05 Dec Earn with Margin Lending on Bitfinex

When you’re holding both fiat or cryptocurrency on Bitfinex however not actively buying and selling, Margin Lending is a brilliant method to put your capital to work. You possibly can earn by collaborating in our peer-to-peer funding market.

In easy phrases: you lend to different merchants who want leverage for his or her positions. You earn whereas preserving possession of your crypto.

Traditionally, margin lending has supplied usually greater returns than typical financial savings accounts, making it an alternate for long-term holders who want to generate earnings with their in any other case idle property.

What Is Margin Lending?

Margin lending (additionally referred to as Margin Funding on Bitfinex) is a peer-to-peer (P2P) market the place you possibly can lend your property to merchants who wish to commerce with leverage.

Right here’s the way it works in easy phrases:

You (the lender) have funds (might be cryptocurrency or fiat) sitting in your account. As a substitute of letting it sit idle, you supply it to merchants at an rate of interest you select.

Merchants (the debtors) want further capital to amplify their buying and selling positions, whether or not going lengthy (betting costs will rise) or brief (betting costs will fall). They put up collateral, borrow your funds quickly and pay you curiosity.

The platform (Bitfinex) matches your lending gives with merchants’ borrowing gives, manages the collateral, and handles the curiosity funds routinely.

Why Contemplate Margin Lending?

1. Earn Every day: You earn each day with out requiring lively buying and selling or technical evaluation. Earnings are credited every single day round 01:30 AM UTC, offering a constant fee stream.

2. Potential Larger Returns Than Conventional Financial savings: In periods of excessive buying and selling exercise or volatility, charges can spike considerably as demand for leverage will increase.

3. You Keep in Management: You resolve:

- How a lot to lend (minimal $150)

- The rate of interest you’re keen to just accept

- The length of the mortgage (from 2 to 120 days)

4. Platform Safeguards: Bitfinex has carried out a number of protecting measures:

- Collateral Necessities: Merchants should present collateral from their margin pockets earlier than borrowing

- Automated Liquidation: If a dealer’s place strikes towards them and their collateral drops under the upkeep margin, their place is liquidated routinely

- Precedence Safety: In a liquidation occasion, your lending is paid again earlier than merchants can entry their funds

5. Flexibility: When you lend your funds for a selected interval, you possibly can’t cancel the mortgage early. Nevertheless, the dealer who borrows your funds can return them at any time earlier than the interval ends, and your curiosity is calculated primarily based on how lengthy the funds have been really used. If the funds are returned in lower than an hour, you’ll nonetheless obtain a full hour of curiosity. This implies your funds could come again earlier than anticipated, however you’re all the time paid for the time they have been lent out.

6. Numerous Forex Choices: Bitfinex helps margin funding in a number of currencies, not simply Bitcoin or Ethereum, but in addition stablecoins like USDT (that is really the preferred foreign money for lending in Bitfinex’s peer-to-peer lending market) and lots of others, supplying you with choices primarily based in your danger tolerance and portfolio composition.

7. A Regular Possibility: Relying in your danger urge for food and persona, lending can really feel steadier than buying and selling. Relatively than guessing market path, you merely enable merchants to borrow your funds and earn from the exercise. In unpredictable markets, it’s a calmer method to preserve your capital working with out the fixed stress of creating buying and selling selections.

Actual-World Eventualities*

* The charges, durations, quantities and returns set out above are hypothetical and supplied for illustrative functions solely. Precise earnings, rates of interest or different outcomes could differ. Bitfinex makes no ensures relating to the quantity of earnings, rates of interest or different outcomes. The peer to see lending market on the Website is out there solely pursuant to the Phrases of Service.

How Does Margin Lending Work on Bitfinex?

Conditions: Margin Buying and selling, Margin Funding and Bitfinex Borrow require not less than Intermediate stage verification for all Bitfinex accounts created after March 1, 2022. Make certain your account verification is full.

Step 1: Switch to Funding Pockets

Transfer the foreign money you wish to lend out of your Alternate or Margin pockets on Bitfinex to your Funding Pockets. It is a easy inside switch with no charges. Common decisions embody:

- USDT/USD: Typically highest demand and most secure charges

- BTC: For Bitcoin holders eager to earn in BTC

- ETH: Second hottest crypto for lending

Step 2: Go to Funding

- On the highest navigation bar, click on Funding

- Choose Funding (not Bitfinex Borrow)

- Select the foreign money you need (USDT, USD, BTC, ETH, and so forth.)

