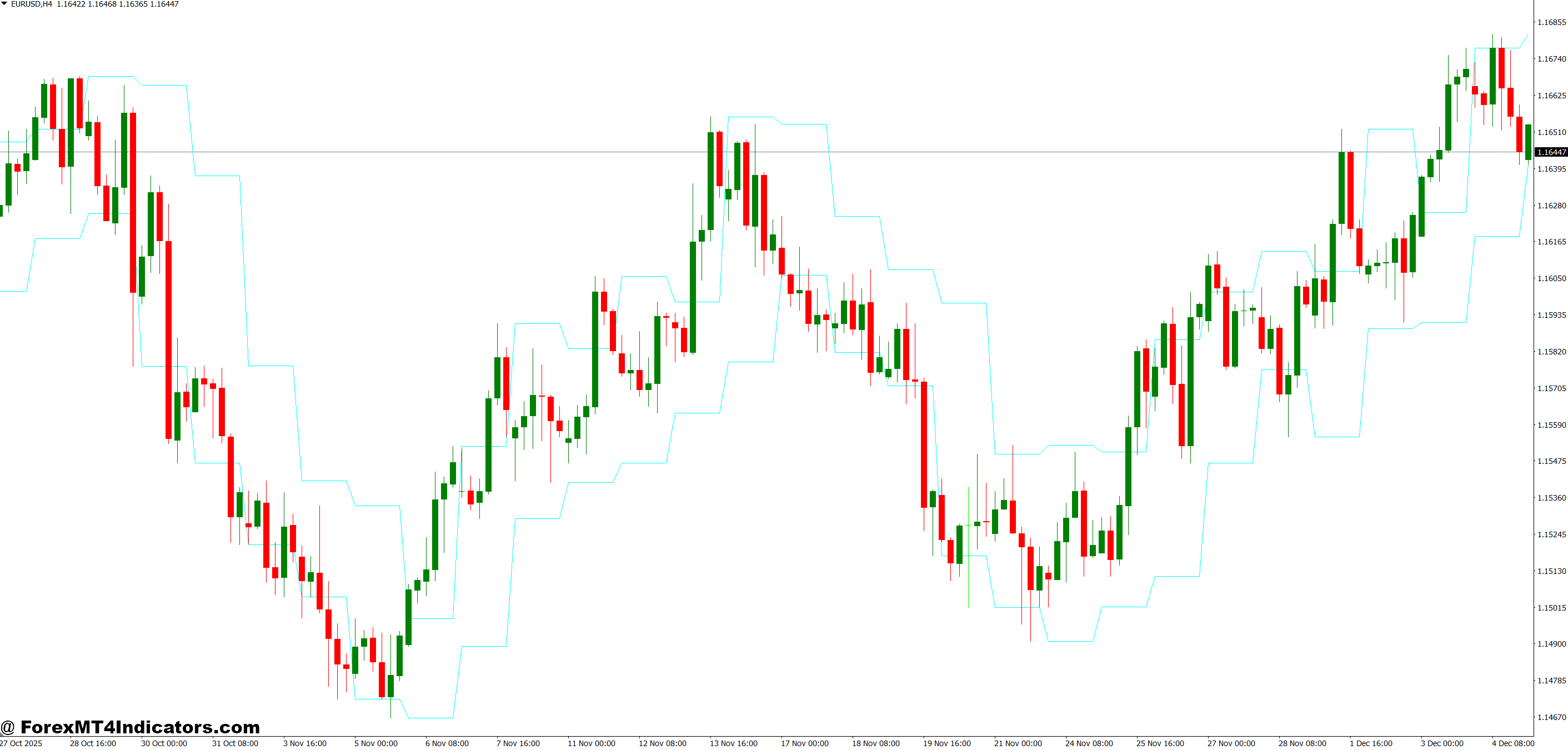

The day gone by excessive low indicator MT4 solves this by routinely plotting yesterday’s value extremes in your chart. No handbook calculations. No switching between timeframes to search out ranges. Simply clear horizontal strains displaying the place value discovered resistance and assist through the prior session. For merchants who make selections based mostly on key ranges, this software removes guesswork from the equation.

What Makes Earlier Day Ranges Essential

Assist and resistance aren’t random ideas. They exist as a result of merchants bear in mind the place value reversed earlier than. Yesterday’s excessive represents the value degree the place sellers beforehand overwhelmed consumers. Yesterday’s low reveals the place consumers stepped in with sufficient drive to halt the decline.

These ranges carry psychological weight. When EUR/USD approaches yesterday’s excessive at 1.0850, merchants who watched that rejection the day earlier than change into cautious. New sellers enter, anticipating historical past to repeat. This collective reminiscence creates self-fulfilling prophecies. Worth typically reacts at these zones not due to magic, however as a result of sufficient individuals make selections based mostly on them.

