03 Nov Bitfinex Alpha | Calmness Descends on BTC

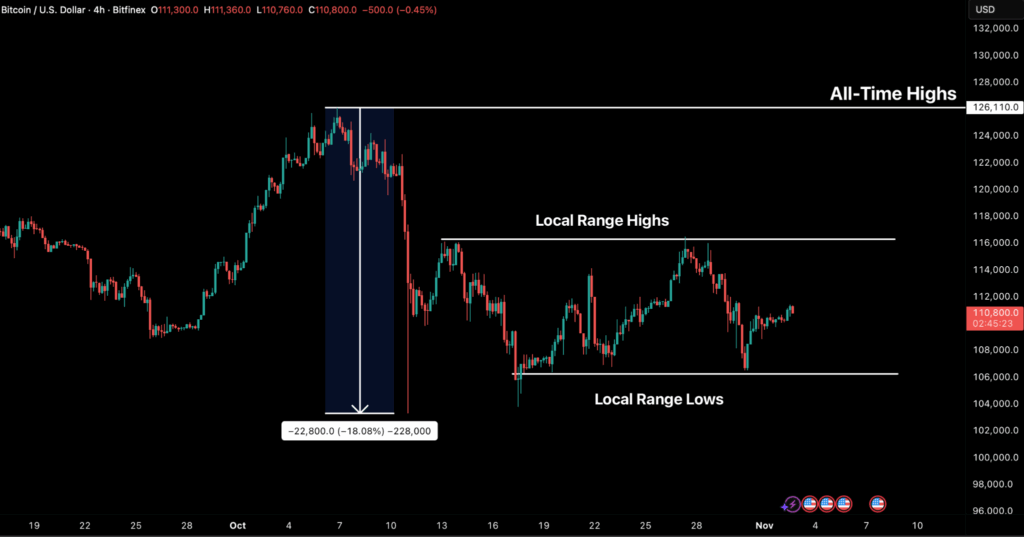

Bitcoin has spent the previous two weeks confined inside a slender $106,000–$116,000 vary. Regardless of a quick aid rally to $116,500 final week, BTC stays weighed down by a short-term resistance cluster, that’s seeing continued distribution from long-term holders and weak institutional demand. Within the choices market implied volatility has continued to compress, and investor positioning has shifted to impartial, underscoring a broad lack of directional conviction following the October tenth liquidation occasion. The cautious tone in danger markets is exacerbated by combined macro indicators from the newest FOMC assembly, and has saved speculative urge for food muted and worth motion subdued.

Whereas structural assist nonetheless stays intact close to $106,000, the stability of proof factors to fragility beneath the floor. Analysing the Lengthy-Time period Holder Internet Place Change metric reveals that this cohort is deeply adverse at –104K BTC per 30 days, signalling persistent profit-taking, whereas the Brief-Time period Holder Internet Unrealised Revenue/Loss metric exhibits waning conviction amongst current consumers. Until ETF inflows or new spot demand returns to soak up ongoing distribution, BTC is prone to stay range-bound, with a danger bias towards retesting the $106,000–$107,000 zone. A sustained break under this stage may open the trail to $100,000 per BTC, whereas a decisive reclaim above $116,000 would mark the primary signal of structural restoration heading into November.