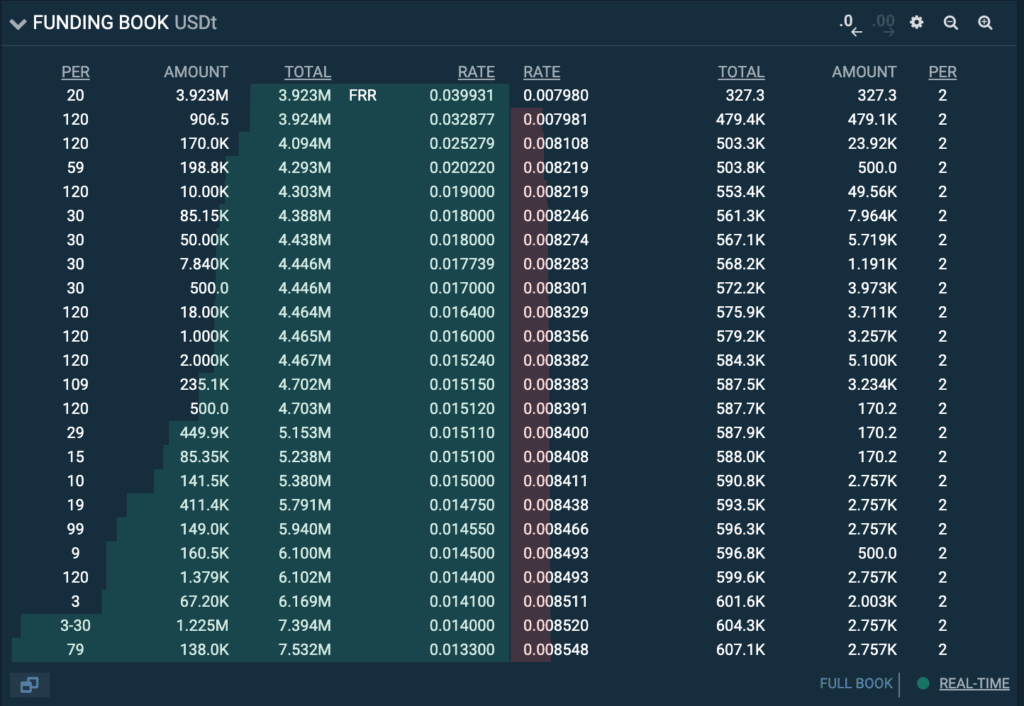

Step 3: Evaluate the market

Earlier than creating your supply, verify the present market:

- Inexperienced (bids): What merchants/ debtors are keen to pay

- Pink (gives): What different lenders/ sellers are providing

- Take a look at the charges, quantities, and durations being requested

Navigate to the Funding Type and set your phrases:

- Quantity: Minimal $150 value

- Fee: Select between:

- Mounted fee: You set a particular each day fee manually by getting into the each day fee you wish to obtain and never checking every other containers (Hidden, FRR, FRR Variables, FRR Mounted)

- FRR (Flash Return Fee): This fee follows the market fee within the Bitfinex lending market. If you choose this feature, your lending gives shall be on the then present FRR when the mortgage is taken, nevertheless it stays fastened at that fee for the entire mortgage. (The FRR is predicated on the weighted common of the newest funding trades, smoothed to keep away from sudden spikes. This fee updates as soon as per hour.)

- FRR Variable: If you choose this feature, your fee will routinely transfer up and down together with the FRR and never be fastened through the time period of your mortgage.

- FRR + Delta: This lets you make loans primarily based on the FRR, however with a bonus for you or a discount to make your loans extra aggressive. FRR with a customized offset (for instance, FRR + 0.001). If you choose this feature, your lending gives shall be on the then present FRR when the mortgage is taken adjusted by the offset you chose, and stays fastened at that fee for the entire mortgage.

- Interval: 2-120 days (most typical: 2, 7, or 30 days)

Professional tip: Verify what charges are getting crammed. Setting your fee barely extra aggressive than others will increase the possibility of fast matching.

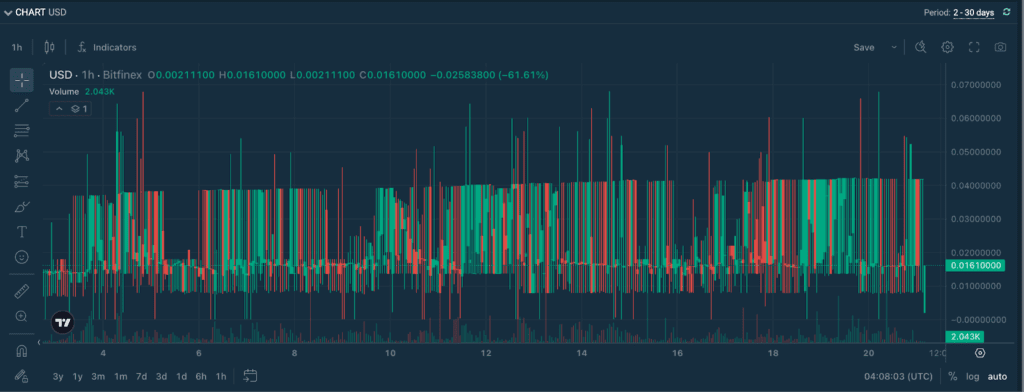

Bonus: Use the chart to see historic funding charges, matched funding quantity, and FRR APR:

