Downside with Trendy Approaches

Trendy strategies for buying and selling baskets of property usually depend on easy guidelines: go lengthy the N greatest‑performing devices, brief the N worst‑performing ones (or vice versa), or simply cut up capital equally amongst a number of forex pairs, shares, or ETFs. At first look, this appears to work—you diversify danger and don’t preserve all of your “eggs” in a single basket. However in actuality, a number of points come up:

-

Hidden correlations. Belongings can transfer collectively in non‑apparent methods. For instance, EUR/USD and GBP/USD usually react to the identical information regardless of being totally different pairs. When you ignore their connection, dangers “add up”—a single occasion can ship each positions into loss concurrently.

-

Unequal weighting. Merely dividing capital into equal elements doesn’t account for every instrument’s volatility. You may allocate 10% to every asset, but when one is traditionally way more “jumpy,” it’s going to dominate your portfolio’s danger.

-

Over‑optimization. Many buying and selling techniques match parameters to historic knowledge (“curve‑becoming”). In consequence, efficiency seems to be nice on previous knowledge, however usually fails in reside buying and selling.

In brief: with out accounting for interdependencies and every instrument’s true contribution to portfolio danger, you both go away potential returns on the desk or expose your account to extreme hazard.

Resolution and Benefits of PCA

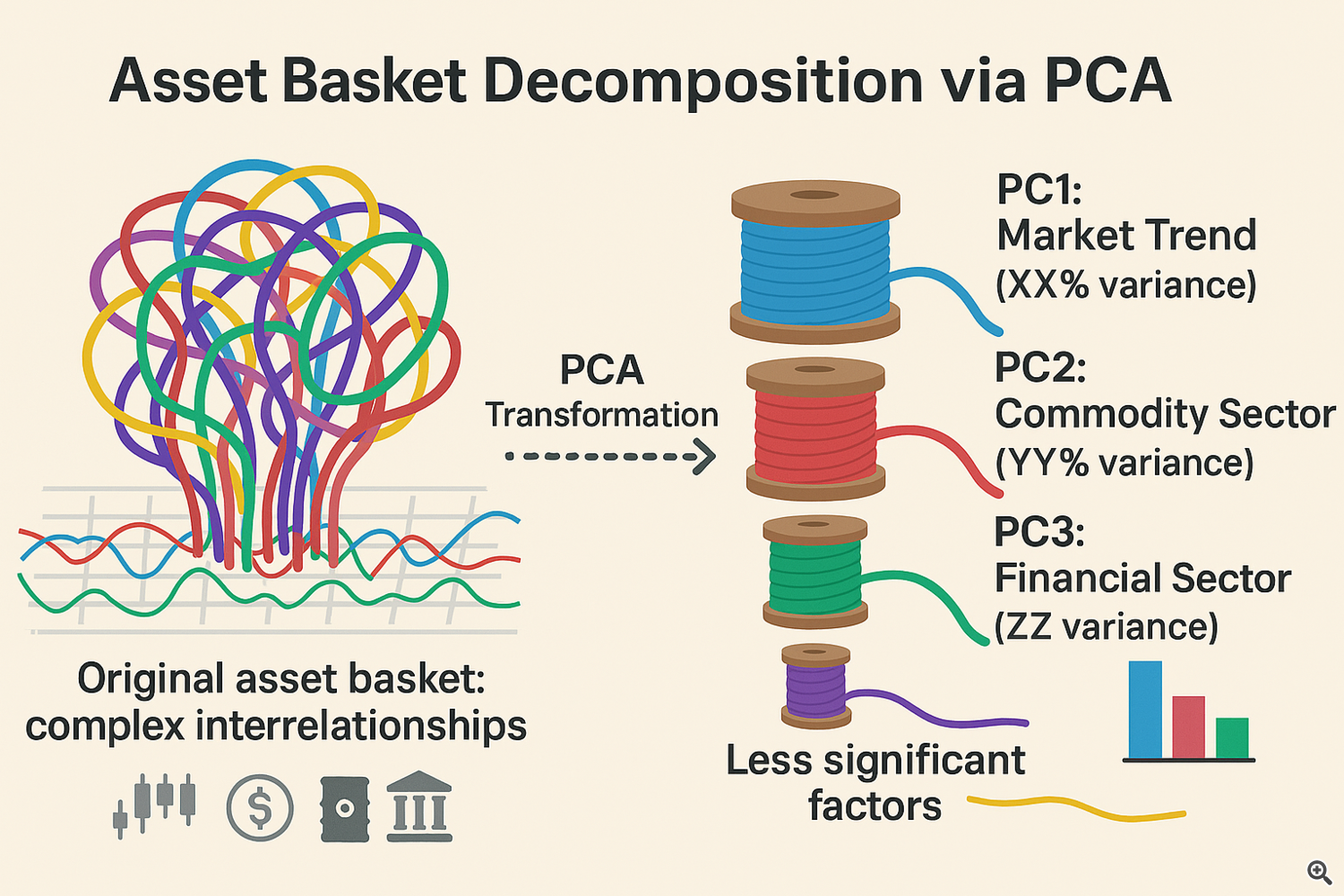

Principal Part Evaluation (PCA) is a method to “decompose” a fancy asset basket into a couple of unbiased components. Think about your basket as a bundle of multicolored threads all tangled collectively. PCA gently untangles them, highlighting probably the most vital “threads” (motion components) that designate the basket’s general conduct.

How It Works in Easy Phrases:

-

You collect historic value modifications (or returns) to your devices—currencies, CFDs, shares, ETFs.

-

PCA finds a brand new coordinate system (components) the place every issue is a “linear mixture” of the unique property. The primary issue explains the most important share of the portfolio’s general “wiggle,” the second explains the following largest share, and so forth.

-

By inspecting these components, you establish which “themes” (for instance, the overall market pattern, commodities sector, or banking sector) really drive your devices.

Sensible Advantages for the Dealer:

-

