06 Oct Bitfinex Alpha | BTC Hits New ATH as October Begins Strongly

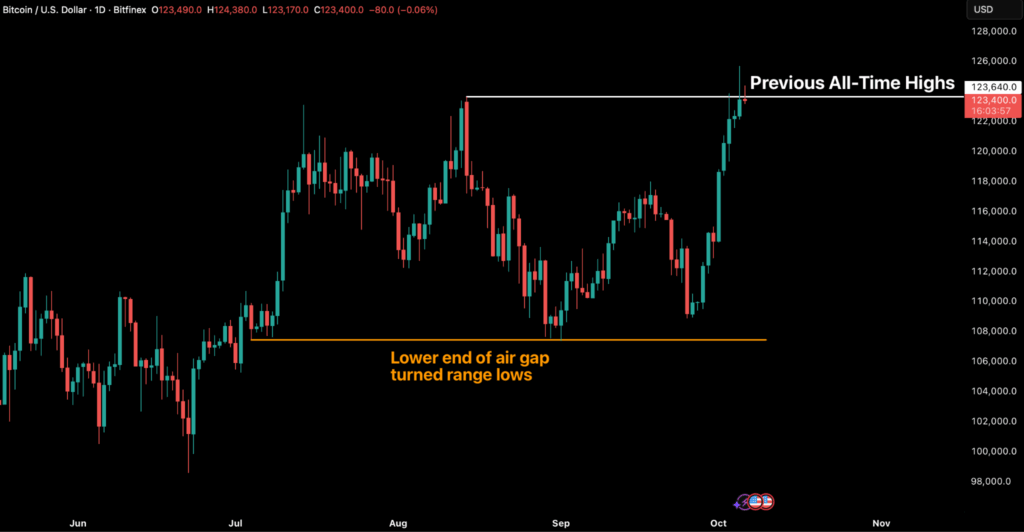

Bitcoin efficiently defended the decrease finish of the July air hole close to $107,500, repeatedly rebounding from this help as promoting stress eased consistent with expectations. This resilience culminated in a recent all-time excessive on Bitfinex at $125,710, a 17.08 % restoration from September’s correction lows. The broader market additionally opened October on a powerful footing.

Seasonality now helps a bullish outlook for BTC. Traditionally, October, recognized colloquially as “Uptober”, has delivered optimistic returns in 9 of the previous eleven years, averaging positive factors of roughly 21 %. This autumn has additionally persistently been Bitcoin’s strongest quarter, with common returns of almost 80 %.

A significant component behind Bitcoin’s rebound has been a sharp discount in promote stress. The late-summer correction was primarily pushed by Quick-Time period Holder capitulation and heavy whale distribution, coinciding with profit-taking after the Fed’s first fee lower. With leveraged positions flushed and the $110,000–$112,000 zone reclaimed, recent demand has absorbed provide, reigniting momentum. Macro tailwinds have strengthened in parallel. US spot Bitcoin ETFs have reversed outflows, recording over $647 million in common each day inflows final week, whereas whale distribution has slowed materially. The setup stays beneficial: a dovish Federal Reserve, easing inflation, renewed ETF inflows, and steady on-chain help recommend the corrective part is probably going behind us.

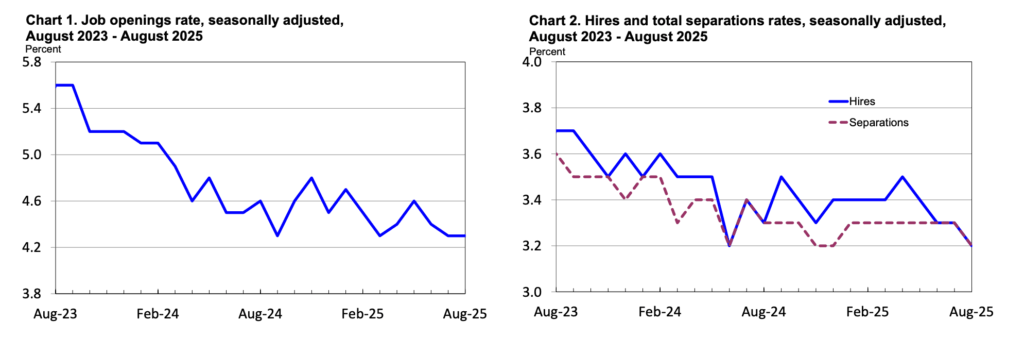

The US financial system is displaying renewed pressure as labour market information indicators slowing momentum and rising uncertainty. August’s JOLTS report confirmed job openings holding regular at 7.2 million however hiring falling sharply, whereas the quits fee declined for a 3rd straight month, reflecting weaker employee confidence.

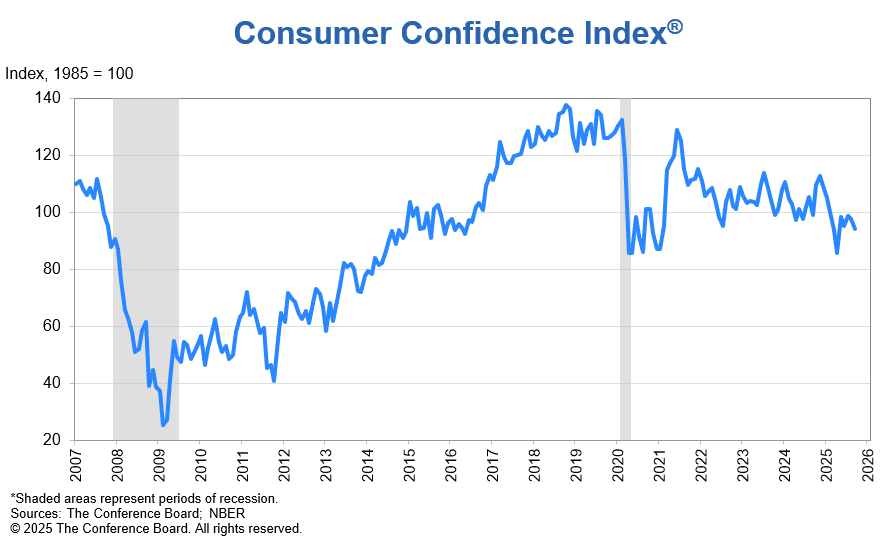

ADP’s September information confirmed job losses throughout small and mid-sized corporations, pointing to fragility regardless of the Federal Reserve’s fee lower in mid-September. That weak spot has been compounded by the federal government shutdown that started on October 1st, threatening to push unemployment greater and weigh on client sentiment, which was already sliding by late September.

World momentum towards digital asset integration accelerated this week. The European Central Financial institution finalised agreements with a number of tech corporations to develop core infrastructure for a possible digital euro, although progress stays topic to EU laws. Within the US, CME Group introduced plans to introduce 24/7 crypto futures and choices buying and selling by early 2026, aligning conventional markets with the nonstop nature of crypto and eliminating the long-standing “CME hole”, that has been created on account of no weekend buying and selling. In the meantime, the SEC noticed a surge of over two dozen new crypto ETF filings from issuers like REX Shares, Osprey Funds, and Defiance ETFs, benefiting from new itemizing requirements that streamline approvals. Nevertheless, the US authorities shutdown has quickly stalled progress, delaying potential launches. Collectively, these strikes underscore fast institutional enlargement into digital belongings amid ongoing regulatory uncertainty.