See the primary chart for historic funding charges. You might additionally add indicators like Shifting Averages (MA) or Relative Energy Index (RSI) to raised filter volatility and common highs.

See prime left for quantity and FRR APR*.

*FRR APR = FRR each day x 365

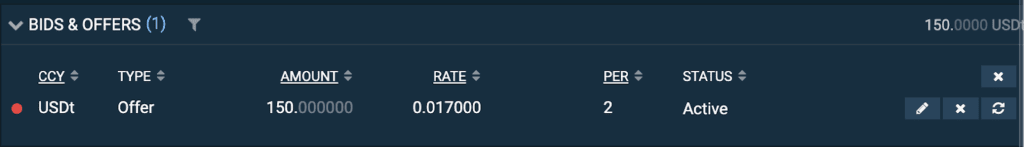

Step 4: Order Matching & Earnings

Your supply goes into the funding order e-book.

When a borrower’s bid matches your supply phrases, the funding is supplied routinely.

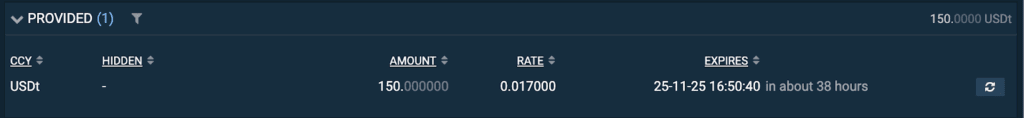

As soon as matched, you’ll have the ability to see the quantity you might be providing, the speed at which curiosity shall be calculated, and when the funds are scheduled to return to you. Curiosity accumulates each day and is credited round 01:30 AM UTC.

Step 5: Monitor & Gather Underneath “Supplied”, observe your lively loans, curiosity earned, and time remaining. When the mortgage interval expires or the dealer closes their place early, your principal plus amassed curiosity returns to your Funding Pockets, able to be lent once more or withdrawn.

Understanding the Numbers

Rates of interest on Bitfinex are quoted as each day charges, however it might be simpler to suppose in annual phrases.

Instance:

- You lend $10,000 USDT at a each day fee of 0.06%

- Every day earnings: $10,000 × 0.06% = $6.00 per day

- Annualized fee: 0.06% × 365 = 21.9% per 12 months

As a funding supplier, you obtain the curiosity paid by the dealer borrowing your funds. Bitfinex deducts a 15% charge out of your earned curiosity (or 18% for hidden orders).

So your precise each day earnings could be:

- $6.00 × 0.85 (after 15% charge) = $5.10 per day

- Roughly $1,861.50 per 12 months on a $10,000 mortgage

Understanding the Dangers and Why “Whales” Select Bitfinex

Whereas margin lending on Bitfinex has protecting mechanisms, it’s essential to know the potential dangers:

1. Excessive Market Volatility

In concept, if the worth modifications dramatically losses might be incurred by margin funding suppliers. Consider excessive situations like flash crashes or “black swan” occasions the place liquidation mechanisms can’t execute quick sufficient.

There’s a purpose Bitfinex has been the platform of selection for institutional merchants and “whales” since 2012. Margin lenders have by no means suffered losses from lending within the 13 years that Bitfinex has been in operation, even throughout occasions such because the 2020 COVID crash, the 2021 Evergrande disaster, and the 2022 Luna collapse. Our multi-layered liquidation engine is designed to guard lenders first and has a observe document of doing simply that.

2. Platform Danger

Whereas Bitfinex’s safety infrastructure, common proof-of-reserves, and conservative danger administration have earned the belief of the world’s largest crypto merchants, like several exchange-based exercise, there’s inherent platform danger to margin lending. Your funds stay on an trade whereas lent out, so customary trade safety issues apply.

3. Alternative Value

When you lend your cryptocurrency at a hard and fast fee and market charges spike dramatically, you’re locked into your unique fee till the mortgage interval expires or is repaid. That is merely the character of fastened time period lending. That mentioned, Bitfinex’s funding market gives each fastened and versatile fee choices, which might modify extra rapidly to altering market circumstances. It additionally permits for shorter mortgage durations (2-7 days) so you possibly can keep nimble. As soon as a short-term mortgage expires, you possibly can replace your fastened fee to match the most recent market circumstances. That is why many lenders are likely to favor shorter durations: they get to refresh their gives extra typically and keep aligned with the place the market is heading.

