daan, Ethereum is at present buying and selling inside a really tight vary, with worth wicks on each side being persistently absorbed. This sort of compression usually alerts an incoming surge in volatility. Daan notes that when one facet offers in, the ensuing transfer typically turns into explosive and sustained.

The present range-bound motion displays equilibrium between patrons and sellers, however that stability received’t final perpetually. Merchants are watching intently for a decisive greater timeframe shut above resistance—or beneath help—as affirmation of the following development course. With ETH positioned close to main technical zones, a breakout might result in vital momentum, probably bringing Ethereum nearer to reclaiming the psychological $3,000 mark and reigniting a push towards cycle highs. Till then, the market stays in a wait-and-see mode.

Associated Studying

Ethereum Continues Vary-Sure Buying and selling As Key Help Holds

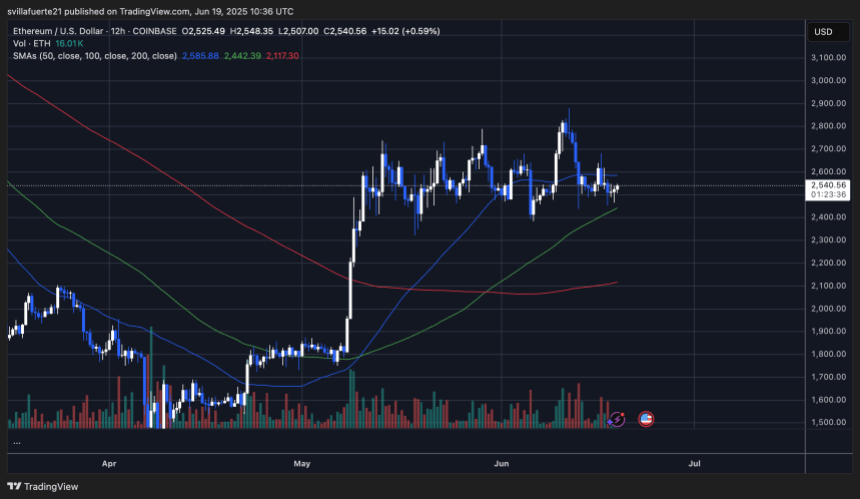

Ethereum (ETH) stays locked in a good vary between roughly $2,500 and $2,800, displaying little directional readability over the previous a number of weeks. The chart above (12-hour timeframe) displays persistent consolidation with a number of wicks on each ends of the candles, indicating absorption of each bullish and bearish momentum. This means that neither patrons nor sellers have taken agency management.

ETH at present trades close to $2,540 and is holding above the 100-period easy shifting common (SMA), which is performing as short-term help. The 50 SMA has flattened, additional reinforcing the sideways nature of the worth motion. Quantity has additionally tapered off, typical in compression phases that always precede sturdy breakouts or breakdowns.

If ETH fails to reclaim the $2,675–$2,800 resistance zone, the 200 SMA close to $2,117 could grow to be related as a deeper help goal. Nonetheless, so long as ETH maintains worth motion above $2,500, bulls are nonetheless in play.

Associated Studying

The construction means that Ethereum is constructing vitality for a decisive transfer. The next timeframe shut above $2,800 might set off a brand new leg up towards $3,000 and past. Conversely, a break beneath $2,500 might result in renewed bearish stress. For now, merchants are anticipating breakout affirmation.

Featured picture from Dall-E, chart from TradingView