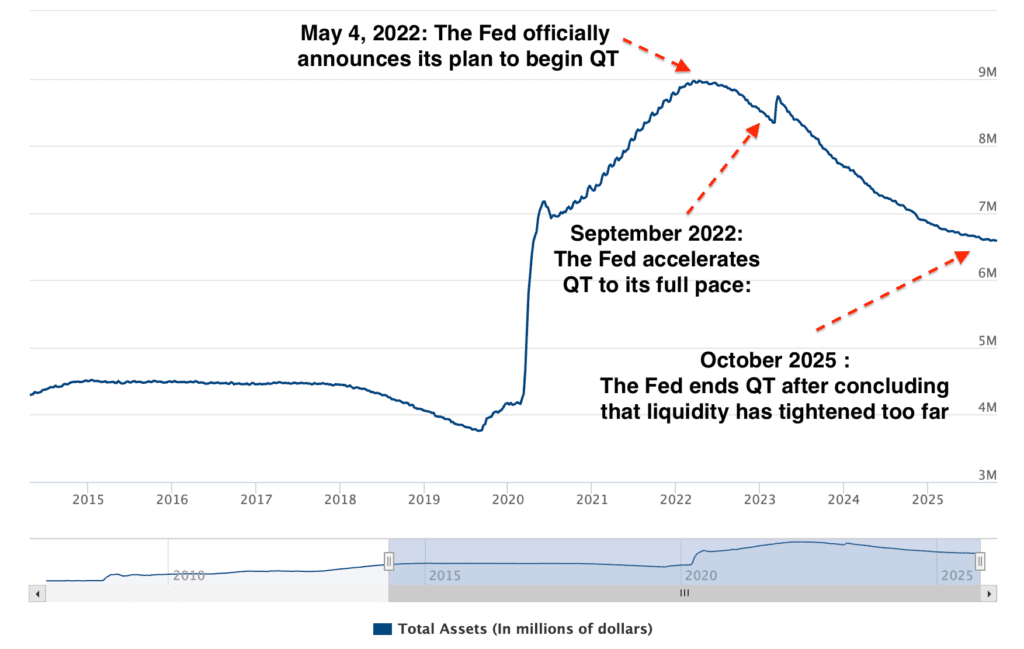

Underpinning the temper in crypto markets is a US economic system that’s shifting into a brand new stage of coverage recalibration because the Federal Reserve shifts from tightening to liquidity administration as development slows and inflation eases.

At its assembly on October thirtieth, the Federal Open Market Committee ended its stability sheet runoff coverage and lower rates of interest by 25 foundation factors to a spread of three.75–4 %. The transfer responds to tightening liquidity situations, as money-market funds pull money from the Fed’s reverse repo facility to purchase Treasury payments, draining reserves from the banking system.

The bond market has been signalling expectations of slower development and extra price cuts for the reason that Summer time, with 10-year Treasury yields dropping to round 4 % and 30-year yields to 4.6 %. Extra lately, nevertheless, the time period premium, which is the additional return demanded by bond traders for taking up danger, has turned constructive for the primary time in years. It displays the market view that although recession fears are easing, issues over fiscal and inflation dangers are rising.

The labour market additionally exhibits indicators of fatigue. In response to the Bureau of Labour Statistics, wage development slowed to three.7 % in August from 4.7 % final 12 months. Shopper confidence has dipped as effectively: the Convention Board’s index fell to 94.6 in October, reflecting unease amongst lower- and middle-income households whilst fairness markets stay sturdy.

Final Monday, ETHZilla Company offered roughly US$40 million in Ether to fund an aggressive share repurchase program, signalling a shift in how crypto-native corporations handle treasury property. By changing a part of its ETH holdings into buybacks, ETHZilla goals to slender the low cost between its share worth and web asset worth, successfully turning its crypto reserves into a company finance lever. Only a day later, Western Union entered the crypto area with the announcement of its US dollar-pegged stablecoin, constructed on the Solana blockchain in partnership with Anchorage Digital Financial institution. The launch is indicative of one other conventional monetary establishment modernising cross-border funds by lowering settlement occasions and prices by means of blockchain know-how. In the meantime, in Asia, Japan took a daring step towards state-linked crypto integration. Mining {hardware} producer Canaan revealed a deal with a significant Japanese utility to deploy hydro-cooled Avalon A1566HA miners for a grid-stability challenge. The initiative makes use of Bitcoin mining to stability renewable vitality hundreds, illustrating how blockchain infrastructure can improve energy grid effectivity fairly than pressure it.