Diminished correlation danger. You commerce not ten disparate devices, however successfully 2–3 unbiased components. It’s like investing in market “themes” moderately than particular person securities—danger is focused on actual driving forces, not single issuers.

-

Smarter place sizing. Working with components allows you to see precisely how a lot every issue contributes to whole volatility. You may stability your portfolio in order that no single issue dominates, stopping one overly risky theme from dragging you down.

-

Simplified administration. As an alternative of monitoring dozens of charts, you monitor just some principal‑element graphs. This protects time and reduces emotional stress—selections are based mostly on “themes,” not each single ticker.

Instance of Software:

Suppose you have got a basket of 5 forex pairs. PCA identifies two principal components:

-

Issue 1 displays the greenback’s general motion towards a basket of different currencies.

-

Issue 2 captures relative shifts inside the eurozone (EUR vs. GBP, CHF).

You may then construction trades to “commerce” these components: go lengthy Issue 1 (lengthy USD) should you count on the greenback to strengthen, and concurrently brief Issue 2 should you anticipate realignments inside euro‑space currencies.

Conclusions and Wrap‑Up

PCA is just not a “magic capsule,” however a robust device that makes basket‑buying and selling extra clear and manageable. It helps you:

-

See what issues. Filter out noise and concentrate on the portfolio’s key drivers.

-

Stability dangers. Allocate volatility clearly throughout components to stop anybody asset from dragging the portfolio down.

-

Scale back emotional stress. Fewer charts and indicators—simply concentrated data on the principle components.

For a retail dealer, implementing PCA means transferring from “blind” equal‑weight allocation to a mathematically grounded method. Even with out deep math background, you need to use prepared‑made instruments (for instance, the PCA Arbitrage3X EA in MetaTrader 5), which robotically calculate the principal elements and provide you with a “recipe” for place sizes.

Last Ideas:

PCA offers a easy, intuitive method to break a basket of property into unbiased themes, stability them by danger, and thereby enhance the soundness and readability of your technique. Whether or not you commerce foreign exchange, CFDs, shares, or ETFs—anyplace diversification and volatility management matter—PCA Arbitrage3X EA could be your highly effective ally in constructing smarter, extra versatile buying and selling techniques.