A business airline pilot goes by means of an in depth pre-flight guidelines to keep away from any issues as soon as that jumbo-jet will get airborne. Equally, you need to undergo a buying and selling guidelines earlier than you get ‘airborne’ and enter a stay commerce. However, how typically do you sit down in entrance of your pc, open your buying and selling platform and start looking for trades with out going by means of any sort of guidelines to be sure to’re doing issues proper? For many merchants, that is how they function on a regular basis and it’s an enormous purpose they don’t become profitable.

A business airline pilot goes by means of an in depth pre-flight guidelines to keep away from any issues as soon as that jumbo-jet will get airborne. Equally, you need to undergo a buying and selling guidelines earlier than you get ‘airborne’ and enter a stay commerce. However, how typically do you sit down in entrance of your pc, open your buying and selling platform and start looking for trades with out going by means of any sort of guidelines to be sure to’re doing issues proper? For many merchants, that is how they function on a regular basis and it’s an enormous purpose they don’t become profitable.

Buying and selling plans or checklists could seem boring to you, but when they do it’s since you aren’t excited about them proper, in actual fact, once you begin viewing them as ‘cheat-sheets’ that may really make you a extra worthwhile dealer, you’ll begin them from a unique perspective.

A buying and selling plan / guidelines will act as a filter which you set your predetermined buying and selling standards in and that may act as not solely a commerce setup filter, but additionally as a buying and selling mistake filter. All of us want a buying and selling plan to remain on monitor and to remain grounded – I nonetheless use a psychological guidelines on a regular basis earlier than trying on the charts. Nonetheless, when starting, it is advisable to print this out or write it down and bodily undergo it every time you scan for trades, till you’ve gotten made it a HABIT!

What follows is probably a scaled-down or thinner model of what your finalized pre-trade guidelines will appear to be and I encourage you to broaden yours so it goes into extra element and leaves no stone un-turned, so to talk. So, here’s a stable basis / instance guidelines so that you can start constructing yours from…

Technical Evaluation Guidelines:

1. Did I attract key ranges and developments?

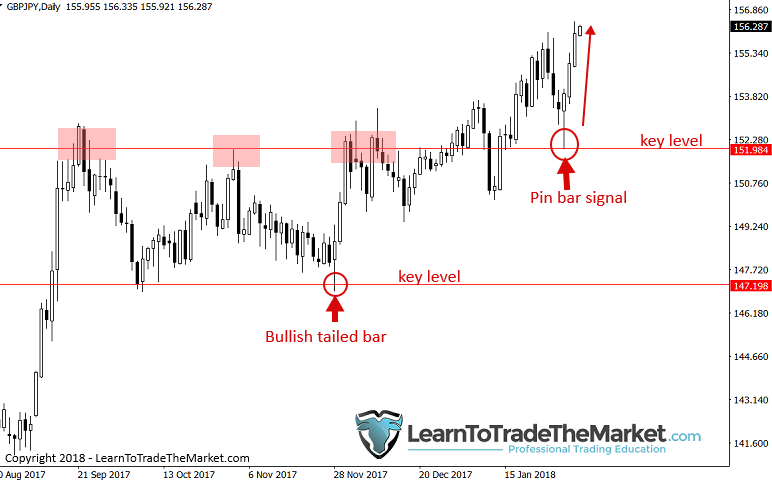

Did you zoom out to the weekly chart timeframe and start the method of figuring out the important thing long-term horizontal assist and resistance ranges?

Did you establish the present long-term / total development or market situation? Is it up-trending, down-trending or transferring sideways in a wide variety on the weekly chart? Determine this out subsequent.

Did you then drill-down to the every day chart timeframe and attract every other apparent sorts of assist and resistance? This would come with (however not restricted to) horizontal ranges in addition to transferring averages (if trending), 50% retrace ranges and occasion areas.

What’s the near-term every day chart development? Is there even a development or is it consolidating in a variety? Is the market simply uneven? Determine if the present market motion is trending or if it’s a sideways market. The reply to this may decide the way you method this market.

