Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a video revealed on Wednesday, crypto analyst and dealer Miles Deutscher devoted a prolonged phase to the long-anticipated distribution of FTX chapter proceeds, arguing that tomorrow’s launch of roughly $5 billion in stablecoins might grow to be a pivotal liquidity shock for digital-asset markets.

$5 Billion Liquidity Hits Crypto Tomorrow

Deutscher reminded viewers that the money part of the FTX property—“round 5 billion in stablecoins,” as he put it—enters collectors’ accounts on Might 30, the primary wave of repayments because the trade collapsed in 2022. “Might thirtieth is perhaps one of the crucial essential days this cycle,” he stated. “FTX is distributing over 5 billion in stablecoins to collectors this week. That’s round 2 p.c of the whole stable-coin provide.”

Associated Studying

As a result of most victims “stayed in crypto regardless of the FTX blow-up,” Deutscher believes the majority of the reimbursement is not going to be cashed out to conventional financial institution accounts however redeployed in-kind throughout the ecosystem. “When that $5 billion hits, it’s not sitting idle […] they’re going to rotate that liquidity again into the market,” he predicted, including that the influx “may very well be the catalyst that pushes Bitcoin to $120,000 and triggers the alt-season setup we’ve been ready for.”

The YouTuber framed the timing as unusually propitious. Bitcoin trades close to its prior all-time highs, Ethereum is displaying its first sustained out-performance versus Bitcoin this 12 months, and US lawmakers seem nearer than ever to passing a regulatory framework for stablecoins. In that context, he argued, even a conservative estimate—the place only some hundred million {dollars} of the FTX haul migrates straight into smaller tokens—would nonetheless characterize “web new liquidity that has not been within the area as a result of retail cash has been utterly dry.”

Already Priced In?

Deutscher pushed again on the concept that the occasion has already been priced in: “It doesn’t really feel like buy-the-rumor, sell-the-news […] in any other case individuals would have been speaking about all of it week. It’s solely immediately that individuals are realizing that is truly taking place in a few days’ time.” He referred to as the forthcoming transfers “sleeper liquidity,” stressing that social-media and trading-desk chatter stays muted in contrast with final 12 months, when reimbursement schedules first surfaced.

Associated Studying

How the funds fragment as soon as they land is, after all, unknowable. The analyst conceded that allocations will differ—some recipients will go for Bitcoin or Ethereum, some might maintain in stablecoins, others will chase speculative altcoins—however the overarching impact is expansionary. “What I do know is that that is web new liquidity hitting the market,” he stated. “And what you’ve acquired to ask your self is the place that liquidity goes to go.”

Market individuals is not going to have to attend lengthy for first-order proof. Redemption directions contained in the BitGo portal are already stay, and collectors have till 1 June to finish know-your-customer verification. By tomorrow, not less than a portion of the stable-coin tranche ought to be seen on-chain, giving analysts real-time knowledge with which to verify—or problem—Deutscher’s thesis.

Whether or not the $5 billion surge proves a short-term jolt or the ignition level of a broader risk-on cycle, it can shut one in every of crypto’s darkest chapters with an injection of recent capital. As Deutscher summed up, “This may very well be a fairly good setup alongside the opposite catalysts that I’ve identified.” The market now waits to see whether or not the reclaimed funds will, certainly, grow to be the tide that lifts all boats.

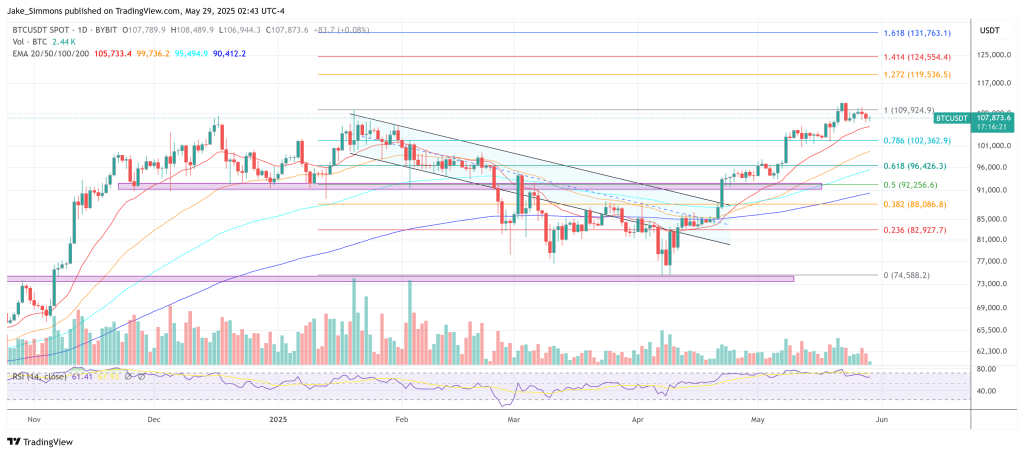

At press time, BTC traded at $107,873.

Featured picture created with DALL.E, chart from TradingView.com