Bitfinex is among the many few main exchanges that provide a real peer to see funding market pushed fully by provide and demand. You select your fee, your quantity, and your mortgage length, with phrases as brief as two days. Another exchanges supply yield merchandise the place the platform dictates the phrases and charges and clients have a lot much less management.

4. Market-Pushed Returns

There isn’t any deposit insurance coverage and funding returns are decided by market demand for leverage. In slower markets, gives will not be matched instantly. Bitfinex hosts an lively margin buying and selling neighborhood, which frequently results in constant borrowing exercise nonetheless, there aren’t any ensures. Borrower demand normally rises when volatility picks up, and funding charges can replicate that shift extra dynamically in contrast with conventional yield merchandise.

Ceaselessly Requested Questions (FAQ)

1. Can I alter or shut my funding supply early?

As soon as your funding is matched and lively, it can’t be recalled early by you. You need to wait till the mortgage expires or till the borrower returns the funds. In case your supply continues to be pending within the order e-book, chances are you’ll cancel or modify it at any time.

2. How does Bitfinex match lending orders?

Margin Funding is a market which matches debtors and lenders on a rate-priority + duration-compatibility foundation:

- Decrease-rate gives are usually matched first

- Your most length have to be equal to or longer than the borrower’s requested length

- FRR (Flash Return Fee) gives modify routinely, however aren’t assured to match instantly; they’re crammed solely when the market borrowing fee meets or exceeds the FRR stage

- Handbook fixed-rate gives solely fill when debtors settle for the desired fee

Partial fills could happen, and lenders present liquidity to quite a lot of completely different debtors relatively than to a single borrower.

3. How can I enhance my lending returns?

Returns depend upon market demand. Frequent methods embody:

- Utilizing shorter durations (2–7 days) to seize fee actions

- Mixing handbook fixed-rate gives (choose present matched charges) with FRR for flexibility

- Benefiting from high-volatility durations

- Utilizing automated instruments or bots that assist modify charges and durations dynamically

Shorter-term gives typically seize market spikes extra successfully.

4. Are there any charges for offering funding?

Lenders don’t pay charges to supply funding. Debtors pay curiosity, and Bitfinex takes a share of the funding earnings because the platform charge. See our charges web page for extra particulars: https://www.bitfinex.com/charges/.

5. What occurs when my mortgage expires?

At expiration, funds return to your Funding Pockets. If Auto-Renew is enabled, Bitfinex routinely routes a brand new lending supply in your behalf primarily based on the settings you chose (i.e., the identical settings are your earlier mortgage). Mounted-rate loans can’t be adjusted mid-term, even when market charges rise.

6. Can I take advantage of third-party lending bots?

Bitfinex helps third-party integrations by API keys, and lots of superior clients select lending bots to automate fee changes and enhance capital effectivity.

Nevertheless, please take into accout:

- Bitfinex doesn’t endorse, certify, or assure any third-party instruments

- Prospects are totally answerable for granting and managing their very own API permissions

- We strongly suggest utilizing API keys with restricted permissions and reviewing the bot supplier’s safety practices

- If switching bots, chances are you’ll generate a brand new API key at any time

Many skilled lenders discover these instruments useful in automating their methods, however correct warning and danger administration are essential when utilizing any exterior service.

Prepared to start out incomes?

Margin lending on Bitfinex presents a possibility for cryptocurrency holders to place their idle property to work. Whether or not you’re incomes each day curiosity on stablecoins or accumulating extra cryptocurrencies by lending, margin lending supplies a versatile instrument to extend the potential of your crypto holdings.

For extra details about Margin Funding on Bitfinex, please go to our Assist Middle:

https://help.bitfinex.com/hc/en-us/sections/900000425526-Margin-Funding

Necessary Observe:

You shouldn’t construe the data supplied on this put up as monetary, authorized or different recommendation. The knowledge supplied on this put up just isn’t a suggestion to borrow or lend. Additionally it is not the solicitation, advice or endorsement of any course of transacting. The knowledge supplied on this put up is for info and illustrative functions solely. Any references to earnings, rates of interest or different outcomes are hypothetical and never assured. Precise earnings, rates of interest or different outcomes could differ. Bitfinex makes no ensures relating to the quantity of earnings, rates of interest or different outcomes. The peer to see lending market on the Website is out there solely pursuant to the Phrases of Service.