Bitcoin confronted a swift correction under the $125,000 stage after reaching a brand new all-time excessive of $126,200 on Monday, triggering widespread volatility throughout the market. The worth retraced over 4% to round $120,000, liquidating thousands and thousands in leveraged positions as merchants anticipated additional upside. The transfer caught many off guard, particularly after days of robust momentum and renewed optimism that Bitcoin was making ready to enter one other worth discovery part.

Associated Studying

Regardless of the pullback, key on-chain knowledge reveals a contrasting development beneath the floor — an enormous accumulation by US traders. Analysts be aware that whereas short-term merchants confronted liquidations, spot demand from US-based consumers continues to develop, significantly by regulated platforms and ETFs. This regular influx of capital offers a robust basis for long-term market energy, even amid short-term volatility.

The correction might have flushed out extreme leverage, resetting market circumstances for a more healthy continuation. As Bitcoin consolidates across the $120,000–$122,000 vary, analysts are watching carefully to see whether or not institutional accumulation can offset the promoting strain. For now, the broader development stays bullish, with rising proof that US traders are utilizing each dip to extend publicity to the world’s main digital asset.

US Demand Surges As Coinbase Premium Hole Indicators Accumulation

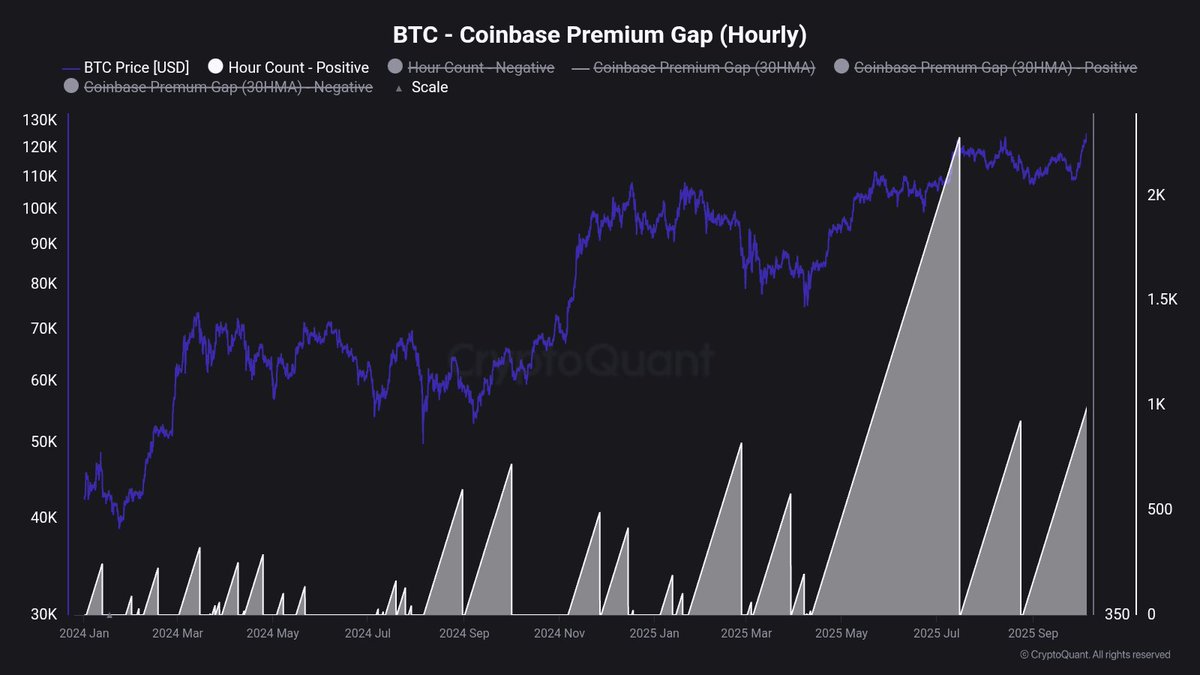

Prime onchain analyst Maartunn shared new knowledge revealing a pointy improve in US-based Bitcoin accumulation, pushed largely by exercise on Coinbase, one of the vital influential exchanges for institutional and retail traders in the USA. In line with his insights, the Coinbase Premium Hole — which measures the worth distinction of Bitcoin between Coinbase and different international exchanges — has surged to its second-highest stage because the ETF launch earlier this 12 months.

This spike alerts an aggressive shopping for spree from US traders, suggesting robust spot demand that’s outpacing international averages. Traditionally, comparable jumps within the Coinbase Premium Hole have coincided with phases of main market enlargement, usually previous new highs as US capital flows into Bitcoin-led rallies. The information signifies that US merchants are keen to pay a better premium in comparison with their counterparts on platforms like Binance or OKX — a transparent expression of localized demand.

Analysts interpret this as a bullish sign within the context of Bitcoin’s present consolidation close to all-time highs. After a short correction from $126,000 to $120,000, robust institutional curiosity may present the liquidity wanted for a brand new breakout. Many market watchers consider that such strong accumulation is never random; it usually precedes a major expansive transfer, as consumers place themselves earlier than one other upward leg.

If this shopping for strain sustains, Bitcoin may quickly reclaim its highs and enter a brand new part of worth discovery. Mixed with rising ETF inflows and regular US accumulation traits, Maartunn’s knowledge reinforces the narrative that the market’s subsequent main impulse might as soon as once more be led by US demand — the identical catalyst that ignited Bitcoin’s earlier all-time excessive breakout earlier this 12 months.

Associated Studying

Bitcoin Consolidates After Sharp Rally

Bitcoin is presently buying and selling round $122,500, displaying indicators of stabilization after the current surge to an all-time excessive close to $126,000 earlier this week. The chart highlights a wholesome pullback from the highs, with BTC discovering help simply above the $120,000 stage — a zone that beforehand acted as resistance and has now was a short-term help vary.

The 8-day and 21-day transferring averages are trending upward, confirming the continuation of a bullish construction. In the meantime, the 50-day transferring common stays under the worth, indicating that momentum nonetheless favors the bulls regardless of short-term volatility. If Bitcoin manages to carry above the $120,000–$121,000 area, the setup may appeal to renewed shopping for strain for one more try to interrupt above the $125,000 resistance.

Associated Studying

Nevertheless, failure to take care of these ranges may open the door for a retest of the $117,500 space, the place the following main help lies. This could nonetheless be inside a wholesome correction vary following the current 15% rally. Total, Bitcoin’s construction stays bullish, with robust larger lows forming and institutional demand — led by Coinbase inflows — persevering with to help the market. A decisive transfer above $125,000 may sign the start of a brand new worth discovery part.

Featured picture from ChatGPT, chart from TradingView.com