Funding flows into crypto exchange-traded merchandise surged to a report degree final week, signaling robust demand from massive traders.

Associated Studying

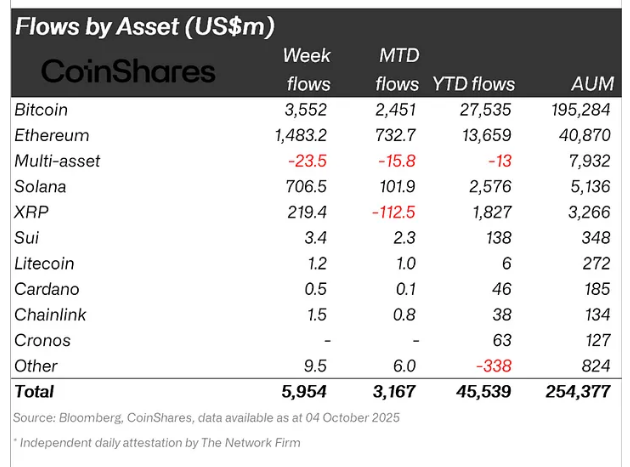

In keeping with CoinShares, crypto ETPs drew near $6 billion in new cash within the week that ended Friday, the largest weekly influx on report. Bitcoin led the transfer, taking in $3.6 billion alone as merchants and funds piled into BTC choices.

Bitcoin Dominates The Week’s Inflows

Studies have disclosed that the most recent whole beat the prior excessive of $4.4 billion by about 35%. The week’s beneficial properties weren’t evenly unfold. Whereas earlier information had been cut up extra between Bitcoin and Ether, this time Bitcoin funds attracted the lion’s share.

Ether ETPs nonetheless registered robust curiosity, including $1.48 billion and bringing year-to-date inflows for Ether to roughly $13.7 billion. Solana ETPs pulled in $706.5 million, and XRP merchandise noticed $219 million. These figures present that traders are placing contemporary capital into a spread of crypto merchandise, whilst BTC takes the lead.

Macro Headlines Drove Contemporary Shopping for

Based mostly on stories, merchants pointed to a mixture of macro occasions that doubtless pushed allocations into crypto. A latest reduce to rates of interest by the Fed, weaker-than-expected employment numbers, and issues a few US authorities shutdown had been all cited by market watchers as triggers.

Some traders handled crypto instead play whereas political and financial worries persevered. Markets reacted quick. Bitcoin climbed above $125,000 through the week, a transfer that pushed whole crypto belongings underneath administration previous $250 billion, reaching a bit of over $254 billion.

Technical Readings And Analyst Targets Add Gas

In keeping with market analysts and on-chain information observers, the availability of Bitcoin on exchanges has dropped to ranges not seen in six years. That pattern is commonly learn as holders selecting to maintain cash off market platforms, which may scale back promoting strain.

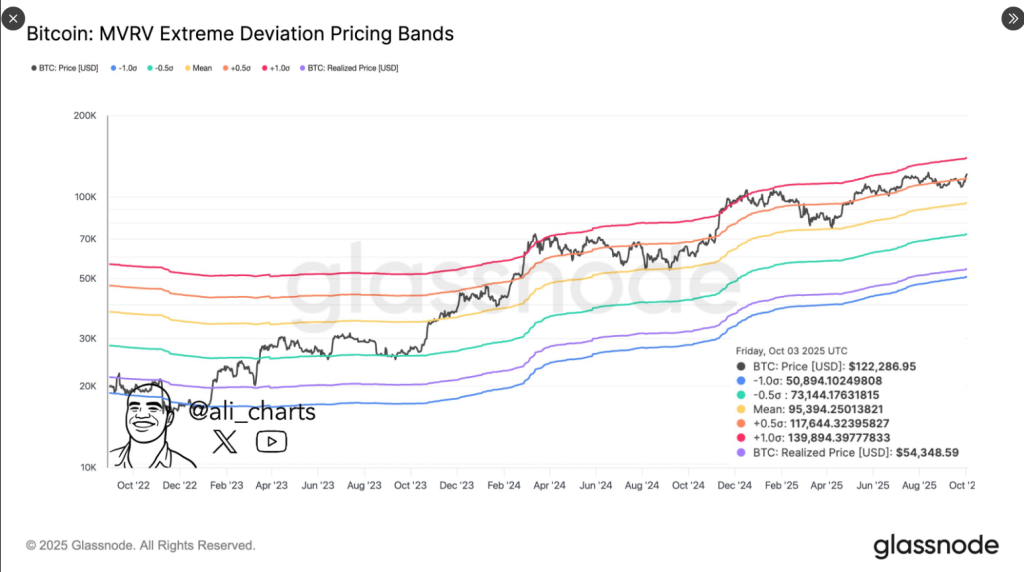

So long as Bitcoin $BTC holds above $117,650, the Pricing Bands level to $139,800 subsequent. pic.twitter.com/DTPtz3Wj52

— Ali (@ali_charts) October 4, 2025

Glassnode’s pricing bands had been utilized by some analysts to argue that Bitcoin was holding a key assist space and that upside towards $139,800 was attainable if that assist stayed intact.

Associated Studying

One other forecast talked about a decrease time horizon at round $135,000. These targets had been used out there commentary, and so they helped form market expectations through the transfer up.

Buying and selling flows, too, indicated a transparent bias: traders had been usually lengthy. As James Butterfill, head of analysis at CoinShares, describes, consumers didn’t even flip to quick funding merchandise at worth highs. If this habits doesn’t replicate an intent to hedge towards the uptick, then it displays confidence that the asset continues to understand.

Featured picture from Unsplash, chart from TradingView