Have you ever ever been so satisfied {that a} market was about to breakout to a brand new excessive or low that you just actually felt prefer it was a ‘certain wager’, solely to then see value briefly breakout after which rocket again in the wrong way?

Have you ever ever been so satisfied {that a} market was about to breakout to a brand new excessive or low that you just actually felt prefer it was a ‘certain wager’, solely to then see value briefly breakout after which rocket again in the wrong way?

While you can’t predict the market’s conduct with 100% accuracy, you possibly can change the way in which you concentrate on it and be taught to interpret it higher, so that you just start to commerce much less just like the ‘herd’ and extra like a contrarian.

To be extra particular, I’m primarily speaking about false-breaks and the way they catch merchants on the flawed facet of the market. You might purchase a breakout that appears like a ‘certain wager’ to you, exposing your self to the market, then in case you get caught in certainly one of these false breakouts, you will need to cowl again your place, you and plenty of, many different merchants as nicely. This works to gas the following transfer in the wrong way that stops you out for a loss. That is the place the expressions “caught lengthy” or “caught brief” got here from, in addition to what is called a “squeeze”; because the breakout unravels, merchants who purchased or offered into it get caught on the flawed facet of the market and get squeezed out of their positions.

It’s time to separate your self from the herd…

In case you’re uninterested in feeling like you’re simply one other dealer caught within the herd of those that lose cash and constantly get caught on the flawed facet of the market, it’s time to do one thing about it, time to make a change…

Here’s what it’s essential keep in mind: The markets are designed to pretend you out and do the other of what they often appear like they need to or may do. For an beginner dealer or for somebody who hasn’t but discovered methods to learn the charts or take into consideration them correctly, it might probably typically seem to be you’re getting ‘tricked’ by the market or as if somebody is taking part in a merciless recreation with you.

“Simply as a state of affairs author endeavors to mystify his viewers, so swimming pools and manipulators attempt to confuse and affect the general public into pondering a inventory is shifting in a sure path when the last word function is to have it transfer the opposite method.” – Richard Wyckoff

Nevertheless, in case you perceive the mentality of a contrarian dealer, and what meaning, you’ll start to see the markets in a unique mild. A contrarian dealer isn’t solely in search of buying and selling alternatives that meet his or her plan, they’re additionally occupied with what the ‘herd’ is pondering and prone to do, they usually use this as one other piece of confluence or supporting issue to take a place or not.

Sadly for the uneducated merchants on the market, breakouts are ‘prime rib’ for knowledgeable merchants who know what they’re doing and understand how the uneducated suppose. Skilled, contrarian merchants are like affected person snipers, ready to pick-off the enemy when the confluence of occasions come collectively and the chart seems to be ripe for the choosing.

You see, skilled merchants want to reap the benefits of the herd, simply as a pack of lions tries to search out the weak point in a herd of zebras. That is the place phrases like “fading energy” or “fading weak point” come from, or “promoting into energy” or “shopping for into weak point”. Primarily, professionals know that markets ebb and stream and that they’re much extra prone to retrace and revert to the imply than they’re to hold on in a straight line for an extended interval. Starting and unsuccessful merchants are inclined to suppose the other; they’ll purchase when costs are close to the highest or promote when close to the low, solely to get caught on the flawed facet of the market as costs inevitably retrace again the other method.

Professionals look to reap the benefits of this by trying to fade or (commerce towards) energy in a market that’s trending decrease general, or fade weak point in a market that’s rising general. The dropping merchants are solely being attentive to what value is doing ‘proper now’, disregarding the general market context and what the implications of which can be.

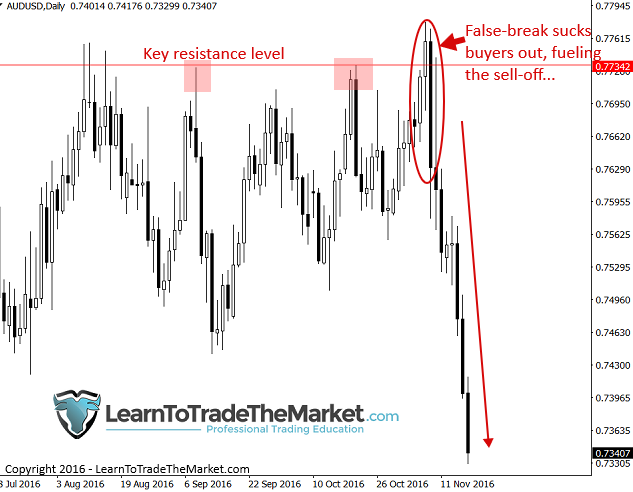

Let’s take a look at an instance to make clear all of this. The idea we’re demonstrating on the chart under is that of a market that for all intents and functions, seems to be like it should nearly actually break greater, this works to lure all of the armature merchants in, setting them as much as be uncovered simply earlier than costs reverse.