The indicator does one thing easy however worthwhile. It identifies these two value factors from the earlier 24-hour interval and extends them as horizontal strains into the present session. On a 15-minute or 1-hour chart, you’ll see precisely the place yesterday’s boundaries had been with out scrolling again by way of knowledge.

How the Calculation Works

The logic behind this indicator is simple. In the beginning of every new buying and selling day (sometimes 00:00 server time), the indicator scans the day past’s value motion. It finds the best value reached throughout that interval and the bottom value touched. These two values change into your reference ranges.

Right here’s what occurs in observe. If Monday’s buying and selling noticed GBP/USD attain a peak of 1.2750 and a low of 1.2680, these precise costs get plotted as horizontal strains on Tuesday’s chart. The strains prolong ahead by way of the present session till a brand new day begins and contemporary ranges change them.

Most variations of this indicator use the D1 (day by day) timeframe knowledge because the supply. Which means it’s pulling the excessive and low from the total 24-hour session, not out of your present chart’s timeframe. This consistency issues as a result of all merchants trying on the similar pair see similar ranges, no matter whether or not they’re buying and selling on M5, M15, or H1 charts.

Buying and selling Methods Utilizing These Ranges

Breakout merchants watch these strains like hawks. When value consolidates under yesterday’s excessive after which breaks by way of with robust momentum, it alerts purchaser power. The logic is easy: if value couldn’t get above 1.0850 all day yesterday however smashes by way of it this morning, one thing modified. Perhaps there’s information, perhaps sentiment shifted, however consumers at the moment are in management.

A typical strategy includes ready for a clear break above the day past’s excessive, then coming into lengthy after a short pullback confirms the breakout. Cease losses sometimes go just under the breakout degree. The day gone by’s low turns into a revenue goal or trailing cease reference level. This creates an outlined risk-reward setup.

Vary merchants use the alternative technique. If EUR/USD spent yesterday bouncing between 1.0800 and 1.0850, these ranges outline as we speak’s anticipated vary. Merchants promote close to the excessive, purchase close to the low, and shut positions when value reaches the alternative excessive. This works fantastically in low-volatility durations however fails spectacularly when robust developments emerge.

Through the London session, I’ve seen these ranges get examined steadily within the first two hours. Worth typically probes yesterday’s excessive or low, rejects, then establishes the day’s route. On GBP/JPY, which strikes aggressively throughout this session, false breakouts occur typically. Worth spikes by way of yesterday’s excessive by 10-15 pips, triggers stops, then reverses. That’s why affirmation issues greater than the preliminary contact.

Settings and Customizations

Most MT4 variations of this indicator allow you to alter line colours, thickness, and elegance. The defaults often present yesterday’s excessive as a pink dashed line and yesterday’s low as a blue dashed line. Change these to match your chart’s shade scheme so that they stand out with out creating visible litter.

Some indicators embrace the earlier week’s excessive and low as nicely. These weekly ranges present broader context, particularly on increased timeframes like H4 or D1. Should you commerce swing positions held for a number of days, weekly extremes matter greater than day by day ones.

The timezone setting deserves consideration. Completely different brokers use completely different server occasions. In case your dealer’s server resets at 00:00 GMT however you’re buying and selling in New York, the “earlier day” won’t align together with your native calendar. This doesn’t make the indicator flawed it simply means it is advisable to perceive which 24-hour interval it’s measuring.

For scalpers on M1 or M5 charts, day by day ranges might sound too broad. However they nonetheless present context. Understanding you’re approaching yesterday’s low whereas taking brief trades on a 5-minute chart tells you the place bigger timeframe assist exists. You may tighten stops or scale out of positions as value nears these zones.

Strengths and Weaknesses

The most important benefit is simplicity. You get two goal value ranges with out interpretation or evaluation. There’s no parameter to optimize, no sign to substantiate. The excessive is the excessive. The low is the low. This objectivity removes discretionary judgment, which helps newer merchants keep away from evaluation paralysis.

These ranges additionally present common reference factors. As a result of most merchants can see the place yesterday’s extremes had been, the degrees achieve significance by way of collective consciousness. When 1000’s of merchants place stops under yesterday’s low, that focus of orders creates actual market impression.

However the indicator has clear limitations. It doesn’t predict value route. A line in your chart displaying yesterday’s excessive tells you nothing about whether or not value will break above it or reject from it. You continue to want further evaluation candlestick patterns, momentum indicators, quantity to make buying and selling selections.

In ranging markets, these ranges work nice. Worth respects boundaries, and the high-low vary defines the battleground. However throughout robust developments, yesterday’s ranges change into irrelevant quick. If EUR/USD is in a 200-pip trending transfer, who cares about yesterday’s 50-pip vary? The outdated ranges get left behind as value makes new floor.

