Some of the necessary issues now we have to do as worth motion merchants, is decide whether or not a market is trending or not. The reply to this can decide which strategy you are taking to a selected market, so it’s essential that you just perceive easy methods to correctly differentiate a trending market from one that’s sideways.

Some of the necessary issues now we have to do as worth motion merchants, is decide whether or not a market is trending or not. The reply to this can decide which strategy you are taking to a selected market, so it’s essential that you just perceive easy methods to correctly differentiate a trending market from one that’s sideways.

When you’ve been scuffling with this just lately, or you might be new to buying and selling, this lesson is for you. After studying it it is best to really feel that you’ve a a lot clearer understanding of precisely easy methods to distinguish a trending chart from a non-trending chart.

Search for trending worth motion patterns

This primary tactic has been round for actually tons of of years and for an excellent motive; it really works.

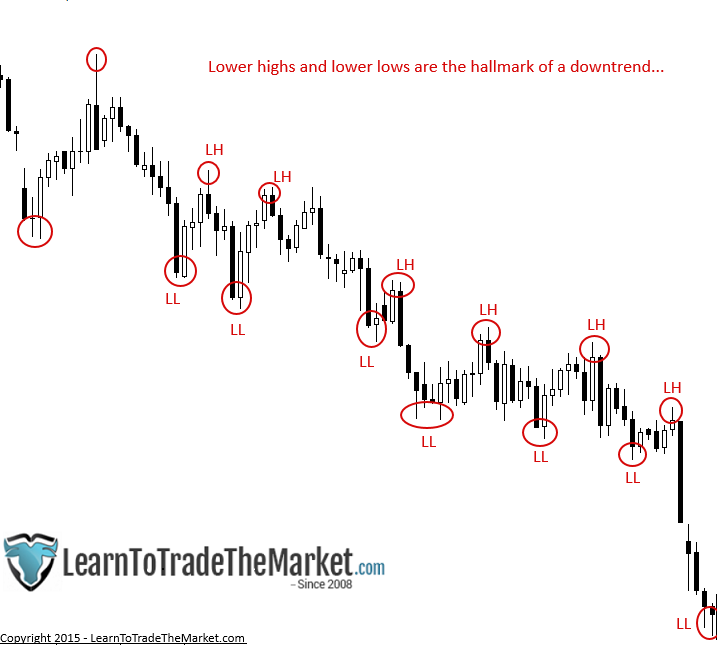

My favorite approach to decide if a market is trending or not, is to easily take a look at the worth motion of that market. Very merely, I search for a repeating sample of Greater Highs (HH) and Greater Lows (HL) in an up-trending market and Decrease Highs (LH) and Decrease Lows (LL) in a down-trending market.

Right here is an instance of a market that was clearly trending decrease as evidenced by the repeating sample of Decrease Highs and Decrease Lows…

Right here is an instance of a market that was clearly trending increased as evidenced by the repeating sample of Greater Highs and Greater Lows…

Tip – I typically get emails asking me how I do know when a brand new development has begun or an outdated one has ended. Effectively, you employ this similar tactic of on the lookout for worth motion patterns of HH HL or LH LL. For instance, when you see a sample of HH and HL has been interrupted or damaged, by worth making a Decrease Excessive, it’s an early-warning that the uptrend could also be coming to an finish.

To actually contemplate that the up-trend has ended and a brand new down-trend has begun nevertheless, we have to see no less than one sample of LH and LL following the uptrend. Which means, as soon as worth makes the primary Decrease Excessive (so it fails to make a Greater Excessive), we’d then have to see it make a Decrease Low following that Decrease Excessive, at this level, we will begin trying to be sellers.

Search for parallel ranges

We will additionally use key ranges of assist and resistance to find out if a market is trending or not. The fundamental strategy is to easily search for worth that’s clearly oscillating between parallel ranges. Whether it is bouncing between two parallel ranges, then you’ve a range-bound or sideways market, not a trending market.

There are two primary sorts of sideways markets; a ‘uneven’ one and a range-bound one, for extra on this, take a look at my latest lesson on easy methods to commerce a sideways market.

Within the instance under, we will see that worth was usually shifting sideways between parallel ranges of assist and resistance. Discover that worth gained’t all the time hit these ranges ‘precisely’, but when the final motion is sideways between two apparent ranges, you’ve a non-trending, range-bound market.

Transferring averages

The subsequent tactic that we will use to differentiate a trending market from a non-trending market is the usage of shifting averages. Transferring averages present a neater visible clue for rookies, however they must be utilized in mixture with the worth motion tactic mentioned in level one above, for causes I’ll focus on quickly.

I usually use the 8 and 21 day exponential shifting averages (emas) on the every day chart timeframe as a quick-guide for development in addition to dynamic assist or resistance (worth) areas.

There are principally two issues to search for when utilizing shifting averages to differentiate a trending from non-trending market. One, is the route of the cross; are the shifting averages crossed up or down? I solely use the ‘crossover’ to find out route, I don’t use it within the conventional “shifting common crossover entry system” that some folks train.

The second factor to search for is that if the shifting averages are diverging (shifting away) from one another, as that is indicative of a really sturdy trending market. Nevertheless, it’s good to mix the shifting averages with the worth motion tactic from level one, as a result of shifting averages alone will typically idiot you if a market is vary certain. They’re actually solely used as a fast reference for development route and to see worth areas to look to purchase and promote from.

The ema’s themselves mark a dynamic (shifting) assist and resistance zone or layer; the ema layer is the world between the 2 ema’s, such because the ‘8 and 21 day ema layer’, and we will look ahead to worth motion indicators from this layer as worth retraces again to it, to commerce in-line with the development.

The principle caveat to utilizing shifting averages for development identification, is that in a range-bound market they will trick you. This is the reason it’s good to additionally use the worth motion technique I mentioned within the first level above, to behave as a ‘filter’ of kinds for the shifting averages.

For instance, in a spread certain market as described in level 2 above, in case you put shifting averages in your chart, they may cross up and down as worth oscillates between the parallel ranges. So, in case you observe the shifting averages in a range-bound market, you’ll constantly get whipsawed as worth will usually change route proper because the shifting averages cross. Because of this, I desire tactic 1 above, however the shifting averages generally is a good complement to that tactic and as I discussed, they will additionally present us with good ‘worth areas’ in a trending market to look to purchase and promote from.

Conclusion

The development is certainly your buddy, and also you need to be completely clear on whether or not a market is trending or not earlier than you begin attempting to commerce it. Hopefully, this lesson has clarified easy methods to distinguish a trending from a sideways market, so that you could enhance your possibilities of catching large strikes out there. To study much more about buying and selling trending and sideways markets, take a look at my worth motion buying and selling course.