2. Is there a sign?

Subsequent, is there one thing price buying and selling right here? Is there an OBVIOUS worth motion sign that matches in with the present market image? That means, does the sign ‘make sense’ with what the market is doing? For instance: if there’s a powerful uptrend in place, you’re solely contemplating purchase indicators, no sells. Or, if the market is range-bound you could be contemplating purchase indicators from assist and promote indicators from resistance. We’re primarily asking ourselves IF there’s an acceptable entry right here, be {that a} worth motion sign or just a ‘blind entry’; bear in mind, we want two out of three: Pattern, Stage, Sign, ideally all three, however generally you’ll solely get two of them lining up.

Most significantly, if an apparent commerce setup doesn’t leap out at you on the every day, 4 hour or 1-hour chart timeframe inside a couple of minutes of trying (assuming you’ve gotten honed this ability), then it’s time to maneuver on, there’s nothing price buying and selling that day.

Bear in mind, being flat (or impartial / not out there) IS a VERY worthwhile place relative to taking a low-probability commerce and LOSING MONEY. To be taught extra, checkout this lesson on the way to filter good commerce indicators from unhealthy.

3. Is there confluence of things / proof?

I touched on this briefly above, however it’s so vital it wants re-hashing…

You probably have recognized a commerce sign, even when it’s an apparent one, it is advisable to ask your self if additionally it is a confluent commerce setup? That means, does it have OTHER supporting components behind it different than simply the worth bar itself? Does the commerce setup make sense within the context of the story the worth motion is telling you? If it doesn’t, you could need to stroll away from that sign. Bear in mind, this filter / guidelines is in place to ensure solely the perfect trades make it by means of, consider it as a solution to filter out all the rubbish, leaving solely the ‘pure’ trades. You’re going to have shedding trades it doesn’t matter what, however our aim as merchants is to enhance our efficiency as a lot as doable and restrict losses and draw-downs, effectively a guidelines just like the one you’re studying about is how that’s executed.

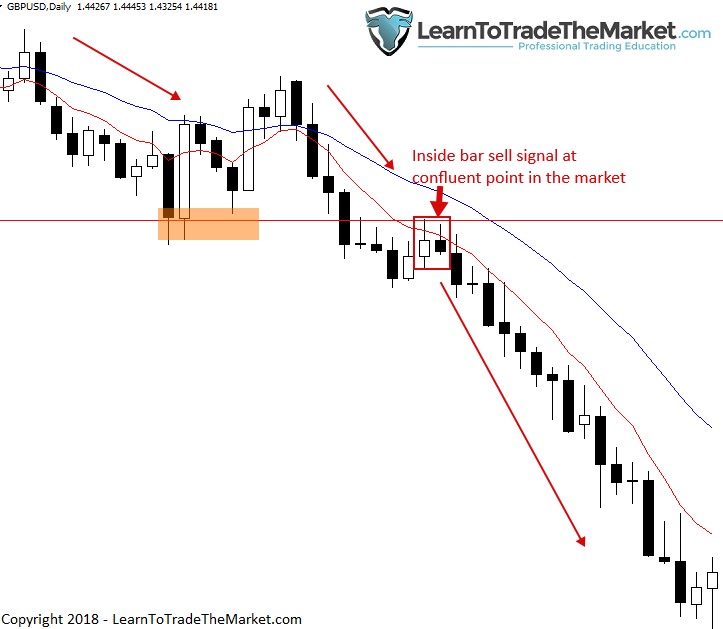

Instance of a confluent inside bar buying and selling sample. This sign was in-line with the downtrend and from resistance (8/21 day transferring averages are crimson and blue strains):

Instance of a confluent fakey buying and selling sample. This sign was in-line with the downtrend and fashioned off a key resistance degree…

Abstract of technical evaluation guidelines:

Determine / decide total market circumstances and ranges so that you could determine which course you want to commerce and from the place on the chart you want to commerce. Search for high-probability entry eventualities that make sense with the beforehand decided market circumstances and ranges. Chances are you’ll need to make every day buying and selling affirmations one thing you undergo every day earlier than you even begin your guidelines course of or earlier than even opening your charts. As you achieve expertise and grasp worth motion buying and selling methods, you may and will bolt-on extra entry indicators and entry eventualities, make them part of your guidelines, don’t simply mentally do that, not till you’re significantly expert in any case. Bear in mind, we are attempting to re-wire your mind to develop optimistic buying and selling HABITS. IT TAKES TIME, PERSISTANCE AND DEDICATION TO TURN ACTIONS INTO HABITS.