Within the AUDUSD chart under, the market was constructing momentum just under key resistance close to 0.7735 space, trying like it could nearly actually breakout to the upside. Nevertheless, what actually occurred was that value briefly broke greater and sucked up all these purchase orders, solely to reverse decrease, stopping everybody out, forcing them to cowl their positions which fueled the sell-off.

Now, I do know what a few of you’re seemingly pondering, so let’s focus on this additional…

You weren’t essentially a ‘dangerous dealer’ in case you purchased the breakout, however what would make you a foul dealer is in case you had no plan in place to include your losses ought to costs reverse decrease, as they did. Many merchants change into SO satisfied {that a} breakout will work that they load up on the place, risking greater than they need to, and typically don’t even use a cease loss, which clearly is a setup to blow out their accounts.

In case you have been lengthy on that breakout, the right factor to do would have been to see it was failing and exit your place. Then, take a deep breath and wait to see what occurred into the day’s shut. You’ll discover that after the large false-break follow-through, value retraced all the way in which again as much as that 0.7735 resistance degree, offering for an excellent second-chance entry alternative to get brief and experience the following transfer down. You see, it’s all about studying the chart and making a plan to reap the benefits of it.

- False breaks usually are not essentially potential to commerce as they’re taking place, nonetheless, if you understand how to learn the chart from left to proper, false breakouts provide help to perceive the dynamics of the chart. In case you take a look at the Aussie/greenback false break within the chart above, you possibly can learn it and make a plan to reap the benefits of it, after the false break itself occurred.

You see understanding false breakouts lets you each suppose like a contrarian (reverse of the herd) but in addition methods to learn the chart from left to proper. Buying and selling is about studying charts and value motion, not essentially buying and selling issues immediately as they’re taking place. We’d like an outlined set of circumstances to discover a commerce; For instance: “Okay, this false-break simply occurred, now how can I reap the benefits of it”?

Let’s focus on one other instance…

False breakouts are a cornerstone of any market, they usually occur in each market. As value motion merchants, we have to be taught to learn the foot prints on the chart. This implies false breakouts like bull and bear traps or lengthy bar tails or wicks at new highs or lows; these are foot prints of the larger gamers attempting to inform us one thing.

You will need to anticipate false breakouts to a point, I’m not saying you must attempt to commerce them as they occur, I’m saying earlier than you enter a brand new place cease and suppose in case you are probably getting sucked right into a false breakout your self. Be on the alert for false breaks as it’s possible you’ll typically miss them as a result of they occur typically and shortly.

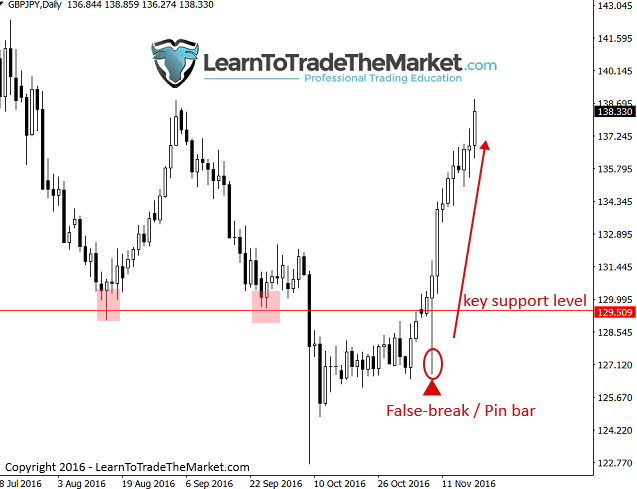

Let’s take a look at the GBPJPY and a current false break that occurred on that chart.

The Sterling/yen pushed down via 129.50 help after which consolidated for a number of weeks earlier than pushing again up via that degree, trapping everybody brief. This can be a excellent instance of the market luring in positions after which squeezing folks out of their brief positions as we reconnected greater.

In case you observe value motion, one of many alerts we train would have gotten you in right here (the pin bar). Notice that we aren’t essentially buying and selling the false-break because it occurred. Nevertheless, had you waited till after it occurred, we bought a sign. That pin bar sign tells us what we will seemingly anticipate subsequent (greater costs) and offers us a plan of motion (get lengthy on any non permanent weak point). That is the way you learn the chart and value motion after which commerce accordingly.

Conclusion

One facet word I need to contact on earlier than we conclude at the moment’s lesson: You might be questioning how my fakey setup suits in with false breakouts. Effectively, a fakey is actually a ‘compressed’ model of the false-break idea. By that I imply, it doesn’t essentially happen at highs or lows, however it might probably happen inside a development or mainly anyplace on the chart. The fakey is a contrarian sign itself, it happens after we get a false-break from an inside bar sign; value initially breaks a method from the within bar however then reverses, trapping everybody on the flawed facet of the breakout, creating the false-break and normally a subsequent transfer the wrong way.

The worth motion methods and patterns mentioned in at the moment’s lesson kind the spine of my buying and selling methods arsenal and are answerable for most trades I take. You possibly can be taught rather more about these superior value motion alerts, together with false breaks and my proprietary fakey sample, in my value motion buying and selling course.