Ether( ETH)

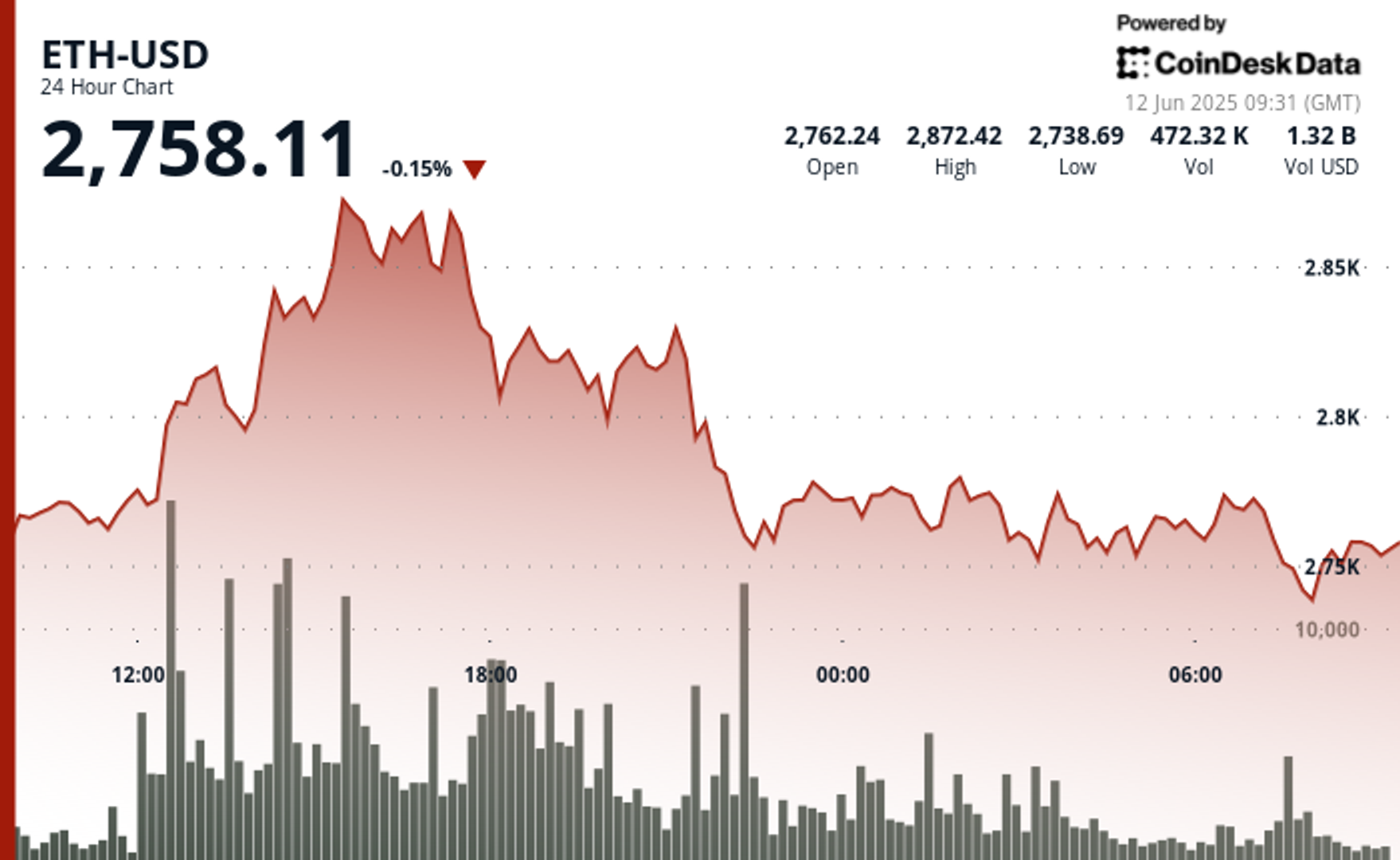

struggled to take care of Tuesday’s momentum, falling 0.15% to $2,758 amid promoting strain that emerged throughout U.S. afternoon buying and selling on June 11.

The pullback adopted a quick rally to $2,872.42, which proved unsustainable as worth motion reversed sharply between 15:00 and 17:00 UTC, in line with CoinDesk Analysis’s technical evaluation mannequin.

The late-session sell-off intensified in early Asia hours, punctuated by a 1.29% dip from $2,772 to $2,736 on heavy quantity, earlier than ether rebounded barely towards $2,758 at press time.

Regardless of the downturn, key metrics recommend rising conviction amongst bulls.

Glassnode reported that choices skew flipped sharply damaging over the previous 48 hours—one-week skew dropping from –2.4% to –7.0% — indicating elevated demand for short-dated calls. Put-call ratios stay closely tilted towards upside publicity, with open curiosity and quantity ratios holding close to multi-week lows.

On-chain flows additionally strengthened the bullish bias.

Analytics agency Sentora (previously, IntoTheBlock) flagged that over 140,000 ETH, price roughly $393 million, was withdrawn from exchanges on June 11 — the biggest single-day outflow in additional than a month.

Concurrently, ETH-based ETFs prolonged their influx streak with one other $240.3 million added Wednesday, surpassing the day’s Bitcoin ETF totals. Analyst Anthony Sassano famous that Ethereum has prevented a single internet outflow day since mid-Might, calling the pattern “accelerating” and arguing that the asset stays structurally undervalued.

Whereas worth motion exhibits short-term weak point, market positioning and capital flows recommend merchants could also be shopping for the dip in anticipation of one other upside try.

Technical Evaluation Highlights

- ETH traded inside a $139 vary between $2,733 and $2,872 earlier than closing at $2,758.

- Heavy promoting emerged close to $2,870–$2,880 throughout June 11’s late U.S. session.

- Assist close to $2,745–$2,755 was breached after a number of assessments, triggering a fast declineVolume spiked above 34,000 ETH throughout a fast drop from $2,772 to $2,736 early June 12.

- A short lived bounce towards $2,752 failed, and a brand new assist zone could also be forming close to $2,735

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.