Psychological / Psychology questions:

4. Am I in the correct frame of mind to enter this commerce?

Are you in a relaxed, collected and total goal frame of mind earlier than you enter this commerce? Did you enter this commerce for the correct causes or is it a revenge or greed-fueled commerce? You’ll have to be trustworthy with your self right here clearly, and you’ll have to act on that honesty, in any other case it’s a waste of time. Bear in mind, you’re delving into the buying and selling world the place there isn’t any boss, nobody is trying over your shoulder to maintain you accountable. You have to do the correct factor when nobody else is trying – buying and selling is probably the last word check of 1’s character!

Another issues to think about are: Did you simply come off an enormous successful commerce that could be inflating your confidence in your buying and selling skills to an unsafe degree? Merchants typically lose cash as a result of they get overly assured and this causes them to take larger / extra dangers out there. Bear in mind, you’re solely nearly as good as your final commerce, so keep centered and stay within the correct buying and selling mindset or your final commerce would possibly negatively affect your subsequent one.

5. Am I mentally and financially ready to just accept this danger?

Ask your self earlier than coming into a commerce, are you mentally ready for the outcomes of the commerce, win or lose? That is the place buying and selling schooling nice Mark Douglas shines, he will get in-depth into the psychology of buying and selling and actually hammers-home the purpose that each commerce’s final result is basically random, a 50/50 shot, and that’s how it is advisable to view it. Nonetheless, that doesn’t imply that time beyond regulation, over a SERIES OF TRADES your edge is just 50/50. It means that there’s a random distribution of wins and losses for any given buying and selling edge. So, you can have 20 losses in a row adopted by 40 winners in a row (uncommon, however doable). Nonetheless, that could be a 66.6%-win fee over the collection of 60 trades. However, most merchants can’t mentally stand up to even a couple of losses in a row, not to mention 20, do you catch my drift right here?

You have to bear in mind that anyone commerce, checked out in a vacuum / aside from the remainder, merely doesn’t matter. Consequently, it is advisable to suppose and behave in settlement this truth. That means, if you’re analyzing your buying and selling efficiency, you can’t care AT ALL about anyone commerce, it’s the total outcomes, the collection of many trades that proves your efficiency. It can do you a WORLD OF GOOD to recollect these factors each time you’re about to enter that subsequent commerce. This angle and method is a part of my set and overlook buying and selling philosophy. Bear in mind, you need to let your buying and selling edge play out sans interference in your half, in any other case you can’t correctly gauge its efficiency over-time as a buying and selling method.

Cash and Commerce Administration Questions:

6. Do I do know my per-trade (1R) danger quantity?

In case you don’t have a pre-determined danger quantity the place (1R = {dollars} risked), you’re in all probability not earning money as a dealer. You have to sit down and decide what number of {dollars} or euros or kilos or no matter, you may realistically afford to lose per commerce. Make this an quantity you can doubtlessly lose 10 to twenty occasions in a row and nonetheless be financially and mentally steady. I at all times inform merchants to do a easy sleep check for danger, during which they let their potential to overlook about their trades and sleep soundly decide in the event that they’re risking a wholesome quantity for them, or not.

