Have you ever taken what you thought was a ‘good’ wanting worth motion sign solely to see it ‘blow up’ in your face instantly after coming into? Did that depart you confused, offended or determined to grasp why it occurred and what you probably did mistaken? Nicely, there may be one enormous piece of the value motion buying and selling puzzle that if lacking, may cause you to really feel this fashion even in case you are ready patiently for what you’re feeling are ‘good’ worth motion setups.

Have you ever taken what you thought was a ‘good’ wanting worth motion sign solely to see it ‘blow up’ in your face instantly after coming into? Did that depart you confused, offended or determined to grasp why it occurred and what you probably did mistaken? Nicely, there may be one enormous piece of the value motion buying and selling puzzle that if lacking, may cause you to really feel this fashion even in case you are ready patiently for what you’re feeling are ‘good’ worth motion setups.

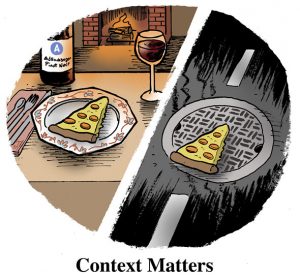

That piece of the puzzle is the context during which the worth motion patterns you take type inside. What I’m speaking about once I say ‘context’ is principally the encompassing worth motion and present / latest market situations, along with the value motion sign you wish to commerce. You see, it’s not simply the sign itself that makes commerce setup, it’s the sign making sense inside the context it shaped inside. In actual fact, I’d even go as far as to say that the context the sign varieties inside itself is AT LEAST (if no more than) equally as essential because the sign itself. A sign that doesn’t make sense within the context of the encompassing and present market situations, is nothing greater than noise.

How you can differentiate between ‘dangerous’ and ‘good’ worth motion alerts

It’s simple to get excited a few specific commerce setup out there whereas forgetting all concerning the context it’s forming in. For instance, you might have two an identical wanting pin bars however relying on market context, one may very well be value buying and selling and one won’t be. Let me clarify a little bit bit about how I differentiate between and dangerous worth motion setup…

First, ask your self the next two questions:

1. Does the sign make sense with the general market image? – Is the market trending? Is it in a buying and selling vary? Asking your self what the general image of a market is will provide help to decide whether or not a selected commerce sign is sensible to enter. When you have a really sturdy uptrend for instance, taking a promote sign towards that uptrend, even when it’s one you’re feeling appears ‘good’, might be a sign you wish to be very very cautious with. More often than not, counter-trend alerts fail, and as I all the time say, you could be a profitable trend-trading earlier than you ever think about counter-trend buying and selling.

If market is vary sure, you’d then look to ‘commerce the vary’ as I say, by looking forward to worth motion alerts close to the boundary of the vary (both help or resistance boundary). One of the best sort of sign in a range-bound market is one which varieties very close to or on the boundary and is false-breaking by means of the extent, indicating worth will reverse once more to the opposite facet of the vary.

2. How does the sign slot in to the encompassing market construction? – That means what’s going on round (close by) the sign? For instance, if it’s a pin bar sample you’re contemplating, is the tail protruding from the encompassing worth motion or did it simply type in consolidation? If it’s an inside bar, is it inside the context of a powerful pattern or is it merely in chop / sideways worth motion? If it’s a fakey, is the false-break very clear and apparent and is it in a pattern or at a key stage?

3. Maybe most essential to ask is; Is their confluence? – That means are there any supporting elements for the sign like help and resistance ranges, shifting averages, 50% retraces, occasion areas, and so on. The extra supporting elements a selected worth motion sign has, the higher. A worth motion sample with none confluence, sitting in the midst of consolidation, is nothing greater than noise to me, even when the sample itself may be very well-defined.

These are the kinds of questions that can provide help to decide the context the sign has shaped inside and finally whether or not or not you actually wish to take the commerce. I could sound cliché, however one of the best worth motion alerts are those which are useless apparent and that just about ‘soar’ off the chart at you. These alerts that you end up questioning about and emailing individuals about or posting on boards about, these are those which are most likely not very high-probability and thus most likely not value risking your cash on.

What to do subsequent…

As you develop your worth motion evaluation abilities, you’ll study to first consider what a market is doing; it’s total situation / state, and THEN you’ll search for worth motion alerts inside that construction; that make sense within the context they type inside. I’ve discovered that novices are likely to focus an excessive amount of on the sign itself and never sufficient on the context; a sign varieties they usually get all excited and suppose it’s an automated inexperienced gentle for a commerce, which in fact results in over-trading and dropping cash.

You need to be choosy concerning the trades you are taking by ensuring the commerce sign is sensible within the context it’s forming inside, and which means you’ll most likely flip down extra trades than you say sure to. I’m not saying that you need to attempt to keep away from dropping trades, as a result of you’ll be able to by no means keep away from some dropping trades, however the very first line of protection for shielding your cash out there is sticking to your buying and selling technique and solely taking alerts that agree with it; not people who you’ve justified to your self for one motive or one other.

The flexibility to be choosy concerning the trades you are taking is the results of having realized easy methods to commerce correctly and having mastered an efficient buying and selling technique. You can not perceive market context and if a sign is sensible (or doesn’t) inside it, if you happen to don’t but know easy methods to learn a worth chart. In case you are a comparatively new dealer or just seeking to increase your chart-reading and worth motion buying and selling skills, you could take a look at my worth motion buying and selling course as a result of it is going to provide help to perceive market context, worth motion methods and easy methods to commerce ensuring these issues are in settlement with each other.