1. Introduction

Cash Thoughts BTC is an Skilled Advisor designed to commerce BTCUSD mechanically, managing each entries and exits. It makes use of dynamic market evaluation to find out optimum entry factors and applies international threat and revenue management. This information explains every configuration parameter, the way it impacts buying and selling, and the best way to alter it based mostly in your threat profile.

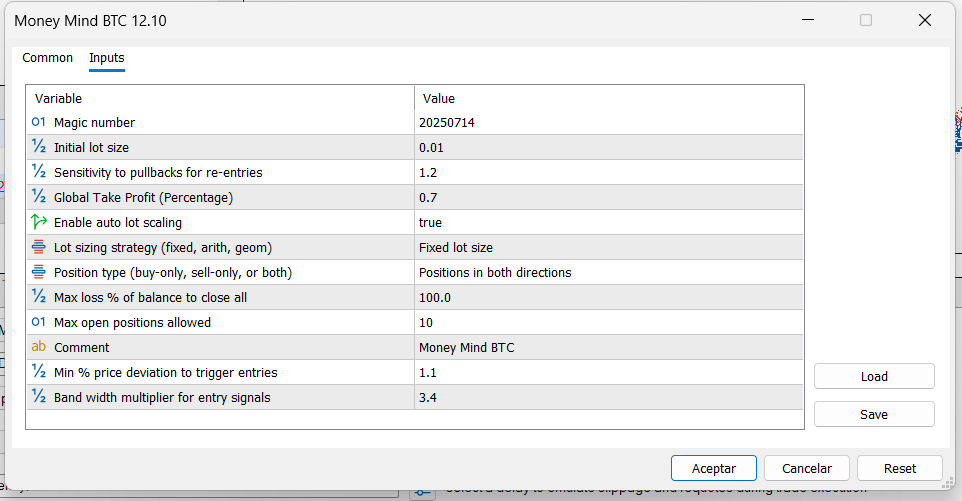

2. Configuration Parameters

magicNumber – Magic quantity

Distinctive identifier for the EA’s trades. If operating a number of EA situations on totally different symbols or timeframes, assign a unique quantity to every to keep away from mixing trades.

initialLotSize – Preliminary lot dimension

Preliminary lot dimension for the primary commerce.

Suggestion:

• Small accounts (< $1,000): 0.01

• Medium accounts ($1,000 – $5,000): 0.02 – 0.05

• Giant accounts (> $5,000): alter in accordance with threat.

If autoLotScaling is enabled, this worth adjusts mechanically with steadiness development or discount.

kDistance – Sensitivity to pullbacks for re-entries

Multiplier of the common vary (M15, 20 candles) defining the minimal pullback distance for brand spanking new entries of the identical kind.

Impact:

• Decrease worth = extra re-entries, extra threat.

• Larger worth = fewer re-entries, much less publicity.

Advisable beginning worth: 1.2 for steadiness between frequency and threat.

takeProfitGlobalPct – World Take Revenue (Share)

Share of whole account steadiness revenue to shut all EA positions.

Instance: With a $10,000 steadiness and 0.7% worth, EA will shut all when floating revenue reaches $70.

Suggestion:

• Conservative: 0.5% – 0.7%

• Reasonable: 0.7% – 1.0%

• Aggressive: 1.0% – 1.5%

autoLotScaling – Allow auto lot scaling

If enabled, preliminary lot dimension is adjusted proportionally to steadiness development.

Utilization:

• Allow for compounding development.

• Disable to take care of a set lot.

lotStrategy – Lot sizing technique (fastened, arith, geom)

Lot dimension calculation technique:

• fixLot: Lot doesn’t change (aside from autoLotScaling).

• martingaleArithmetic: Provides a small increment to the final lot.

• martingaleGeometric: Multiplies the final lot, growing dimension quicker.

Suggestion:

• Mounted for low threat.

• Arithmetic for average improve.

• Geometric for aggressive profiles with strict threat management.

positionType – Place kind (buy-only, sell-only, or each)

Permits buying and selling solely buys, solely sells, or each instructions.

Utilization: Choose “Each” for full buying and selling, or prohibit to at least one aspect if a transparent market pattern is detected.

generalStopLoss – Max loss % of steadiness to shut all

Most allowed loss as a proportion of account steadiness to shut all trades.

Instance: With a $10,000 steadiness and 1.0% worth, EA will shut all if floating loss reaches -$100.

Necessary: Outline this worth earlier than optimizing different parameters.

maxOpenPositions – Max open positions allowed

Most variety of open trades allowed by the EA.

Suggestion:

• Conservative: 3 – 5

• Reasonable: 6 – 8

• Aggressive: 9 – 12

Should align with the chosen lot technique to keep away from extreme margin utilization.

comentario – Remark

Textual content added to the “Remark” discipline of every commerce.

Utilization: Helps determine trades in historical past and dealer terminal.

devMinPct – Min % value deviation to set off entries

Minimal value deviation from the reference worth to permit the primary entry.

Impact:

• Decrease worth = extra indicators and frequent entries.

• Larger worth = extra filtered entries.

Suggestion for BTC: 1.0% – 1.4%.

bandMult – Band width multiplier for entry indicators

Multiplier of common vary to calculate activation bands for the primary entry.

Impact:

• Slim bands = extra crosses, extra entries.

• Large bands = fewer entries, extra selective.

Suggestion for BTCUSD: 3.0 – 3.6.

3. Normal Utilization Suggestions

- Take a look at the EA on demo for not less than 2 weeks earlier than going reside.

- Set generalStopLoss and maxOpenPositions first to manage threat.

- Use autoLotScaling provided that aiming for compounding development and accepting lot variation.

- Optimize devMinPct, bandMult, and kDistance to steadiness commerce frequency and stability.

- Keep away from utilizing martingaleGeometric on small accounts or with many pairs without delay.

- Assessment efficiency usually, as BTCUSD volatility can change and require changes.

Gross sales solely by way of MQL5 Market – Purchase right here:

https://www.mql5.com/en/market/product/48053

Extra data and set information: www.mt5setfiles.com

© 2025 Simón Del Vecchio – All rights reserved