7. Did I exploit place sizing correctly?

Did you apply the proper place measurement to the commerce? This goes along with query quantity six, above. In case you don’t perceive place sizing, please learn my article on danger reward and place sizing, to be taught extra. However, to place it succinctly, place sizing means adjusting the variety of tons (your place measurement) to fulfill your pre-determined 1R danger quantity per commerce while contemplating your cease loss placement, which we’ll discuss subsequent. At all times decide cease loss placement earlier than place measurement. You danger per commerce ought to keep the identical. You discover the perfect cease loss placement to offer the commerce a very good probability of understanding (don’t put stops too shut) and then you definitely alter your place measurement to fulfill your 1R danger.

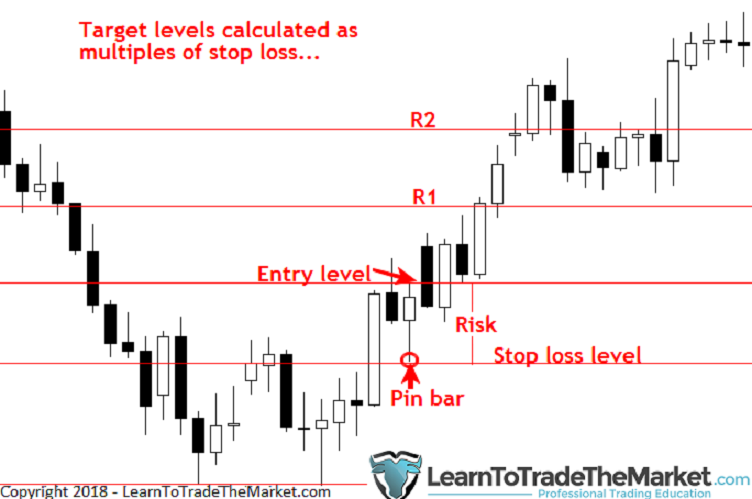

8. Is the chance reward there, realistically?

Is the danger reward there? That means, is there a logical revenue goal accessible relative to close by key chart ranges that means that you can get a 2 to 1 winner or extra? You have to make it possible for your cease loss and revenue goal each make sense within the context of the encircling market construction, to be taught extra about this, checkout my article I wrote a couple of years again on the way to place stops and targets like a professional.

9. Do I’ve a plan to exit this commerce?

Do you’ve gotten an exit plan for this commerce? What’s your total plan to exit this commerce for both a win or a loss? Are you planning to exit at a sure horizontal degree or are you planning to path your cease and let the commerce run as a result of it’s in a powerful development? Will you progress to breakeven at a sure level or simply set and overlook? These particulars ought to be ironed-out earlier than coming into the commerce. If a dramatic flip of occasions occurs while the commerce is stay (like an enormous worth motion reversal in opposition to your place, for instance) you may intervene, however generally, you need to pre-determine your exit technique and stick with that it doesn’t matter what. Checkout my information to commerce exits for extra on this.

10. Does it match my buying and selling plan?

Lastly, in the event you’ve answered all of the above questions efficiently, then your reply to this final query ought to be “sure”. Your buying and selling plan could be a guidelines like this, though yours will likely be extra detailed, and provided that a commerce passes every filter must you give it the “OK”. Don’t fear, finally, the method of going by means of every filter will change into a behavior and one thing you nearly don’t even want to consider it. You’ll intuitively know if a commerce passes all of your filters and standards as a result of you should have gone by means of your guidelines / plan manually so many occasions that it’s going to have seared itself into your mind, it is going to change into a part of you.

Conclusion

All of us want steerage in life, all of us want mentors to enhance and excel. I may be your buying and selling mentor by instructing you what I do know and what I’ve discovered through my buying and selling programs and members neighborhood, however it’s as much as you to place within the ‘hard-work’ and follow-through with what you be taught. As we speak’s lesson is one other piece of the buying and selling puzzle; it is advisable to really make a guidelines like this and put it to make use of in your day-to-day buying and selling and in the event you do, I assure you will notice an enchancment in your buying and selling. You’re going to naturally be extra selective and methodical concerning which trades you’re taking and the way you commerce the market.

Make this buying and selling guidelines part of your every day buying and selling routine and you’ll marvel the way you ever traded with out it.

What did you consider this lesson? Please share it with us within the feedback beneath!