Whipsaw value motion round these ranges creates one other downside. Worth may contact yesterday’s excessive 5 occasions in an hour, every time rejecting barely. Do you promote each contact? Enter as soon as and maintain? The indicator reveals the extent however doesn’t let you know the best way to commerce it. That’s the place your technique and expertise are available in.

Evaluating to Comparable Instruments

The pivot level indicator serves an identical function however makes use of completely different math. Pivot factors calculate assist and resistance ranges based mostly on yesterday’s excessive, low, and shut utilizing particular formulation. You get a number of ranges (R1, R2, S1, S2) as an alternative of simply two. Merchants who need extra granular ranges typically favor pivots.

Assist and resistance indicators try and establish these zones routinely by analyzing historic value reactions. They scan for ranges the place value reversed a number of occasions and draw zones accordingly. The day gone by excessive low indicator is easier it doesn’t care about historic reactions, simply yesterday’s extremes.

Fibonacci retracement instruments additionally mark potential reversal zones, however they require handbook placement based mostly on swing highs and lows. The day gone by indicator eliminates that handbook work, although it lacks the a number of ranges that Fibonacci supplies.

What units this indicator aside is its time-based nature. It refreshes day by day with new ranges based mostly on the newest 24-hour interval. Different instruments may present ranges from weeks or months in the past. This day by day refresh retains the indicator related for short-term merchants who care most about current value motion.

The best way to Commerce with Earlier Day Excessive Low Indicator MT4

Purchase Entry

- Breakout above earlier day’s excessive – Enter lengthy when value closes above yesterday’s excessive with at the least 5-10 pips clearance on EUR/USD 1-hour chart; confirms bullish momentum shift.

- Retest of damaged excessive as assist – Purchase when value pulls again to yesterday’s excessive after breaking it, displaying 2-3 bullish candles rejecting that degree on 15-minute timeframe.

- Bounce from earlier day’s low – Go lengthy when value touches yesterday’s low and types bullish engulfing or hammer candle on GBP/USD 4-hour chart throughout London session.

- Cease loss under the low – Place stops 10-15 pips beneath yesterday’s low to guard in opposition to false breakouts; danger not more than 2% of account per commerce.

- Morning vary breakout – Enter purchase if value consolidates for two+ hours close to yesterday’s excessive then breaks by way of with quantity spike after 8 AM GMT.

- Keep away from throughout uneven periods – Skip purchase alerts throughout Asian session low-volume durations when EUR/USD sometimes ranges between earlier day’s ranges with out clear route.

- Goal earlier week’s excessive – Set revenue targets eventually week’s excessive degree when buying and selling day by day charts; supplies 3:1 risk-reward ratio on trending pairs.

- Verify with increased timeframe development – Solely take purchase alerts when 4-hour and day by day charts present uptrend; don’t battle in opposition to increased timeframe momentum.

Promote Entry

- Breakdown under earlier day’s low – Enter brief when value closes under yesterday’s low by 5-10 pips on GBP/USD 1-hour chart with robust bearish candle.

- Rejection at earlier day’s excessive – Promote when value spikes above yesterday’s excessive however closes again under it inside 1-2 candles; signifies failed breakout on 15-minute chart.

- Double prime at yesterday’s excessive – Go brief when value exams yesterday’s excessive twice with out breaking by way of on EUR/USD 4-hour chart; reveals resistance holding agency.

- Cease loss above the excessive – Place stops 10-15 pips above yesterday’s excessive to restrict draw back; by no means danger greater than earlier day’s vary on single commerce.

- Fade the breakout – Brief false breakouts above yesterday’s excessive that reverse inside half-hour on decrease timeframes; frequent lure throughout information releases.

- Vary-bound scalping – Promote close to yesterday’s excessive when value ranges between excessive/low for 4+ hours with out breakout try; works greatest on EUR/USD throughout quiet periods.

- Skip earlier than main information – Keep away from promote alerts half-hour earlier than NFP, GDP, or central financial institution bulletins; volatility destroys technical ranges.

- Goal earlier day’s low – Set preliminary revenue goal at yesterday’s low degree; transfer cease to breakeven after capturing 50% of the vary.

Ultimate Ideas

Buying and selling foreign exchange carries substantial danger. No indicator ensures income, and the day past excessive low indicator received’t make buying and selling selections for you. What it does is mark two goal value ranges the place the market confirmed clear curiosity yesterday.

Use these ranges as context, not as standalone alerts. They work greatest when mixed with development evaluation, momentum affirmation, and correct danger administration. The day gone by’s excessive issues extra in an uptrend. The day gone by’s low beneficial properties significance throughout downtrends.

Begin by including the indicator to your charts and easily observing how value reacts to those ranges over per week. You’ll discover patterns sure pairs respect them greater than others, sure periods present extra reactions. That remark interval builds the expertise it is advisable to use these ranges successfully. Don’t leap straight into buying and selling them with out understanding how they behave together with your particular pairs and timeframes.

Advisable MT4/MT5 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90